Cannon County Specific Power of Attorney for the Sale of Property Form

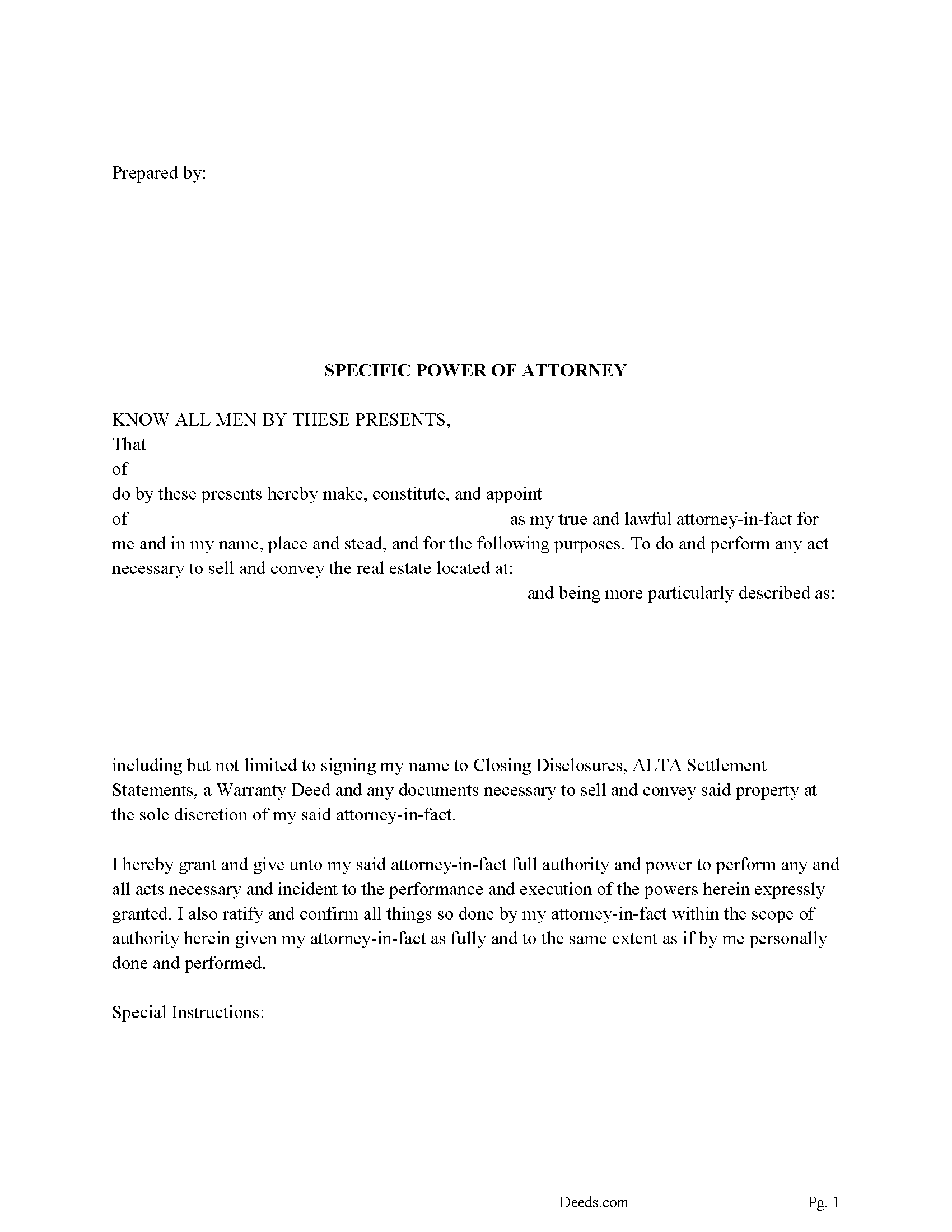

Cannon County Specific Power of Attorney Form / Sale of Property

Fill in the blank form formatted to comply with all recording and content requirements.

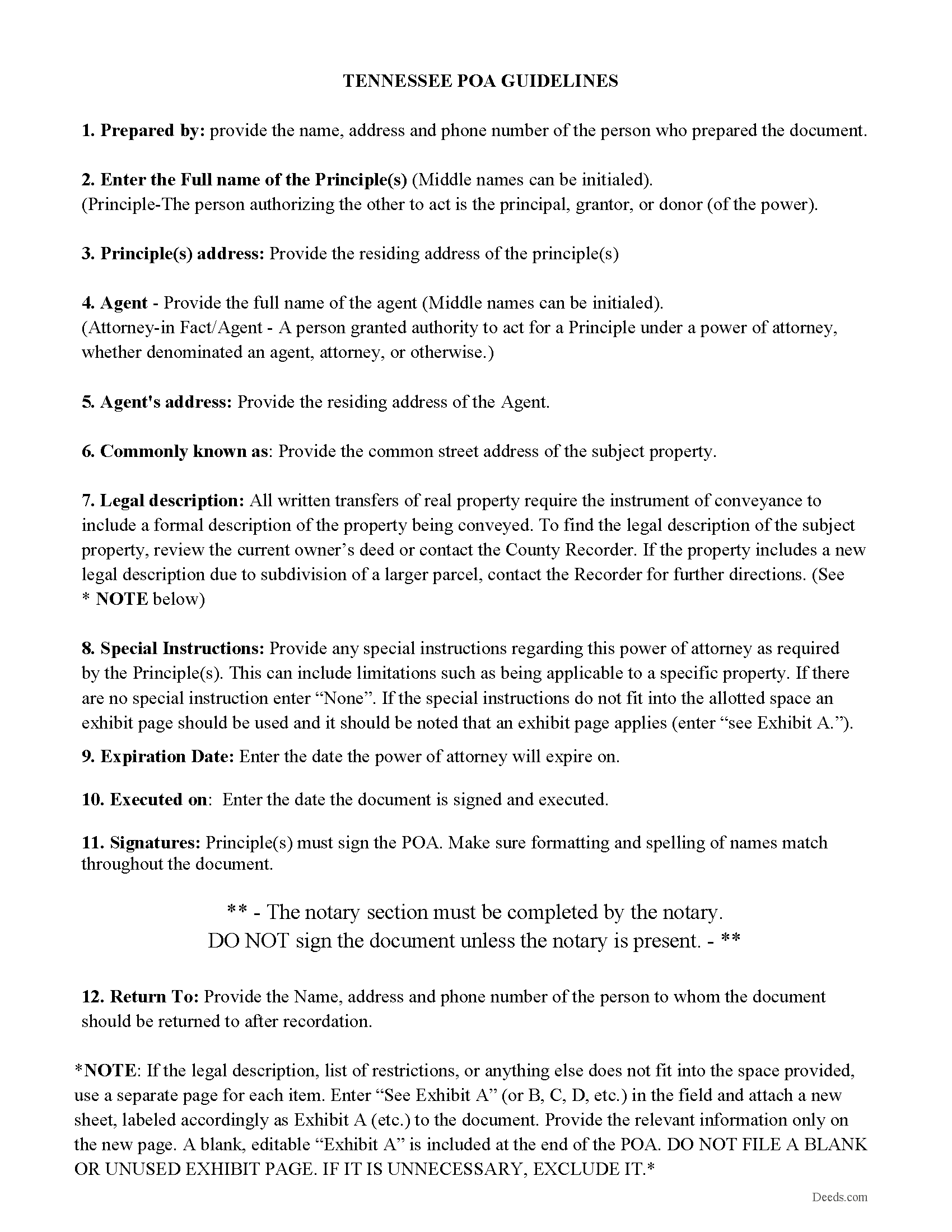

Cannon County Specific Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

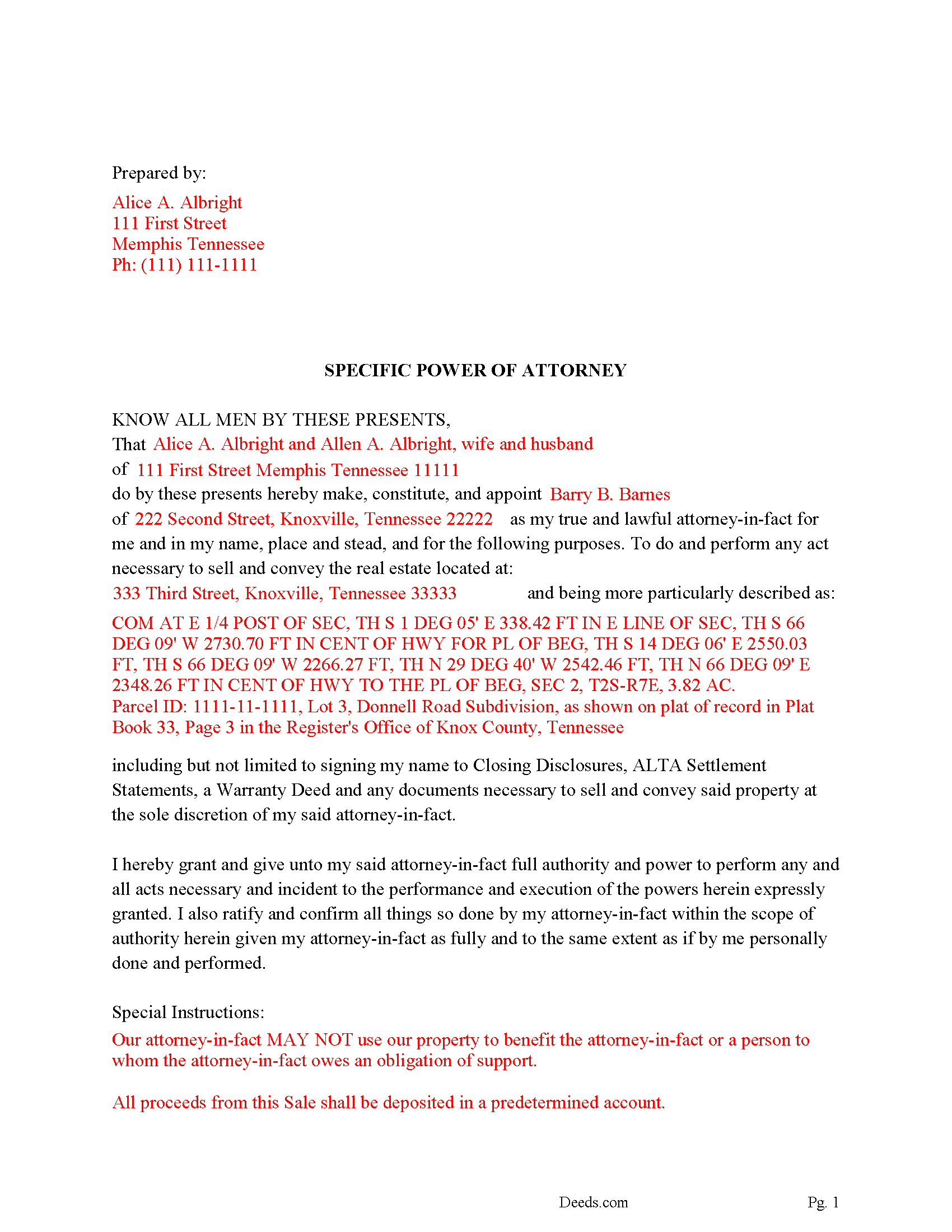

Cannon County Completed Example of the Specific POA

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Tennessee and Cannon County documents included at no extra charge:

Where to Record Your Documents

Cannon County Register Of Deeds

Woodbury, Tennessee 37190

Hours: 8:30 to 4:30 M-F

Phone: (615) 563-2041

Recording Tips for Cannon County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Cannon County

Properties in any of these areas use Cannon County forms:

- Auburntown

- Bradyville

- Readyville

- Woodbury

Hours, fees, requirements, and more for Cannon County

How do I get my forms?

Forms are available for immediate download after payment. The Cannon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cannon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cannon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cannon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cannon County?

Recording fees in Cannon County vary. Contact the recorder's office at (615) 563-2041 for current fees.

Questions answered? Let's get started!

The Principal(s), owners of the property appoint a second party, attorney-in-fact to sell a specific property. In this form the principal is empowering the attorney-in-fact to do and perform any act necessary to sell and convey the real estate specified. Included is a "Special Instructions" section where the attorney-in-fact's powers can be further limited and/or defined.

This power of attorney shall become effective immediately upon the execution of same and pursuant to Tennessee Code Annotated Section 34-6-101 et seq. and shall be considered a "Durable Power of Attorney."

This power of attorney is formatted for recording in the Tennessee County, where the subject property is located and terminates upon a date provided by the principal. Therefore 60, 90, 120 days, etc. can be allotted for the sale.

(Tennessee SPOA-Sale Package includes form, guidelines, and completed example)

Important: Your property must be located in Cannon County to use these forms. Documents should be recorded at the office below.

This Specific Power of Attorney for the Sale of Property meets all recording requirements specific to Cannon County.

Our Promise

The documents you receive here will meet, or exceed, the Cannon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cannon County Specific Power of Attorney for the Sale of Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

SUSAN B.

September 16th, 2024

THE PROCEDURE IN GETTING THIS MECHANICS LIEN PROCESSED HAS SO FAR BEEN RELATIVELY SIMPLY - BETTER THAN HAVING TO WAIT ON MAIL OR GO IN PERSON TO GET RECORDED

We are delighted to have been of service. Thank you for the positive review!

raquel f.

July 28th, 2021

Wow!!! that was super easy to record a mechanic lien! I will definitely use your service again but I hope I won't have to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry J.

May 20th, 2019

we are hoping this is what we need. Thanks

Thank you!

Rosa D.

June 18th, 2019

Obtaining a quick claim deed from this website was easy and friendly I must say. Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

SHIRLEY H.

September 21st, 2022

I like that they have all the forms, but I could not find it they would submit the forms to the recorders office

Thank you!

Kimberly H.

December 17th, 2021

Exceptional Service all Year~ I wish Deeds.com A Happy Holidays & A Happy New Year.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anne B.

July 29th, 2020

Great experience! It was so easy and quick. We will definitely use the service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bonnie A.

March 3rd, 2020

I little struggle downloading the forms at first but support helped. After that it was a breeze, happy with everything.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary H.

June 15th, 2020

I have downloaded all the forms and the guidelines. The information provided is very helpful and easy to access. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Ping O.

September 5th, 2019

Thank you for making this easy!

Thank you!

Sera E.

January 25th, 2022

East, fast, reliable. Great service!

Thank you!

Shane T.

March 7th, 2020

The Transfer on Death Deed form package was very good. But like anything, could use some improvements. There is not enough space to fill more than one beneficiary with any level of additional detail like "as his sole and separate property" The area for the legal description could be a bit bigger and potentially fit many legal descriptions. Or it could be made to simply say "See Exhibit A" as is likely necessary for most anyway. The guide should indicate what "homestead property" means so the user doesn't have to research the legal definition. (which turns out to be obvious, at least in my state, if you live there, it's your homestead.) It would be helpful if an "Affidavit of Death" form were included in the package for instances where the current deed hasn't been updated to reflect a widowed owner as the sole owner before recording with only the one signature.

Thank you for your feedback. We really appreciate it. Have a great day!

rich b.

September 3rd, 2021

Had pretty much everything I needed. Had to slice and dice a bit.

Thank you!

Susan M.

March 15th, 2022

Loved my experience with deeds.com! Easy and simple to fill in the form, plus the extra instructions were helpful! I will use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Gretchen N.

February 8th, 2019

The filled out form could have been placed on the real form then deleted with current info. Form quite simplified but example & help good.

Thank you for your feedback Gretchen.