Marion County Texas Affidavit of Heirship Form

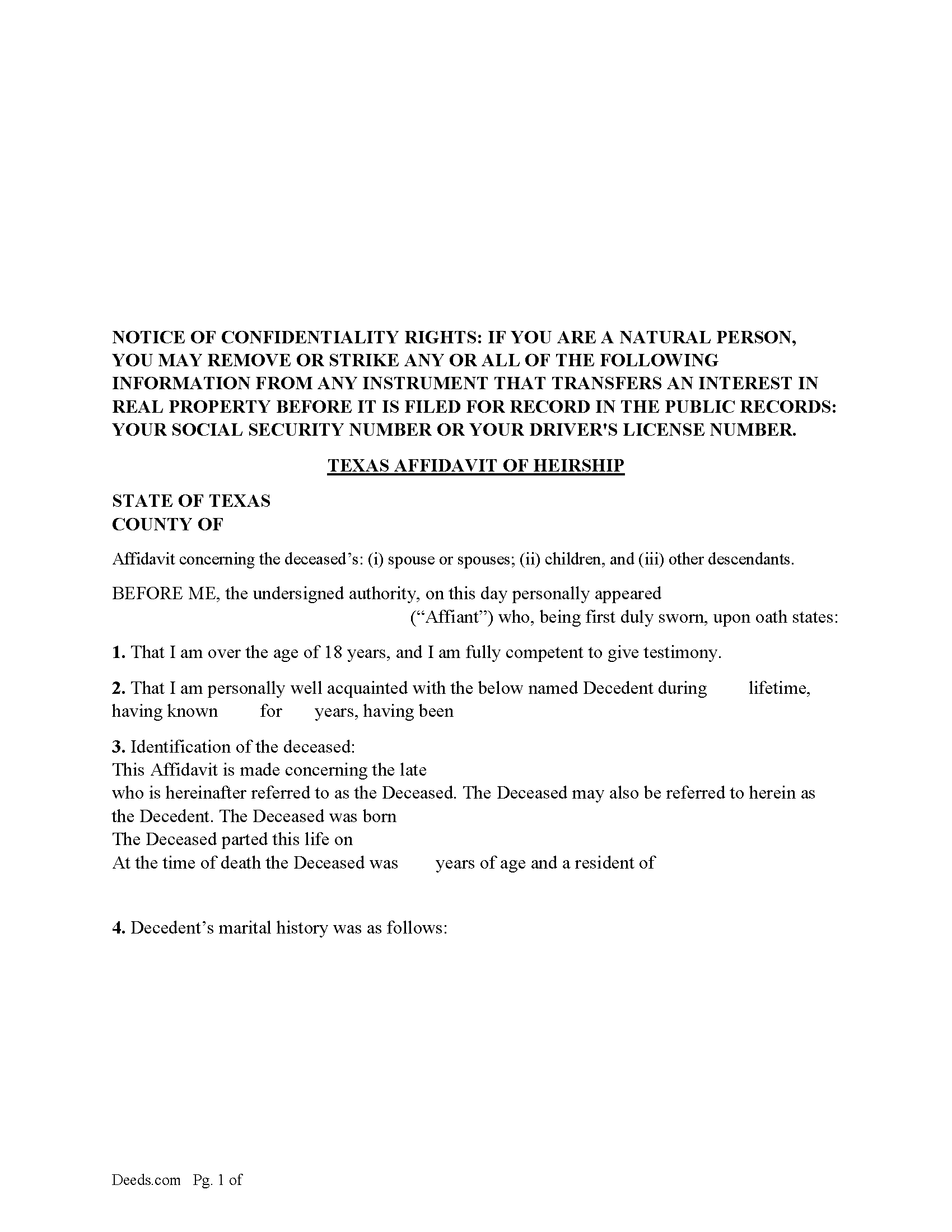

Marion County Affidavit of Heirship Form

Fill in the blank form formatted to comply with all recording and content requirements.

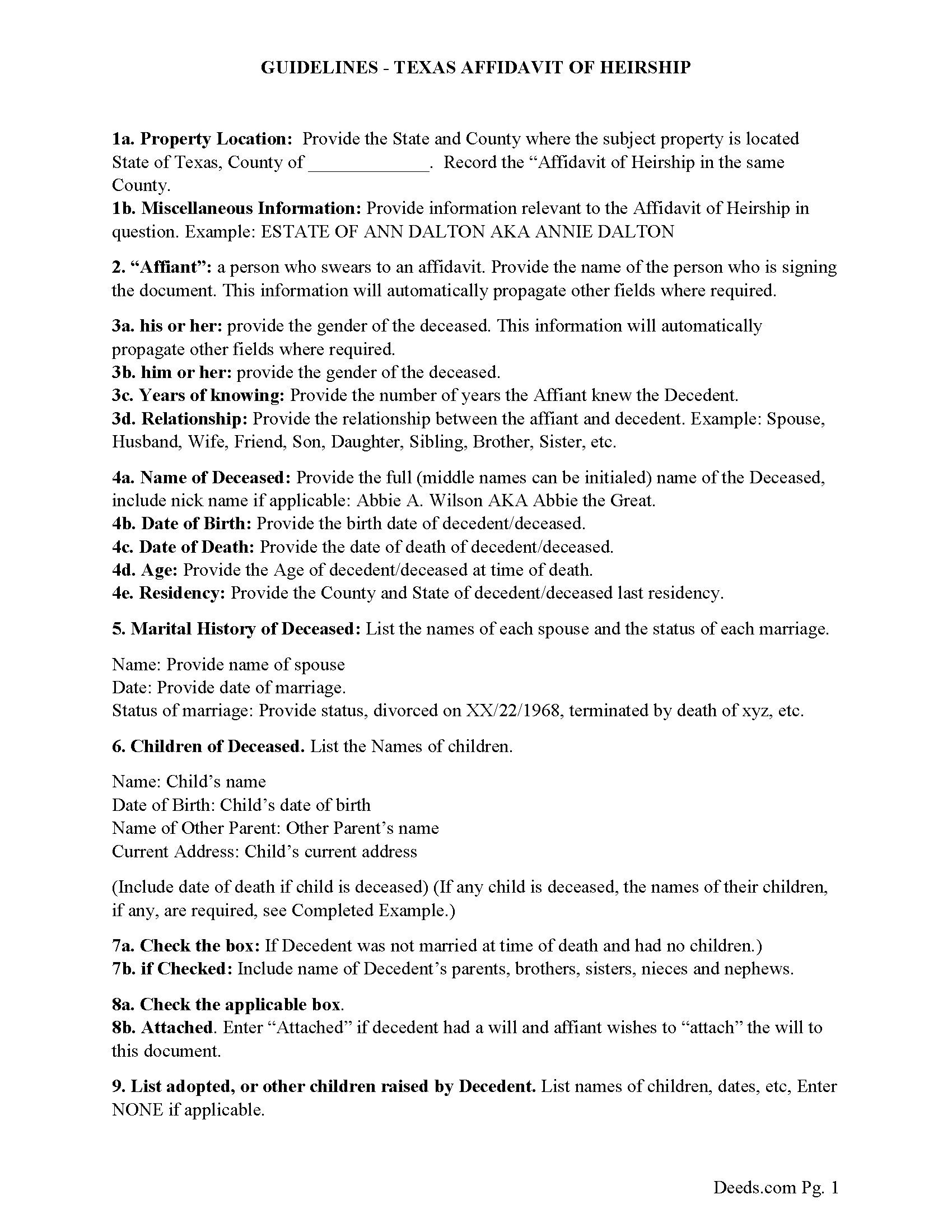

Marion County Guidelines for Texas Affidavit of Heirship

Line by line guide explaining every blank on the form.

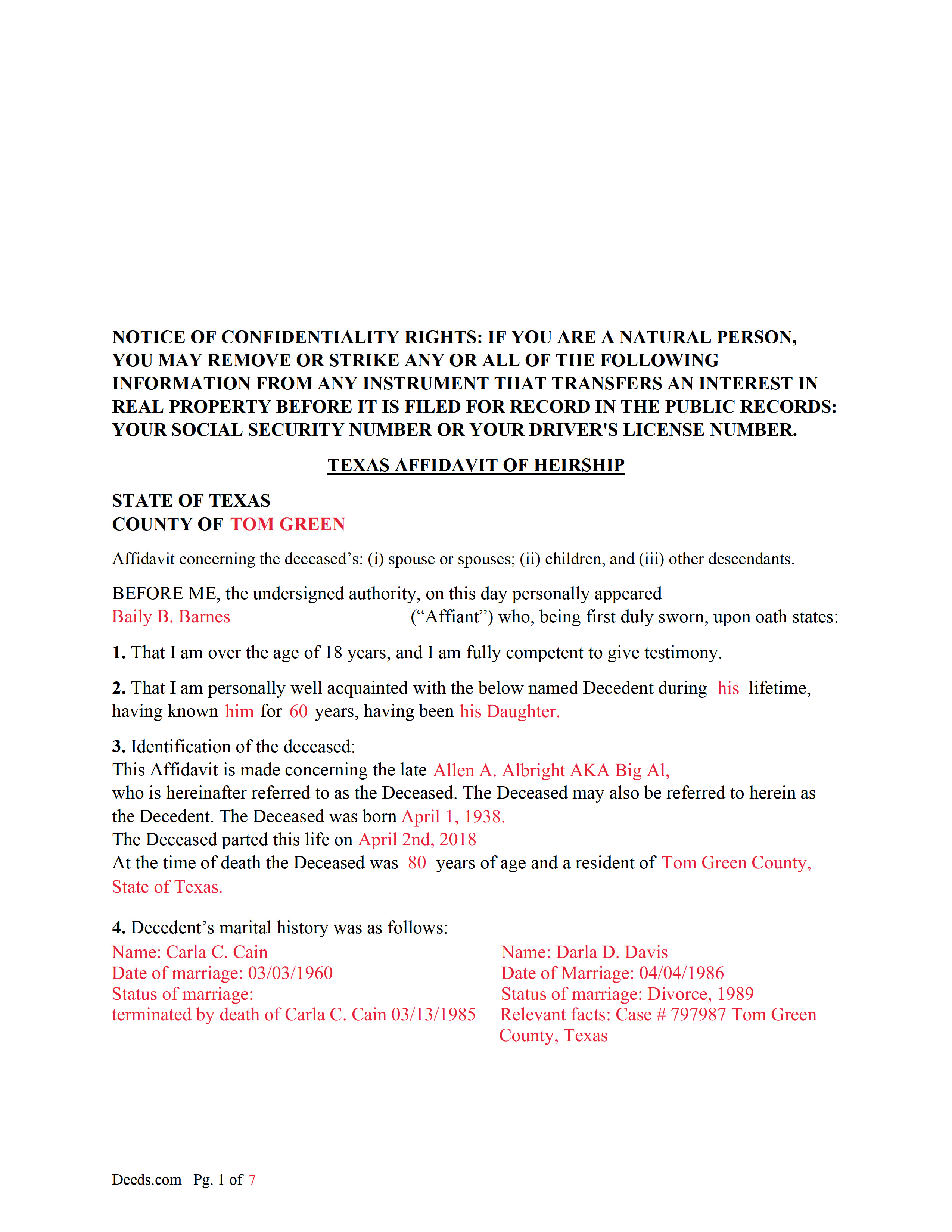

Marion County Completed Example of a Texas Affidavit of Heirship Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Marion County documents included at no extra charge:

Where to Record Your Documents

County Clerk's Office - Government Center

Jefferson, Texas 75657

Hours: Monday - Friday 8:00am - 12:00 & 1:00 - 5:00pm

Phone: (903) 665-3971

Recording Tips for Marion County:

- Ask if they accept credit cards - many offices are cash/check only

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Jefferson

- Lodi

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (903) 665-3971 for current fees.

Questions answered? Let's get started!

This form is typically used when the deceased did NOT leave a will or estate plan. The Affidavit of Heirship is a sworn statement used to establish the heirs of a property, with a goal of putting the property in their name. Sometimes this form is used to bypass probate when the deceased left a will that leaves the property solely to the direct descendants of the deceased or when 4 years have passed since the death of the owner, the general time frame to probate a will in Texas. An Affidavit of Heirship can be filed anytime. An Affidavit of Heirship alone does not transfer property title. It identifies the heirs of the property.

General parameters for a Texas Affidavit of Heirship document:

No valid will, or if beneficiaries and/or heirs agree to disregard the will.

Only real estate needs to be transferred to heirs.

The deceased does not have any debts.

No administration of estate required.

(Texas Affidavit of Heirship Package includes form, guidelines, and completed example)

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Texas Affidavit of Heirship meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Texas Affidavit of Heirship form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Nicole M.

June 3rd, 2020

This is my very first use with your company. I submitted my package and within the hour you had responded with an Invoice for me to pay so you could proceed with my recording. So far I am very impressed! Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Delba O.

January 4th, 2021

This was the easiest process ever. Thank you for making this so easy. No hassle, just upload your docs, pay the invoice and done. It didn't even take 2 business days to get my deed recorded. If I ever need to record anything I will definitely use your services again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terralynn J.

July 18th, 2019

I was very pleased to find ONLINE, Deed Revision Document(s) and their explanation. I ordered these document Forms, downloaded them and Printed them. Now, I will be able to fill them out in the privacy of my home. Instructions were also included, how to file this new Deed, after I complete it and have it Notarized. This has saved me time and emotional stress following the death of my husband. THANK YOU.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara E.

April 4th, 2019

Fast efficient, just what I needed.

Thank you so much Barbara. We appreciate your feedback.

Julie G.

December 15th, 2020

Such a great site!! Everyone is so helpful! Thanks again! Julie

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doris I.

June 7th, 2019

My grandaughter in law got the info for me and it looks very help ul nThanks Doris

Thank you!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Patricia C.

March 31st, 2019

Only source I could find. Wasn't sure if I needed same certificate from each state and site had me checkout separately for each. Good way to keep you customer paying up. Just hope what I received is acceptable.

Thank you!

Tonya J.

December 14th, 2019

User friendly and fast response time!!

Thank you for your feedback. We really appreciate it. Have a great day!

Lacee G.

November 25th, 2019

Great real estate deed forms.

Thank you!

Judith F.

October 15th, 2021

Easy to understand and use!

Thank you!

Brennan H.

October 4th, 2023

I had worked for a couple of months sending things back and forth to the county and still had no success. I decided to use deeds.com and it was all done in a few hours. Such a relief! While I find this to be wrong and the county should work with property owners as well as they work with third parties, I was still grateful for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Jerry W.

March 16th, 2020

Great program and easy to follow instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Esfir K.

October 3rd, 2022

I had to call 3 times, two calls were hanged up on me. Thank you to 3rd representative, who helped me with my question. Unfortunately, I do not know her name. She was very patient, kind, professional. I am very thankful for her help.

Thank you!

George Y.

June 24th, 2021

Thought it was great, no issues. Very convenient especially dealing with difficult municipalities and a post COVID world. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!