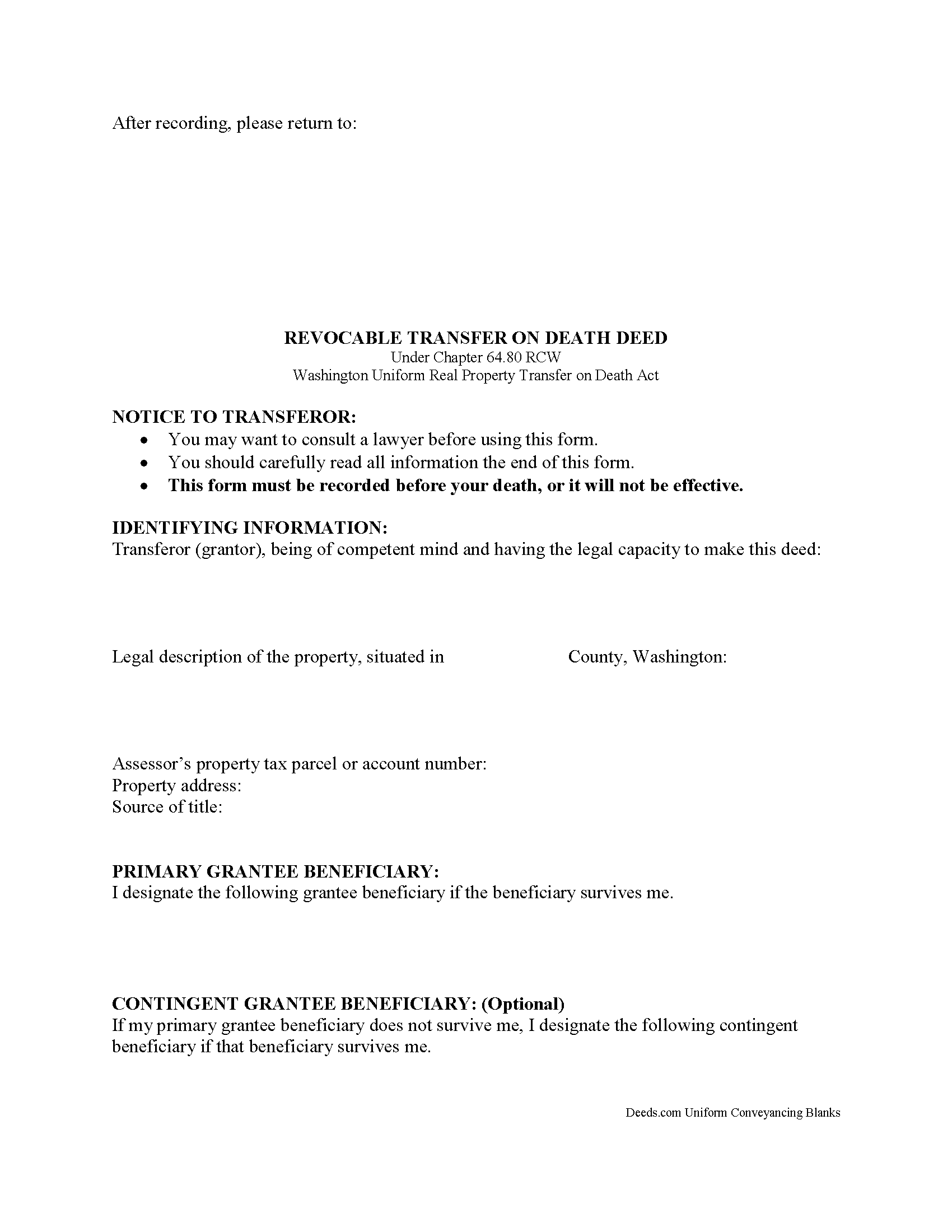

Whitman County Transfer on Death Deed Form

Whitman County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

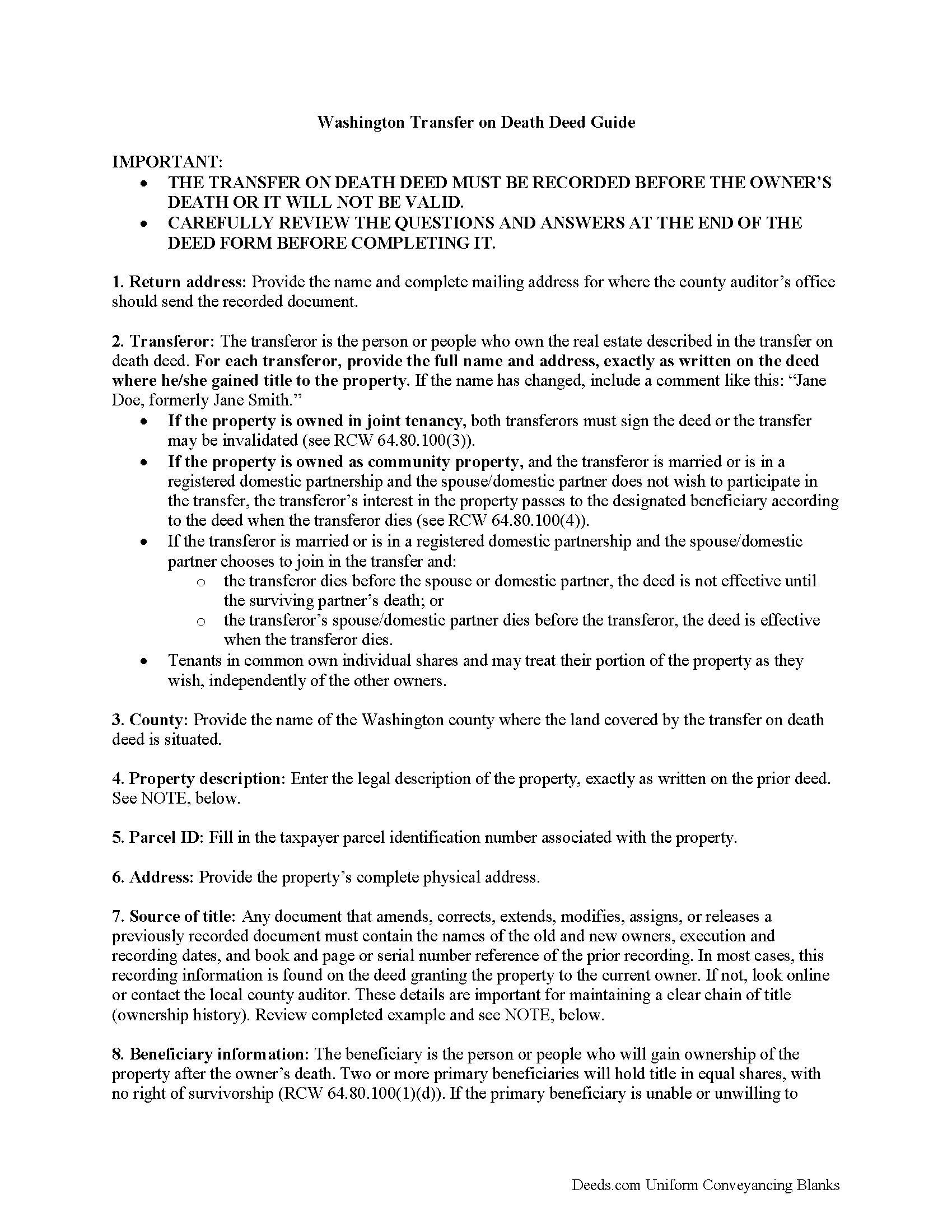

Whitman County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

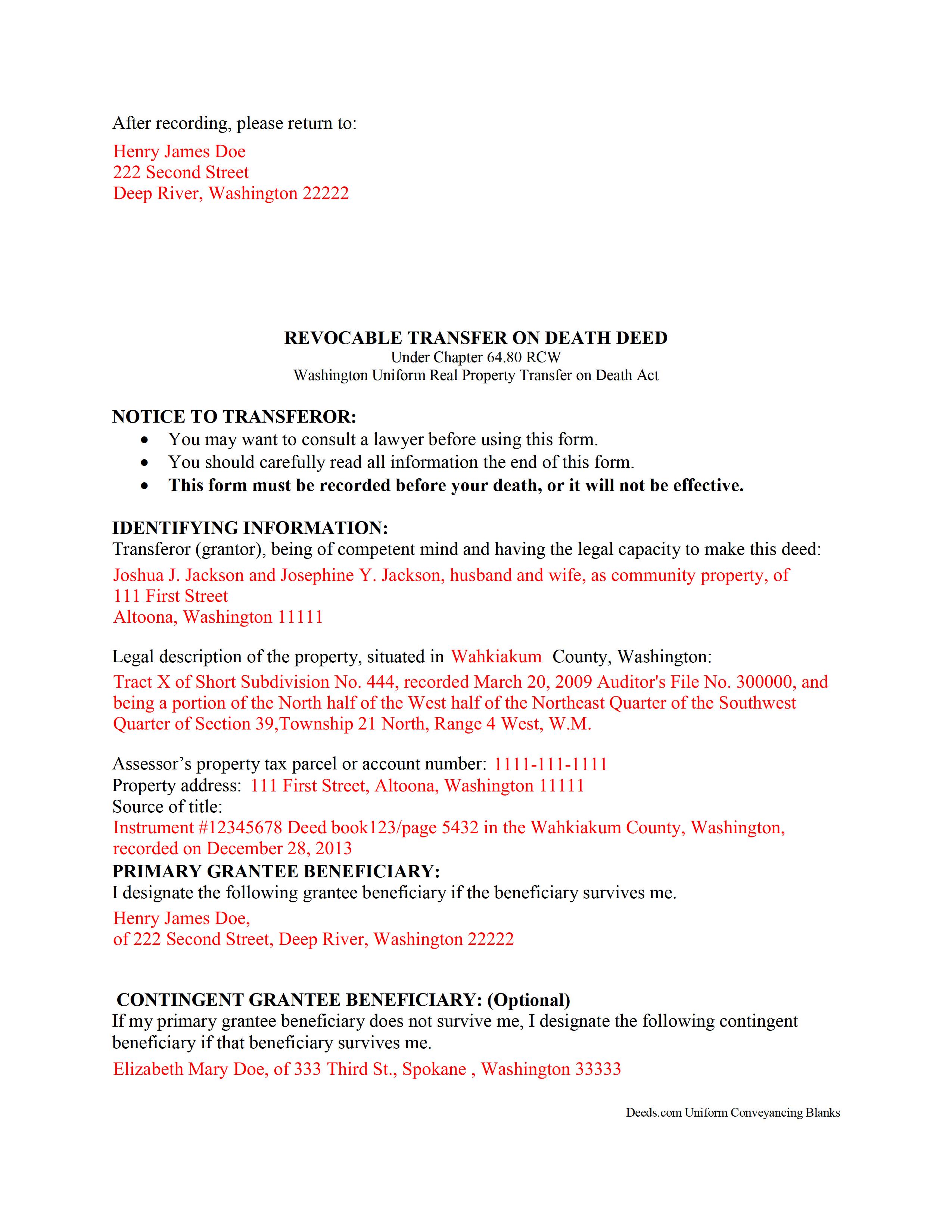

Whitman County Completed Example of the Transfer on Death Deed Document

Example of a properly completed Washington Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Washington and Whitman County documents included at no extra charge:

Where to Record Your Documents

Whitman County Auditor: Recording

Colfax, Washington 99111

Hours: 9:00 to 4:30 M-F / Recording: 9:00 to 2:30 in person, 8:00 to 3:30 electronic

Phone: (509) 397-6270

Recording Tips for Whitman County:

- Request a receipt showing your recording numbers

- Recording fees may differ from what's posted online - verify current rates

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Whitman County

Properties in any of these areas use Whitman County forms:

- Albion

- Belmont

- Colfax

- Colton

- Endicott

- Farmington

- Garfield

- Hay

- Hooper

- Lacrosse

- Lamont

- Malden

- Oakesdale

- Palouse

- Pullman

- Rosalia

- Saint John

- Steptoe

- Tekoa

- Thornton

- Uniontown

Hours, fees, requirements, and more for Whitman County

How do I get my forms?

Forms are available for immediate download after payment. The Whitman County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Whitman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Whitman County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Whitman County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Whitman County?

Recording fees in Whitman County vary. Contact the recorder's office at (509) 397-6270 for current fees.

Questions answered? Let's get started!

Real estate owners in Washington have an estate planning option: the transfer on death deed (TODD). Find the full text in the Revised Statutes of Washington at Chapter 64.80.

This statute is based on the Uniform Real Property Transfer on Death Act (URPTODA). Along with Washington, a growing number of states are choosing to adopt the provisions of the URPTODA. The new law allows landowners to direct the distribution of what is often their most significant asset, their real estate, with a correctly executed and recorded transfer on death deed.

Transfer on death deeds are nontestamentary, which means ownership of the property passes to the beneficiary without instructions in a will or the need for probate (64.80.040). Unnecessary conflicts are likely to add confusion and expense, so best practices dictate that landholders should take care to ensure that their wills and TODDs lead to the same outcomes.

Washington's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

- The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (64.80.050, 11.12.010).

- It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (64.80.060(1))

- It must state that the transfer to the designated beneficiary is to occur at the transferor's death (64.80.060(2))

- It must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (64.80.060(3)).

The named beneficiary gains no present rights to the property, only a potential future interest. Instead, the transferors retain absolute control during their lives. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (64.80.090). These details, along with the fact that TODDs only convey the property rights remaining, if any, at the owner's death, explain why they do not require notice or consideration (64.80.070).

According to 64.80.100(1)(a), the beneficiary gains equitable interest in the property ONLY when the owner dies. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate (64.80.100(1)(b)). To prevent this from happening, the owner may identify one or more contingent beneficiaries. All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (according to 64.80.100(2)).

With the new transfer on death deeds, real property owners in Washington have access to a convenient, flexible tool for managing one aspect of a comprehensive estate plan. Even so, a TODD may not be appropriate for everyone. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

(Washington TODD Package includes form, guidelines, and completed example)

Important: Your property must be located in Whitman County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Whitman County.

Our Promise

The documents you receive here will meet, or exceed, the Whitman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Whitman County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4579 Reviews )

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Shirley W.

August 26th, 2021

I found the form easy to file out. But everything else was confusing with very little direction and help.

Thank you!

Donald H.

April 17th, 2020

Easy to use and very quick turn around ... Very satisfied with ease of use and services provided ...

Thank you for your feedback. We really appreciate it. Have a great day!

Mary S.

March 25th, 2022

Really, really great. Instructions are so helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas M.

August 24th, 2021

Great Service. I had to record 13 deeds in various Oregon counties, with o previous experience, and the process was straightforward with excellent instruction. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

March 20th, 2019

Very timely service and retrieved information I was looking for

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hanna M.

June 10th, 2019

Very helpful information! Thank you for your service!

Thank you!

JENNIE W.

November 3rd, 2020

This is so much easier than going downtown to file paperwork! Thanks deeds.com!

Thank you!

DIANA S.

August 19th, 2019

Five star rating. I requested a copy of the deed to my house and it arrived very quickly and for a fraction of the cost that it would have cost me on other sites. Great company. Will do business again. Five stars.

Thank you!

Ginger O.

March 27th, 2019

Thank you for making this so easy to use. I had looked all over the internet and yours was the most user friendly and for a reasonable price.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine H.

March 30th, 2023

extremely thorough by covering all bases, easy to understand, direct access, fair price with no strings attached. I recommend the service to everyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia N.

May 7th, 2025

Wonderful fast service, quick thoughtful responses on chat! Files download easily too, great pruces

We are delighted to have been of service. Thank you for the positive review!

Ernest S.

July 30th, 2019

Took it to the Courthouse and the Register of Deeds said,"well Done" Thanks you so much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer A.

May 20th, 2020

Great site

Thank you!