Hardeman County Notice to Owner Form

Hardeman County Notice to Owner Form

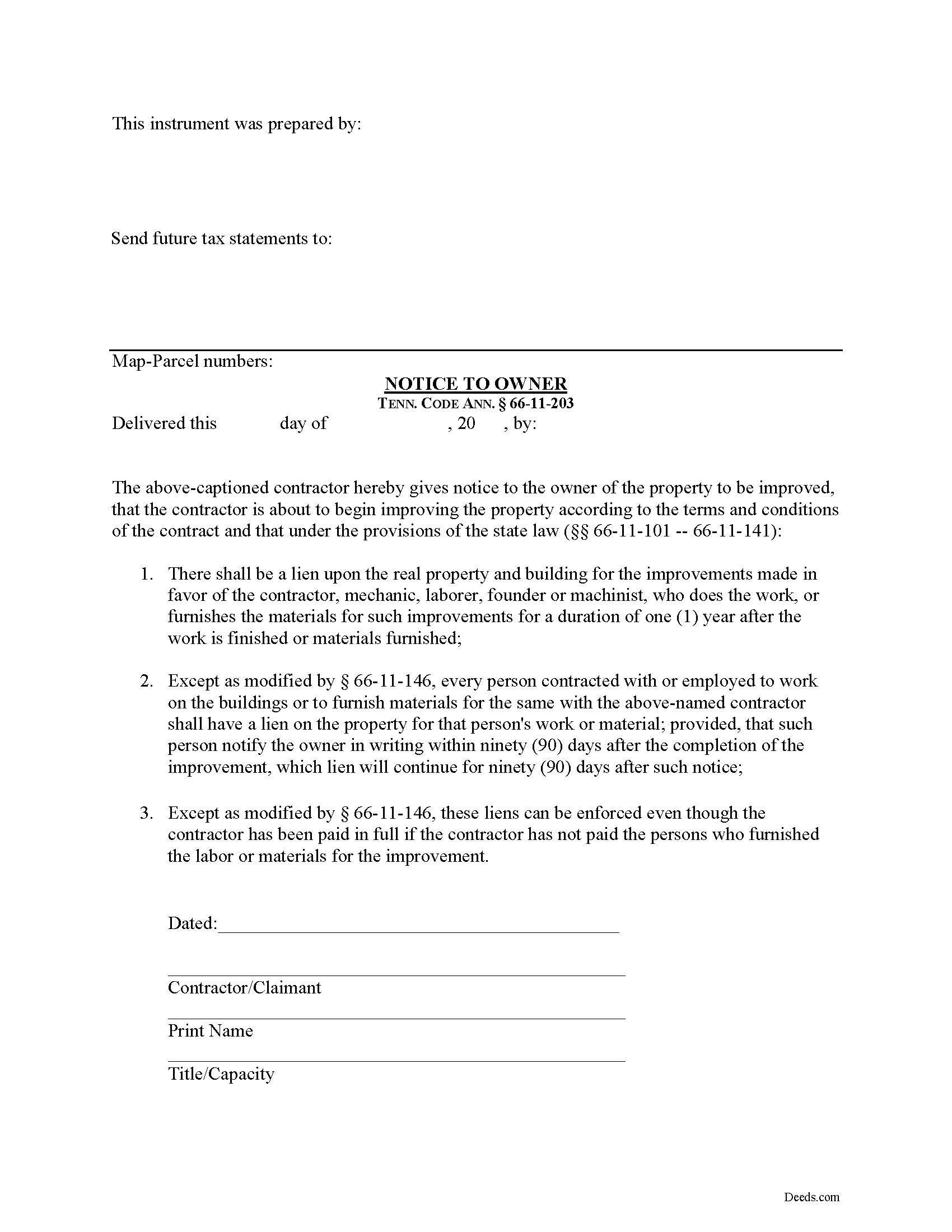

Fill in the blank Notice to Owner form formatted to comply with all Tennessee recording and content requirements.

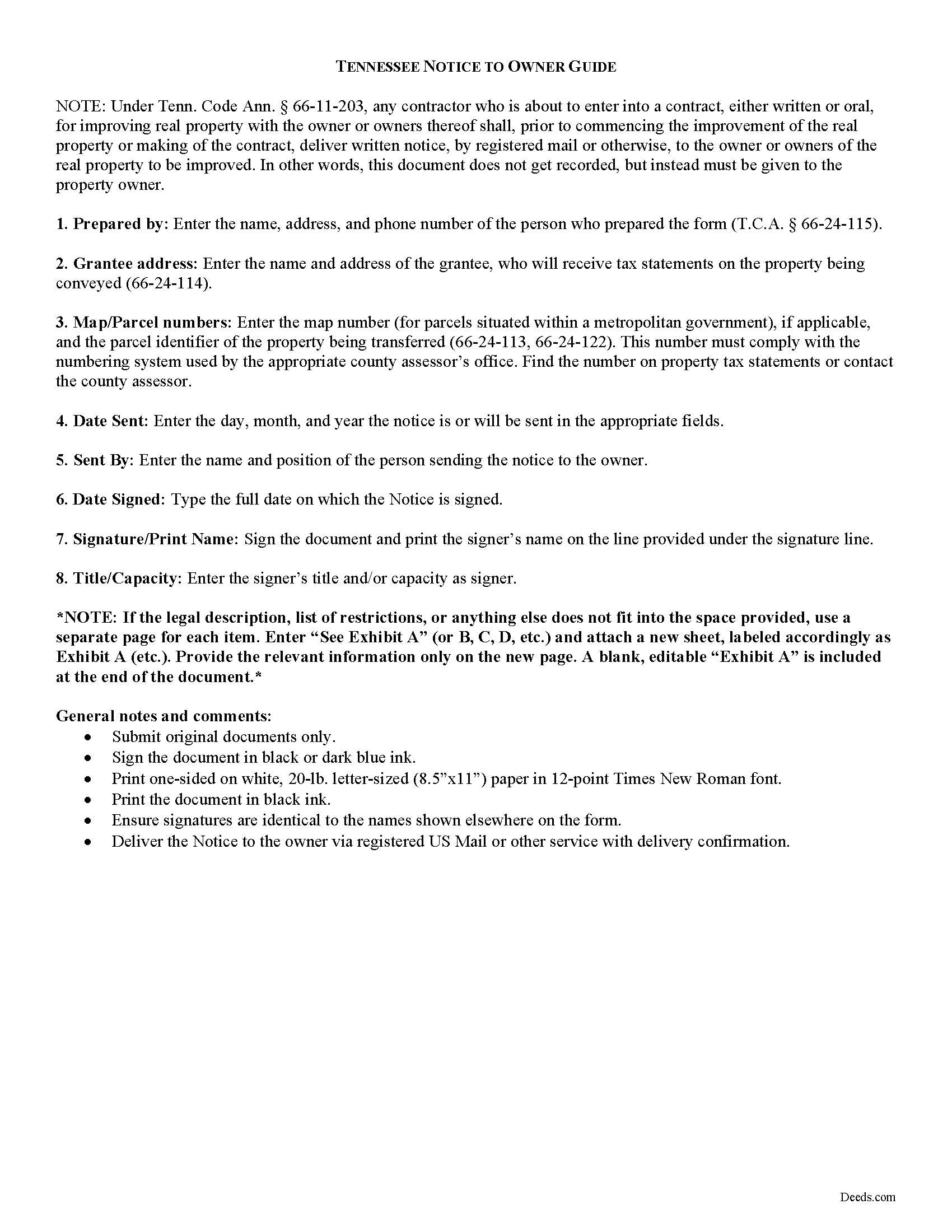

Hardeman County Notice to Owner Guide

Line by line guide explaining every blank on the form.

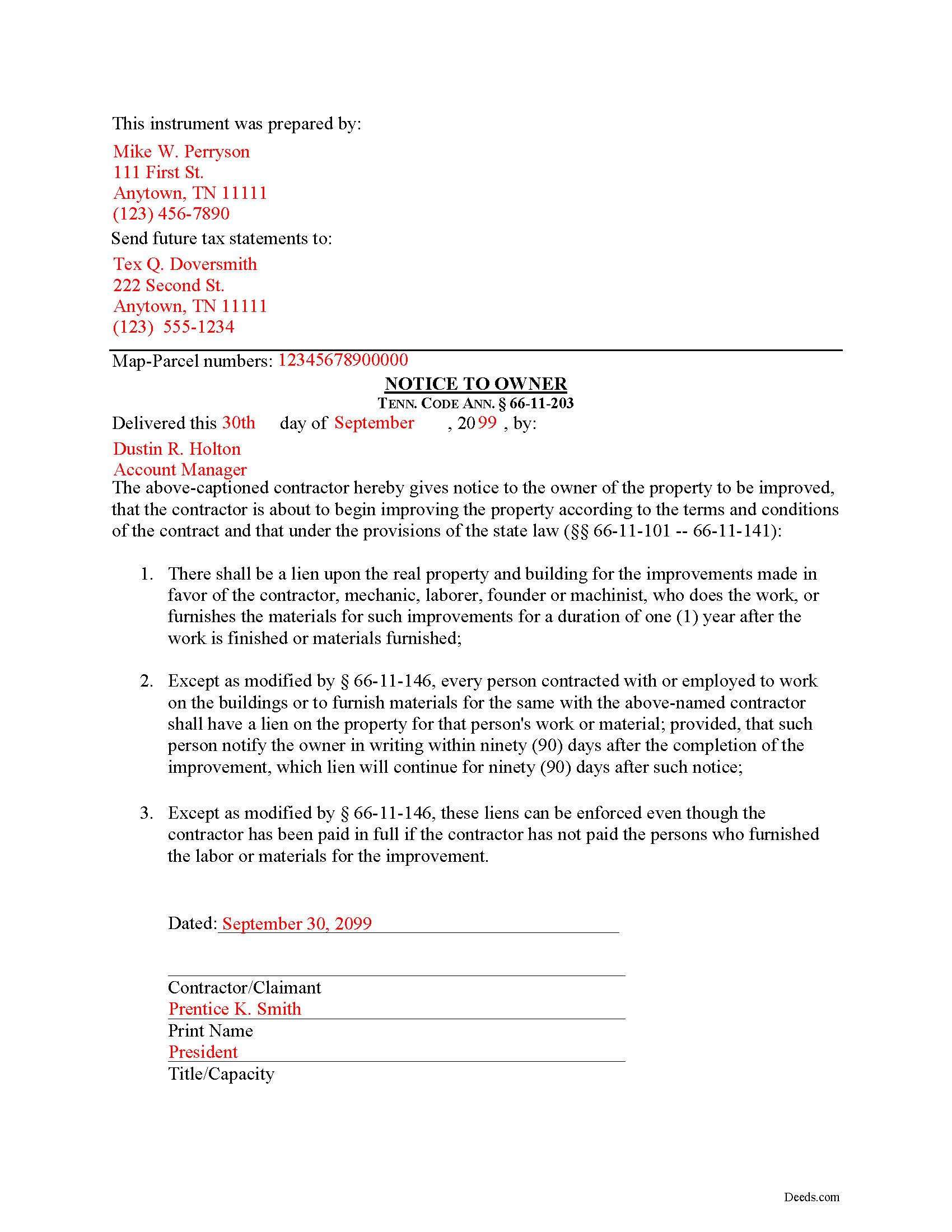

Hardeman County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Hardeman County documents included at no extra charge:

Where to Record Your Documents

Hardeman County Register of Deeds

Bolivar, Tennessee 38008

Hours: 8:30 to 4:30 M-Th; 8:30 to 5:30 Fr

Phone: (731) 658-3476

Recording Tips for Hardeman County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Hardeman County

Properties in any of these areas use Hardeman County forms:

- Bolivar

- Grand Junction

- Hickory Valley

- Hornsby

- Middleton

- Pocahontas

- Saulsbury

- Silerton

- Toone

- Whiteville

Hours, fees, requirements, and more for Hardeman County

How do I get my forms?

Forms are available for immediate download after payment. The Hardeman County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hardeman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hardeman County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hardeman County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hardeman County?

Recording fees in Hardeman County vary. Contact the recorder's office at (731) 658-3476 for current fees.

Questions answered? Let's get started!

Most states require contractors and other workers to provide a written notice to a property owner that lets he or she know that a project is about to commence. Sending the notice is necessary to protect any later mechanic's lien rights. In Tennessee, the form of notice is called a "Notice to Owner."

Any contractor who is about to enter into a contract, either written or oral, for improving real property with the owner or owners thereof shall, prior to commencing the improvement of the real property or making of the contract, deliver, by registered mail or otherwise, to the owner or owners of the real property to be improved a written notice. Tenn. Prop. Code 66-11-203.

The purpose of the Notice is to identify who the contractor is and inform the owner that the contractor is about to commence work and will have a right to claim a lien under State law. Id.

The notice identifies the parties, the delivery date, and the intended location and start date for the work or improvement. It must be sent before the work begins or else the person sending the notice may only be able to claim a lien for work arising after the notice is sent (if sent late). This document does not need to be recorded, but the potential claimant should either deliver it by hand or via USPS Registered mail or another delivery service that offers confirmation.

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens or sending notice to an owner.

Important: Your property must be located in Hardeman County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Hardeman County.

Our Promise

The documents you receive here will meet, or exceed, the Hardeman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hardeman County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Michael F.

May 12th, 2021

I'm not too bright and I made a mess of things when I tried to create my own deed. It was lucky that I found the forms here after so many of my personal failures. It's good that the pros know what they are doing.

Such kind words Michael, thank you.

Ellen D.

November 25th, 2019

Fantastic service! The forms were available to download instantly and they were perfect for my situation. Easy to use on my older computer. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia P.

December 10th, 2019

Not user friendly despite additional guide. There are other products out there that are superior. A waste of $20.

Sorry to hear that Virginia. Your order and payment has been canceled. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Andrew M.

January 21st, 2024

Awesome service, I don’t know how much it saved me but I know it was a lot cheaper than going to a lawyer.

We are delighted to have been of service. Thank you for the positive review!

Richard O.

February 18th, 2025

It has an easy-to-use interface and well-formatted, detailed forms. Consider adding AI agents to assist in completing these forms from data provided or available from public sources. Overall, I am very satisfied!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Sidney H.

August 3rd, 2022

Fabulous resource! They provide everything you need at an extremely reasonable price.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda A.

April 22nd, 2020

This company and it's customer service ARE wonderful. GREAT tool to assist you with any situation you may have. I HAVE RECOMMENDED THEM TO MY FRIENDS AND FAMILY.

Thank you!

Melissa H.

August 10th, 2021

Amazing forms! Order the quitclaim deed forms, got the form and lots of extra forms which is good because I needed a few of them and didn't even know it. Very happy, will be back if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurentina F.

December 10th, 2020

Great and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leonard S.

March 2nd, 2023

OK service

Thank you!

Peter M.

February 3rd, 2020

Quick and complete. Thanks!

Thank you!

Theadore L.

January 4th, 2024

Bought a transfer on death deed form and it worked great. Easy to fill out and record with the County. Got some helpful information from the county recorders office before filling out the form. I found out that I could use one deed for 2 properties. Saved me money not having to pay fees for 2 deeds.

We are delighted to have been of service. Thank you for the positive review!

Sharon B.

August 11th, 2022

My questions were answered promptly. I was not able to locate the deed I was searching for because my county has not uploaded the documents to be accessed through this system. I am sure I could have found what I was looking for had the information been available through the system. Thank you for your assistance.

Thank you!

Robyn D.

July 28th, 2020

Excellent service, knowledgeable and helpful representatives via the messaging service. Reliable information provided by reps, overall excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

timothy h.

November 12th, 2020

Too complicated and too expensive

Sorry to hear that Timothy, we do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.