Dallas County Enhanced Life Estate Deed Form

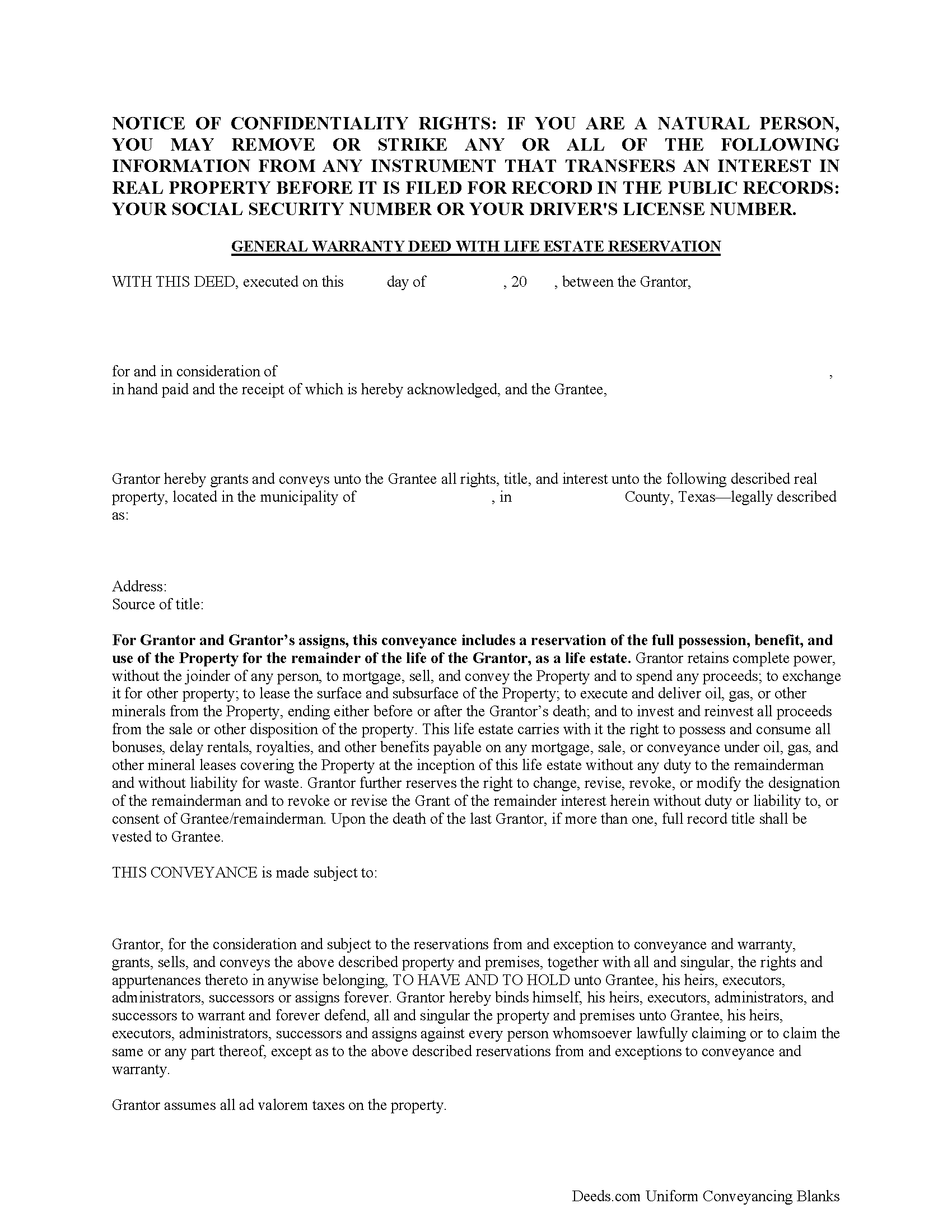

Dallas County Enhanced Life Estate Form

Fill in the blank form formatted to comply with all recording and content requirements.

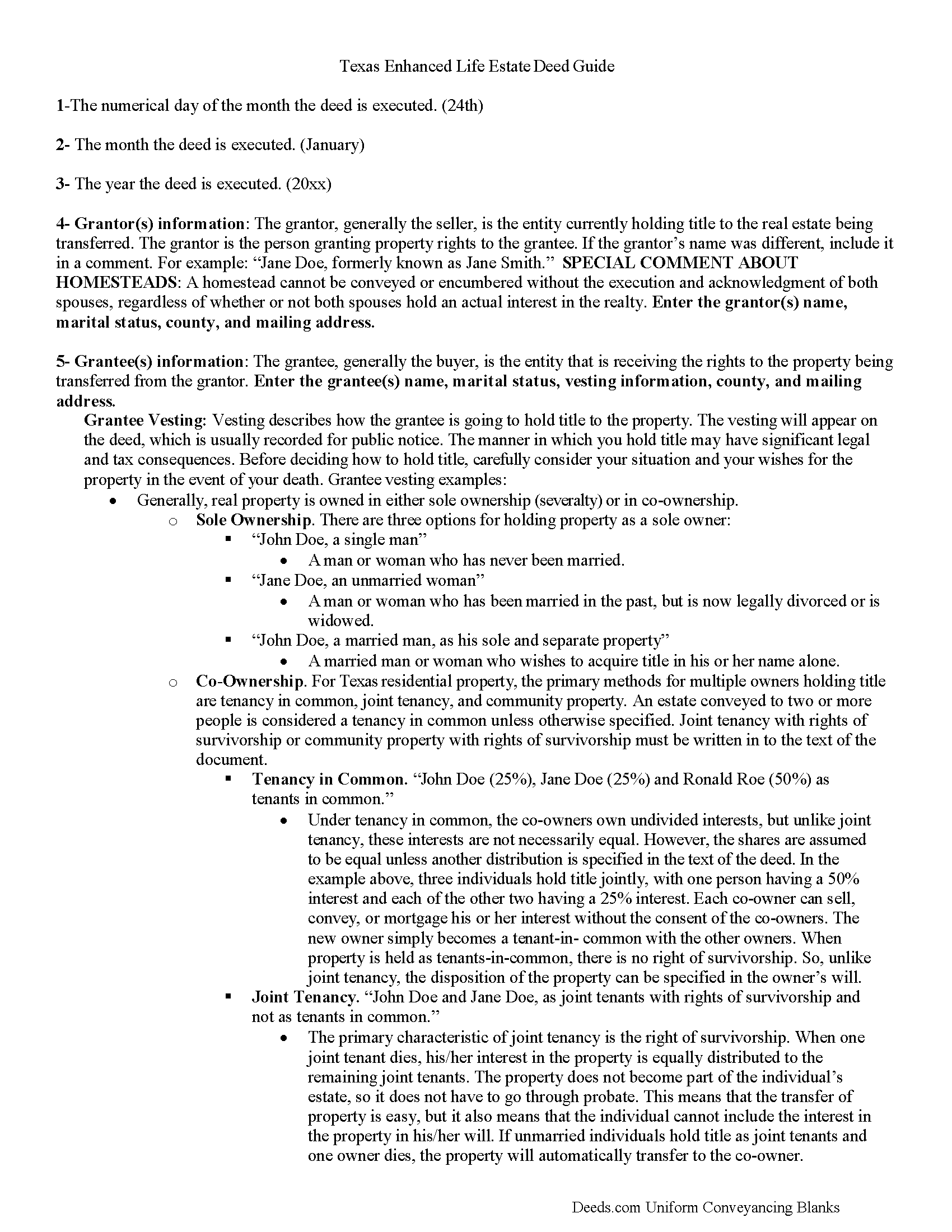

Dallas County Enhanced Life Estate Guide

Line by line guide explaining every blank on the form.

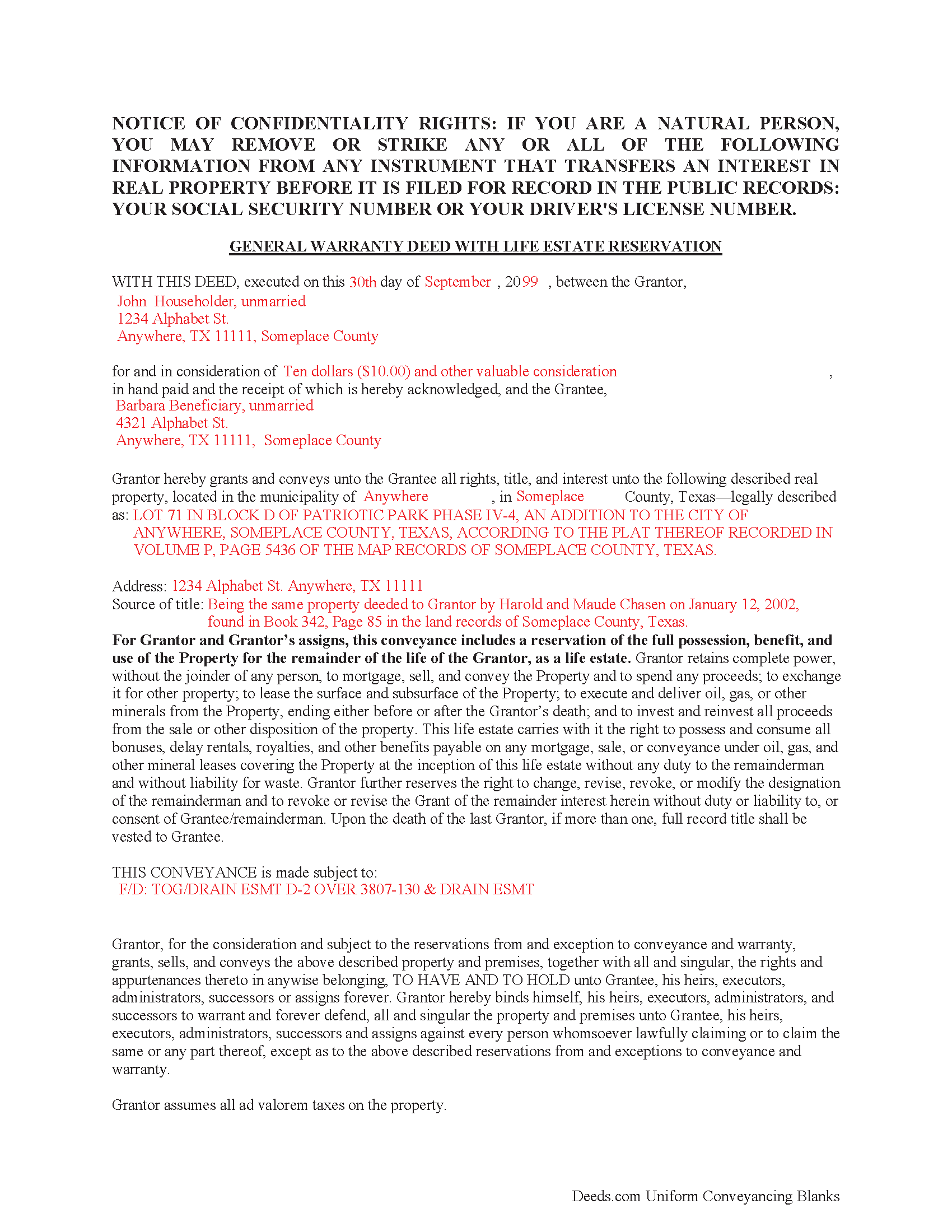

Dallas County Completed Example of the Enhanced Life Estate Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Dallas County documents included at no extra charge:

Where to Record Your Documents

Dallas County Clerk

Dallas, Texas 75270

Hours: 8:00am to 4:30pm M-F

Phone: 214-653-7099 press 7

Recording Tips for Dallas County:

- Bring your driver's license or state-issued photo ID

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Dallas County

Properties in any of these areas use Dallas County forms:

- Addison

- Carrollton

- Cedar Hill

- Coppell

- Dallas

- Desoto

- Duncanville

- Garland

- Grand Prairie

- Hutchins

- Irving

- Lancaster

- Mesquite

- Richardson

- Rowlett

- Sachse

- Seagoville

- Sunnyvale

- Wilmer

Hours, fees, requirements, and more for Dallas County

How do I get my forms?

Forms are available for immediate download after payment. The Dallas County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dallas County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dallas County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dallas County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dallas County?

Recording fees in Dallas County vary. Contact the recorder's office at 214-653-7099 press 7 for current fees.

Questions answered? Let's get started!

A Lady Bird deed, also called an enhanced life estate deed or reservation of a life estate with a general power of appointment, is a useful estate planning tool. When executed, the grantor conveys a life estate in real property to himself, with the remainder conveyed to the beneficiary of his choice, thereby avoiding the probate process. This type of deed enables the grantor to preserve homestead status (if claimed) as well as any deductions, protections, and tax exemptions associated with the real estate during his lifetime. In addition, he retains absolute control over the property, allowing for the option to change the beneficiary or even sell, convey, or mortgage the property before the transfer of ownership goes into effect upon the grantor's death.

(Texas Enhanced Life Estate Package includes form, guidelines, and completed example)

Important: Your property must be located in Dallas County to use these forms. Documents should be recorded at the office below.

This Enhanced Life Estate Deed meets all recording requirements specific to Dallas County.

Our Promise

The documents you receive here will meet, or exceed, the Dallas County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dallas County Enhanced Life Estate Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

James B.

June 9th, 2019

Reliable and fast. A great assest.

Thank you!

Jan M.

June 5th, 2019

Fantastic company. They are the absolute best and helped me get the information I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Josephine R.

November 18th, 2019

Completed, notarized, and recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

William S.

June 4th, 2021

Contents were well done. Could not remove and replace the "Deeds/" footer, rendering the form unusable for filing with a court and county deed records. This should be corrected.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas G.

March 16th, 2020

A few parts are confusing'.Like sending Tax statements to WHO ?/ The rest is simple I hope.Have not tried to record yet

Thank you!

Robert K.

June 13th, 2021

Very user friendly - I found the affidavit I needed right away together with the guide to filling it out.

Thank you!

Larry L.

January 20th, 2022

I am completely satisfied. It was easy to find the correct form and download it. The instructions were very clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Brenda K R.

October 1st, 2021

Hello, I like how easy the form is to follow. I'm unsure however of how to proceed as what I am trying to do is have my name added to the deed so in event of death I have ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Janet P.

July 30th, 2021

Extremely easy to use. The guide and sample were a great source of reference.

Thank you for your feedback. We really appreciate it. Have a great day!

Edwart D.

November 30th, 2021

I tend to not pay attention to the details and then blame other people. Thankfully Deeds.com has my back when I make silly mistakes.

Thank you!

Thomas C.

April 12th, 2023

I got the right form but I waited too long to use it and Oregon changed the formatting. I should have checked and made sure the form was still good. Deeds responded quickly.

Thank you!

George S.

June 24th, 2020

Very good, very expensive. I hope that this is what my lawyer needed for us to finish our wills. George

Thank you!

Alan M.

December 3rd, 2021

The packet I downloaded was complete and useful, and process was not unduly opaque. However, I would have liked to download the whole packet, about 6 files, all at one go. Still, the forms provided the complete solution to my situation.

Thank you for your feedback. We really appreciate it. Have a great day!

samira m.

December 9th, 2022

I love whoever is behind this website. I bought the wrong form and I told them and they refunded me asap! I figured out which form I need days later and bought it just now. They didn't have to refund me for my own mistake. That was very kind. I'll be returning for any other forms I may need and will tell others too. Thank you so much!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!