Wayne County Grant Deed Form

Last validated January 26, 2026 by our Forms Development Team

Wayne County Grant Deed Form

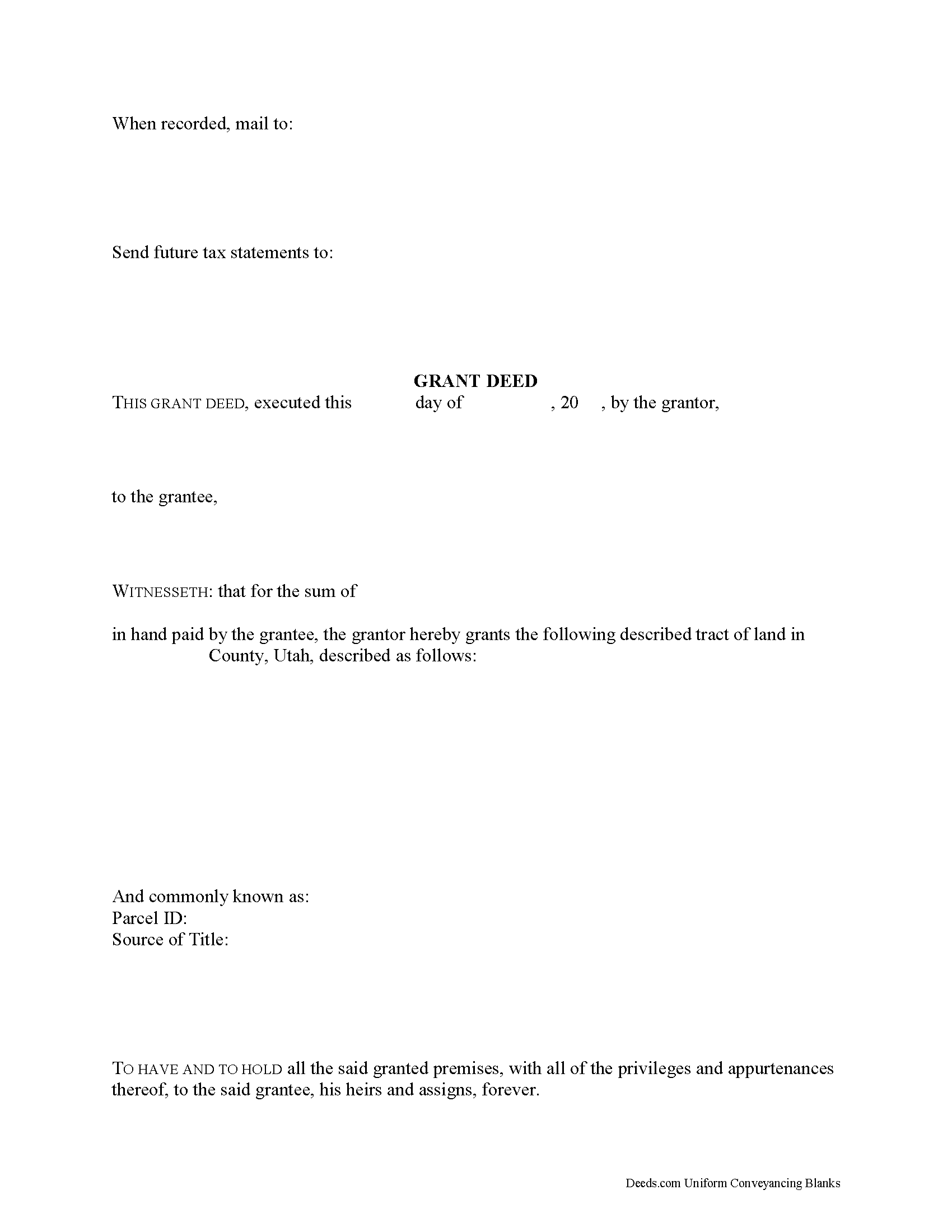

Fill in the blank form formatted to comply with all recording and content requirements.

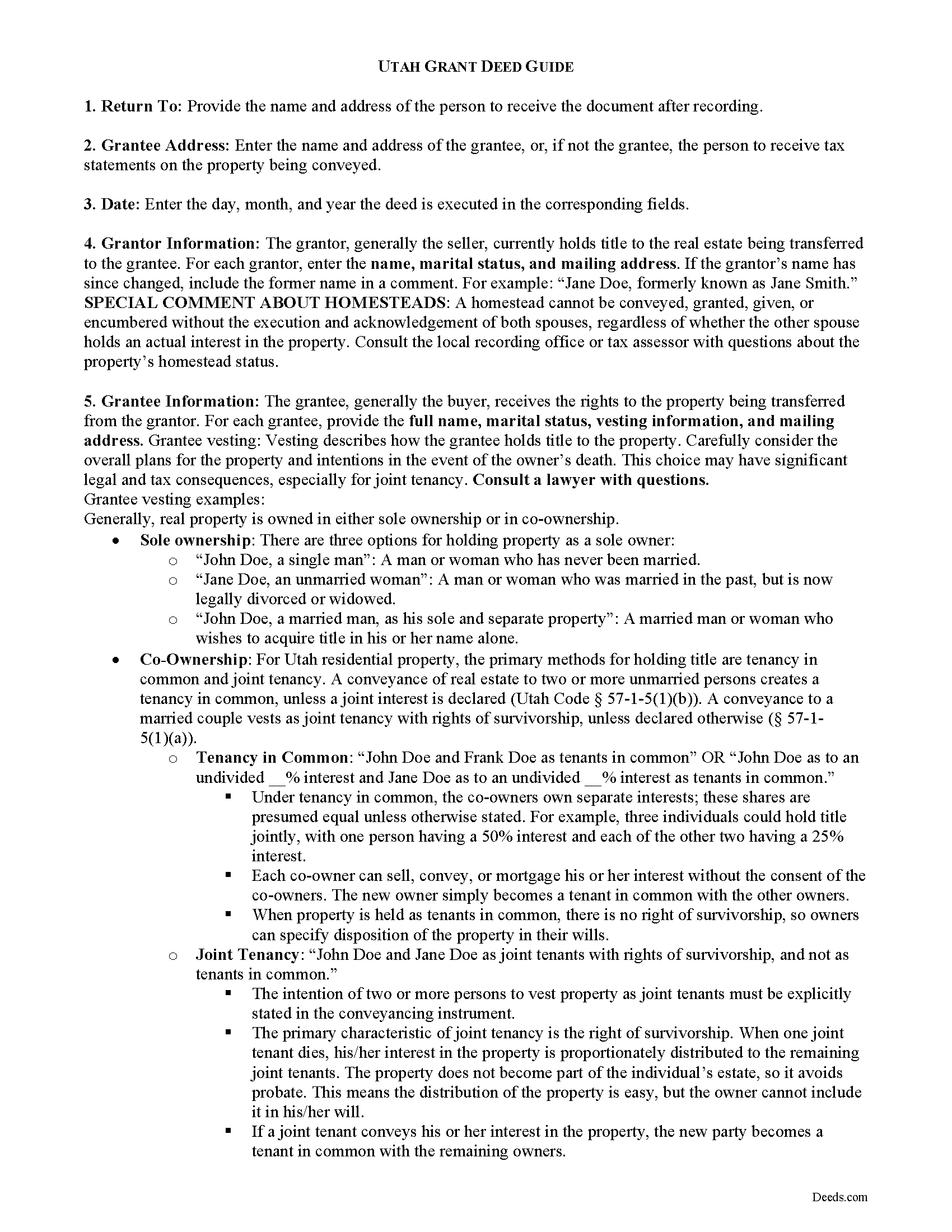

Wayne County Grant Deed Guide

Line by line guide explaining every blank on the form.

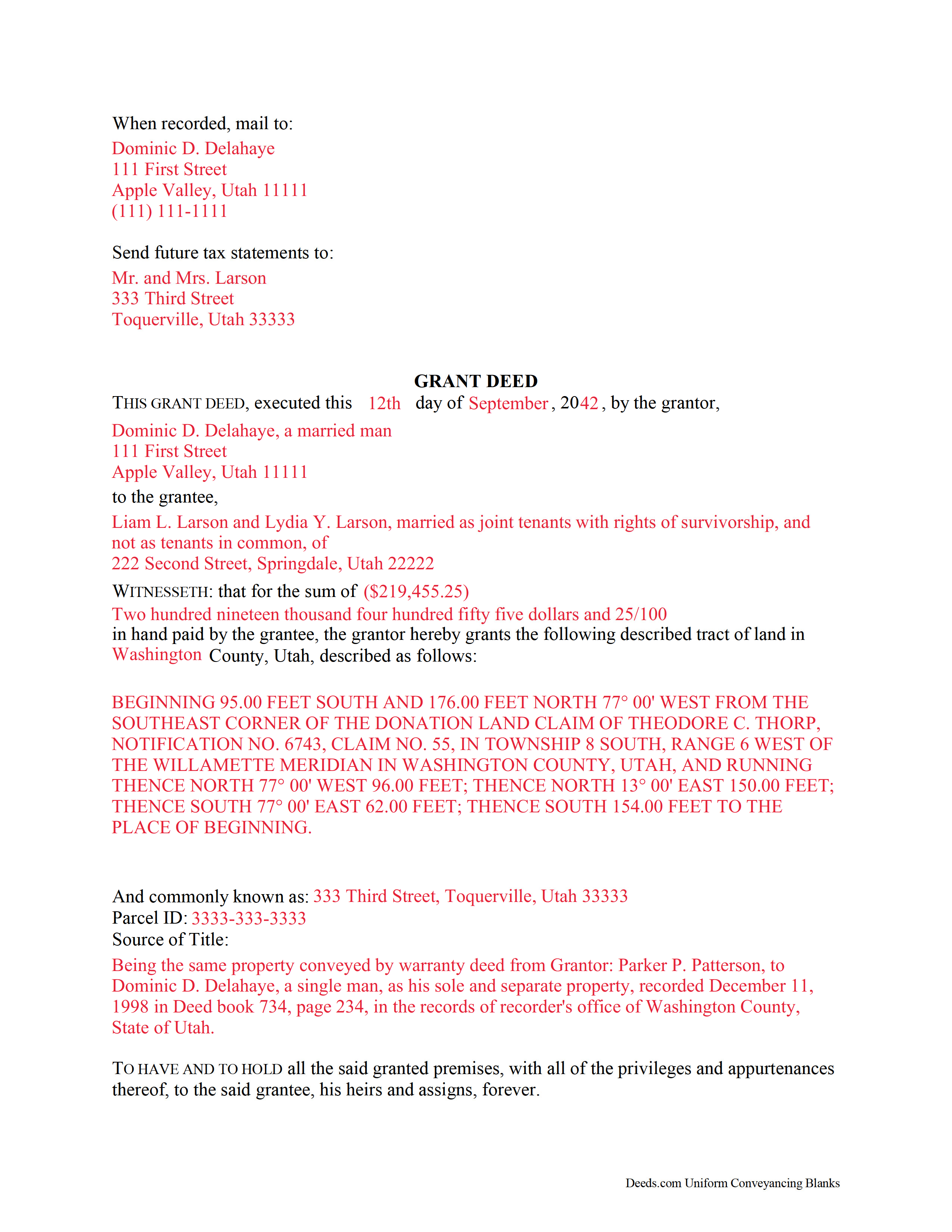

Wayne County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Utah and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Treasurer/Recorder

Loa, Utah 84747

Hours: 9:00 to 5:00 M-F

Phone: (435) 836-1303

Recording Tips for Wayne County:

- White-out or correction fluid may cause rejection

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Bicknell

- Hanksville

- Loa

- Lyman

- Teasdale

- Torrey

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (435) 836-1303 for current fees.

Questions answered? Let's get started!

In Utah, title to real property can be transferred from one party to another by executing a grant deed. Use a grant deed to transfer a fee simple interest with some covenants of title. The word "grant" in the conveyancing clause typically signifies a grant deed, but it is not a statutory form in Utah.

Grant deeds offer more protection for the purchaser (grantee) than quitclaim deeds, but less than warranty deeds. A grant deed differs from a quitclaim deed in that the latter offers no warranty of title, and only conveys any interest that the grantor may have in the subject estate. Grant deeds guarantee through implied covenants that the title is free of any encumbrances (except for those stated in the deed) and that the grantor holds an interest in the property and is free to convey it. A warranty deed offers more surety than a grant deed because it requires the grantor to defend against claims to the title.

A lawful grant deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Utah residential property, the primary methods for holding title are tenancy in common and joint tenancy. A conveyance of real estate to two or more unmarried persons creates a tenancy in common, unless a joint interest is declared (Utah Code 57-1-5(1)(b)). A conveyance to a married couple vests as joint tenancy with rights of survivorship, unless declared otherwise (57-1-5(1)(a)).

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel (57-3-105). Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. The completed deed must be acknowledged by the grantor (and his or her spouse, if applicable) in the presence of a notary. Finally, it must meet all state and local standards for recorded documents.

Record the original completed deed, along with any additional materials, at the recorder's office in the county where the property is located. Contact the same office to verify recording fees and accepted forms of payment.

A water rights addendum under 57-3-109 is required for all applicable deeds. Applicable deeds include any conveyance in fee simple of title to land or any conveyance of water rights. This form must be completed and signed by the grantor and joined by the grantee to acknowledge receipt.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Utah lawyer with any questions related to the transfer of real property.

(Utah Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4637 Reviews )

lee s.

March 21st, 2019

Over all quality of document was good. The issue I had was where it states claimant did not have a contract with the owner or their agent. I did have a contract with their agent, and there was no option for both. So had improvise.

Thank you for your feedback. We really appreciate it. Have a great day!

Matthew T.

September 9th, 2020

I am a litigator based in Lee County that rarely needs to record deeds or mortgages. However, at times, the settlement or resolution of a dispute results in the conveyance of real property. I ended up in a situation where a deed to real property in Bradford County needed to be recorded on behalf of a client. My usual e-recording vendor does not include that County. Registering with Bradford County's regular e-recording vendor would have required an expensive and unnecessary annual fee. Deeds.com was easy to use, inexpensive and fast. I highly encourage its use, especially for lawyers that occasionally need to record instruments but do not do so regularly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heather T.

January 21st, 2022

Thank you for making this so easy

Thank you!

Deborah C.

February 1st, 2019

I would recommend these forms to others.

Thank you!

Claire W.

March 24th, 2022

The price is right, and very simple to follow

Thank you!

James L.

February 15th, 2022

The process to obtain online forms was simple and straight forward and uncomplicated.

Thank you for your feedback. We really appreciate it. Have a great day!

John H.

September 16th, 2022

Response was timely, even though unsuccessful in locating a requested deed. Deeds very courteously and professionally cancelled my order and cancelled its charge to my credit card.

Thank you for your feedback. We really appreciate it. Have a great day!

matt k.

March 16th, 2022

you guys/girls are the bestest..

Thank you!

Roger W.

June 11th, 2023

Documents were provided quickly and as promised. Very Satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

Ryan J.

September 5th, 2024

This was an excellent experience. The jurisdiction I was registering the Deed with, entrusts Deeds.com with their filing needs. And the staff held my hand through the process, and worked to submit the best package, and the Deed was successfully recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Meredith B.

January 5th, 2021

Clean and easy process. Super attentive and helpful.

Thank you!

Jena S.

April 7th, 2020

I love how quick the turnaround is, my only request would be for an email notification be sent once an invoice is ready and then once a document is recorded and ready to download (only because I have a large caseload and it's very easy to forget things sometimes).

Thank you!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Shari W.

July 30th, 2020

Fast and easy. Great service. Thanks.

Thank you!

MARILEE S.

June 24th, 2019

A very easy website....consumer friendly, which is what is so important to me. I will be using your service again. Thank you

Thank you!