Ector County Notice of Contractual Retainage Form

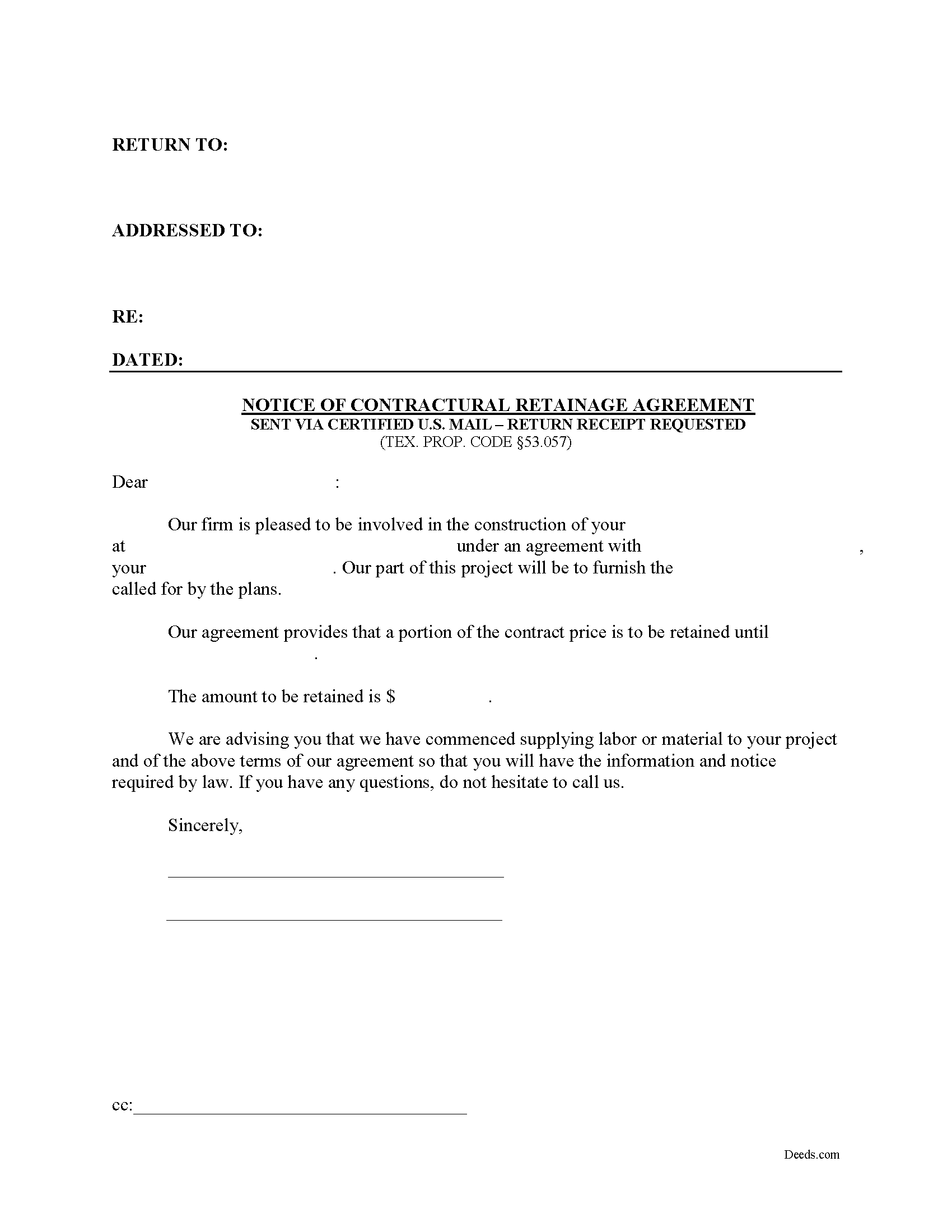

Ector County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

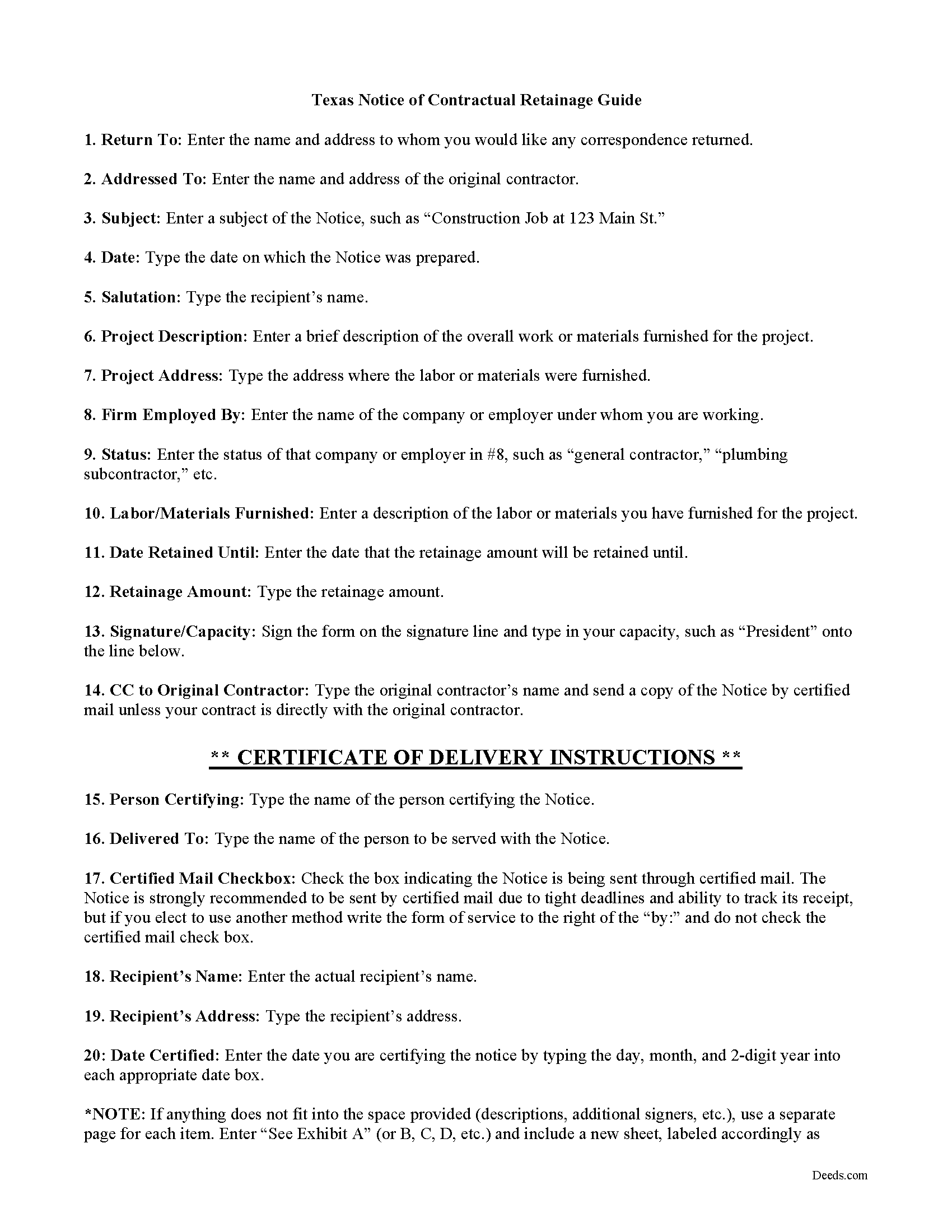

Ector County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

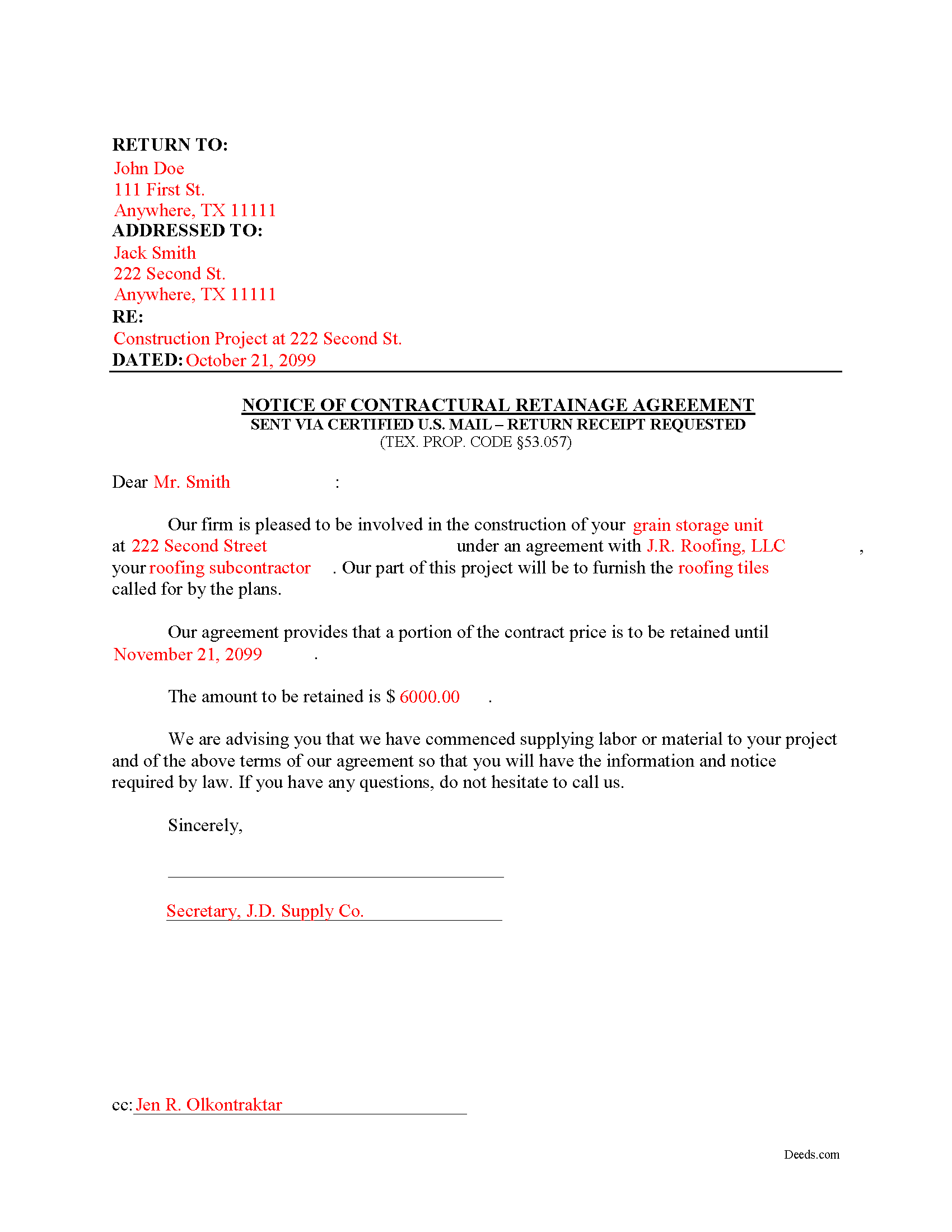

Ector County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Ector County documents included at no extra charge:

Where to Record Your Documents

Ector County Clerk

Odessa, Texas 79760

Hours: 8:00 to 4:30 M-F

Phone: (432) 498-4130

Recording Tips for Ector County:

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Recorded documents become public record - avoid including SSNs

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Ector County

Properties in any of these areas use Ector County forms:

- Gardendale

- Goldsmith

- Notrees

- Odessa

- Penwell

Hours, fees, requirements, and more for Ector County

How do I get my forms?

Forms are available for immediate download after payment. The Ector County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Ector County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ector County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Ector County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Ector County?

Recording fees in Ector County vary. Contact the recorder's office at (432) 498-4130 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Ector County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Ector County.

Our Promise

The documents you receive here will meet, or exceed, the Ector County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ector County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Carolyn M.

March 31st, 2022

Very helpful and informative. The online site walked you through step by step and if you had a question, which I did, I called with my question. Thanks again.

Thank you!

James C.

October 29th, 2019

First time user and was directed there from a search on my home state for a state form. The downloaded form was complete with instructions and sample filled out form. I was not happy about the cost for the form, but it did the job.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy H.

December 31st, 2018

Site was excellent and saved a trip to the County office to pick up forms.

Thank you Nancy. Glad we could help. Have a great day!

Mark S.

September 14th, 2022

Very easy site to navigate. The quit claim deed I downloaded was perfect for my needs. Would like to see a (Deed in Lieu of Foreclosure) added to the forms list.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janna V.

December 2nd, 2020

Very easy process!

Thank you!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie P.

December 9th, 2020

So far Deeds.com has done everything they say they'll do and very promptly.

Thank you for your feedback. We really appreciate it. Have a great day!

DENNIS K.

July 22nd, 2020

I am a civil engineer, not an attorney. I deal with easements on a regular basis but not so much on the "recording" side of things. I normally prepare the graphic exhibits that accompany the dedication language but I am not the one who provides that language. Your forms solved that issue for me. Thanks.

Thank you!

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Nancy J M.

August 22nd, 2021

Site is easy to navigate and forms are as described. Too bad there is no secure payment link service (PayPal, Apple Pay, etc. So after I verify charge has hit my credit card I will delete my Deeds.com account.

Thank you!

Dennis S.

October 24th, 2020

I am still working on the forms. I am having problems doing the forms as you can only save as pdf and it is difficult to change or modify the pdf. You have to purchase a pdf convertor program. but all seems to be there to do the deed submittals.

Thank you for your feedback. We really appreciate it. Have a great day!

Carolyn S.

January 24th, 2021

This website was very helpful in explaining what a "gift" deed is and how to execute it. I didn't want to incur legal fees for a simple transaction and this website helped me avoid that.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles S.

September 15th, 2022

I was very please with the deed, deed of trust and the deed of trust note. It save me a lot of preparation time.

Thank you!

Stephen M.

September 15th, 2022

The process to record took five minutes of my time, and within 45 minutes, my document was recorded! Simple, efficient and affordable! Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Thanh P.

July 18th, 2024

Awesome services. Quick and efficient.

Thank you for your kind words Thanh, we appreciate you.