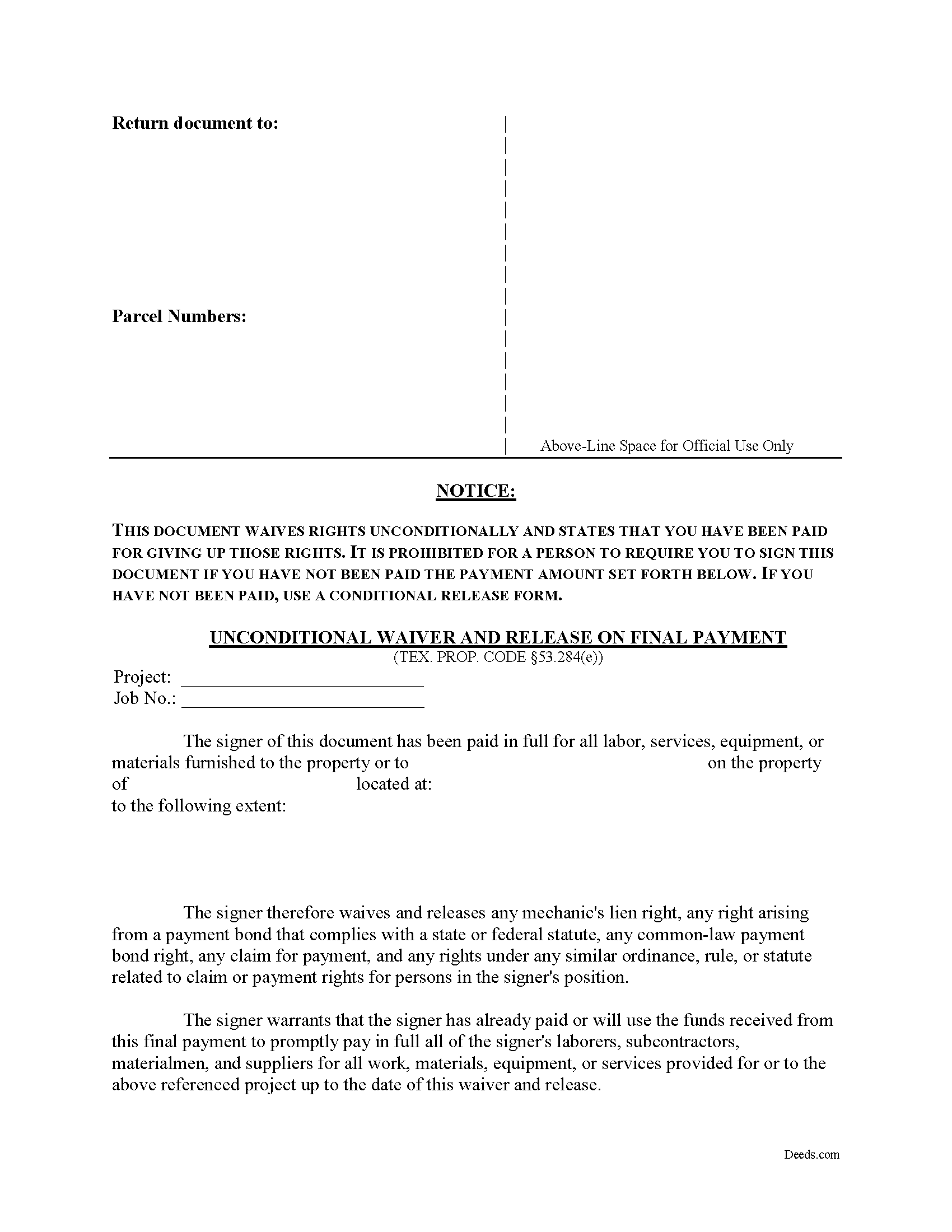

Randall County Unconditional Waiver on Final Payment Form

Randall County Unconditional Waiver on Final Payment Form

Fill in the blank Unconditional Waiver on Final Payment form formatted to comply with all Texas recording and content requirements.

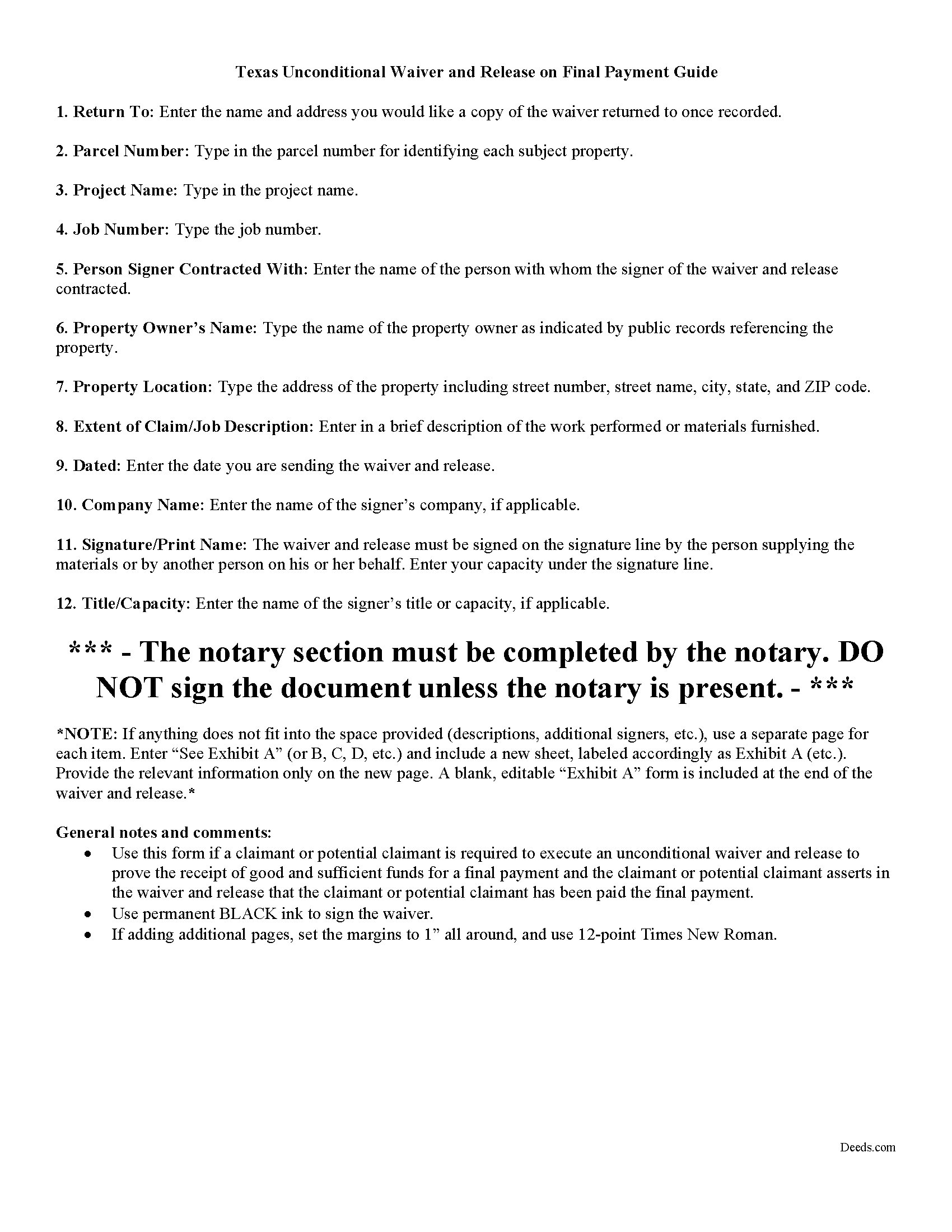

Randall County Unconditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

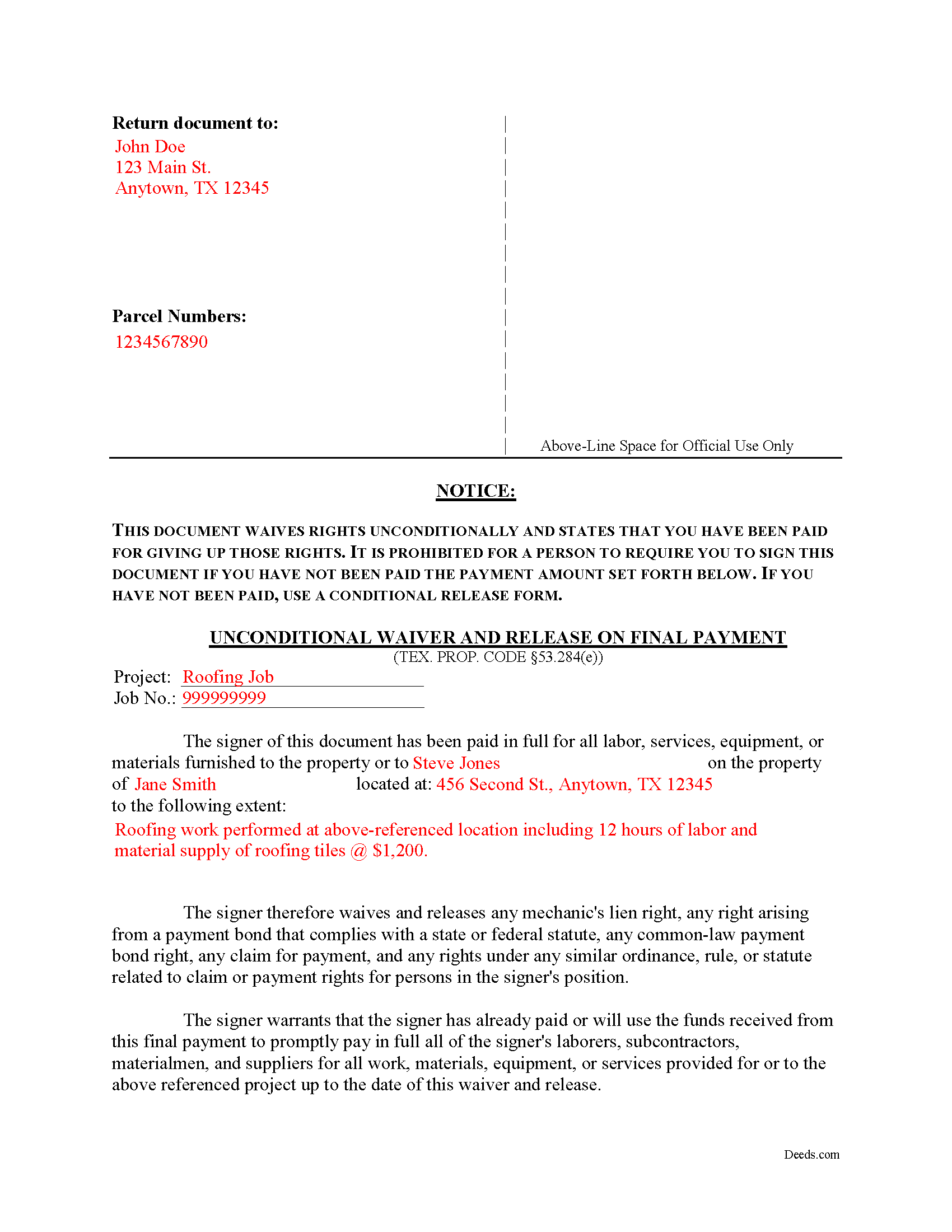

Randall County Completed Example of the Unconditional Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Texas and Randall County documents included at no extra charge:

Where to Record Your Documents

Randall County Clerk

Canyon, Texas 79015

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (806) 468-5505 x4003

Recording Tips for Randall County:

- Ensure all signatures are in blue or black ink

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Randall County

Properties in any of these areas use Randall County forms:

- Amarillo

- Canyon

- Umbarger

Hours, fees, requirements, and more for Randall County

How do I get my forms?

Forms are available for immediate download after payment. The Randall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Randall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Randall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Randall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Randall County?

Recording fees in Randall County vary. Contact the recorder's office at (806) 468-5505 x4003 for current fees.

Questions answered? Let's get started!

A lien waiver is used by a lien claimant or potential claimant to forfeit his or her right to a lien upon a progress payment or final payment. The waiver can be conditional, meaning that the payment must clear the bank before the lien is released, or unconditional, meaning the lien is released upon the recording of the waiver regardless of whether or not the claimant is ever actually paid.

A waiver and release given by a claimant or potential claimant is unenforceable unless it substantially complies with the applicable form described in Sec. 53.284 of the Texas Property Code.

The four types of lien waivers in the State of Texas include:

- Conditional Waiver and Release on Progress Payment;

- Unconditional Waiver and Release on Progress Payment;

- Conditional Waiver and Release on Final Payment; and

- Unconditional Waiver and Release on Final Payment

Let's say a contractor completes work a project where she recorded a lien. The owner wants the lien released and writes a check for the total amount due. If the contractor offers an unconditional waiver and release on final payment, she gives up her right to lien, even if the bank refuses to honor the check, so make sure any payments clear the bank before issuing such a comprehensive waiver and release.

Texas lien law requires an actual payment before an owner may request an unconditional waiver. A person may not require a claimant or potential claimant to execute an unconditional waiver and release for a progress payment or final payment amount unless the claimant or potential claimant received payment in that amount in good and sufficient funds. See Sec. 53.283.

Use a waiver under Sec. 53.284(e) if a claimant or potential claimant is required to execute an unconditional waiver and release to prove the receipt of good and sufficient funds for a final payment. In this document, the claimant or potential claimant asserts that the outstanding balance has been paid in full.

All unconditional waivers must be titled as such and contain the following required statutory warning: "This document waives rights unconditionally and states that you have been paid for giving up those rights. It is prohibited for a person to require you to sign this document if you have not been paid the payment amount set forth below. If you have not been paid, use a conditional release form."

Further, the waiver identifies the parties, the project, the work and/or materials provided, and relevant dates and payment amounts. Sign it in front of a notary and submit it to the local recording office.

In summary, a lien waiver is an important tool, but take care to use the proper form. The wrong choice can lead to a loss of lien rights before receiving payment. Each case is unique, and Texas lien law can be complicated. Contact an attorney for complex situations, with questions about waivers, or any other issues related to mechanic's liens.

Important: Your property must be located in Randall County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver on Final Payment meets all recording requirements specific to Randall County.

Our Promise

The documents you receive here will meet, or exceed, the Randall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Randall County Unconditional Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Mary M.

May 7th, 2019

So easy to use. I was able to download all the forms I need, it saves a lot of time!

Thank you!

George D.

August 23rd, 2020

The TODD form has been notarized and registered with my county Register of Deeds office, so it works just fine. My only quibble is that when I printed it out, it missed part of the last line of the notary's info and the fine print in the bottom corners. When I printed it at 90% scale, it included those things.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane D.

July 2nd, 2020

Document site was very easy to access and pull up what I needed.

Thank you!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth J.

May 17th, 2019

It is very good and I would use the site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn M.

March 31st, 2022

Very helpful and informative. The online site walked you through step by step and if you had a question, which I did, I called with my question. Thanks again.

Thank you!

Karen H.

April 6th, 2024

Saves a trip to the Recorders Office!

It was a pleasure serving you. Thank you for the positive feedback!

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.

Sandra N.

April 13th, 2019

Very quick and painless process!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dave S.

May 1st, 2019

Easy to use and get forms I needed. Corporate need for an invoice/receipt could be a bit easier - have to print screen to get any info.

Thank you for your feedback Dave, we really appreciate it.

Roy W.

April 29th, 2020

It's fine

Thank you!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

Rosemary S.

July 25th, 2020

It was quick and so very easy. Very detailed information. Love the app.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnny A.

December 15th, 2018

My complete name is Johnny Alicea Rodriguez And the DEED is on my half brother and mine name. Jimmy Dominguez and myself Thanks