Kane County Deed of Trust and Promissory Note Form

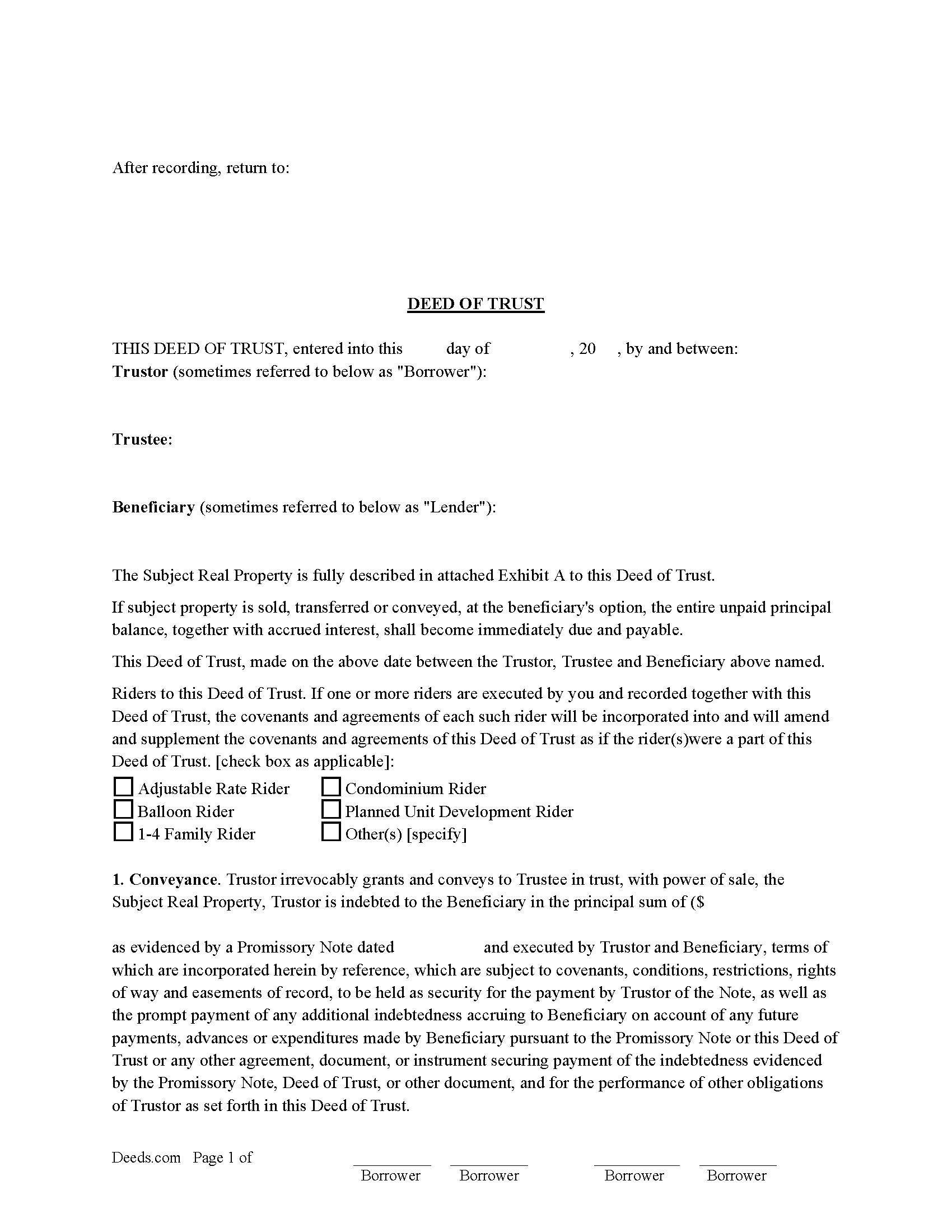

Kane County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

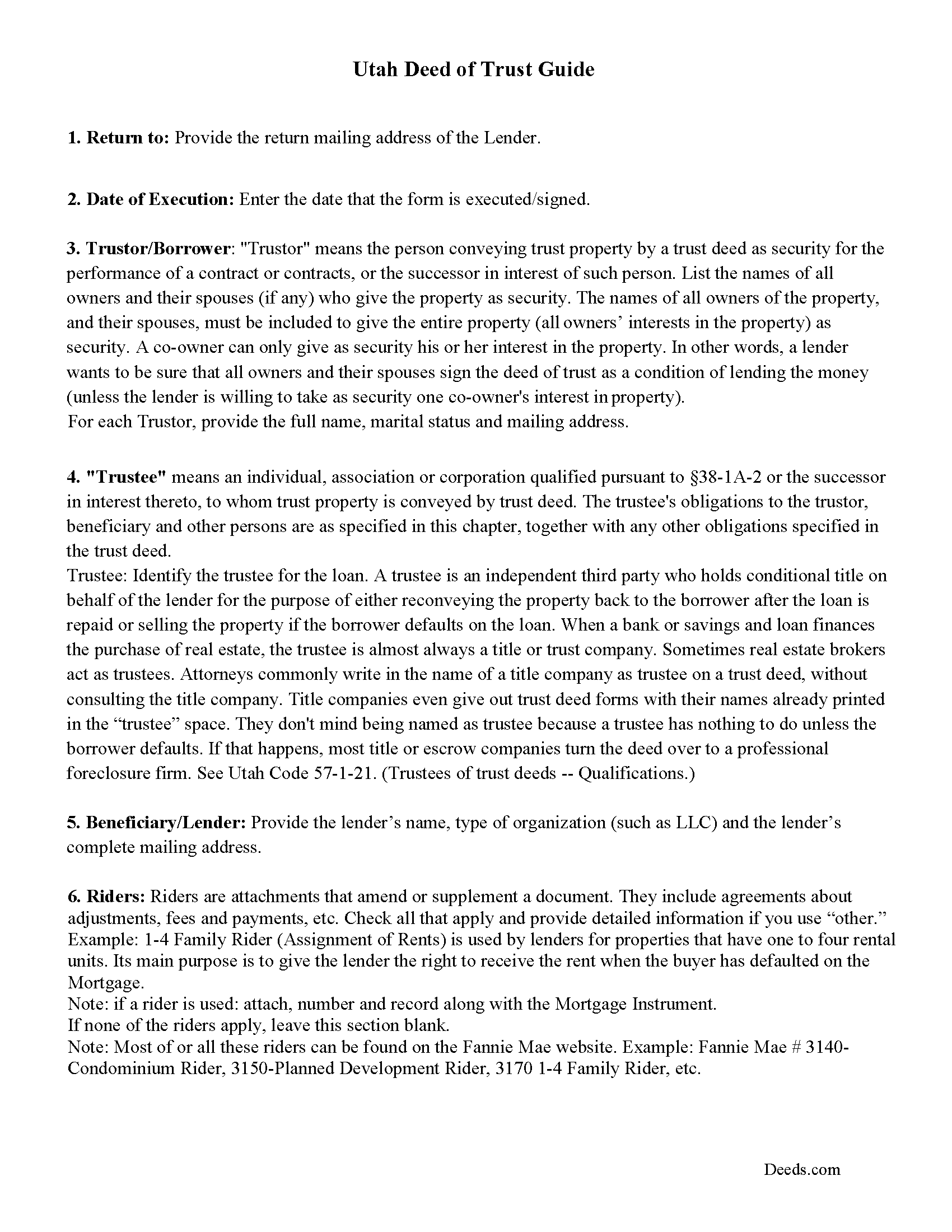

Kane County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

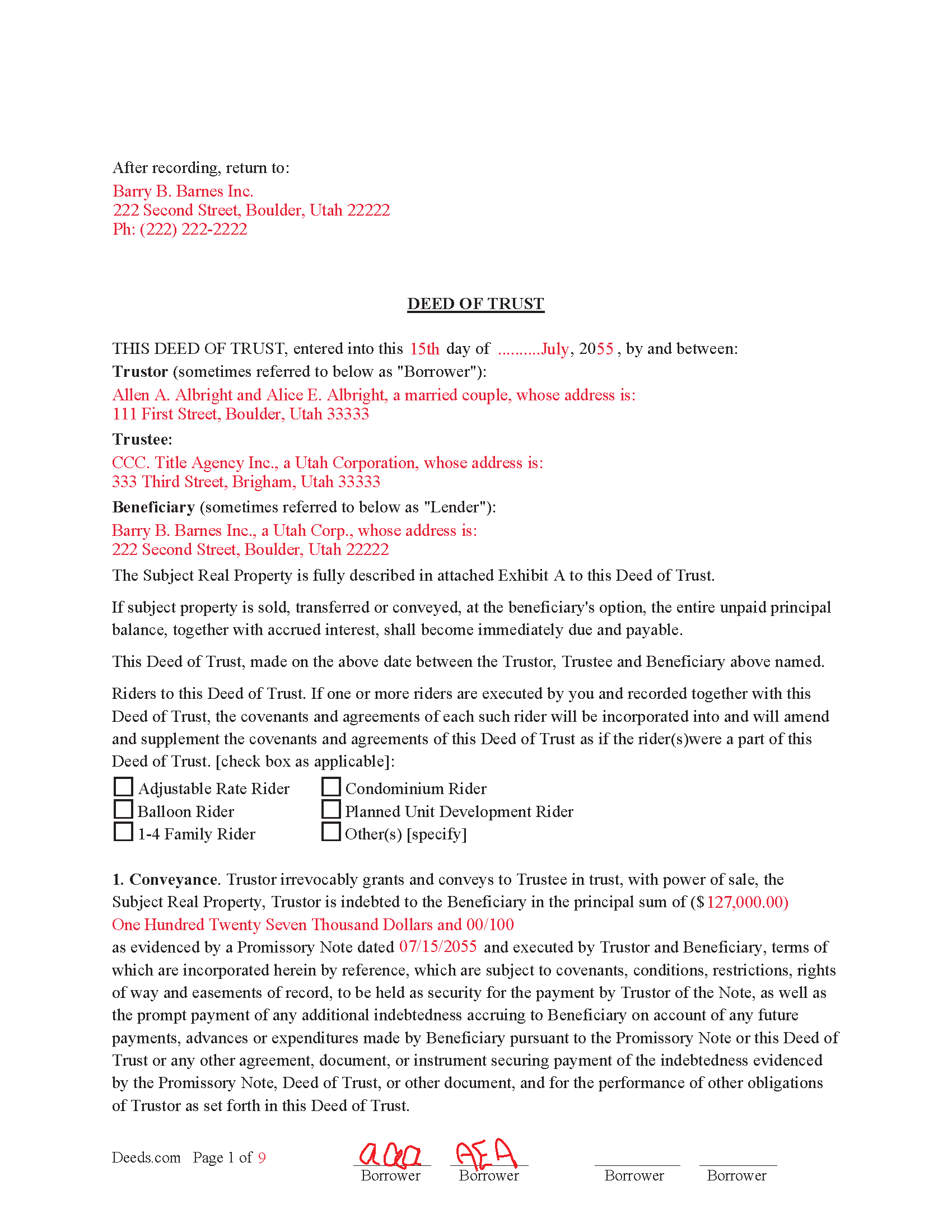

Kane County Completed Example of the Deed of Trust Form

Example of a properly completed form for reference.

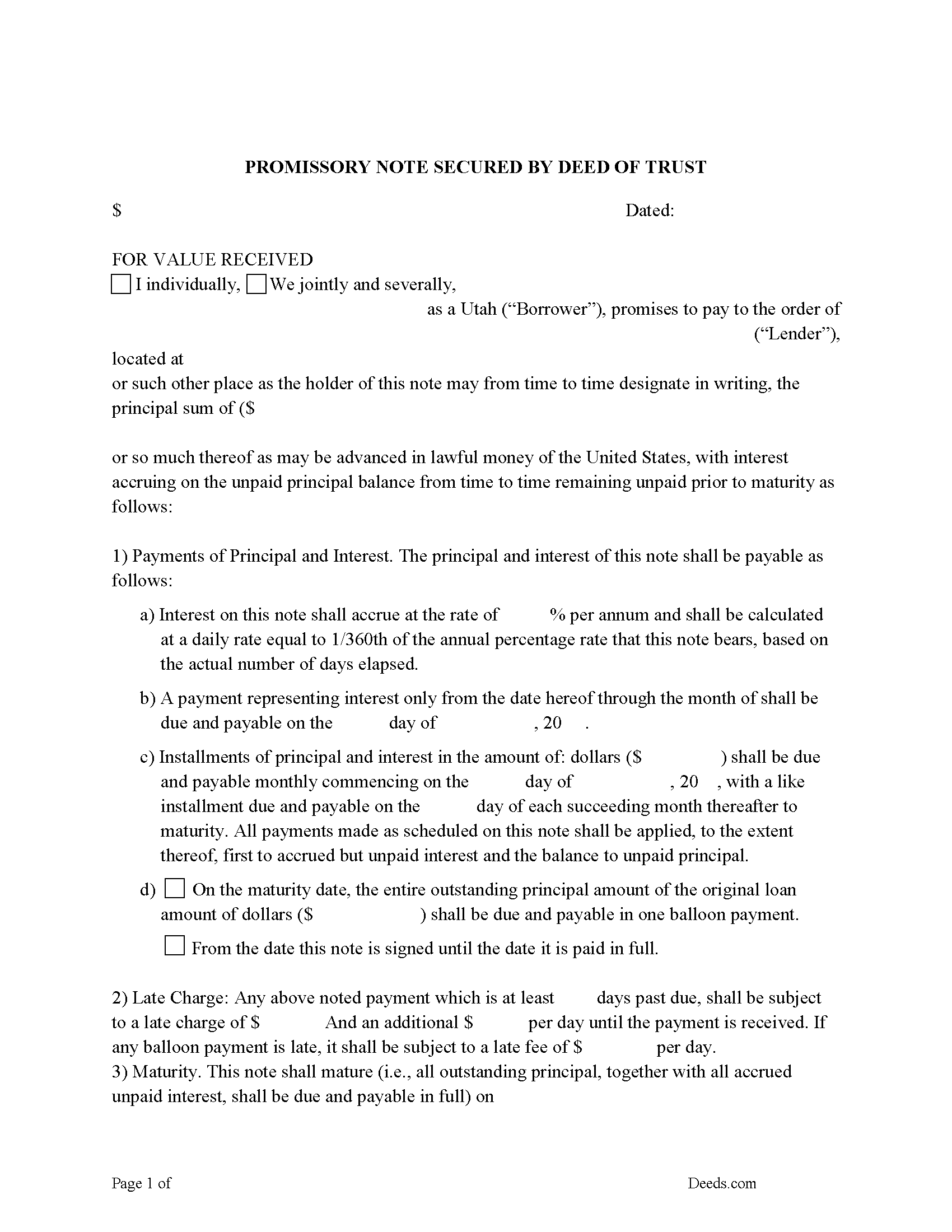

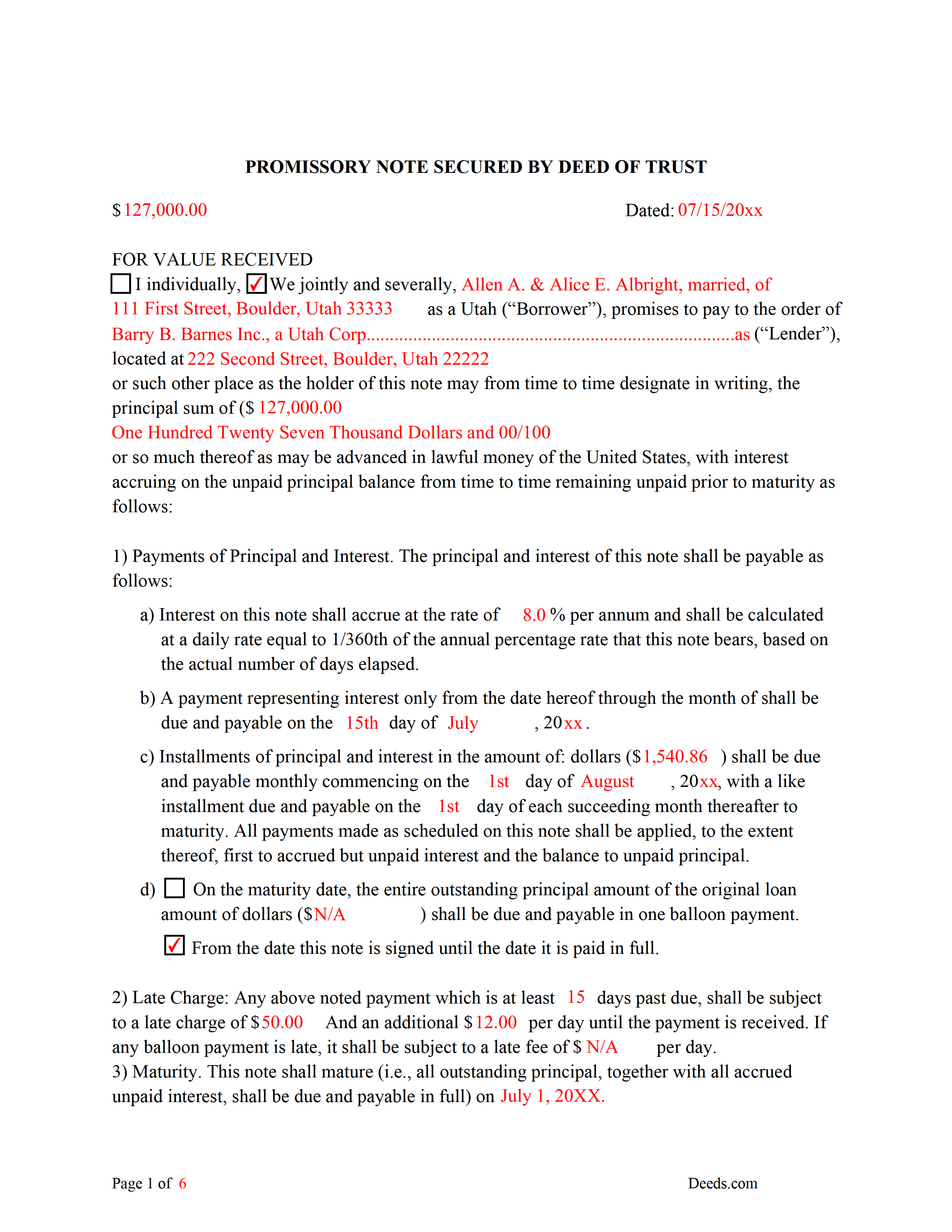

Kane County Promissory Note Form

Note that is secured by the Deed of Trust.

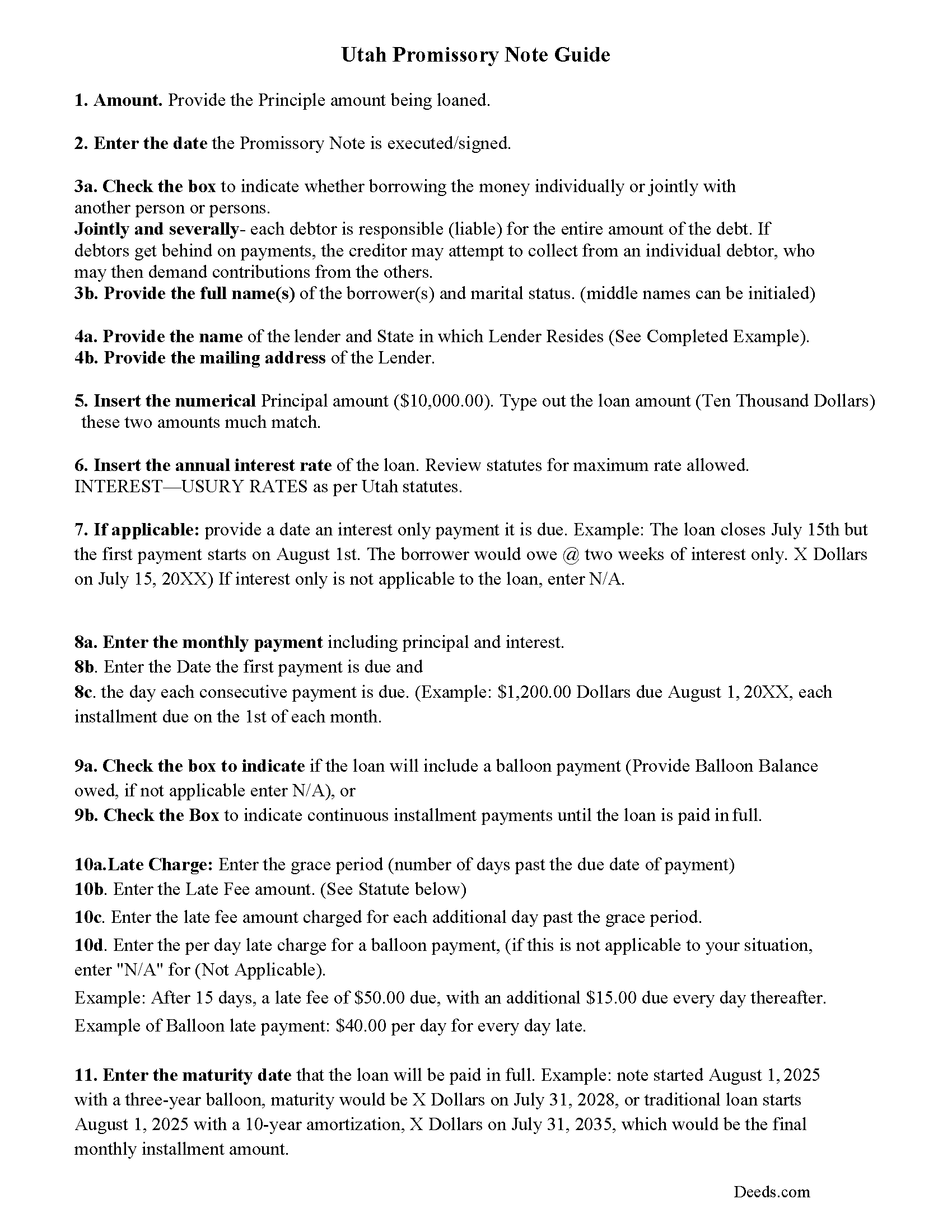

Kane County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Kane County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

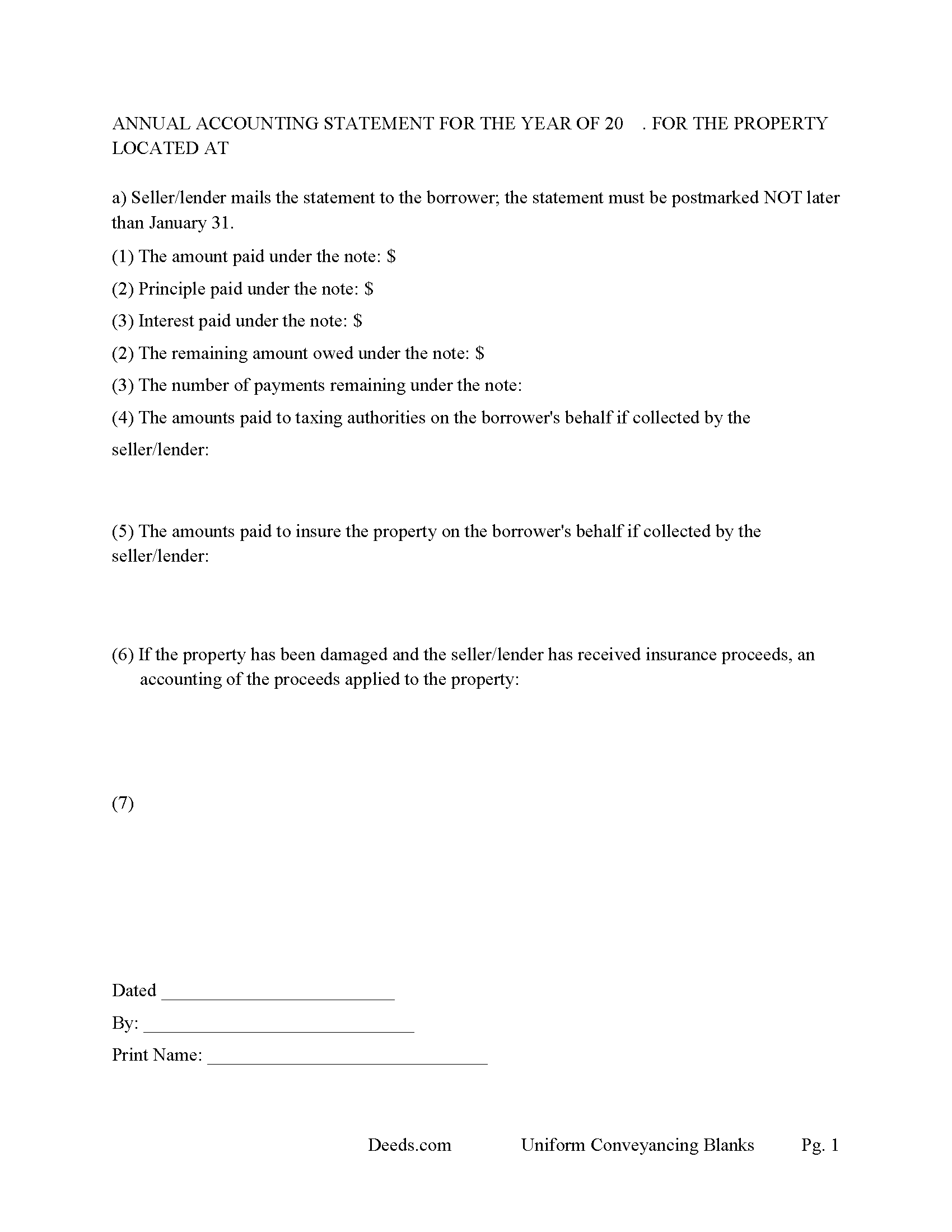

Kane County Annual Accounting Statement Form

Lender sends to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Kane County documents included at no extra charge:

Where to Record Your Documents

Kane County Recorder

Kanab, Utah 84741

Hours: 8:00am-5:00pm M-F

Phone: (435) 644-2360

Recording Tips for Kane County:

- Verify all names are spelled correctly before recording

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Kane County

Properties in any of these areas use Kane County forms:

- Alton

- Duck Creek Village

- Glendale

- Kanab

- Mount Carmel

- Orderville

Hours, fees, requirements, and more for Kane County

How do I get my forms?

Forms are available for immediate download after payment. The Kane County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Kane County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kane County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Kane County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Kane County?

Recording fees in Kane County vary. Contact the recorder's office at (435) 644-2360 for current fees.

Questions answered? Let's get started!

A deed of trust (DOT), is a document that conveys title to real property to a trustee as security for a loan until the Trustor/borrower repays the Beneficiary/lender according to terms defined in an attached promissory note. In Utah a Deed of Trust with "Power of Sale" is the most favored lending instrument, foreclosures can be non-judicially, saving time and expense.

There are Three parties in a Deed of Trust

("Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest. (Utah Code 57-1-19(1)) Also known as Lender

("Trustor" means the person conveying real property by a trust deed as security for the performance of an obligation.) (Utah Code 57-1-19(2)) Also known as borrower

("Trustee" means a person to whom title to real property is conveyed by trust deed, or his successor in interest. Utah Code 57-1-19(4))

In the case of default on loan, the (Trustee is given the power of sale by which the trustee may exercise and cause the trust property to be sold in the manner provided in Sections 57-1-24 and 57-1-27, after a breach of an obligation for which the trust property is conveyed as security; or, at the option of the beneficiary, a trust deed may be foreclosed in the manner provided by law for the foreclosure of mortgages on real property.) (57-1-23)

These forms contain clauses that are stringent, helping to protect the lender, typically used by an individual/investor/landlord financing residential property, rental property, condominiums, vacant land, small commercial and office.

1. Right to Inspect Property

2. Care of Property (Lender may make necessary repairs and add the cost to the Note, protecting against undue depreciation)

3. Due on Sale (balance due upon sale of property by borrower)

4. Additional financing prohibited unless approved by lender

5. Defaults on prior incumbrances (borrower promises to comply with the terms of prior mortgages or encumbrances.)

6. Indemnification of Lender. Borrower shall indemnify the Lender against any and all liability

7. Assignment of Rents (borrower can collect rents so long as no event of default has occurred)

Promissory Note - use for traditional installment or balloon payment.

1. Late Charge: Any above noted payment which is at least ___ days past due

2. Default Rate: I payment is/are at least 30 days past due, then the principal balance shall bear interest at default rate of ( ___%).

3. In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee.

4. Governed by Utah Law.

(Utah DOT Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Kane County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Kane County.

Our Promise

The documents you receive here will meet, or exceed, the Kane County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kane County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Mary B.

December 2nd, 2020

I was very pleased with my experience on Deeds.com. I hand purchased the wrong papers and they credited my account so I could purchase the correct papers. I will use them again

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph H.

May 13th, 2019

It had all the info I was looking for!

Thank you Ralph, we appreciate your feedback.

John S.

May 20th, 2023

Easy to use website and reasonably priced forms. I recommend it.

Thank you for the kind words John.

Theodore K.

September 8th, 2021

This does the job but we are not able to save this in our account and if you don't pay for Adobe and only have Adobe reader, I cannot save any information on the form online in my account. I do understand why they do this because they would lose money. A huge issue is that when I got to the end of the document and was adding an Exhibit A, as I typed, the page kept jumping back up the to top and I couldn't see what I was typing. I had to type a little then scroll back down and when I would type more, it would jump up again. This was a real problem.

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID S.

January 16th, 2019

I was very impressed with the speed at which information was retrieved on my very first search. Unfortunately, the county we were looking for is behind times and has not digitized its information. I will be using Deeds.Com again and appreciate that I was not charged for no information being returned back. Thank You David S

Thank you for your feedback. We really appreciate it. Have a great day!

Oldemar T.

June 23rd, 2020

You guys simplified my life. You offer very convenient services. Thank you.

Thank you!

Michelle K.

August 20th, 2020

Excellent service! Easy to use, great communication, quick response time and very helpful with any questions I had. I would recommend to anyone seeking the services they provide.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

katherine a.

July 20th, 2021

loved the ease of use for the forms. went on line to find out about Adobe Reader, too. Had a test to see if I had it. Took few seconds. Then on to ordering and downloading which took only 5 minutes for the three forms I wanted. Thanks, Katie Anderson

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen H.

December 12th, 2022

Great experience. Rapid service, no unexpected problems, and reasonable pricing. I will definitely use Deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Amanda W.

August 18th, 2020

Very helpful.

Thank you!

Scott P.

October 24th, 2020

So far so good

Thank you!

Mary L.

February 6th, 2021

Great site. Very easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Scotty A.

October 2nd, 2021

A great time and money saver that also has a money back guarantee. I received all the pertinent forms and instructions for less than a family eating a fast food dinner.

Thank you!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.