El Paso County Grant Deed Form

El Paso County Grant Deed Form

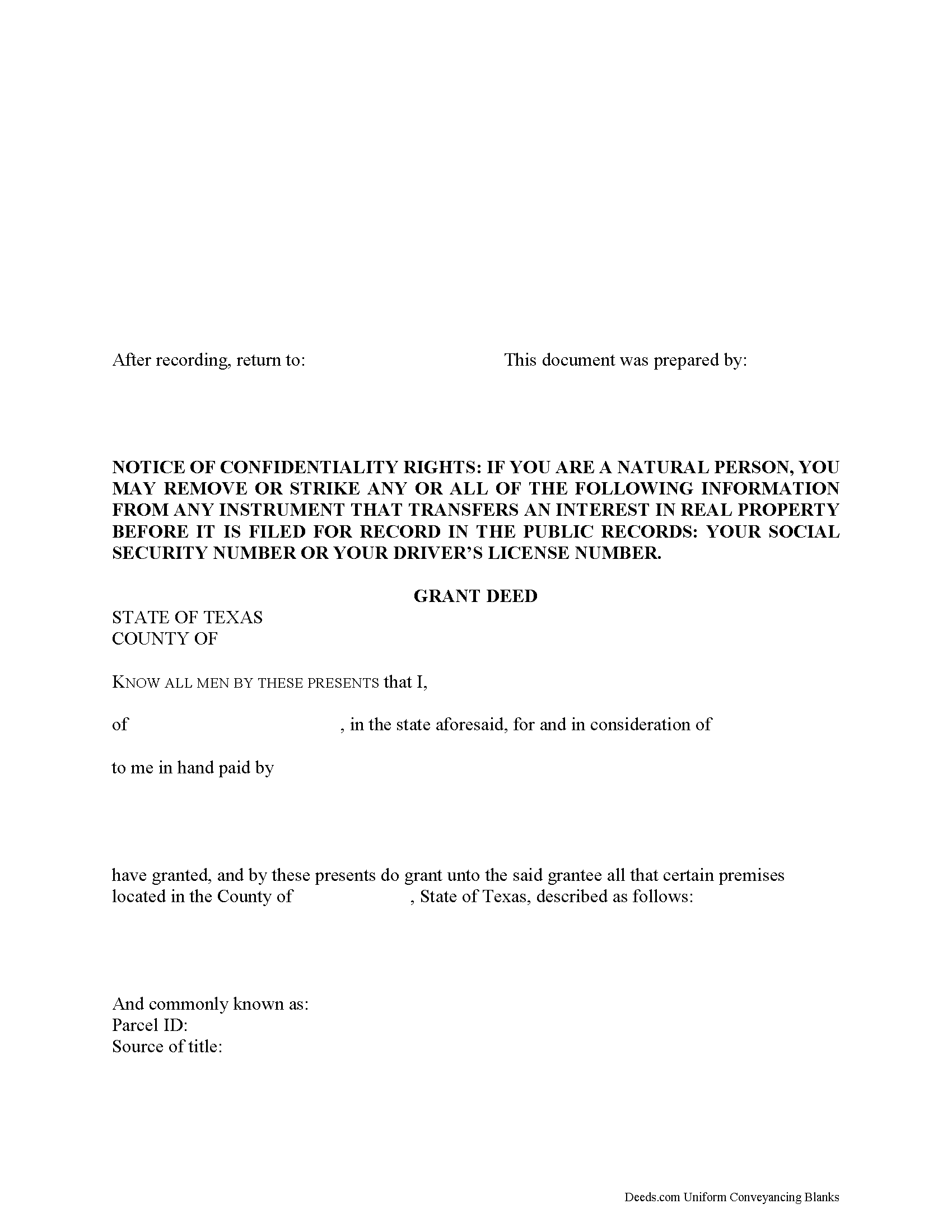

Fill in the blank form formatted to comply with all recording and content requirements.

El Paso County Grant Deed Guide

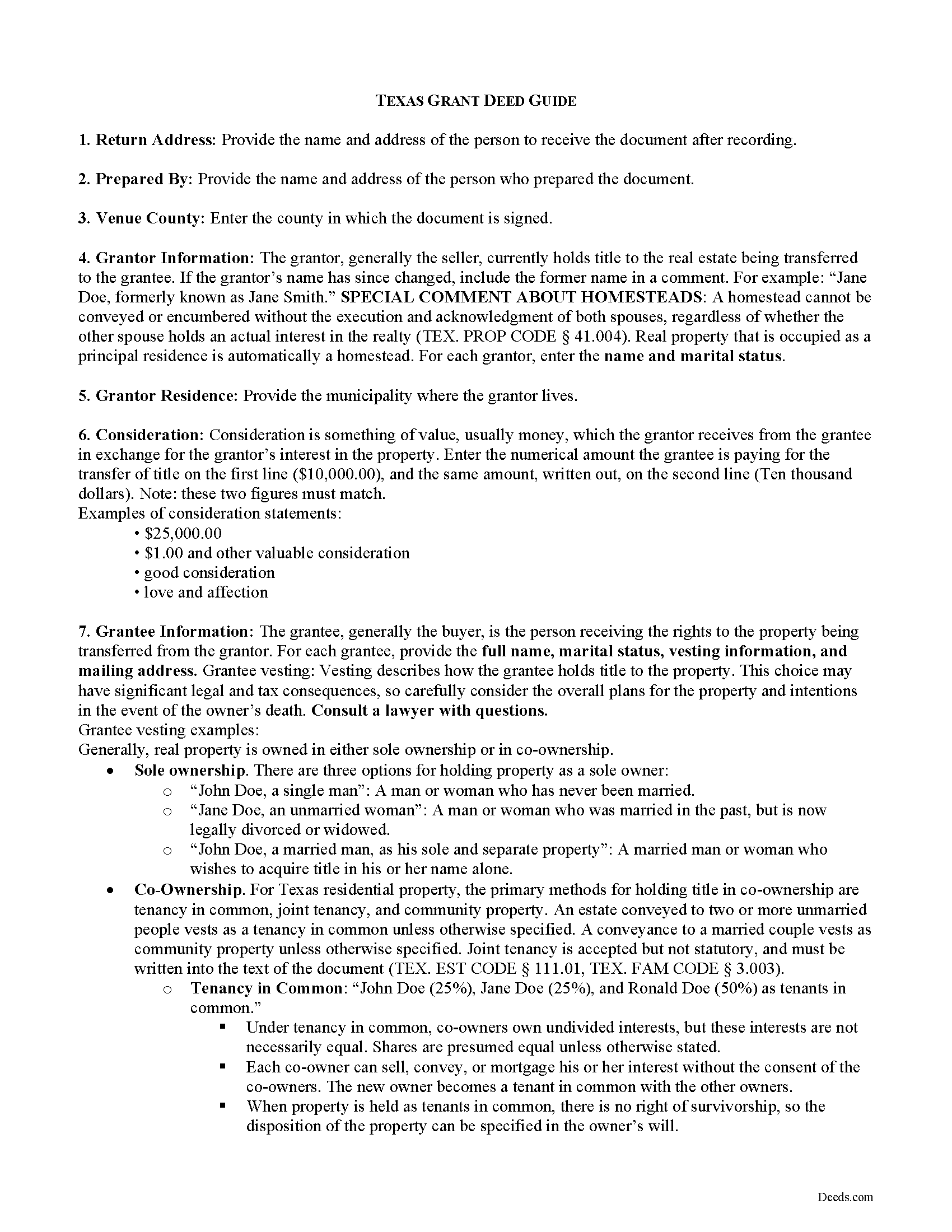

Line by line guide explaining every blank on the form.

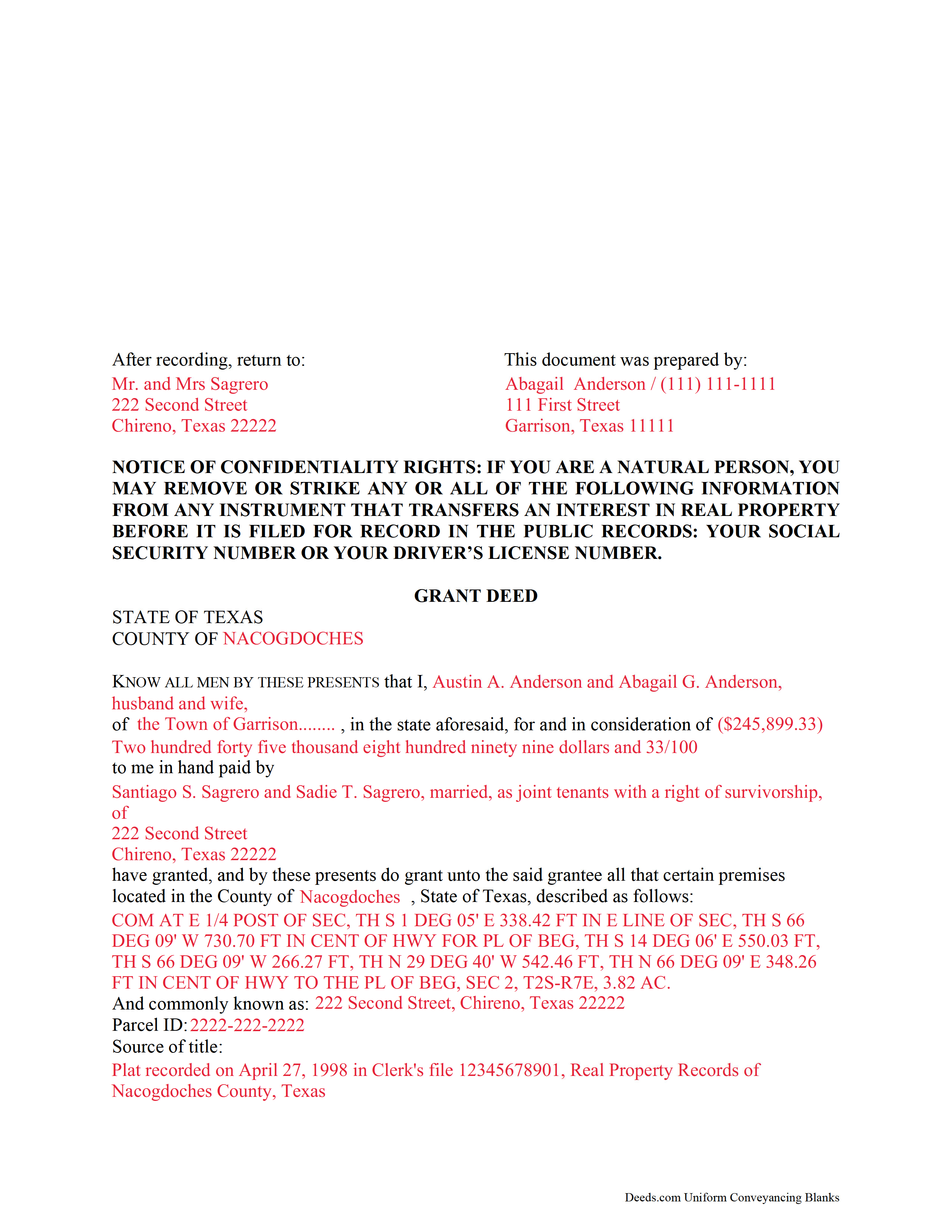

El Paso County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and El Paso County documents included at no extra charge:

Where to Record Your Documents

El Paso County Clerk

El Paso, Texas 79901

Hours: 8:00am to 5:30pm Monday through Friday

Phone: (915) 543-3816 & 546-2071

Recording Tips for El Paso County:

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in El Paso County

Properties in any of these areas use El Paso County forms:

- Anthony

- Canutillo

- Clint

- El Paso

- Fabens

- Fort Bliss

- San Elizario

- Tornillo

Hours, fees, requirements, and more for El Paso County

How do I get my forms?

Forms are available for immediate download after payment. The El Paso County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in El Paso County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by El Paso County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in El Paso County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in El Paso County?

Recording fees in El Paso County vary. Contact the recorder's office at (915) 543-3816 & 546-2071 for current fees.

Questions answered? Let's get started!

In Texas, a grant deed conveys title to real property with implied covenants. By including the words "grant" or "convey," the grantor guarantees that he/she has not transferred title to the property to anyone other than the grantee, and that, at the time of transfer, the estate is free from impediments. Implied covenants carry the same legal implications as if they were explicitly stated (TEX. PROP CODE 5.023).

The document must state the grantor's full name and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting information, and mailing address. Include a complete legal description of the parcel, and recite the source of title to maintain a clear chain of title, detailing any restrictions associated with the property. The document must be signed and acknowledged by the grantor in the presence of two credible witnesses or a certified officer (TEX. PROP CODE 12.001b).

Depending on the nature of the transaction, the deed might also require supporting and/or supplemental documentation. Record the completed deed, along with any additional materials, in the clerk's office of the county where the property is located.

Using a Grant Deed in Texas

A deed is a legal document that transfers real property from one party to another. In Texas, property owners can use a grant deed to transfer real estate with implied covenants of title. By including the words "grant" or "convey," the grantor (seller) guarantees that he/she has not transferred title to the property to anyone other than the grantee (buyer), and that, at the time of legal transfer of property, the estate is free from any impediments to the transfer. Implied covenants carry the same legal implications as if they were explicitly stated (TEX. PROP CODE 5.023).

A lawful grant deed includes the grantor's full name and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Depending on the nature of the transaction, the deed might also require supporting and/or supplemental documentation. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Texas residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and community property (TEX. EST CODE 111.001, TEX. FAM CODE 3.003).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the source of title in order to confirm a clear chain of title, and detail any restrictions associated with the property. Record the completed deed, along with any additional materials, in the clerk's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

In Texas, an unrecorded deed (or instrument) "is binding on a party to the instrument, on the party's heirs, and on a subsequent purchaser who does not pay a valuable consideration or who has notice of the instrument" (TEX. PROP CODE 13.001). This means that, even if a grant deed is unrecorded, it is still a binding document that applies to parties who have signed or acknowledged it.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Texas lawyer with any questions about grant deeds or other issues related to the transfer of real property.

(Texas Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in El Paso County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to El Paso County.

Our Promise

The documents you receive here will meet, or exceed, the El Paso County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your El Paso County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Jill C.

March 6th, 2023

Easy directions for document information.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

Laura M.

November 12th, 2023

Very easy and I appreciate that when you hover over the blank, directions pop up and tell you what to put in that blank. I also appreciated that when I lost the original password, I sent an email and Deeds.com cancelled my order, refunded my account, so that I could start over.

It was a pleasure serving you. Thank you for the positive feedback!

James E.

December 1st, 2020

Forms were available for immediate download. Examples were helpful in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dan M.

November 8th, 2024

Quick ... Easy ... Great Instructions ... Easy Peasy ...

We are grateful for your feedback and looking forward to serving you again. Thank you!

James C.

February 5th, 2019

An excellent resource for users.

Thank you!

John B.

July 15th, 2021

I bought a Quitclaim Deed package for Fayette County, Kentucky, to transfer my house into a Living Trust that I had set up previously. Creating my Quitclaim Deed was pretty straightforward, using the form, the instructions, and the sample Quitclaim Deed. I signed my Quitclaim Deed at a nearby Notary Public, then took it to the Fayette County Clerk's office to be recorded. The clerk there asked me to make two small changes to the Quitclaim Deed, which she let me do in pen on the spot: * In the signature block for the receiver of the property, filled in "Capacity" as "Grantee as Trustee ______________________________ Living Trust". * In the notary's section, changed "were acknowledged before me" to "were acknowledged and sworn to before me".

Thank you for your feedback. We really appreciate it. Have a great day!

MICHAEL D.

April 4th, 2020

I had a wonderful experience and am looking forward to doing business with you again.

Thank you!

James C.

October 20th, 2022

was very helpfull, It provided the refernces to the stat laws so I coul have a deeper look into the issue I was trying to deal with.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

CAROLYN H.

July 14th, 2022

Thanks. Was simple and easy to use.

Thank you!

Lois B.

December 13th, 2018

It works pretty well, had trouble with the word December. It printed out Decedmber with weird spacing but I think it will be ok.

Thank you for the feedback. We will take a look at the date field to see if there are any issues. Have a great day!

steven l.

July 29th, 2020

As a first time user and not having knowledge of how your site worked it was awkward to upload a file and not know what to do next. I found out there is nothing to do next but that after some time looking for a submit button or some kind of confirmation that I was doing the right thing. Ended up being very easy, just wasted time trying to figure out what to do when there was nothing left to do.

Thank you!

James M.

November 23rd, 2020

Clear and easy instructions! Prompt notices of steps and status. Great job! I wish all counties in all states were this easy!

Thank you for your feedback. We really appreciate it. Have a great day!

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!

Amanda S.

April 3rd, 2019

Thank you! My husband and I went in the get notary stamps for a Special Warranty Deed and a Post Nuptial Agreement. The representative was very knowledgeable and thorough with the notary process. She made sure we read and understood all documents that we were signing and they required us to recite in sworn statements that everything there was true and understood! I will be using the notary service again at Bank of America! The representative was very respectful and had a nice smile the entire time to make our visit great!

Thank you!