Cameron County Executor Deed Form

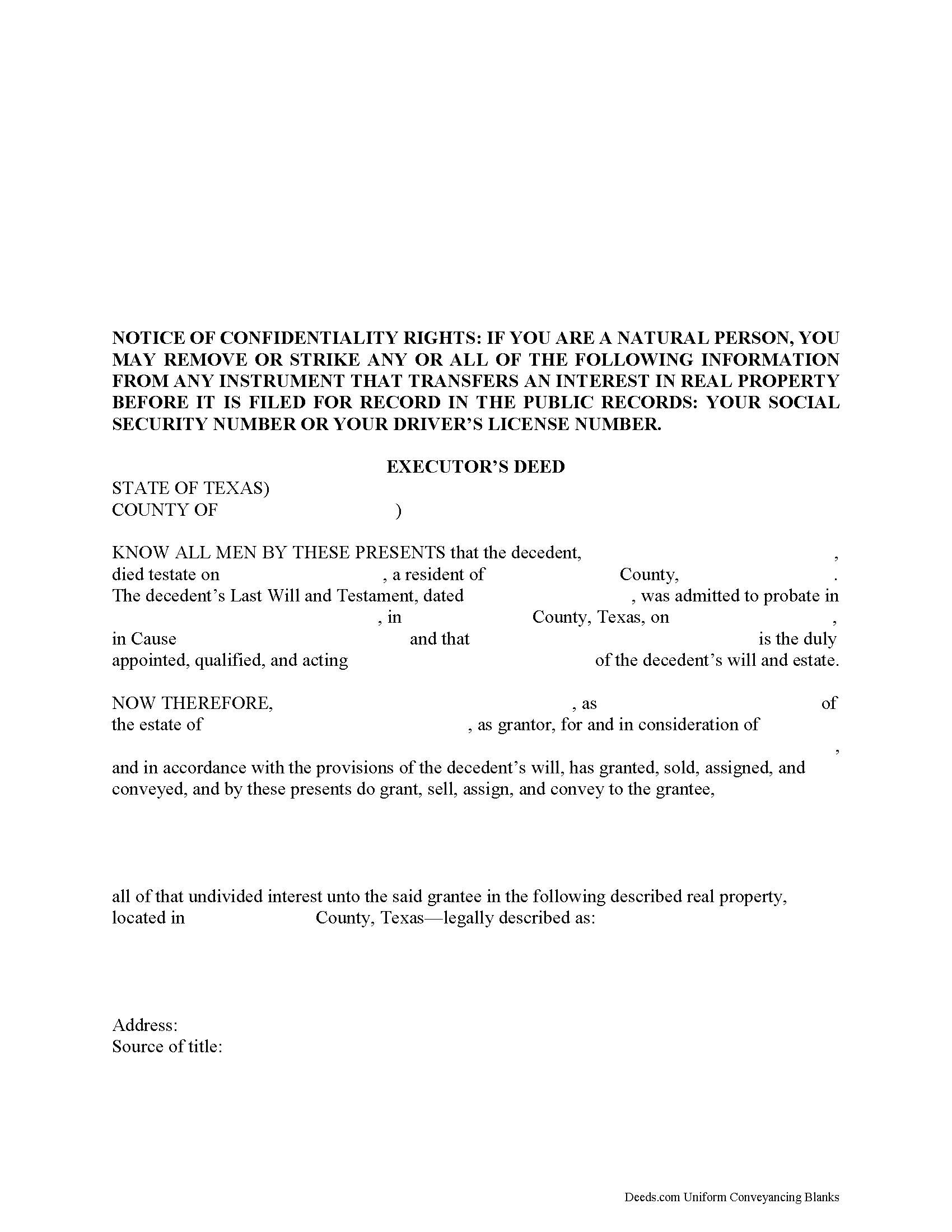

Cameron County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

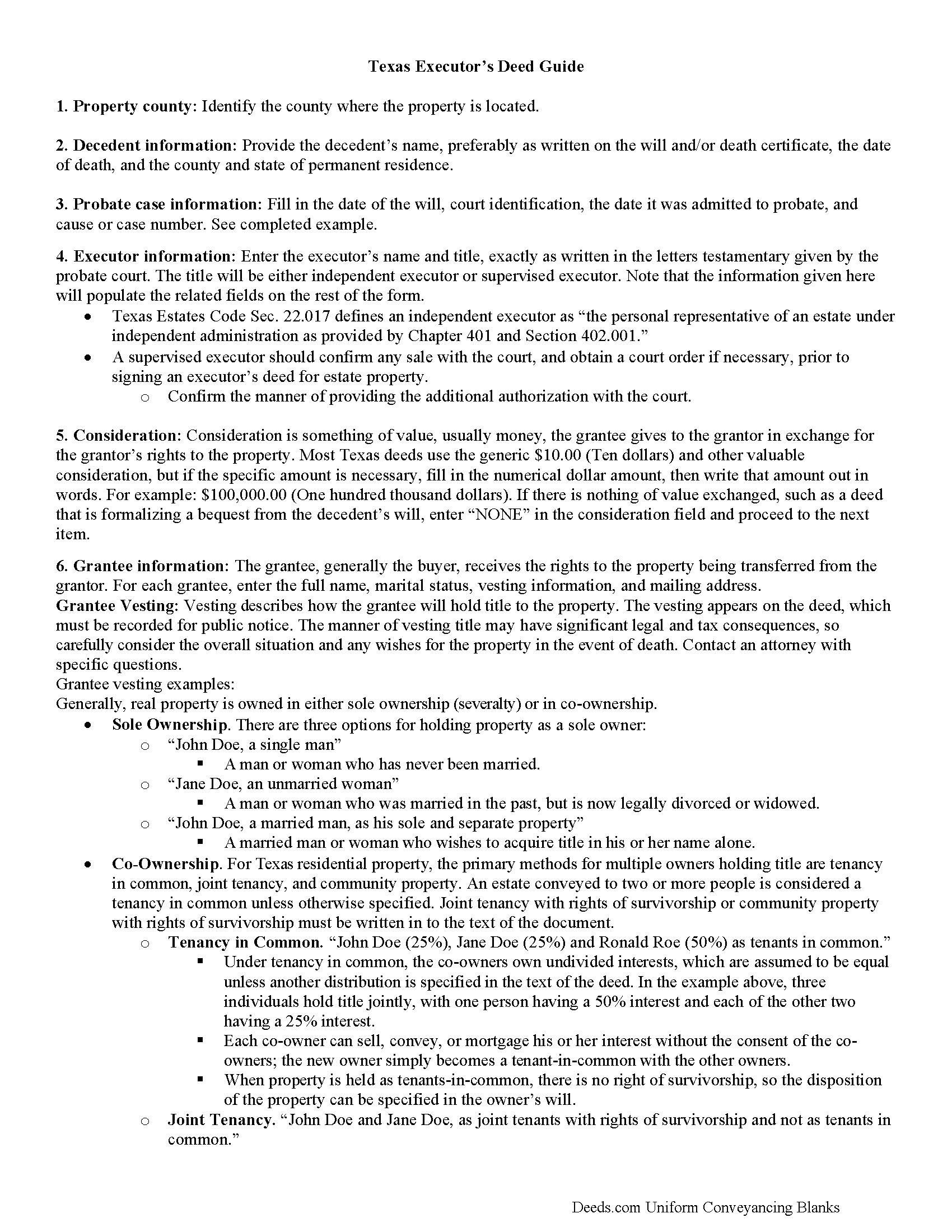

Cameron County Executor Deed Guide

Line by line guide explaining every blank on the form.

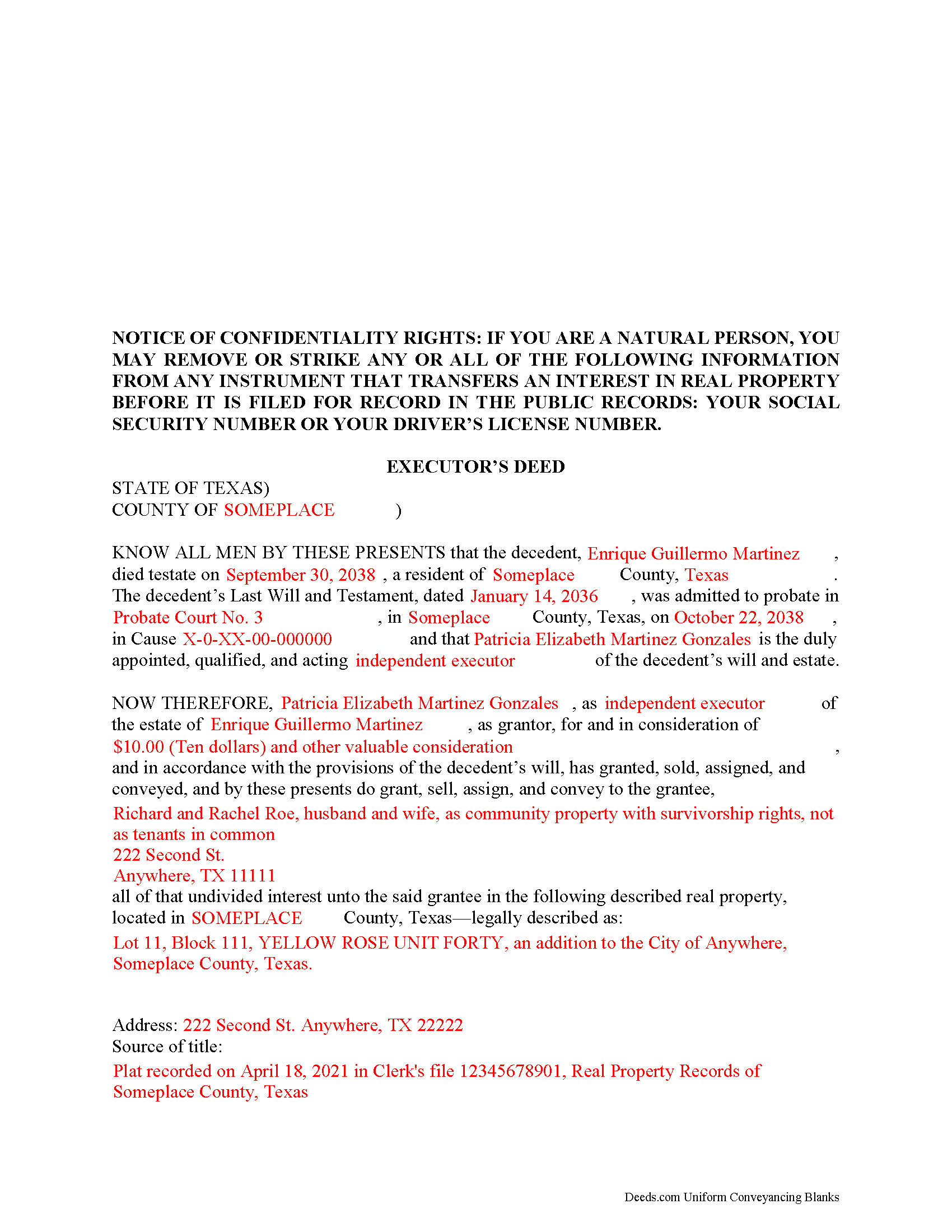

Cameron County Completed Example of the Executor Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Cameron County documents included at no extra charge:

Where to Record Your Documents

Mail: Cameron County Clerk, Filing & Recording Dept

Brownsville, Texas 78522

Hours: N/A

Phone: use for mailing purposes

Branch Office

San Benito, Texas 78586

Hours: 8:00 - 5:00 M-F

Phone: 956-247-3509

Cameron County Clerk

Brownsville, Texas 78520

Hours: 8:00 to 5:00 M-F

Phone: (956) 544-0815

Recording Tips for Cameron County:

- Verify all names are spelled correctly before recording

- Both spouses typically need to sign if property is jointly owned

- Check margin requirements - usually 1-2 inches at top

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Cameron County

Properties in any of these areas use Cameron County forms:

- Brownsville

- Combes

- Harlingen

- La Feria

- Los Fresnos

- Los Indios

- Lozano

- Olmito

- Port Isabel

- Rio Hondo

- San Benito

- Santa Maria

- Santa Rosa

- South Padre Island

Hours, fees, requirements, and more for Cameron County

How do I get my forms?

Forms are available for immediate download after payment. The Cameron County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Cameron County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Cameron County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Cameron County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Cameron County?

Recording fees in Cameron County vary. Contact the recorder's office at use for mailing purposes for current fees.

Questions answered? Let's get started!

The Texas Statutes cover the rules for selling a decedent's property from a probate estate in Chapter 356 of the Estates Code.

When a will is admitted to probate, the court officer authorizes an executor to manage, and eventually close, the estate. Among other duties, this involves identifying the assets and liabilities, paying the bills, and distributing property according to the terms specified in the will.

Many estates contain real property. Depending on the circumstances, the executor might transfer the title to heirs as directed in the decedent's will or sell the property outright. In any case, the executor must issue a deed for the transfer. Note that executor's deeds do NOT typically include a general warranty on the title. The executor may offer a special warranty, meaning that he has the right to sell the property, and will only defend the title against claims on his actions.

An executor's deed is used by executors who are authorized by the Probate Court to transfer real property out of an estate. These instruments must meet the same requirements as a warranty deed or quitclaim deed, plus include additional information about the probate case. Sometimes, the executor must also include supporting documentation such as copies of the letters testamentary, the will, signatures from heirs or beneficiaries, etc.

Settling probate estates can be complicated, so take the time to understand the issues. Before buying or selling real property from an estate, review all the risks and benefits, and contact an attorney with questions.

(Texas Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Cameron County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Cameron County.

Our Promise

The documents you receive here will meet, or exceed, the Cameron County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Cameron County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Shirley S.

June 11th, 2025

Laborious process to gain access; need to indicate PRIINT when complete and inform that if page is backspaced, entered info disappears, necessitating starting all over again. There is only one “A” provision, when some documents have several more. Space is too limited in some instances to provide what is necessary for recording. Thank you

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Michael W.

August 27th, 2021

This was really easy and very helpful. Thanks,

Thank you!

Lucille F.

December 9th, 2019

Instructions very detailed and clear.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

davidjrhall e.

March 13th, 2023

So far its been good. The David Jr Hall Estate Trust is a Business Blind Trust and we are looking forward to working with your platform and seeing how far we can go.

Thank you!

Earline S.

December 24th, 2018

Total package. Very prompt with complete instructions & example to complete forms. If you don't want to hire a lawyer, this is pretty simple & will bypass probate.

Thank you, we really appreciate your feedback.

Larry R.

December 8th, 2020

I appreciate the opportunity to take care of business without the hassle of parking, security checks and lines. It was all done quickly and easily.

Thank you!

Barbara Y.

December 14th, 2020

I found your instructions and sample for completing a quit-claim deed in Arizona to be simple and easy to follow with one exception. The website to use in order to determine the code for the reason for exemption of fees was incorrect, as a result of which I had to contact the County Recorder to obtain that information.

Thank you for your feedback. We really appreciate it. Have a great day!

Nick A.

January 13th, 2022

Easy to use website. Found what I was looking for.

Thank you for your feedback. We really appreciate it. Have a great day!

Ramona C.

October 28th, 2020

Easy to use and the sample really helped.

Thank you!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorien C.

March 25th, 2023

Easy to use, thank you.

Thank you!

Richard L.

February 13th, 2021

Thanks for the complete and reasonably priced set of docs. I was specifically looking for and glad to find a current version of a TOD deed following the California extension.

Thank you for your feedback. We really appreciate it. Have a great day!

David C.

July 21st, 2021

I was very impressed. Your program makes it very user friendly which is a must for most of the public . I have recommended this site to various clients for estate planning documents with simple estates.

Thank you!

Clarice O.

June 15th, 2020

It was very easy plus exactly what I neded.

Thank you!