Caroline County Unconditional Lien Waiver on Final Payment Form

Caroline County Unconditional Lien Waiver on Final Payment Form

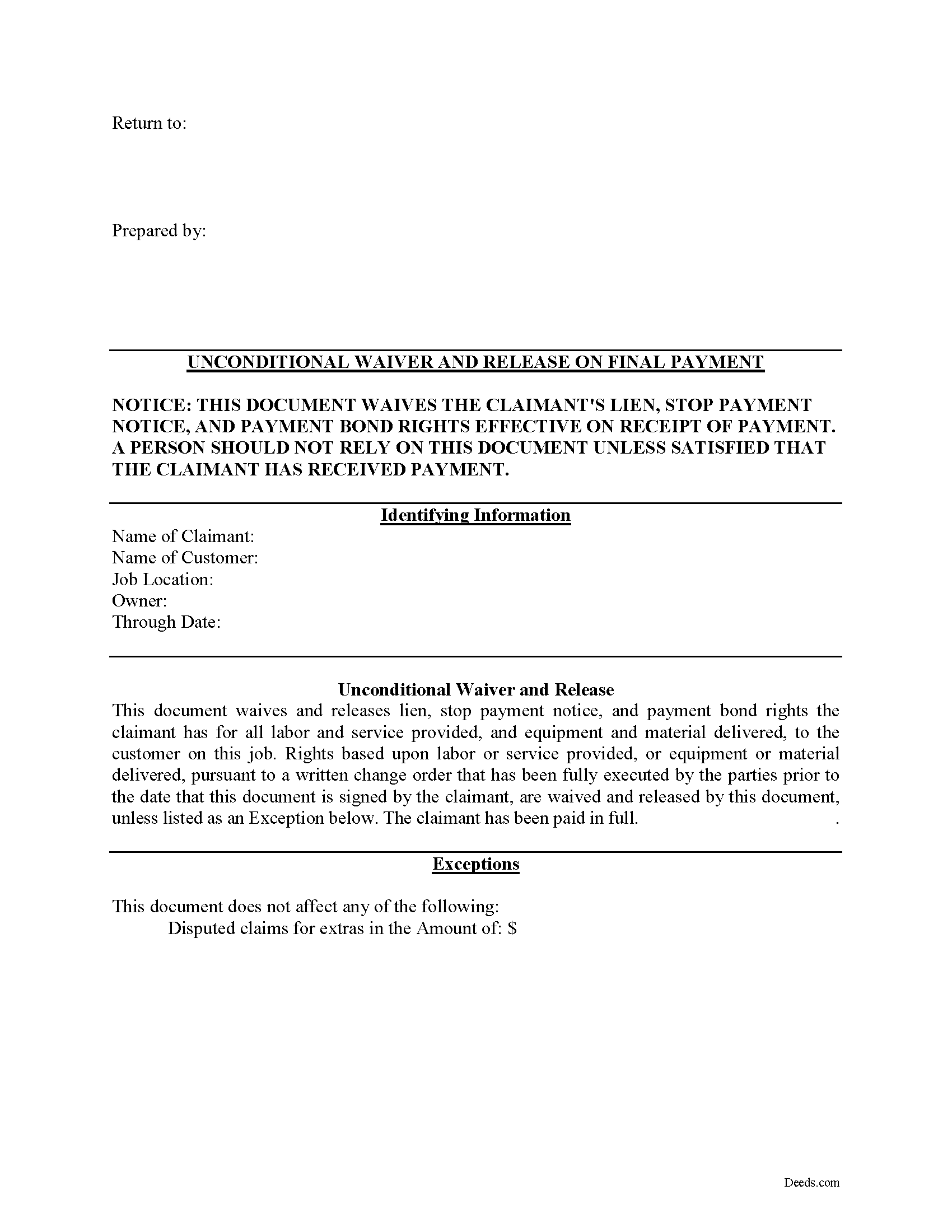

Fill in the blank Unconditional Lien Waiver on Final Payment form formatted to comply with all Virginia recording and content requirements.

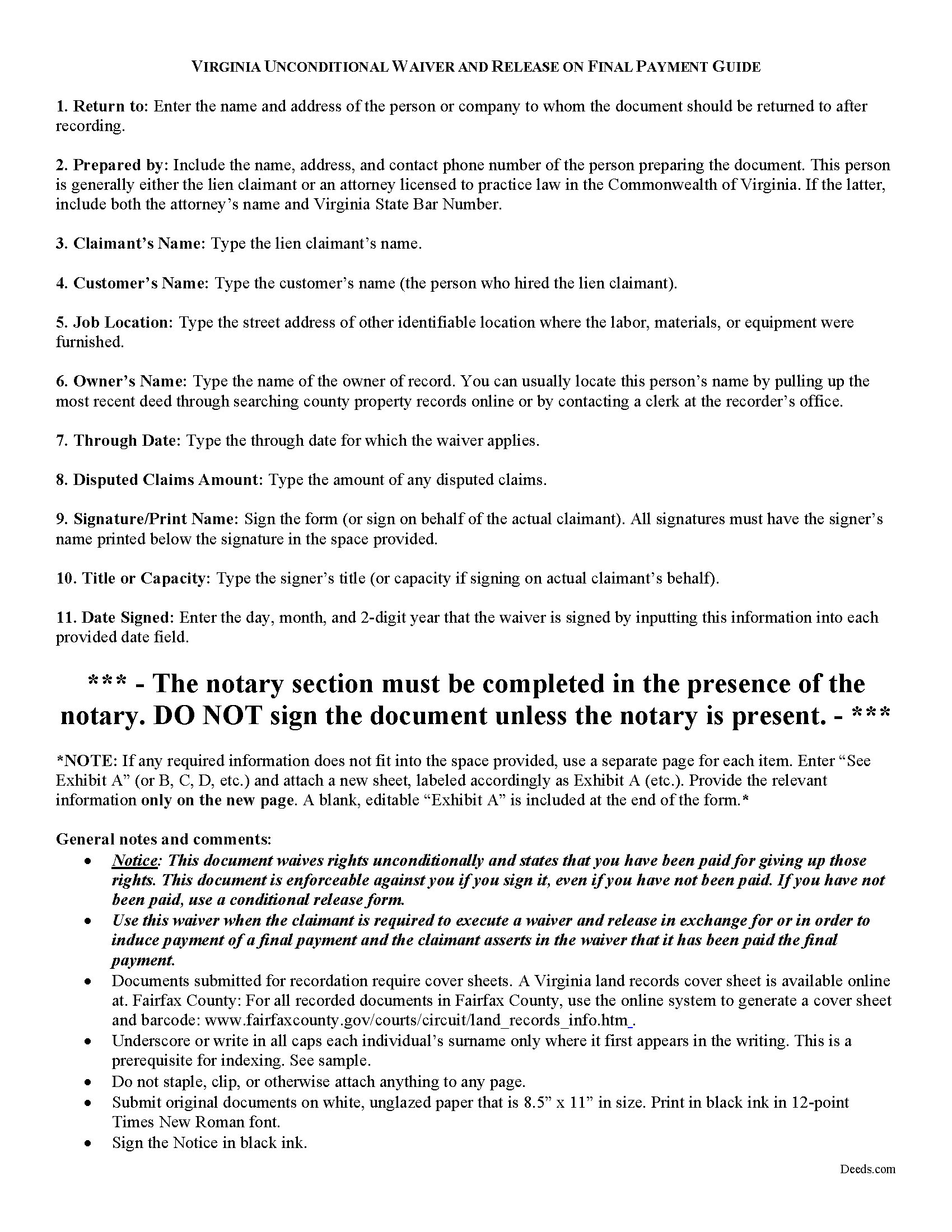

Caroline County Unconditional Lien Waiver on Final Payment Guide

Line by line guide explaining every blank on the form.

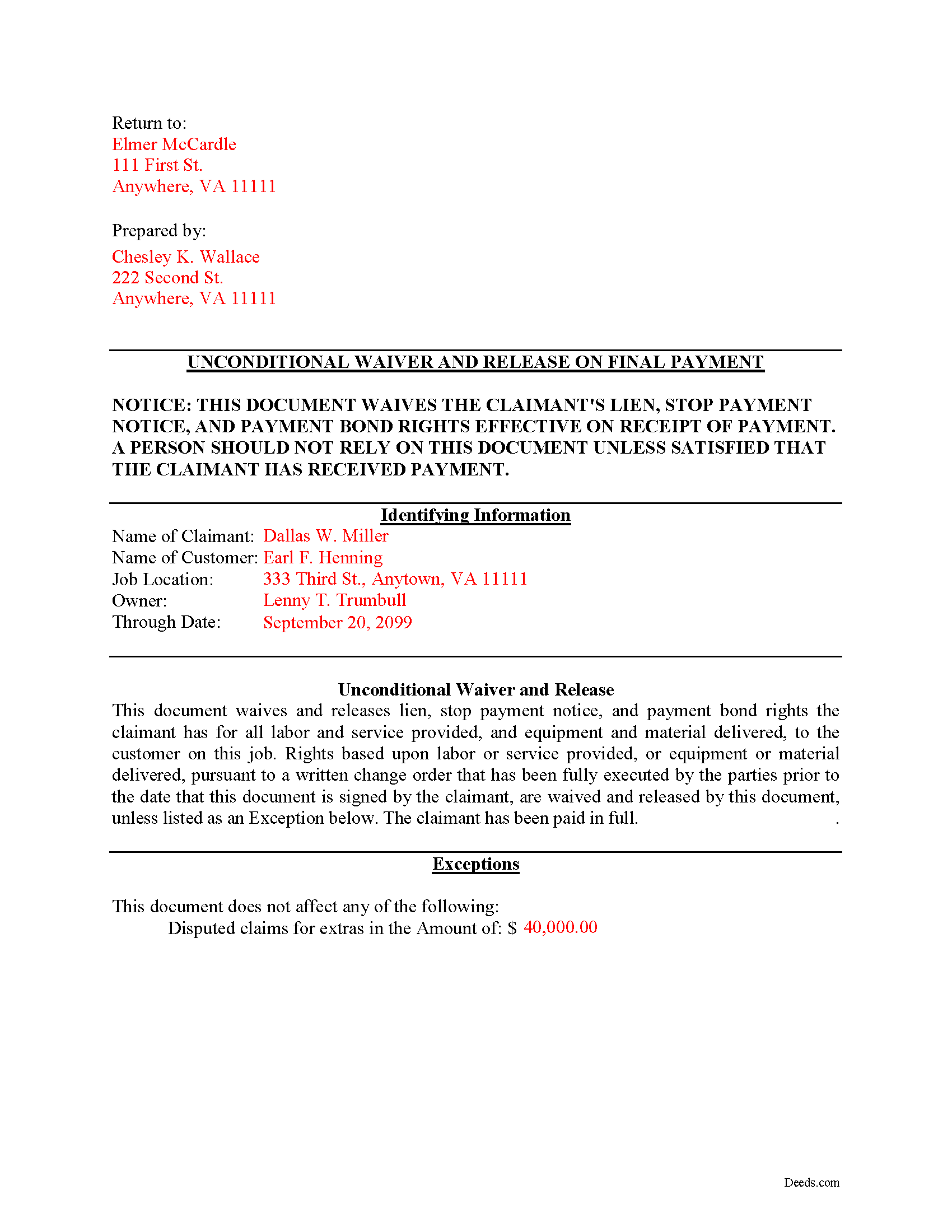

Caroline County Completed Example of the Unconditional Lien Waiver on Final Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Virginia and Caroline County documents included at no extra charge:

Where to Record Your Documents

Clerk of Circuit Court

Bowling Green, Virginia 22427-0309

Hours: Monday - Friday 8:30 to 4:00 / Recording until 3:30

Phone: (804) 633-1090, 633-1092, or 633-1184

Recording Tips for Caroline County:

- Ask if they accept credit cards - many offices are cash/check only

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Caroline County

Properties in any of these areas use Caroline County forms:

- Bowling Green

- Corbin

- Ladysmith

- Milford

- Port Royal

- Rappahannock Academy

- Ruther Glen

- Sparta

- Woodford

Hours, fees, requirements, and more for Caroline County

How do I get my forms?

Forms are available for immediate download after payment. The Caroline County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Caroline County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Caroline County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Caroline County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Caroline County?

Recording fees in Caroline County vary. Contact the recorder's office at (804) 633-1090, 633-1092, or 633-1184 for current fees.

Questions answered? Let's get started!

Lien waivers are used between contractors and property owners as a quid-pro-quo arrangement to induce payment from an owner in return for the contractor waiving some or all available mechanic's lien rights. If the appropriate waivers are used, they offer advantages for both the contractor and the owner.

In Virginia, any right to file or enforce any mechanics' lien may be waived in whole or in part at any time by any person entitled to such lien, except that a subcontractor, lower-tier subcontractor, or material supplier may not waive or diminish his lien rights in a contract in advance of furnishing any labor, services, or materials. Va. Code 43-3(C). A provision that waives or diminishes a subcontractor's, lower-tier subcontractor's, or material supplier's lien rights in a contract executed prior to providing any labor, services, or materials is null and void. Id.

The Virginia legislature does not mandate a required form of a lien waiver, so common law principles of contract allow for the parties to use any form that clearly spells out their intentions. Note that it is a felony for any person to knowingly present a waiver form to an owner, his agent, contractor, lender, or title company for the purpose of obtaining funds or title insurance if the person forges or signs the form without authority. Va. Code. 43-13.1.

Waivers fall under two broad categories of "conditional" and "unconditional," and there are two subcategories of waivers for a "partial" or "final" payment. Each type comes with benefits and risks, so take care to use the correct form for the situation.

An unconditional waiver becomes effective when presented to the owner or other party, regardless of whether or not the payment is valid. If you unconditionally waive a lien, you can still sue on a breach of contract or other legal theory, but that is no substitute for the protections and ease of a mechanic's lien in recovering any money owed. An unconditional waiver gives an owner more protection while taking away some rights from the contractor.

Only use an unconditional final waiver AFTER receiving the final or full payment.

So, when used properly, waivers can facilitate the flow of business and encourage prompt payment.

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. For any questions about Virginia lien waivers, please speak with a lawyer.

Important: Your property must be located in Caroline County to use these forms. Documents should be recorded at the office below.

This Unconditional Lien Waiver on Final Payment meets all recording requirements specific to Caroline County.

Our Promise

The documents you receive here will meet, or exceed, the Caroline County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Caroline County Unconditional Lien Waiver on Final Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

Austin S.

August 13th, 2020

Everything is done in a timely manner which is very much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Dorothy B.

November 4th, 2020

Love your deed service. Simple and easy.

Thank you!

Charles B.

April 5th, 2020

KVH really went above and beyond to help me try to find what I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen L.

February 1st, 2023

The website was easy to navigate but only needed one form. The guide was helpful also. Cost want high but contains many documents that I didn't need but may someday. Could not save form after completed but printed copies that needed to be court filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darlene D.

June 21st, 2019

A little confusing to try to save your docouments and how to process them but once figured out easy to do.

Thank you!

Viola G.

November 2nd, 2023

no as easy as anticipated but convenient.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Niki G.

January 13th, 2022

Absolutely love the Golden Girls homage in the quit claim deed example. Funny stuff!

Thanks for the feedback Niki. Glad you enjoyed our attempt to spice up the mundane. Have an amazing day.

Roger E.

August 30th, 2019

I have not yet used the product, but am confident that I will like it, because of this prompt request for a product review.

Thank you for your feedback. We really appreciate it. Have a great day!

Richard B.

April 27th, 2023

Excellent! I was able to complete the documents especially using the instructions as a guide. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Scott A.

July 8th, 2020

Good site. Saved me a trip to one or two courthouses.

Thank you for your feedback. We really appreciate it. Have a great day!

Gloria R.

September 12th, 2023

The website was easy.

Thank you!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

RUTH A.

November 8th, 2024

I truly appreciate the service that you have for the customers. This very convenient and easy to follow. Thank you very much for this service.

Thank you for your feedback. We really appreciate it. Have a great day!