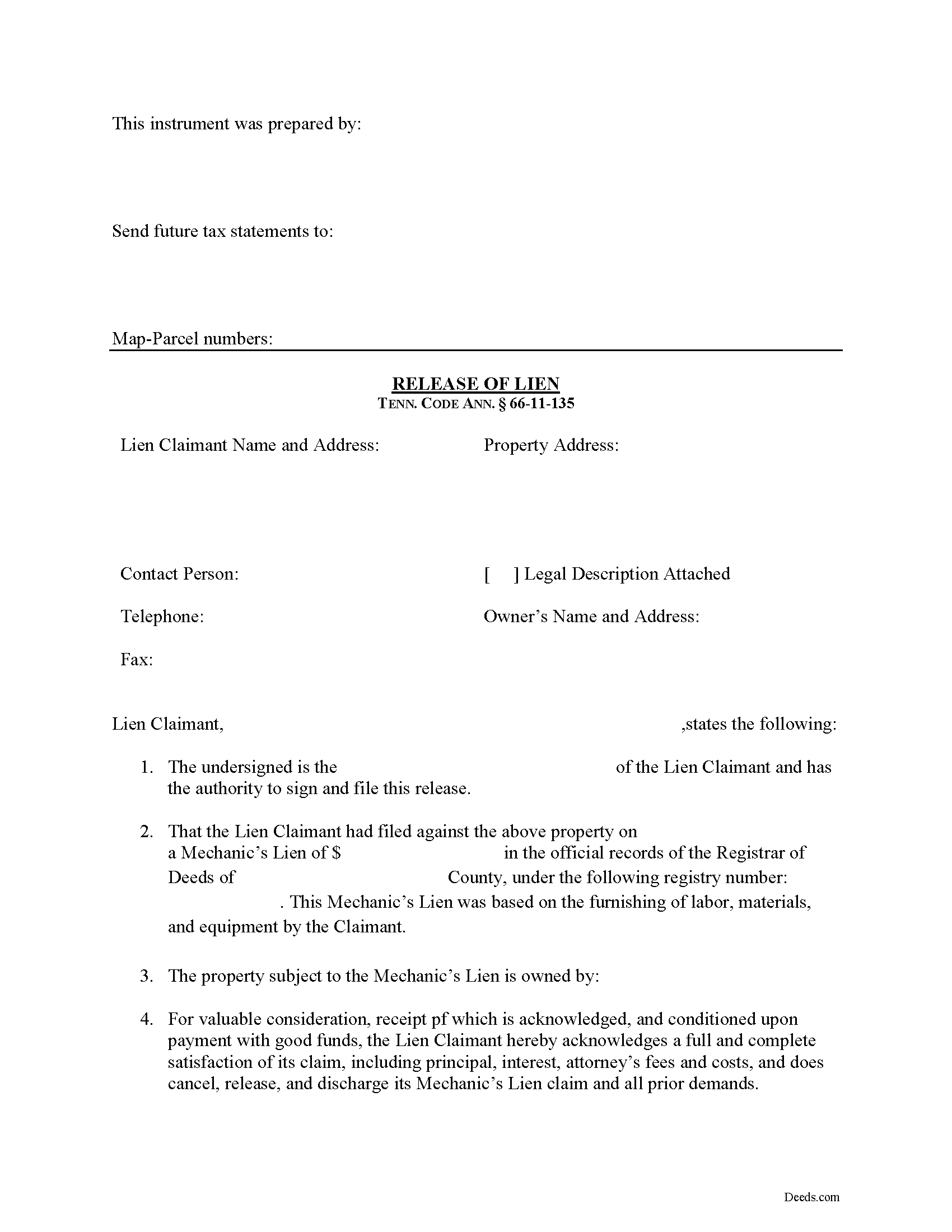

Cannon County Release of Mechanic Lien Form

Cannon County Release of Mechanic Lien Form

Fill in the blank Release of Mechanic Lien form formatted to comply with all Tennessee recording and content requirements.

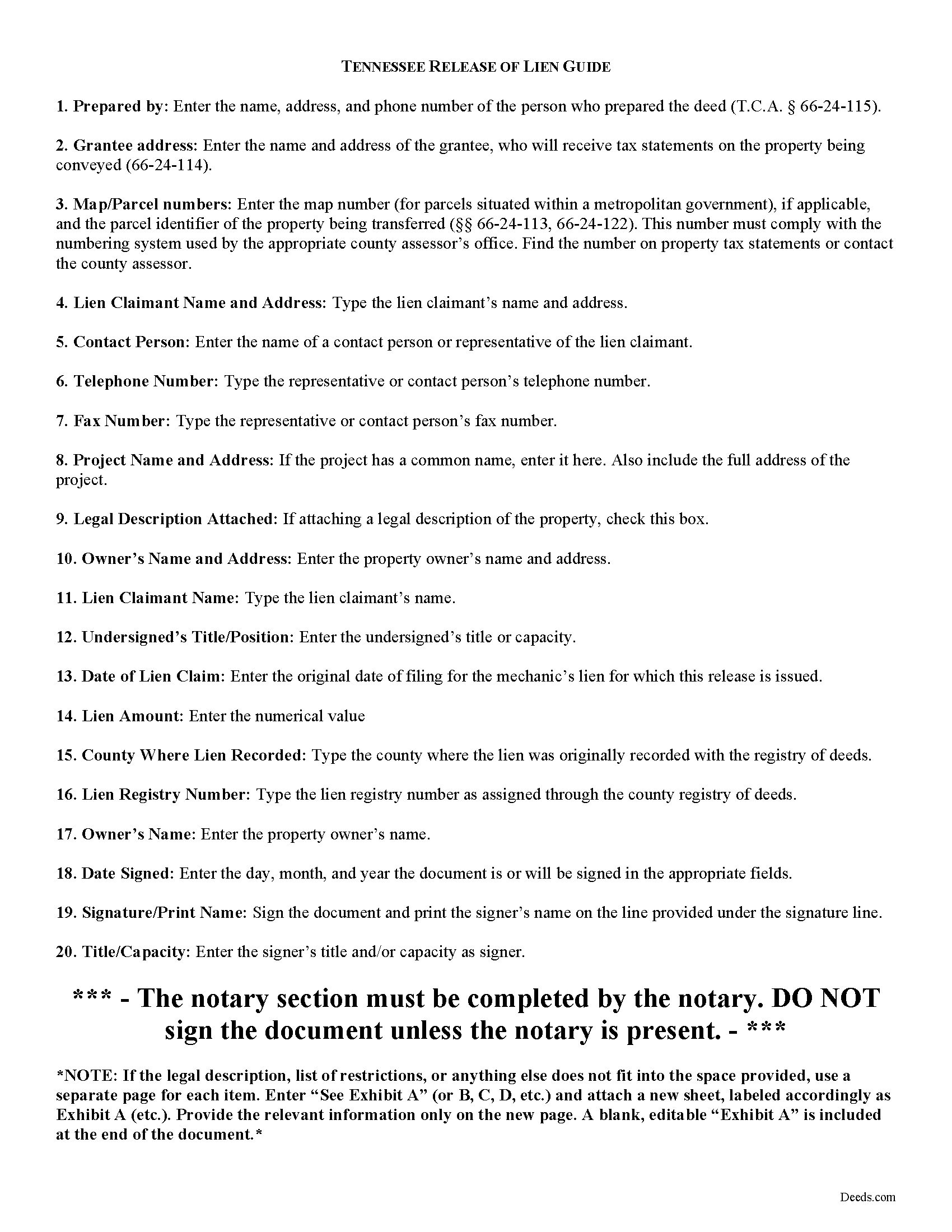

Cannon County Release of Mechanic Lien Guide

Line by line guide explaining every blank on the form.

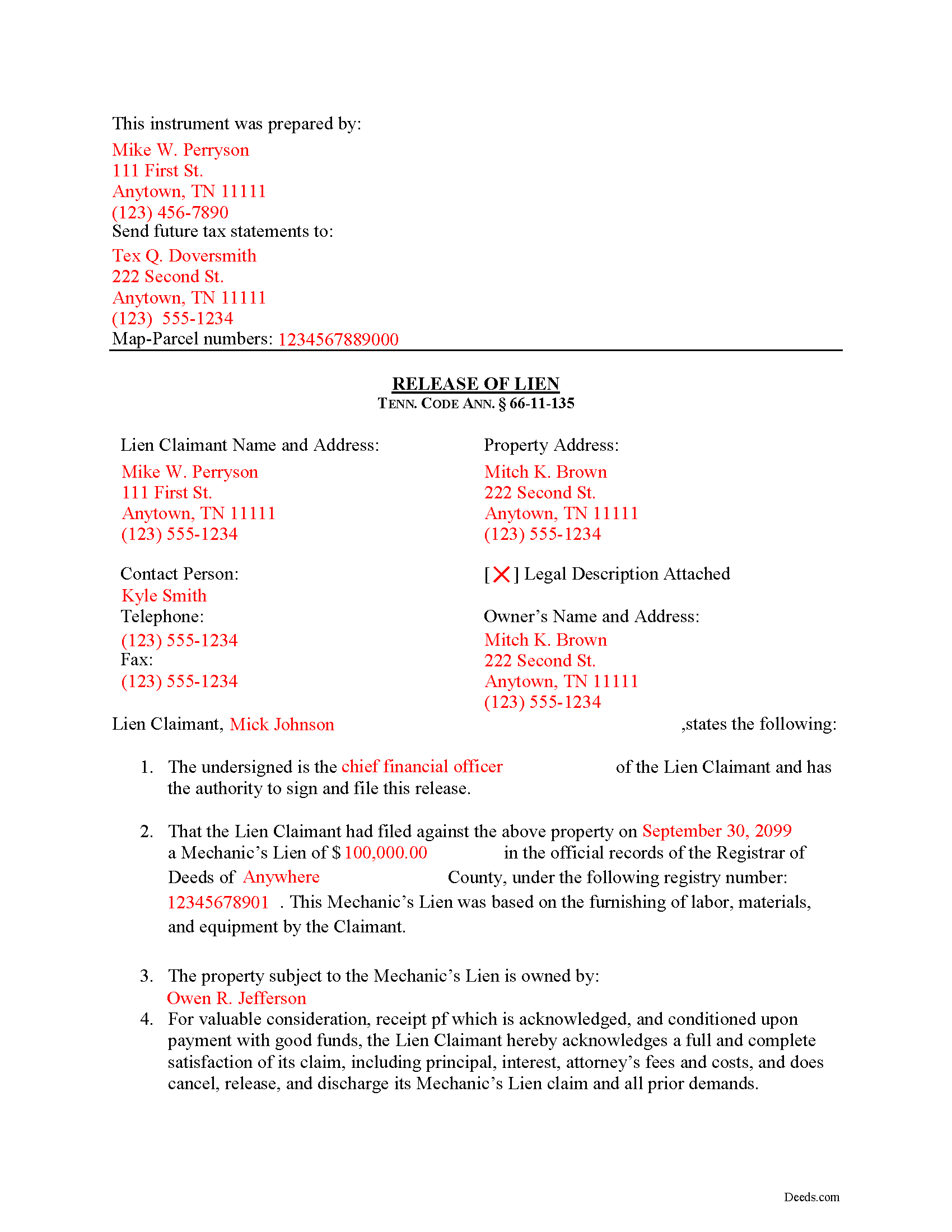

Cannon County Completed Example of the Release of Mechanic Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Cannon County documents included at no extra charge:

Where to Record Your Documents

Cannon County Register Of Deeds

Woodbury, Tennessee 37190

Hours: 8:30 to 4:30 M-F

Phone: (615) 563-2041

Recording Tips for Cannon County:

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Cannon County

Properties in any of these areas use Cannon County forms:

- Auburntown

- Bradyville

- Readyville

- Woodbury

Hours, fees, requirements, and more for Cannon County

How do I get my forms?

Forms are available for immediate download after payment. The Cannon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cannon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cannon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cannon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cannon County?

Recording fees in Cannon County vary. Contact the recorder's office at (615) 563-2041 for current fees.

Questions answered? Let's get started!

Releasing a Mechanic's Lien in Tennessee

Lien claimants must grant releases when the lien is no longer effective because it has been paid off or for any other reason.

If a lienor whose lien has been forfeited, expired, satisfied or adjudged against the lienor in an action on the lien, fails to cause the lien provided by this chapter to be released within thirty (30) days after service of written notice demanding release, the lienor shall be liable to the owner for all damages arising therefrom, and costs, including reasonable attorneys' fees, incurred by the owner. Tenn. Prop. Code 66-11-135(a).

A valid release form under this section identifies the parties, the location of the work or improvement, a reference to the recorded notice of lien, relevant dates and payments, and any other information necessary for the specific situation.

The lienor must file the release in the office where the notice of lien was recorded. Tenn. Prop. Code 66-11-135(b). The fee for recording shall be the fee required for the recording of a release or satisfaction of a mortgage as provided by law. Id. The lien shall be deemed released on the day on which the release of the lien is recorded in the proper office. Tenn. Prop. Code 66-11-135(c).

This article is provided for informational purposes only and should not be considered legal advice or relied upon as any substitute for speaking with an attorney. Please consult a Tennessee attorney familiar with construction law for any issues regarding mechanic's liens.

Important: Your property must be located in Cannon County to use these forms. Documents should be recorded at the office below.

This Release of Mechanic Lien meets all recording requirements specific to Cannon County.

Our Promise

The documents you receive here will meet, or exceed, the Cannon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cannon County Release of Mechanic Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

jonathan f.

June 12th, 2020

I had a one time event. The website instructions were straightforward; the job was completed quickly; the cost was modest. I am completely satisfied and will not hesitate to use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bobby T.

June 17th, 2020

Great!! Helps me out

Thank you!

Patsy B.

February 19th, 2020

This website is very user friendly. I easily found the form I needed and was given an example for filling it out. Highly recommend this website!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody L.

November 8th, 2020

Beware, you cannot save the information you typed and change it later. It will be a PDF upon saving. So if you need corrections...you have to start all over!

Thank you for your feedback. We really appreciate it. Have a great day!

Connie H.

January 18th, 2019

I really appreciated the detailed instructions provided with the document. The instructions made it easy to fill it out correctly. Filed the document with the courthouse the next day and have received confirmation that it has been filed.

Thanks Connie! Have a great day!

Kathryn G.

December 21st, 2023

This was extremely helpful!

We are motivated by your feedback to continue delivering excellence. Thank you!

Pansie H.

August 23rd, 2019

Quick and Easy

Thank you!

Rut P M.

November 15th, 2020

I was very pleased with the document I downloaded. I was able to edit it easily and save a copy both as a permanent copy or one that could still be edited. I also liked being able to cut and paste longer paragraphs. It cost a little more than I expected; however, it was worth it be cause I didn't have to fill it out by hand. Great job!

Thank you for your feedback. We really appreciate it. Have a great day!

Sarah K.

October 22nd, 2019

I was annoyed when I realized I couldn't put the document into Word or WordPerfect. I had to retype the entire document. What a waste of time and money.

Sorry to hear of your annoyance. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Arthur M.

February 25th, 2021

Efficient and easy to use. Thanks.

Thank you!

Susan N.

December 1st, 2019

Hope to get form printed out Ok.

Thank you!

Angie K.

March 29th, 2019

Thank You!

Thank you Angie.

Pamela B.

November 23rd, 2019

Fantastic system, so easy to use even for a simpleton like me.

Thank you!

Kenneth J.

June 15th, 2021

Great product; Got the Job done.

Thank you!

Jon W.

September 16th, 2021

Useless for me. My deed could not be pulled. After investigation, I got a copy online directly from WV for $3. No one but editors of this will ever see this. Shame.

Thank you for your feedback. We really appreciate it. Have a great day!