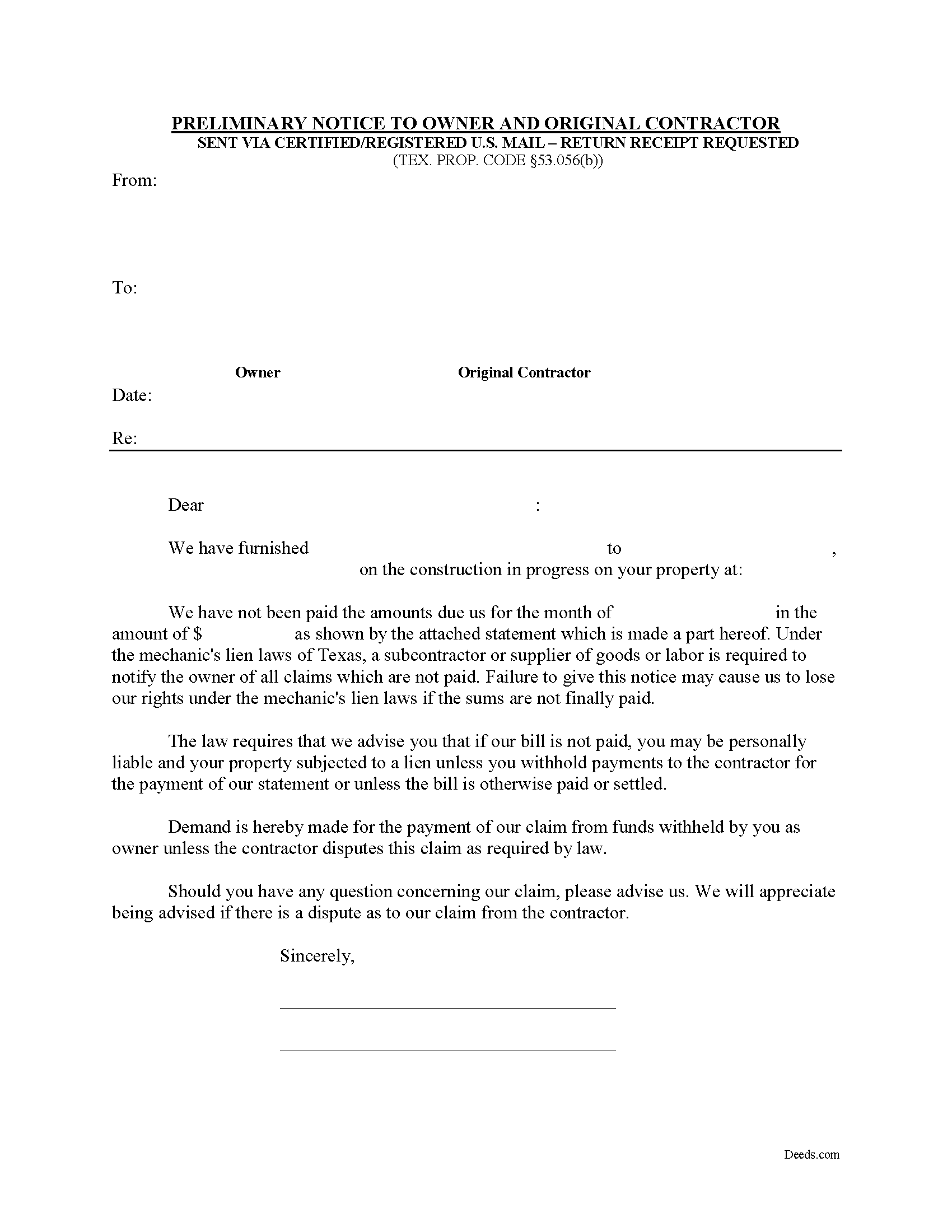

Mills County Preliminary Notice to Owner and Original Contractor Form

Mills County Preliminary Notice to Owner and Original Contractor Form

Fill in the blank Preliminary Notice to Owner and Original Contractor form formatted to comply with all Texas recording and content requirements.

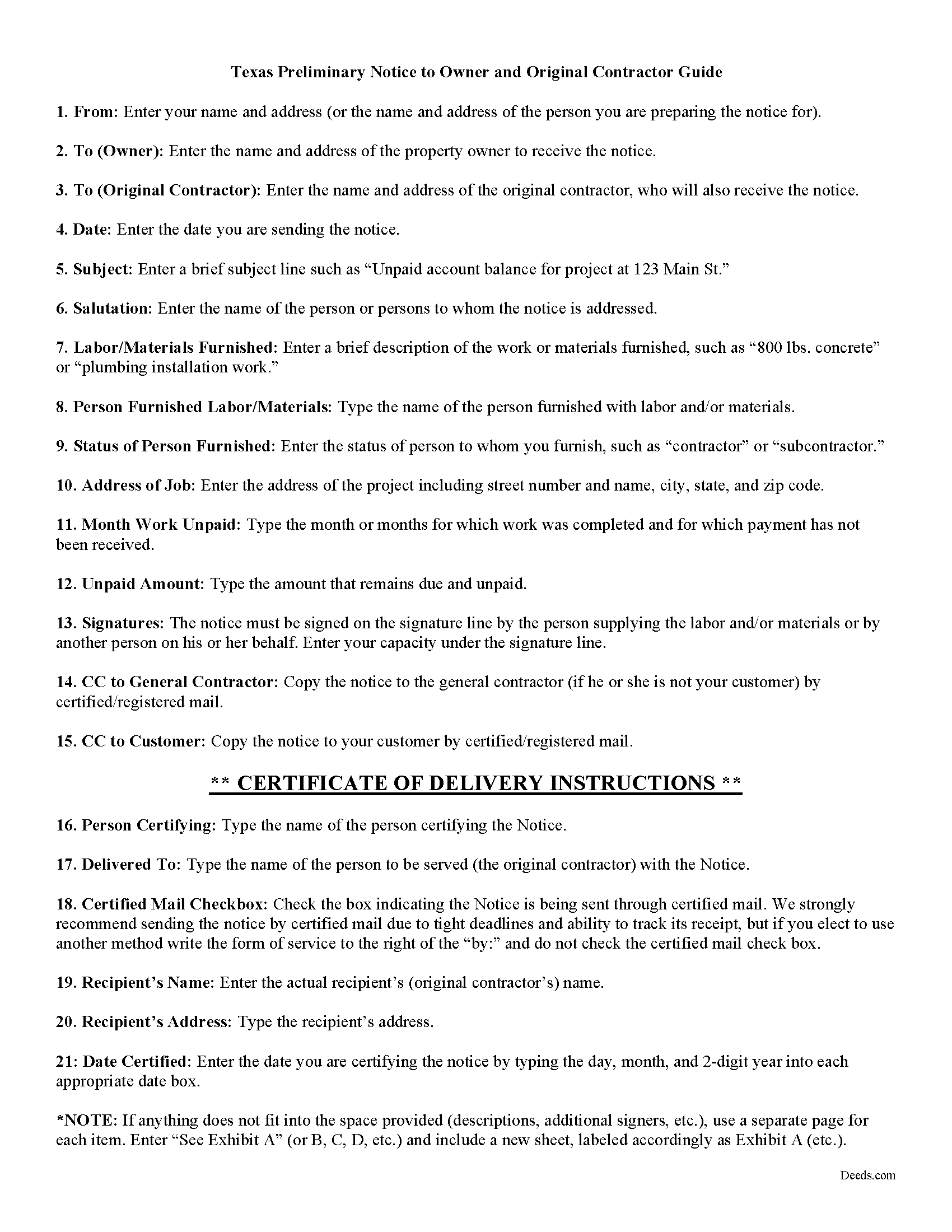

Mills County Preliminary Notice to Owner and Original Contractor Guide

Line by line guide explaining every blank on the Preliminary Notice to Owner and Original Contractor form.

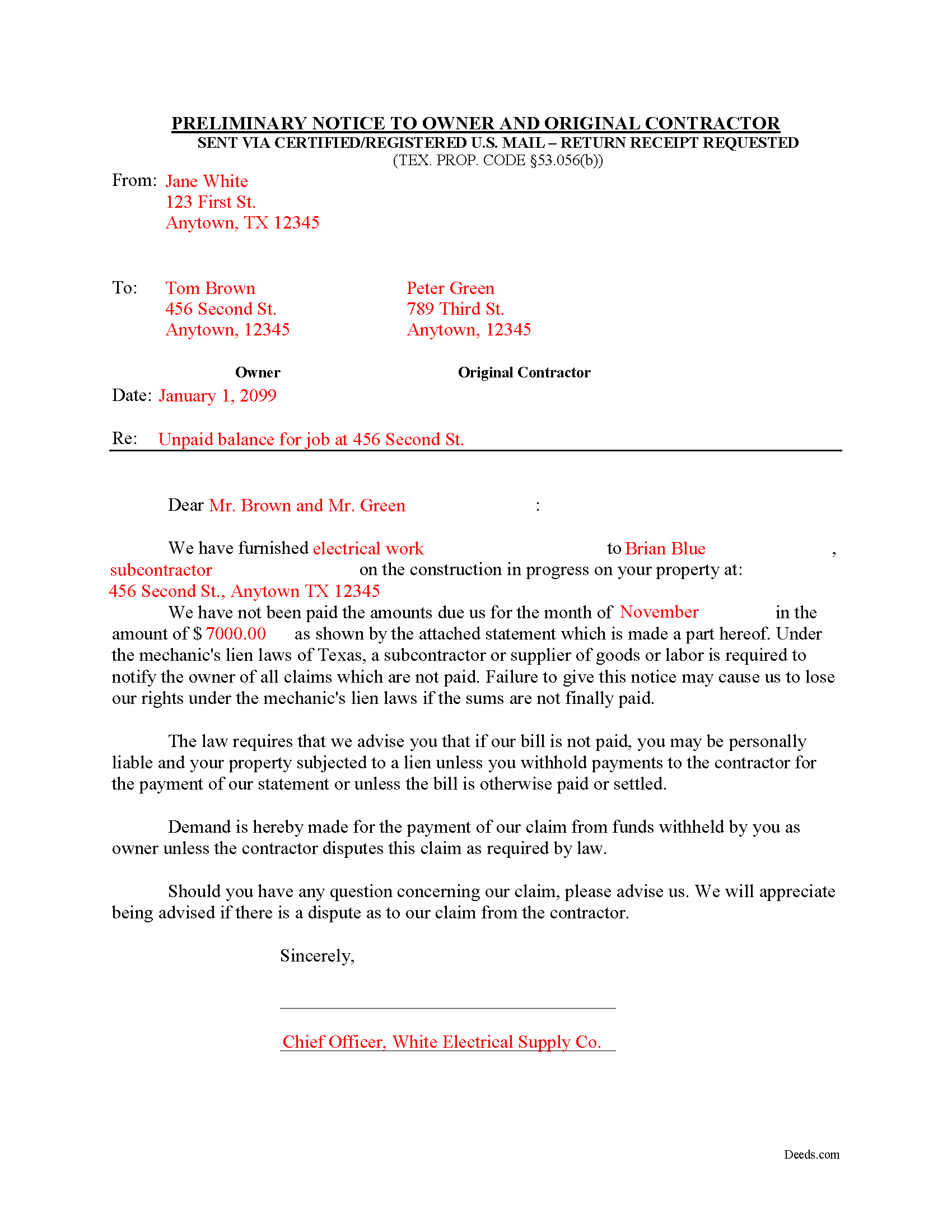

Mills County Completed Example of the Preliminary Notice to Owner and Original Contractor Document

Example of a properly completed Texas Preliminary Notice to Owner and Original Contractor document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Mills County documents included at no extra charge:

Where to Record Your Documents

Mills County Clerk Office

Goldthwaite, Texas 76844

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm / Recording until 4:30pm

Phone: (325) 648-2711

Recording Tips for Mills County:

- Avoid the last business day of the month when possible

- Check margin requirements - usually 1-2 inches at top

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Mills County

Properties in any of these areas use Mills County forms:

- Goldthwaite

- Mullin

- Priddy

- Star

Hours, fees, requirements, and more for Mills County

How do I get my forms?

Forms are available for immediate download after payment. The Mills County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mills County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mills County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mills County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mills County?

Recording fees in Mills County vary. Contact the recorder's office at (325) 648-2711 for current fees.

Questions answered? Let's get started!

Texas Third Month Notice

Under Texas lien law, all claimants other than the original contractor must provide preliminary notice to establish a claim for a valid mechanic's lien. TEX. PROP. CODE 53.056(a).

A mechanic's lien is an encumbrance on an owner's title, used to guarantee payment to builders, contractors, and construction businesses which build or repair structures, by using the property where the work was completed as a form of collateral. Suppliers of materials and subcontractors may also claim a mechanic's lien. The lien ensures that the workmen are paid before anyone else if the property subject to the lien is eventually foreclosed upon.

Texas requires prelien notice to be served on the owner and other interested parties before filing and recording a mechanic's lien. The type of project (whether residential or commercial) determines what kind of prelien notice must be served. Prelien notices serve two purposes: to protect the interests of subcontractors and suppliers, and to give property owners a defense against having to pay twice for parts of the same project.

If the lien claim arises from a debt incurred by the original contractor, the claimant must give notice to the owner or reputed owner, with a copy to the original contractor, in accordance with 53.056(b). TEX. PROP. CODE 53.056(c). The document identifies the parties, the project, date and type of service/materials, amount billed, and balance due. Attach an invoice to clarify more specific details.

Deliver the notice to the original contractor must be given no later than the 15th day of the second month following each month in which all or part of the claimant's labor was performed or material delivered. Id. This notice is also known as a "Second Month Notice." The claimant must give the same notice to the owner or reputed owner and the original contractor NO LATER than the 15th day of the third month following each month in which all or part of the claimant's labor was performed or material or specially fabricated material was delivered. Id. This notice is called a "Third Month Notice."

The notice must be sent by registered or certified mail and must be addressed to the original contractor at his or her last known business or residence address. TEX. PROP. CODE 53.056(e).

Remember that each case is unique and the mechanic's lien law in Texas can be complicated and unforgiving of mistakes. Therefore, contact an attorney for complex situations, with specific questions the required preliminary notice, or any other issue related to mechanic's liens.

Important: Your property must be located in Mills County to use these forms. Documents should be recorded at the office below.

This Preliminary Notice to Owner and Original Contractor meets all recording requirements specific to Mills County.

Our Promise

The documents you receive here will meet, or exceed, the Mills County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mills County Preliminary Notice to Owner and Original Contractor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Richard E.

August 10th, 2021

The QuitClaim deed does not provide enough space in the Grantor block at the top of the first page. In fact, all blocks should provide more space.

Thank you for your feedback. We really appreciate it. Have a great day!

Douglas N.

September 13th, 2021

Great!

Thank you!

Neil S.

January 3rd, 2019

Very impressive. The only change I would suggest is a smaller font on the title.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary B.

September 16th, 2022

Great service. Comprehensive. Reasonably priced.

Thank you for your feedback. We really appreciate it. Have a great day!

diana c.

February 24th, 2022

quick and easy, thankyou

Thank you!

Mary S.

March 25th, 2022

Really, really great. Instructions are so helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie P.

June 30th, 2024

Quick & easy to use. Spoke a lawyer and saved hundreds by doing it myself.

Thank you for your feedback Julie, we appreciate you.

ELIZABETH G.

August 7th, 2020

This site was very easy to use. Great direction on how to complete the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Faith D.

April 26th, 2023

That was really nice to use! Just don't have a computer but will go get copies. Thank you for being there.

Thank you!

Georgia R.

March 29th, 2023

Great experience, fast and efficient, no hassle. Will use again!

Thank you for your feedback. We really appreciate it. Have a great day!

Robert W.

January 5th, 2019

The forms were as I expected them to be. The guide was very helpful. Overall very good.

Thanks Robert. We appreciate your feedback.

THUY N.

December 15th, 2021

It's convenience.

Thank you for your feedback. We really appreciate it. Have a great day!

Carla H.

May 29th, 2020

This is a very useful site for downloading legal forms - just be sure you're getting the form you need before buying. Unfortunately I selected the wrong form initially and had to buy a 2nd form to correct my error. I saw no way of communicating my error at that point - i.e., loss of one star.

Thank you for your feedback. We really appreciate it. Have a great day!

Gene L.

August 5th, 2020

Worked perfect. Thanks.

Thank you!

Patrick U.

November 9th, 2023

Great product. They processed and transmitted the deed promptly. A small question I had was answered quickly and professionally. I would use again if the need arises and will recommend to friends.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!