Tarrant County Notice of Contractual Retainage Form

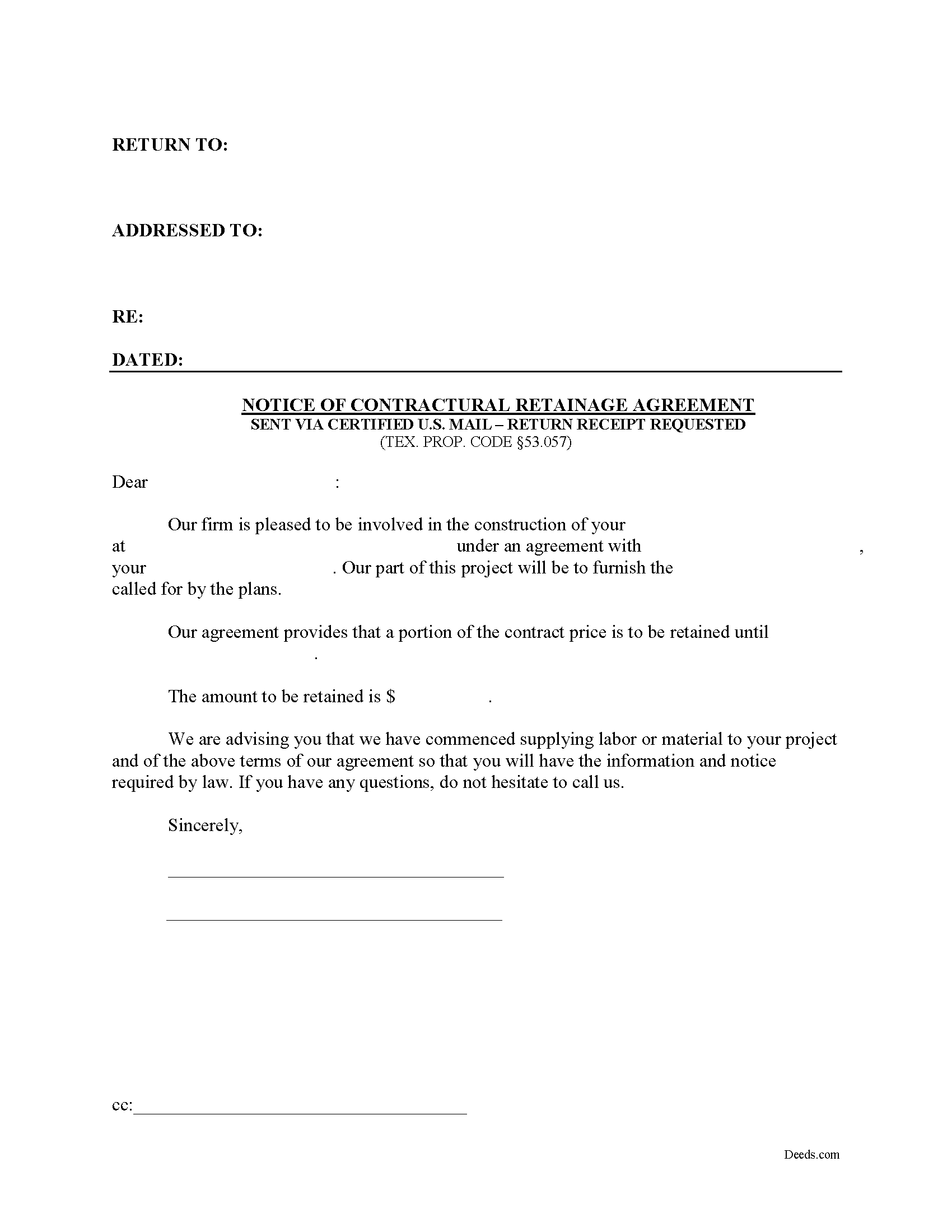

Tarrant County Notice of Contractual Retainage Form

Fill in the blank Notice of Contractual Retainage form formatted to comply with all Texas recording and content requirements.

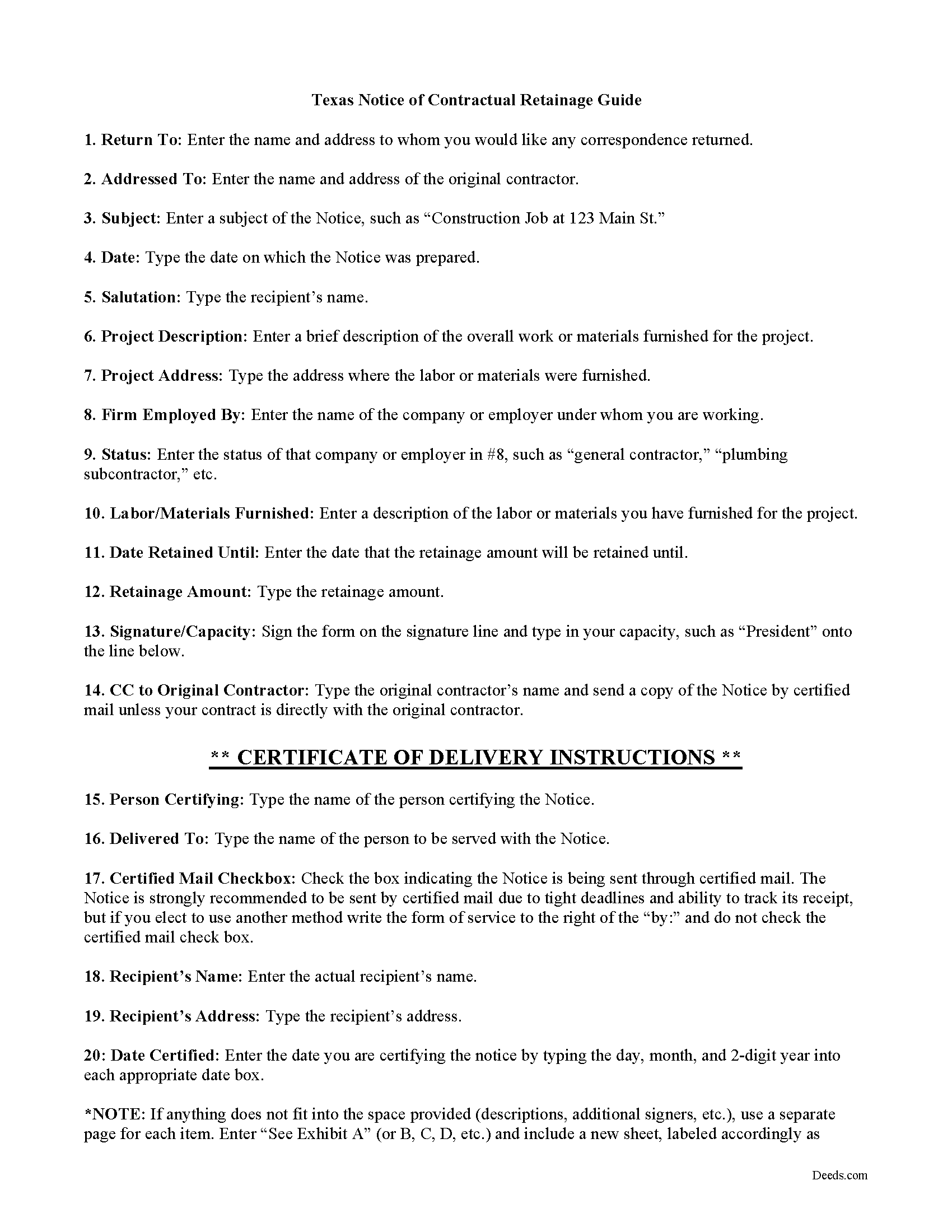

Tarrant County Notice of Contractual Retainage Guide

Line by line guide explaining every blank on the form.

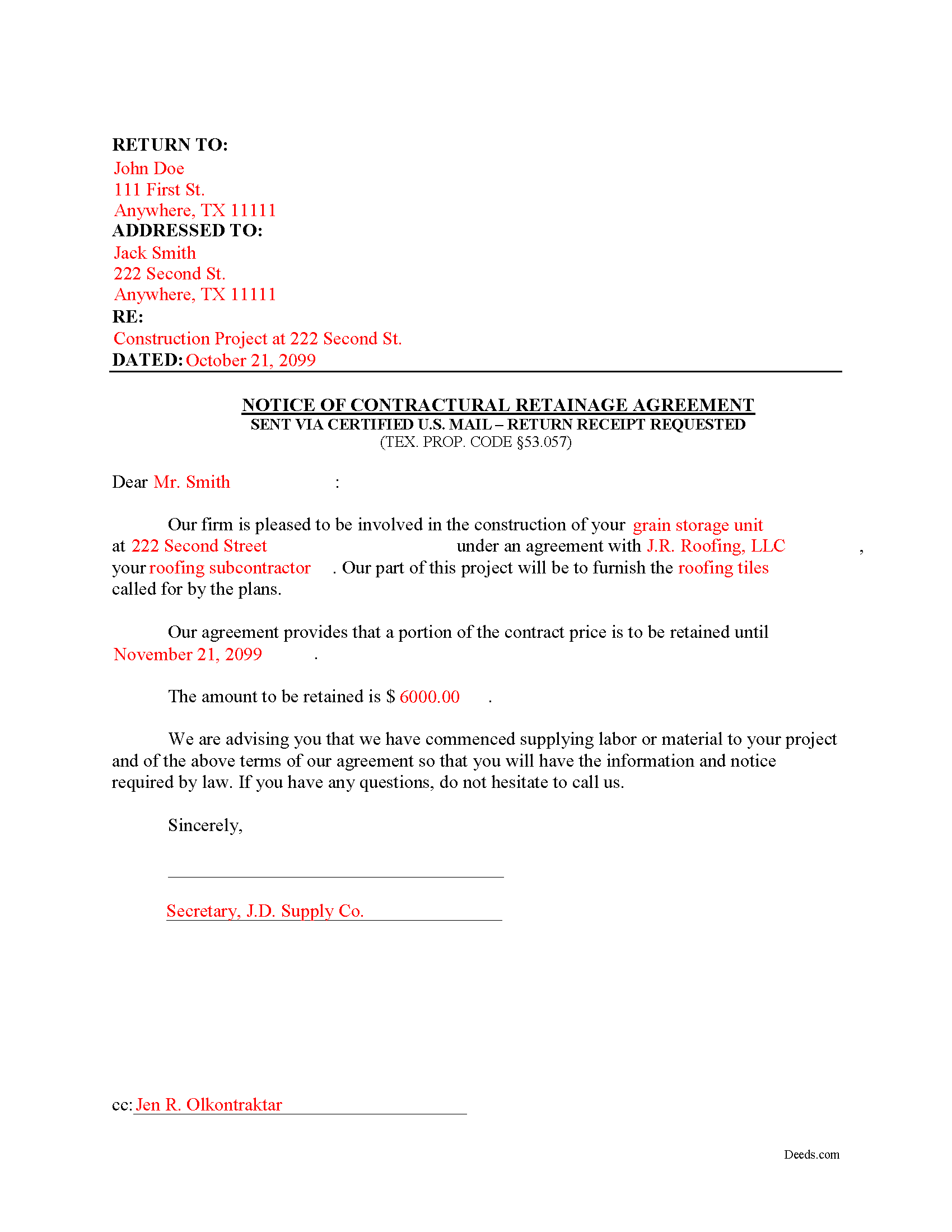

Tarrant County Completed Example of the Notice of Contractual Retainage Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Tarrant County documents included at no extra charge:

Where to Record Your Documents

Tarrant County Clerk

Fort Worth, Texas 76196

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (817) 212-6847

Recording Tips for Tarrant County:

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Verify the recording date if timing is critical for your transaction

Cities and Jurisdictions in Tarrant County

Properties in any of these areas use Tarrant County forms:

- Arlington

- Azle

- Bedford

- Colleyville

- Crowley

- Euless

- Fort Worth

- Grapevine

- Haltom City

- Haslet

- Hurst

- Keller

- Kennedale

- Mansfield

- Naval Air Station/ Jrb

- North Richland Hills

- Southlake

Hours, fees, requirements, and more for Tarrant County

How do I get my forms?

Forms are available for immediate download after payment. The Tarrant County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Tarrant County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Tarrant County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Tarrant County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Tarrant County?

Recording fees in Tarrant County vary. Contact the recorder's office at (817) 212-6847 for current fees.

Questions answered? Let's get started!

As a contractor, it's important to send out early notice forms shortly after beginning work on a construction job. By putting all interested parties on notice, claimants can help protect their lien rights. One important early notice form is called a Notice of Contractual Retainage, as defined at Sec. 53.057 of the Texas Property Code.

Retainage means an amount representing part of a contract payment that is not required to be paid to the claimant within the month following the month in which labor is performed, material is furnished, or specially fabricated material is delivered. TEX. PROP. CODE 53.001(11). Simply put, it is a portion of the agreed upon contract price that is deliberately withheld until the work reaches substantial completion to assure that contractor or subcontractor will satisfy its obligations and complete a construction project. If the job is not up to par, the retainage amount is used to make any changes or fixes.

Give this notice to all other interested parties to make them aware that the person who hired you is withholding a retainage amount from you under your contract. Therefore, once provided with the notice, the other parties above you can withhold a matching retainage amount. If you are an original contractor on the job, the notice is not required since the owner already has such notice of any retainage agreement.

Use this form if you do not have a direct contract with the owner or the original contractor. Thus, you need to provide this notice to these parties to make them aware of the existing retainage agreement. The claimant must give the owner or reputed owner the notice of contractual retainage no later than the earlier of: (a) the 30th day after the date the claimant's agreement providing for retainage is completed, terminated, or abandoned; or (b) the 30th day after the date the original contract is terminated or abandoned. TEX. PROP. CODE 53.057(b).

The Notice of Contractual Retainage does not need to be notarized or recorded. Instead, deliver it to relevant parties via certified or registered US mail, with return receipt requested.

Each case is unique, and the Texas lien law is complicated. Contact an attorney for complex situations, with specific questions about sending a notice of contractual retainage, or any other issue about mechanic's liens.

Important: Your property must be located in Tarrant County to use these forms. Documents should be recorded at the office below.

This Notice of Contractual Retainage meets all recording requirements specific to Tarrant County.

Our Promise

The documents you receive here will meet, or exceed, the Tarrant County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Tarrant County Notice of Contractual Retainage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Andrew B.

January 3rd, 2022

Very easy to use and I appreciate the fees being charged after the submission.

Thank you!

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Daniel A.

April 25th, 2022

First time using Deeds.com. Downloaded the PDF forms for creating an Illinois Mortgage and Promissory Note. Filled them out, saved them, and printed them out. Going to send them to my Title Company for closing on a property. Save a bunch of money on not have to pay lawyer fees for creating the same legal documents that Deeds.com provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Zina J.

October 30th, 2019

Deeds.com supplied exactly what I needed to complete a quitclaim. Deeds.com saved me $180, supplied the necessary forms, and a sample page to use as a guide. I recommend Deeds.com.

Thank you!

juanita S.

May 6th, 2019

Easy to fill with explanations to accompany

Thank you Juanita, we really appreciate your feedback.

John W.

February 10th, 2021

Wow, I wish that I would have found Deeds.com before! Great service!

Thank you!

John B.

July 15th, 2021

I bought a Quitclaim Deed package for Fayette County, Kentucky, to transfer my house into a Living Trust that I had set up previously. Creating my Quitclaim Deed was pretty straightforward, using the form, the instructions, and the sample Quitclaim Deed. I signed my Quitclaim Deed at a nearby Notary Public, then took it to the Fayette County Clerk's office to be recorded. The clerk there asked me to make two small changes to the Quitclaim Deed, which she let me do in pen on the spot: * In the signature block for the receiver of the property, filled in "Capacity" as "Grantee as Trustee ______________________________ Living Trust". * In the notary's section, changed "were acknowledged before me" to "were acknowledged and sworn to before me".

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Donna W.

November 7th, 2023

This is an amazing place to come for all your deed help. I had looked on several other sites without luck, but deeds.com got everything I needed quickly and they are very inexpensive! Love this site and will be recommending it to anyone needing this type of help.

Thank you for your positive words! We’re thrilled to hear about your experience.

Betty B.

February 10th, 2022

Thank you . I appreciate your assistance Once again thanks

Thank you!

Doreen A.

February 13th, 2024

Easy to navigate Efficient Service

Your kind words warm our hearts. Thank you for sharing your experience!

Randy B.

February 3rd, 2019

The form was exactly what we needed and the directions were spot on and perfectly clear. Filling out government forms can be an experience filled with anxiety but deeds.com made it easy and practically worry free.

Thanks Randy, we really appreciate your feedback.

Linda C.

February 23rd, 2019

If I hadn't spent my career as an escrow officer (albeit in another state), I may have had a hard time figuring out exactly which deed I needed and how to prepare them, even with the back-up informational, how-to pdf documents, without an attorney. My experience speaks to how much the general public doesn't understand and how confusing it can be. Nonetheless, the access to so many documents at a fairly reasonable cost, the basic how-to docs made available along with the purchased doc makes all the difference. I appreciate having such things available to the public. Many thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mark B.

March 8th, 2021

I had to download forms one by one: would be more convenient to have a single download for all.

Thank you for your feedback. We really appreciate it. Have a great day!

Erik N.

May 31st, 2025

I liked it, very much.

Thank you!