Oldham County Correction Deed Form

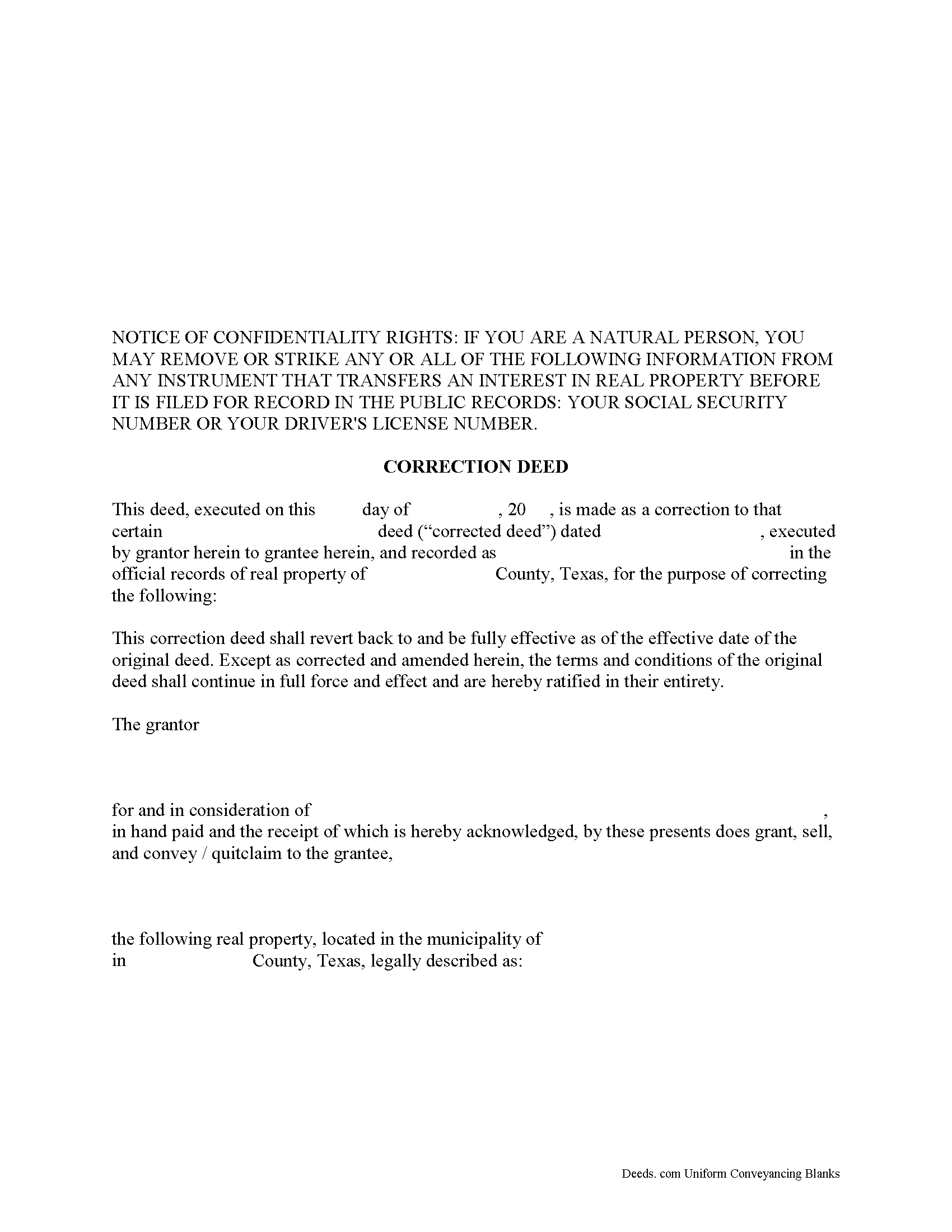

Oldham County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

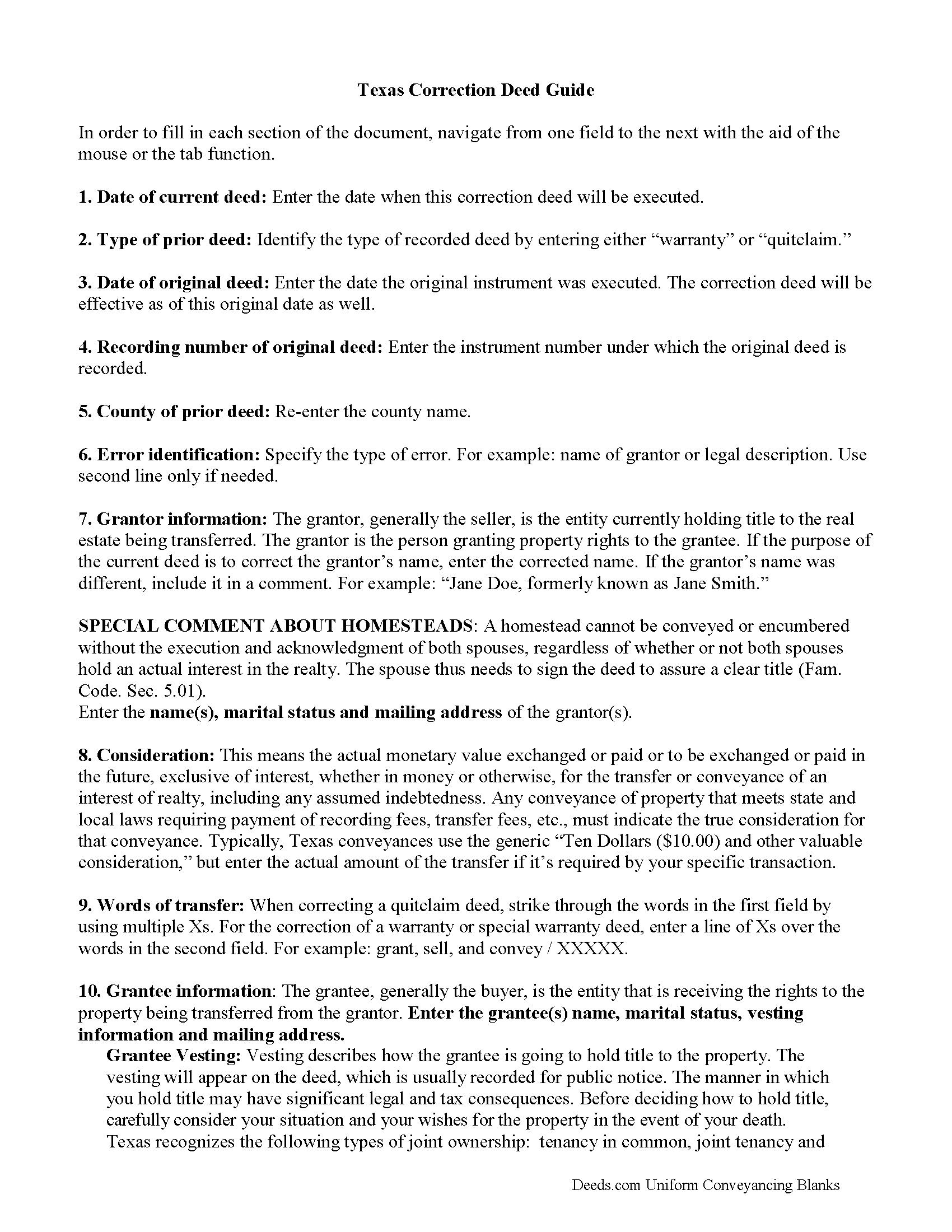

Oldham County Correction Deed Guide

Line by line guide explaining every blank on the form.

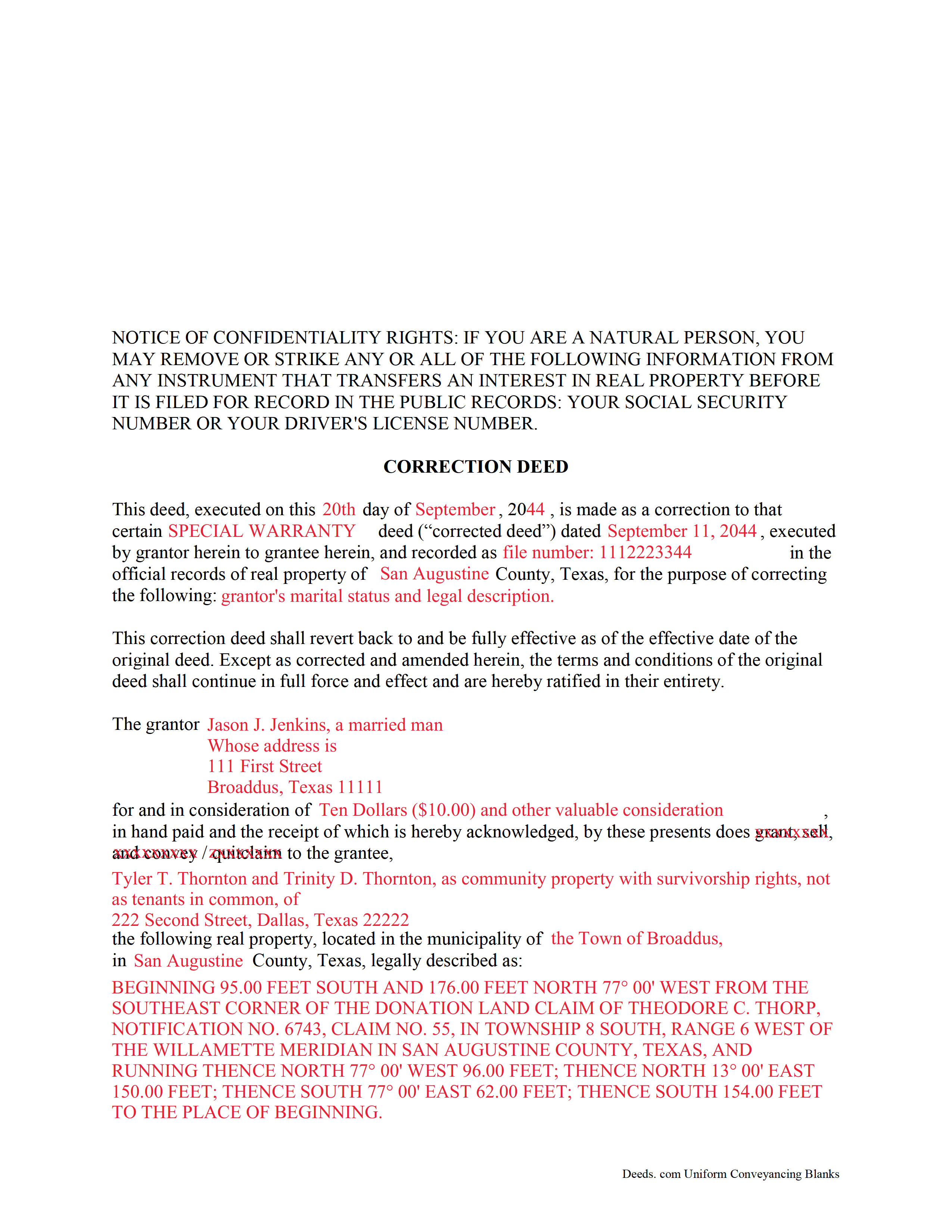

Oldham County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Oldham County documents included at no extra charge:

Where to Record Your Documents

County Clerk's Office

Vega, Texas 79092

Hours: Monday - Friday 8:30am - 12:00 & 1:00 - 5:00pm

Phone: 806-267-2667

Recording Tips for Oldham County:

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Oldham County

Properties in any of these areas use Oldham County forms:

- Adrian

- Boys Ranch

- Vega

- Wildorado

Hours, fees, requirements, and more for Oldham County

How do I get my forms?

Forms are available for immediate download after payment. The Oldham County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Oldham County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Oldham County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Oldham County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Oldham County?

Recording fees in Oldham County vary. Contact the recorder's office at 806-267-2667 for current fees.

Questions answered? Let's get started!

In Texas, a correction deed is the deed issued to make changes to an erroneous deed, referred to as the corrected deed. These two instruments are closely linked, and all corrections are effective as of the date of the original recorded instrument (Property Code Sec. 5.030).

Texas Property Code distinguishes between material and non-material corrections, giving specific examples in each category. Non-material changes are generally clerical in nature and include additions to or corrections of: party names and marital status; elements of the property description, such as, an error in a metes and bounds description or incorrect acreage; the recording date or reference data to an earlier instrument; a missing or defective acknowledgement. All these corrections can be made by persons other than the parties of the original instrument, as long as reasons for the correction and knowledge of the facts corrected are stated and evidence of notification of the original parties or their heirs is provided (Property Code Sec. 5.028).

Material corrections, on the other hand, can only be made by the original parties or their heirs and must be executed by all of parties involved. Such changes include the addition or removal of land, disclaimers, a mortgagee's consent or subordination to a recorded instrument, and changes of lot or unit number (Property Code Sec. 5.029). A Texas Supreme Court decision from 2009 also specified the addition or removal of mineral rights as among the material changes that can only be made by the original parties.

In some areas of Texas, it has been common practice for the attorney who made the error to correct it through a scrivener's affidavit when the parties are not available and the error is only minor in nature. This type of correction is ineffective when a title company employee makes it or when it is made to a certified copy of the original instrument. Only when the parties initial the changes and sign a statement why they are being made is the correction of a certified copy acceptable for recording, but even then, can it be only made for the types of errors specified in the statutes (see above). It is always advisable to check with the local county recorder.

(Texas Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Oldham County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Oldham County.

Our Promise

The documents you receive here will meet, or exceed, the Oldham County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Oldham County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Rosemary S.

July 25th, 2020

It was quick and so very easy. Very detailed information. Love the app.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jane B.

December 20th, 2020

Easy to use,thanks

Thank you!

Shellie J.

February 19th, 2020

Documents are great and easy to use, just wish there was a page helping to know where to mail documents to with an amount since it tells you mailing in is an option.

Thank you for your feedback. We really appreciate it. Have a great day!

Patrick S.

March 4th, 2019

Excellent!

Thank you!

Cheryl M.

April 12th, 2020

Easy.

Thank you!

Lucus S.

May 19th, 2022

I tried to do it myself by copying an old deed and ended up with a bunch of headaches (expensive ones) wish I would have used these documents first. Live and learn.

Thank you!

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

Janice U.

July 26th, 2019

So far everything is going really well. Thank you!

Thank you!

Cecil S.

November 11th, 2020

Fast service done well

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melanie W.

October 23rd, 2022

I used deeds.com to complete a gift deed for transferring a house to our son. Finding the correct form and completing it correctly was extremely easy due to wonderful explanations and examples provided with the purchase of the form. The registrar filing the deed told me she was impressed with the work we did. An attorney would have charged $150 so the $28.00 was well worth the money.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara Beth M B.

August 14th, 2020

great service!!!!! wish this service was listed on the Washoe County Recorder website so people who aren't companies could find it.

Thank you for your feedback. We really appreciate it. Have a great day!

Donovan M.

September 16th, 2020

Straight forward, very fair price with excellent instructions and example. I am very pleased with your product!

Thank you!

Danny A.

January 10th, 2021

This app is a fast and convenient way to download documents you need.

Thank you!

Everette W.

March 5th, 2023

This form was very helpful ... I wish I had run across your before it would have saved me a lot of money.

Thank you!

Gregory B.

May 30th, 2020

I believe you need more instruction on the use of the web site. I would type and nothing would appear on the form. When I tried to save a completed form I ended with a blank form with no detail.

Thank you!