Wise County Personal Representative Deed Form

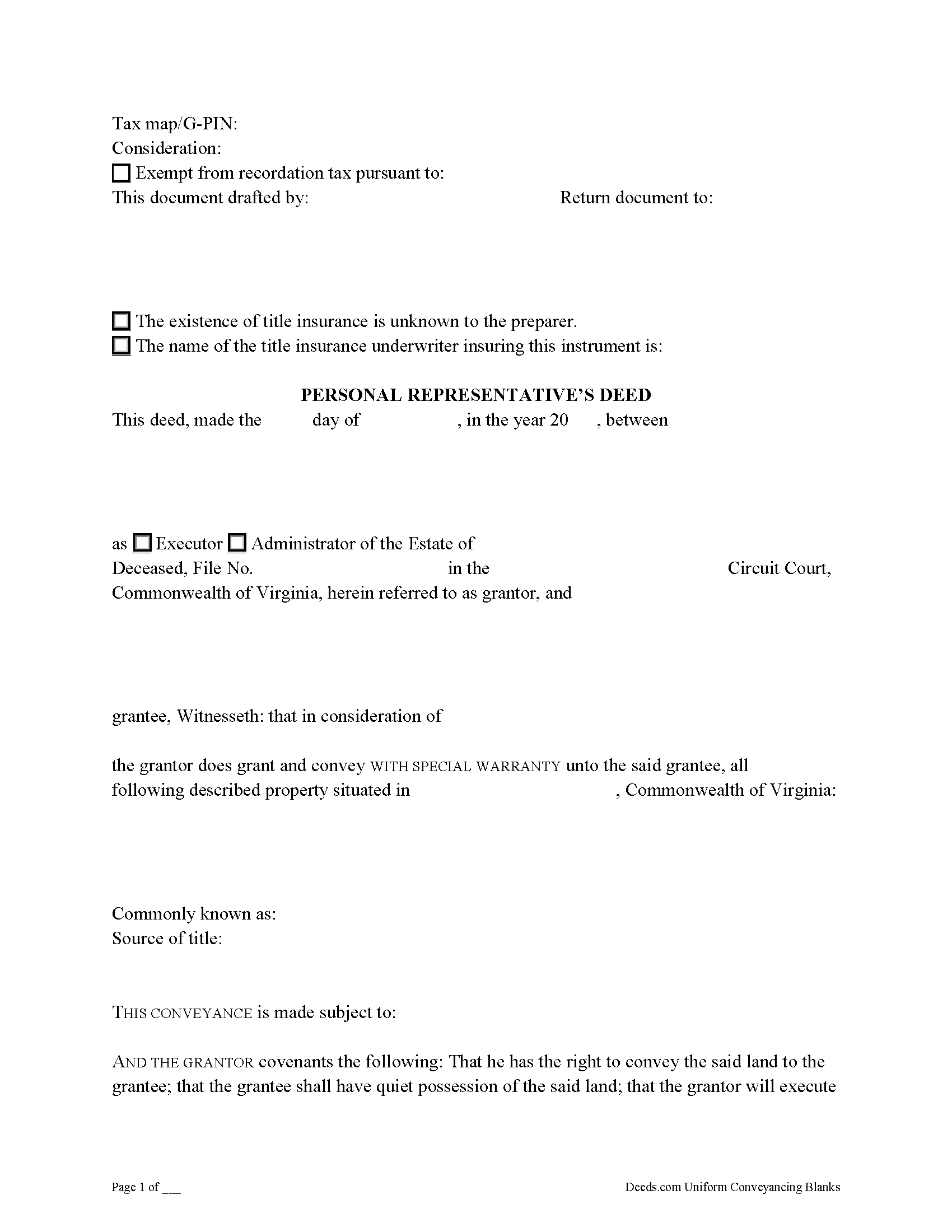

Wise County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

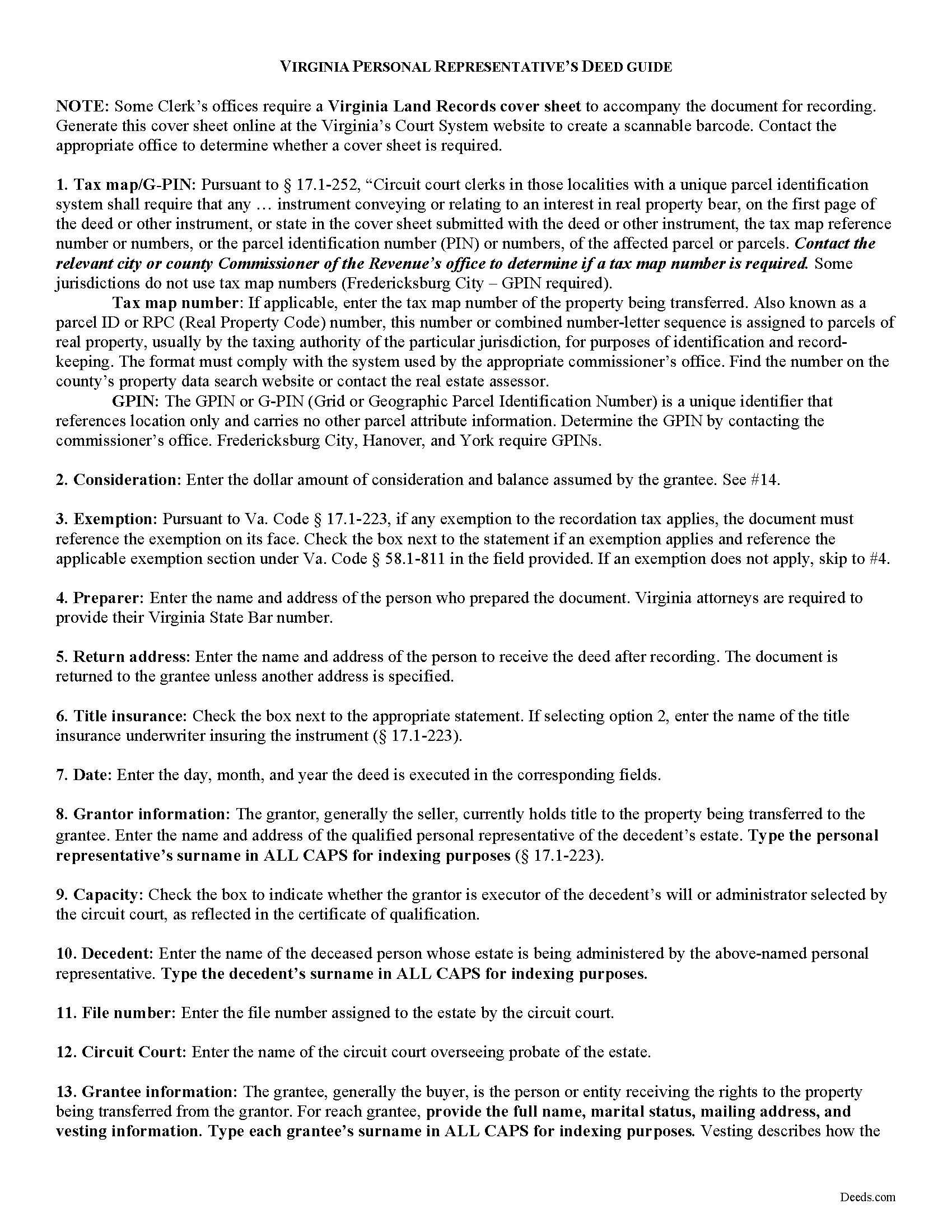

Wise County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

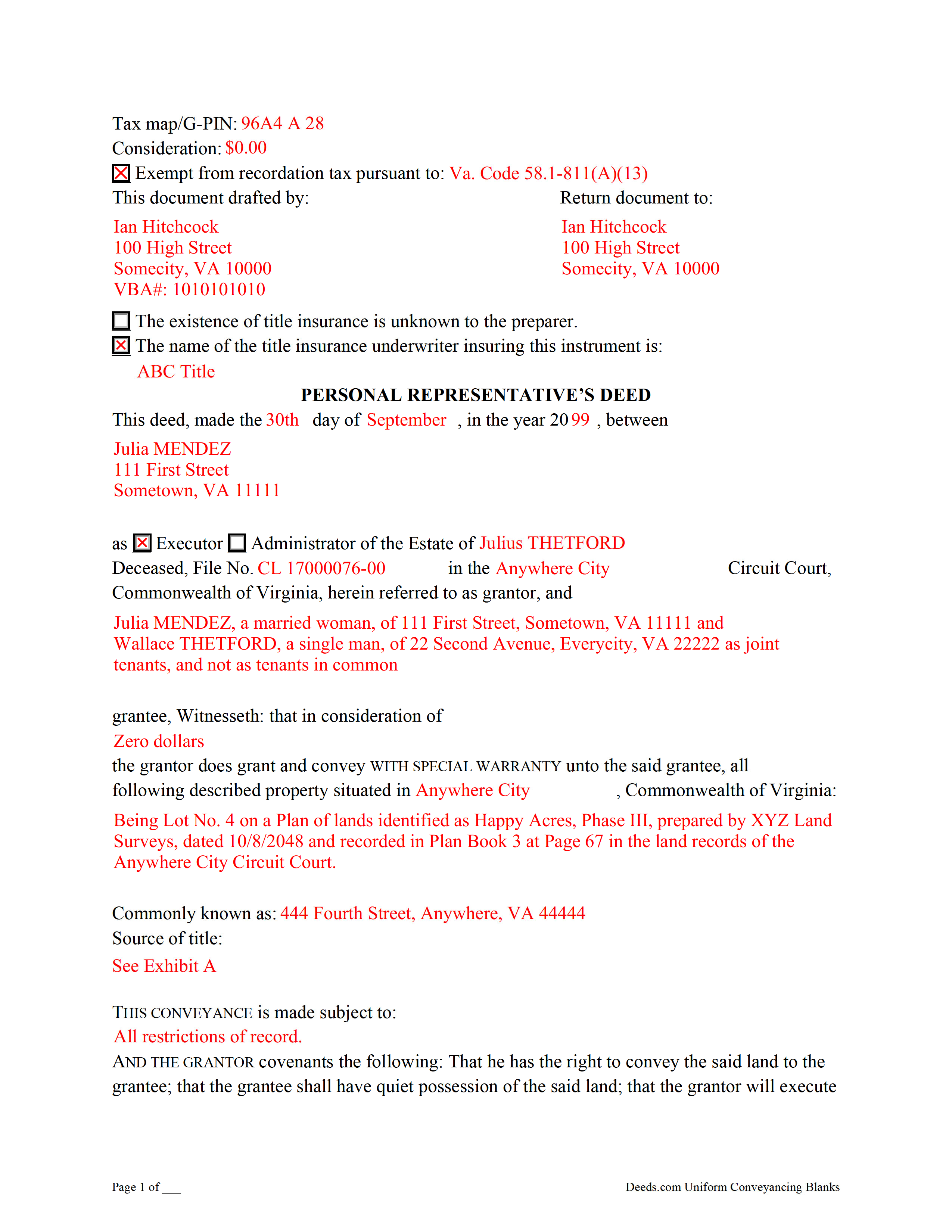

Wise County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Wise County documents included at no extra charge:

Where to Record Your Documents

Wise Clerk of Circuit Court

Wise, Virginia 24293-1248

Hours: 8:30 to 4:30 M-F

Phone: (276) 328-6111

Recording Tips for Wise County:

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Have the property address and parcel number ready

Cities and Jurisdictions in Wise County

Properties in any of these areas use Wise County forms:

- Andover

- Appalachia

- Big Stone Gap

- Coeburn

- East Stone Gap

- Pound

- Saint Paul

- Wise

Hours, fees, requirements, and more for Wise County

How do I get my forms?

Forms are available for immediate download after payment. The Wise County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wise County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wise County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wise County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wise County?

Recording fees in Wise County vary. Contact the recorder's office at (276) 328-6111 for current fees.

Questions answered? Let's get started!

Probate is the legal process of settling a decedent's estate and distributing his property to devisees according to the provisions of a will or to heirs at law. A personal representative is the fiduciary confirmed by the court to administer the estate. When the decedent dies with a will, this person is called the executor. When the decedent dies without a valid will (intestate), this person is called the administrator.

A decedent's real estate passes to the beneficiaries named in his will as part of the probate process, subject to the executor's power of sale, if such power is included in the will. Intestate property passes pursuant to the course of descents established at 64.2-200, first to surviving spouse, then to decedent's children. It does not come under control of the administrator unless specified by court order.

When the decedent's will specifically directs the sale of real estate, the personal representative (either executor or administrator with the will annexed) may sell and convey the property (64.2-521). A testator (will maker) may incorporate fiduciary powers into his will, including the power to sell, transfer, and convey real property and execute and deliver conveyances of real property "in such form and with warranties and covenants as the fiduciary deems expedient and proper" (64.2-105(B)(3)). However, a power of sale is not the same as a directive to sell. To sell real estate, the personal representative must obtain an order granting the power of sale, unless the will directs otherwise.

Pursuant to a directive of the decedent's will or an order of the Circuit Court, use a personal representative's deed to transfer title to a purchaser/grantee with limited warranty of title. A personal representative's deed in the Commonwealth of Virginia is functionally equivalent to a special warranty deed. In Virginia, special warranty deeds also contain covenants of right to convey, quiet enjoyment, further assurances, and that the grantor has done no act to encumber, though these covenants are not implied (55-71 through 55-74). The grantor of a special warranty deed does not covenant that he is seized of the property, and he makes no warranty against encumbrances.

A personal representative deed identifies the fiduciary/grantor by name and capacity. It recites the decedent's name and file number assigned to the estate, as well as the court overseeing probate. The grantee's name, address, and vesting information and the derivation of title must appear on the face of the document to establish clear and marketable title. State the consideration the grantee is paying for the transfer of title. As with all document pertaining to an interest in real property, personal representative's deeds require a legal description of the subject parcel.

The fiduciary/grantor should also reference his source of authority to sell the property. To properly transfer title to the grantee/purchaser, the personal representative signs the deed in the presence of an authorized officer (Clerk, Deputy Clerk, or Notary Public) before recording in the city or county Circuit Court Clerk's office where the parcel is situated. State and local recording fees apply, unless the document notes a valid exemption. Use the Circuit Court deed calculation tool on Virginia's Court System website to determine recording fees. Verify accepted payment methods with the appropriate office.

Deeds must meet standards of form and content for recorded documents. Most county requirements coincide with the Library of Virginia's Standards for Recorded Instruments. Check with the Circuit Court Clerk's office to verify local rules and cover sheet requirements (17.1-227.1).

Consult a lawyer with questions about personal representative's deeds, or for any other issues related to decedent's real property in Virginia.

(Virginia PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Wise County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Wise County.

Our Promise

The documents you receive here will meet, or exceed, the Wise County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wise County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Helen M.

June 10th, 2019

I was quite pleased with Deeds.com. I got the information I requested instantly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Heidi G.

August 19th, 2020

Very happy with the service that you offer. My office will use you again.

Great to hear Heidi, glad we could help. Have an amazing day!

SHERRILL B.

October 10th, 2024

I received prompt attention to the package I submitted. It was submitted promptly the recorders office with a quick turn around for the recorded document. Overall a very pleasant experience.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Larry P.

June 27th, 2023

Easy to follow step by step in completing form. Filing successful on first try. Economical cost. Would highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chris H.

December 8th, 2020

Fast and Easy. Did not have to leave my office to get this done.

Thank you!

Katherine N.

May 22nd, 2019

Very easy to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carlene J.

August 12th, 2021

Great way to do business with Dc Government! I submitted my documents and received everything back and approved on the same day! No wait , no line! Lol

Thank you for your feedback. We really appreciate it. Have a great day!

DAVID K.

April 5th, 2019

Good so far could use more examples for each section of info. needed. ex. (parcel and alt.ID info where to find and etc. #2 more examples. If it was not for the red print examples helping to fill the form out I could have downloaded free forms, the examples are what made me choose your form !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LeRoy E.

June 20th, 2022

So thankful I found this. I was feeling stressed out and reluctant about doing this on my own.

Thank you!

leslie w.

June 23rd, 2020

Easy to use! Thanks for saving the time and expense of an attorney!

Thank you for your feedback. We really appreciate it. Have a great day!

George W.

February 26th, 2021

Phenomenal service! If only every request and transaction with other companies could be this seamless and efficient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rhonda P.

February 23rd, 2021

Very quick and easy! Didn't even have to leave the house and I didn't have to send via USPS which is nice since we are in a pandemic. The convenience of this site is worth the extra money. Would definitely use this site again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!