El Paso County Gift Deed Form

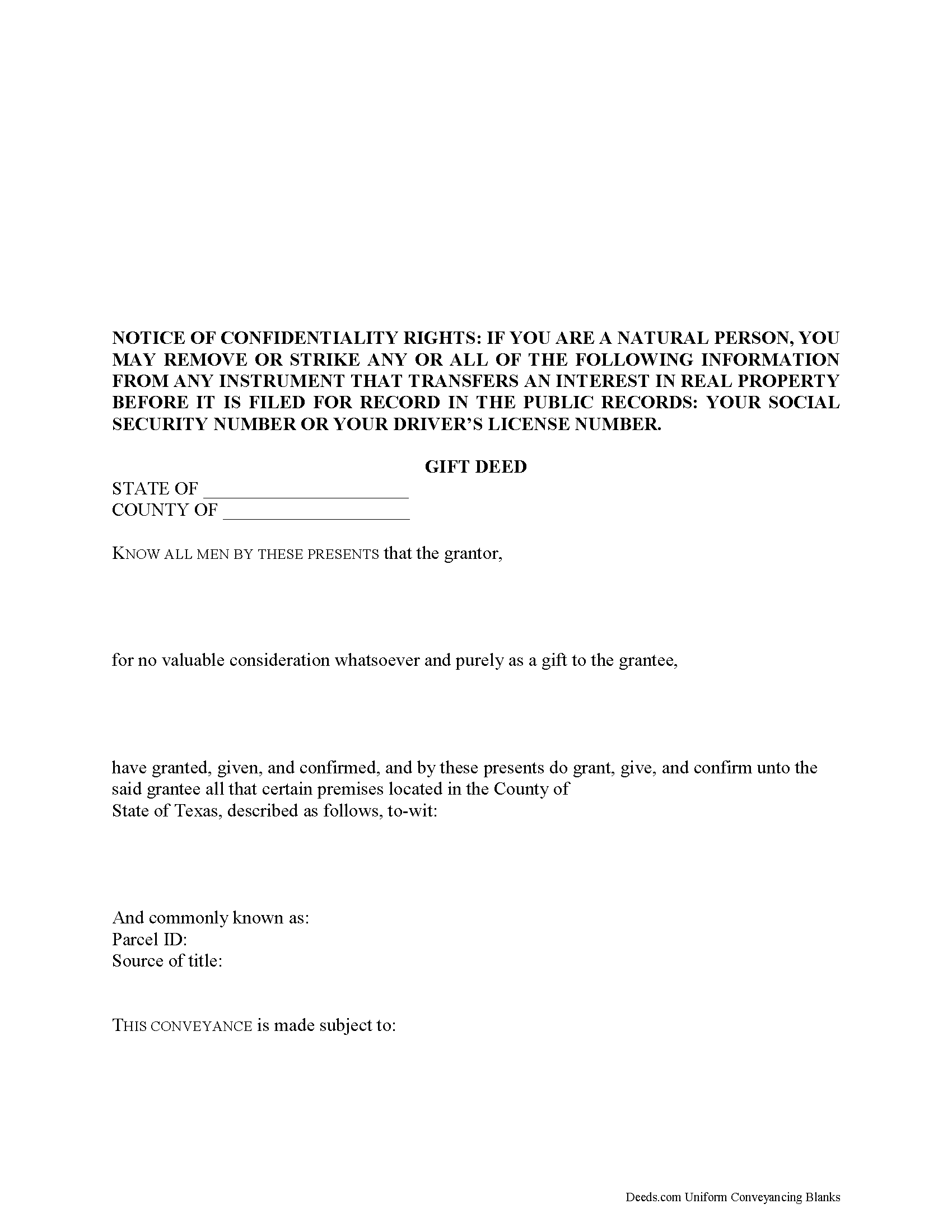

El Paso County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

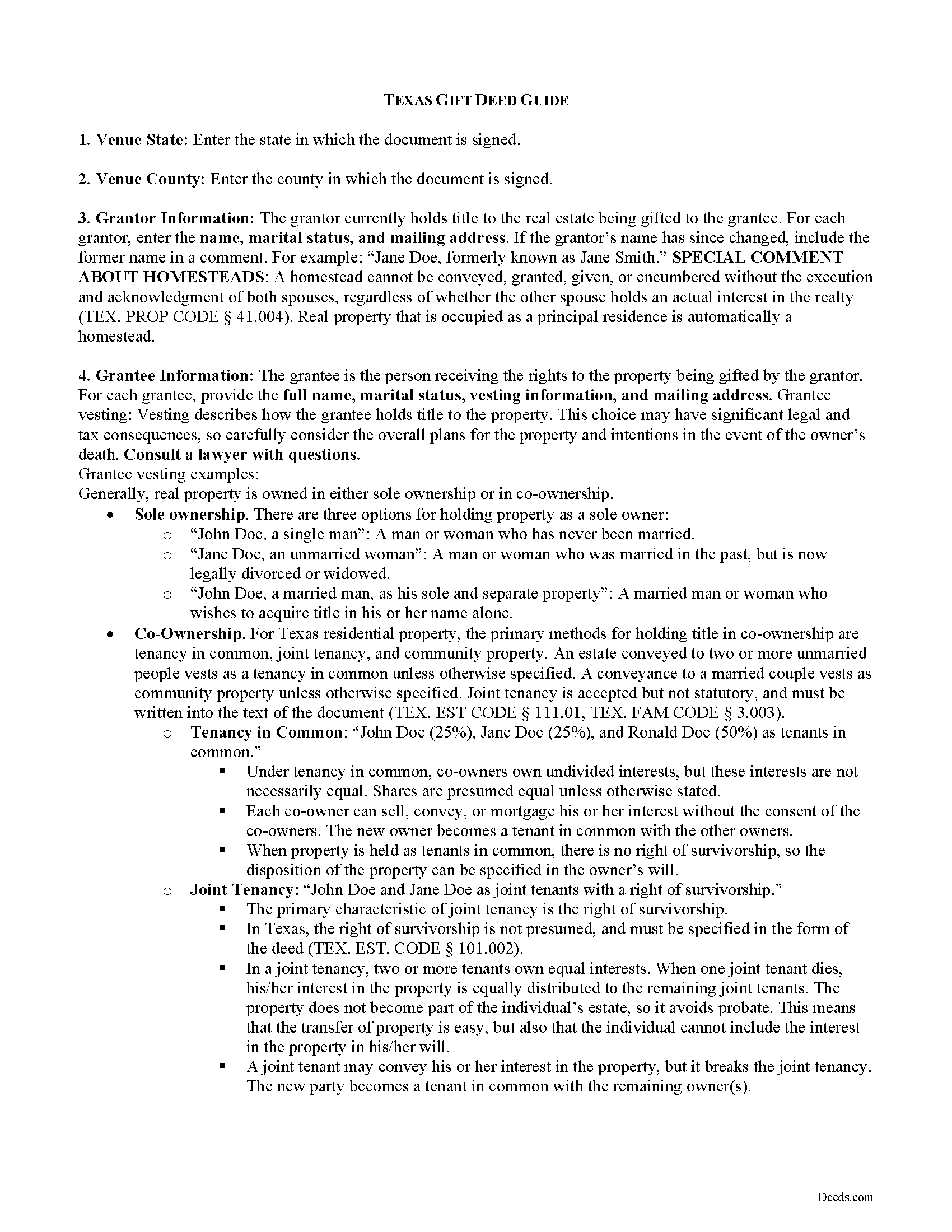

El Paso County Gift Deed Guide

Line by line guide explaining every blank on the form.

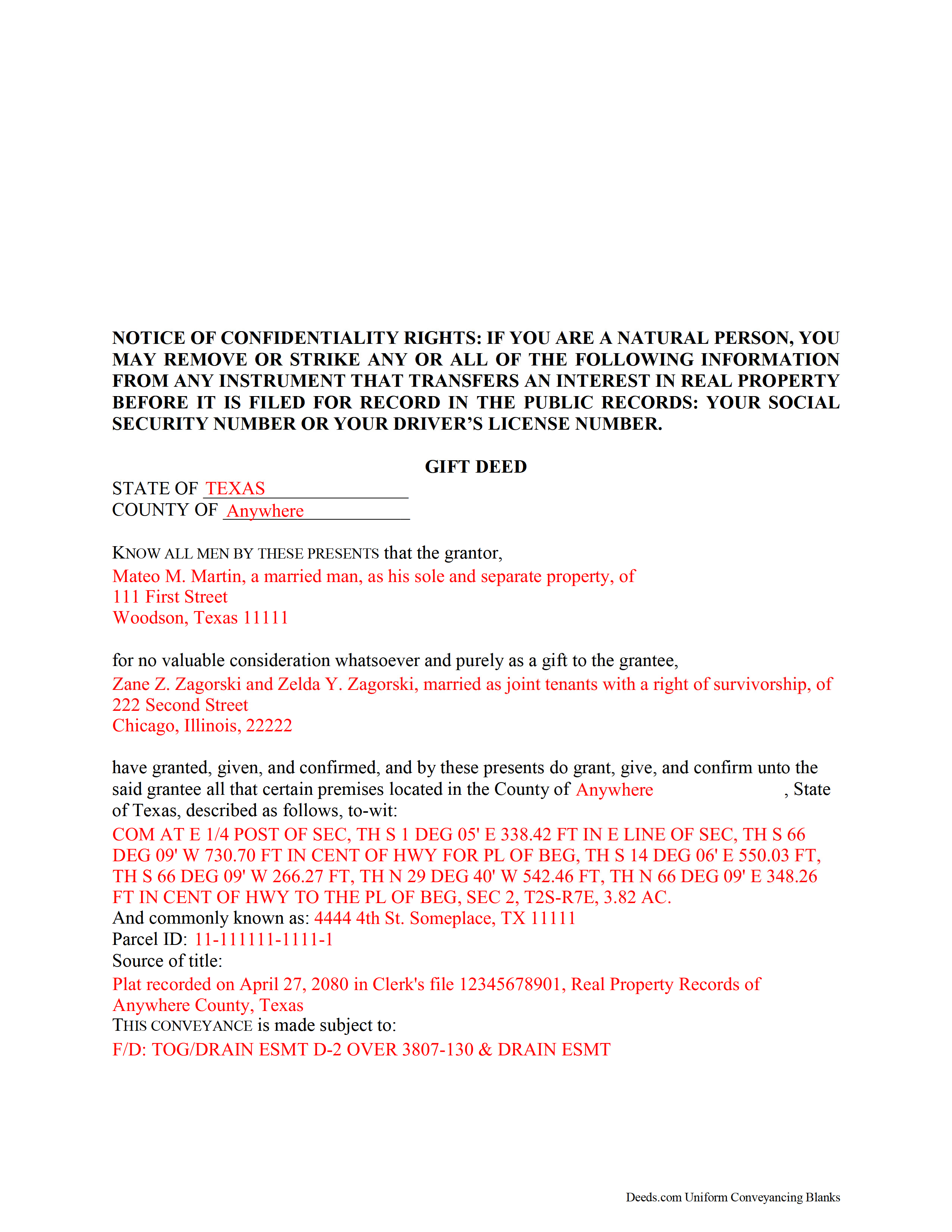

El Paso County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and El Paso County documents included at no extra charge:

Where to Record Your Documents

El Paso County Clerk

El Paso, Texas 79901

Hours: 8:00am to 5:30pm Monday through Friday

Phone: (915) 543-3816 & 546-2071

Recording Tips for El Paso County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in El Paso County

Properties in any of these areas use El Paso County forms:

- Anthony

- Canutillo

- Clint

- El Paso

- Fabens

- Fort Bliss

- San Elizario

- Tornillo

Hours, fees, requirements, and more for El Paso County

How do I get my forms?

Forms are available for immediate download after payment. The El Paso County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in El Paso County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by El Paso County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in El Paso County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in El Paso County?

Recording fees in El Paso County vary. Contact the recorder's office at (915) 543-3816 & 546-2071 for current fees.

Questions answered? Let's get started!

Gifting Real Property in Texas

Gift deeds transfer title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to transfer property as a charitable act or donation, these transfers occur during the grantor's lifetime. It is important that a gift deed contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Texas residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community property (TEX. EST CODE 111.001, TEX. FAM CODE 3.003).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. The document must be signed and acknowledged by the grantor in the presence of two credible witnesses or a certified officer (TEX. PROP CODE 12.001b). Record the completed deed, along with any additional materials, in the clerk's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

In Texas, an unrecorded deed (or instrument) "is binding on a party to the instrument, on the party's heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument" (TEX. PROP CODE 13.001). This means that, even if a gift deed is unrecorded, it is still a binding document that applies to parties who have signed or acknowledged it.

With gifts of real property, the recipient of the gift (grantee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, they are responsible for paying the requisite state and federal income tax [1].

While the amount of the gift does not need to be declared as income, gifts of real property are subject to federal gift taxation. The person or entity making the gift (grantor) is responsible for paying this tax. However, if the donor does not pay the gift tax, the donee will be held liable [1].

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that, if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a donor may benefit from filing a Form 709 [2].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Texas lawyer with any questions about gift deeds or other issues related to the transfer of real property.

[1] http://msuextension.org/publications/FamilyFinancialManagement/MT199105HR.pdf

[2] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Texas Gift Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in El Paso County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to El Paso County.

Our Promise

The documents you receive here will meet, or exceed, the El Paso County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your El Paso County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

William B.

October 22nd, 2023

The forms, and other information, are all excellent. I would be giving a 5-star review if it were not for the fact that downloading a "bundle" about quitclaim deeds required I download every single file independently (15 files). I would far prefer a zip file, or one click to download the whole pile of independent files.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Jesse H.

November 8th, 2021

Good & friendly software, complete & clear instructions & guidance, generates proper forms that were readily accepted @ Clerk & Recorder Office, all of this @ reasonable cost. Five Stars!

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine W.

January 24th, 2019

I was impressed by the completeness of the package of forms PLUS instructions. Particularly helpful is the filled in sample, which enables you to see what a correct, completed deed ought to look like.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin B.

March 31st, 2019

It looks like it can be a huge time saver. I did a deed and appeared very professional.

Thank you for your feedback. We really appreciate it. Have a great day!

Suzan B.

July 24th, 2019

Using Deeds.com could not have been easier. The examples and line-by-line instructions helped a lot! I am so glad I found you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joni Y.

November 25th, 2019

Deeds.com is a very up to date & easy instruction website. I recommend this site to all who are looking for forms dealing with deeds. Thank you for making life easy in this aspect.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

JOHN M.

October 20th, 2019

THANKS FROM A 92 YEAR OLD LADY

Thank you!

Chanda C.

June 2nd, 2020

It's going well so far!

Thank you!

Rebecca M.

February 22nd, 2023

Haven't used yet but I will check it out tomorrow

Thank you!

Cindy A.

January 14th, 2019

Easy to understand and use. However, need to add line for phone number for preparer - Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Rebecca Q.

January 19th, 2019

Very helpful! Unfortunately, they didn't have what I needed, but they got back to me quickly and didn't charge me anything. Easy to work with.

Thank you for your feedback. We really appreciate it. Have a great day!

Daren R.

March 4th, 2023

I believe that you should wait until a pending file is completed before asking for feedback. Thank you. Daren

Thank you!