Corson County Trustee Deed Form

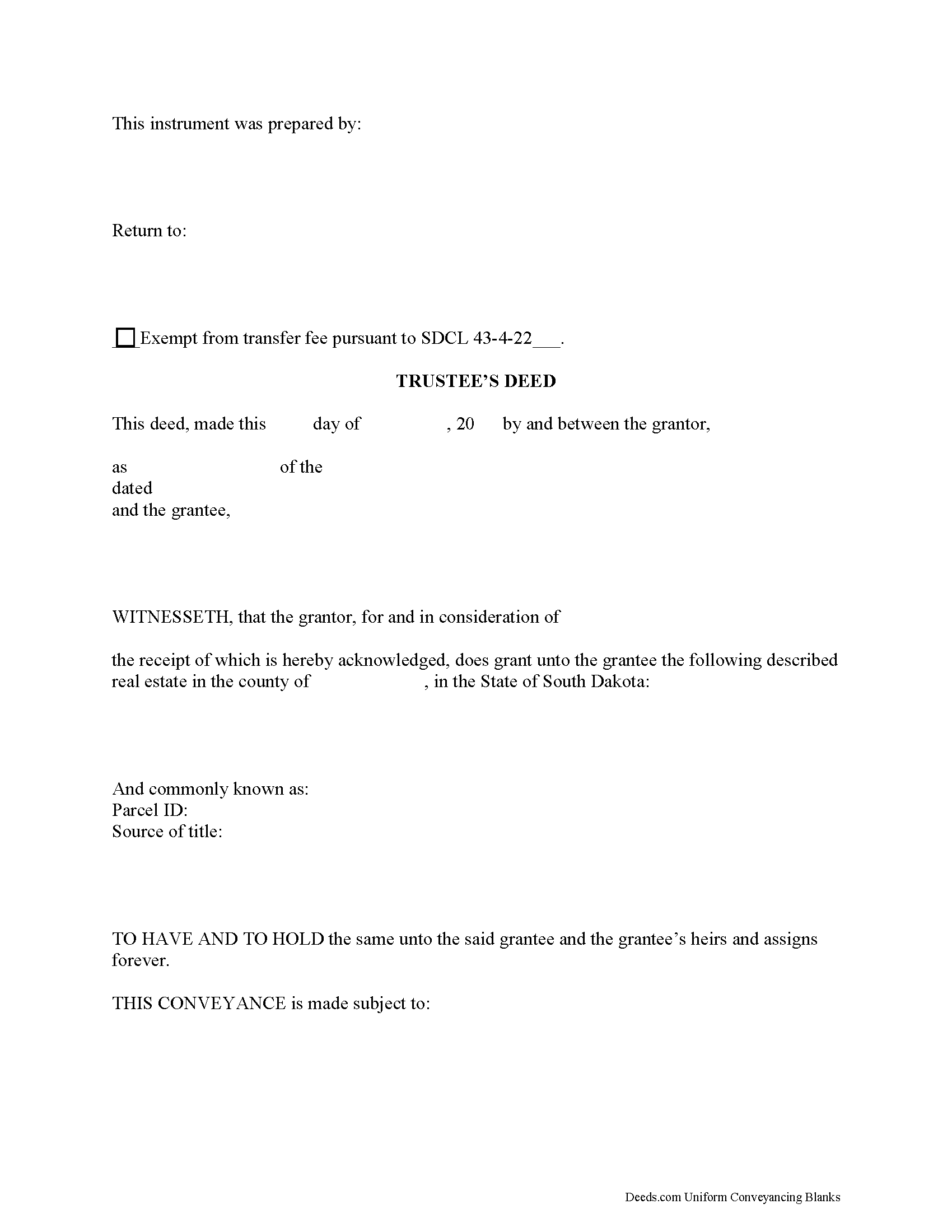

Corson County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

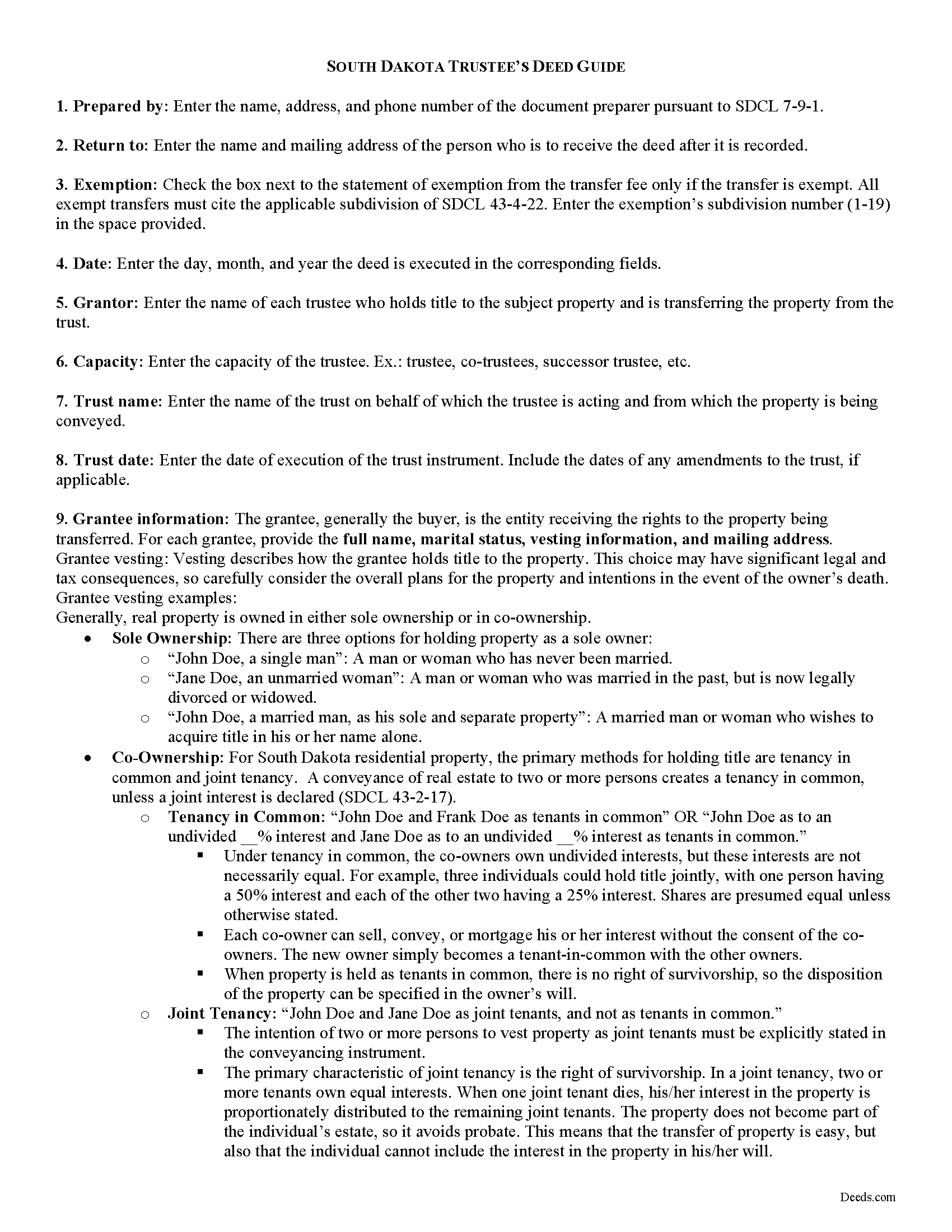

Corson County Trustee Deed Guide

Line by line guide explaining every blank on the form.

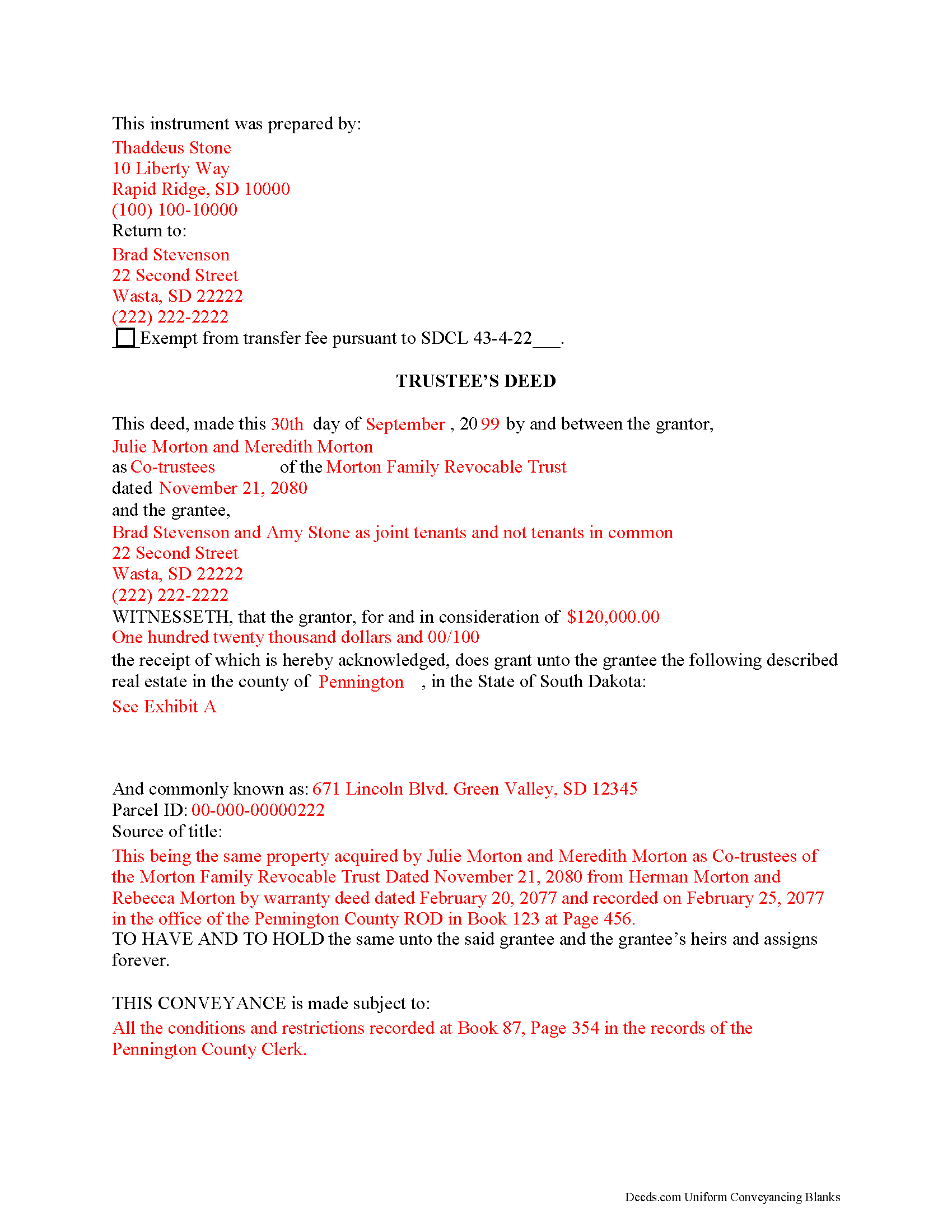

Corson County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional South Dakota and Corson County documents included at no extra charge:

Where to Record Your Documents

Corson County Register of Deeds

McIntosh, South Dakota 57641

Hours: 8:00 to 12:00 & 1:00 to 5:00 M-F

Phone: (605) 273-4395

Recording Tips for Corson County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Leave recording info boxes blank - the office fills these

- Recording fees may differ from what's posted online - verify current rates

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Corson County

Properties in any of these areas use Corson County forms:

- Bullhead

- Keldron

- Little Eagle

- Mc Intosh

- Mc Laughlin

- Morristown

- Trail City

- Wakpala

- Walker

- Watauga

Hours, fees, requirements, and more for Corson County

How do I get my forms?

Forms are available for immediate download after payment. The Corson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Corson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Corson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Corson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Corson County?

Recording fees in Corson County vary. Contact the recorder's office at (605) 273-4395 for current fees.

Questions answered? Let's get started!

Transferring Real Property by Trust in South Dakota

In a trust arrangement, a settlor transfers property (which may include real estate) to another person (called the trustee) for the benefit of another (called the beneficiary). Trusts that take effect during the settlor's lifetime are called living (inter vivos) trusts, and trusts that take effect upon the settlor's (testator's) death through the provisions of a will are called testamentary trusts.

In a living trust, a settlor may serve in all three capacities, as long as he is not the sole beneficiary. Living trusts are estate planning tools that take effect during a settlors' lifetime and allow them to determine how their assets will be managed upon death.

In South Dakota, trusts relating to real property must be created by a written instrument signed by the trustee (SDCL 43-10-4). The trust instrument establishes the trust's provisions, determines how the trust will be managed, designates the trustee and the trustee's powers, and identifies the trust beneficiary. Trust instruments are generally unrecorded in order to maintain the privacy of the settlor's estate plan. Transfers of real property to into trust can either occur concurrently with execution of the trust instrument, or the settlor can execute a later deed titling the property in the name of the trustee on behalf of the trust.

Unless otherwise limited by the terms of the trust, a trustee has a statutory power to "acquire, sell, or otherwise dispose of an asset" (SDCL 55-1A-11). Most trust instruments specifically include a power of sale. Transferring real property from a living trust requires a trustee's deed. A trustee's deed is named for the executing party rather than for the type of warranty conveyed.

In South Dakota, a trustee's deed carries the implied covenants typically associated with a special warranty deed. The word "grant" in the granting clause implies that "the grantor has not conveyed the same estate...to any person other than the grantee" and that "such estate is...free from encumbrances done, made, or suffered by the grantor, or any person claiming under him" (43-25-10).

In titling the property in the name of the grantee, the form of the trustee's deed names each granting trustee and the name and date of the trust on behalf of which the trustee is acting. A valid instrument also includes all requirements for documents relating to real property, such as a legal description of the subject parcel, and compliance with the recording prerequisites established at SDCL 43-28-23. Transfers of property in South Dakota require a certificate of real estate value and payment of applicable transfer fees.

Before recording the deed in the applicable county, it must be signed by each granting trustee in the presence of a notary public. At the time of conveyance, the trustee may also execute a certificate of trust in support of a real property transaction under SDCL 55-4-51.3 to confirm the trust's existence and his authority to convey the property.

Consult a lawyer in the preparation of a trustee's deed in South Dakota. Trust law can quickly become complex, and each situation requires unique attention.

(South Dakota TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Corson County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Corson County.

Our Promise

The documents you receive here will meet, or exceed, the Corson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Corson County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Frank B.

March 16th, 2023

Great website, super easy to use, user friendly to navigate. Will definitely use for future needs, and will definitely refer to other customers. F. Betancourt Texas

Thank you!

James L.

February 15th, 2022

The process to obtain online forms was simple and straight forward and uncomplicated.

Thank you for your feedback. We really appreciate it. Have a great day!

Veda J.

September 11th, 2020

Good Work!

Thank you!

Shirley R J.

February 5th, 2019

Great website.....fast and easy access!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Irma G.

April 30th, 2021

Although I did not use the forms yet, it appears very easy to understand and navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

FE P.

March 4th, 2023

Looked into a good number of DIY deeds on the internet. Very glad that I chose Deeds.com. They made it easy to make your own deed based on your state and the process based on the sample included was easy to follow. Also the cost was very reasonable. Great company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

janelle s.

September 15th, 2020

Uncertain about use as I am new to online forms. Through use I am sure it will feel more comfortable. I like the storage of filled in info forms because I might be using I will be using them or the info in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Judith L.

August 19th, 2019

I bought a package for doing a mineral deed in Sheridan County, Montana. I will now try to use it and we'll see, I guess, how easy it may or may not be, etc. Check back later perhaps for more details~

Thank you for your feedback. We really appreciate it. Have a great day!

MARILEE S.

June 24th, 2019

A very easy website....consumer friendly, which is what is so important to me. I will be using your service again. Thank you

Thank you!

Lisa J.

November 29th, 2019

Thank you so much for your time.

Thank you!

Julie Z.

December 7th, 2024

Just getting started with this process, but I was delighted to find this resource to speed up the decision making. Excellent! Very helpful!

Thank you for your positive words! We’re thrilled to hear about your experience.

Riley K G.

June 23rd, 2022

Awesome, way better than some other offerings out there. Unfortunately some people won't realize that until it's too late.

Thank you!

FRANCIS P.

July 17th, 2022

Finding what I needed was easy. The payment process was easy. Using what I found was easy. Easy-peasy and GREAT results. Professional and succinct all for the price of a steak dinner. I'll be back to DEEDS.COM when I need any paperwork/forms related to deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

Daron S.

July 2nd, 2019

A download in word format would be a lot better than the pdf download.

Thank you for your feedback. We really appreciate it. Have a great day!

MARILYN T.

January 8th, 2021

Deed.com was so easy to use to file my Quit Claim deed. They instructed me on how to send them my documents and it was a breeze. The cost was minimal and saved me tons of time.

Thank you!