Marshall County Deed of Trust and Promissory Note Form

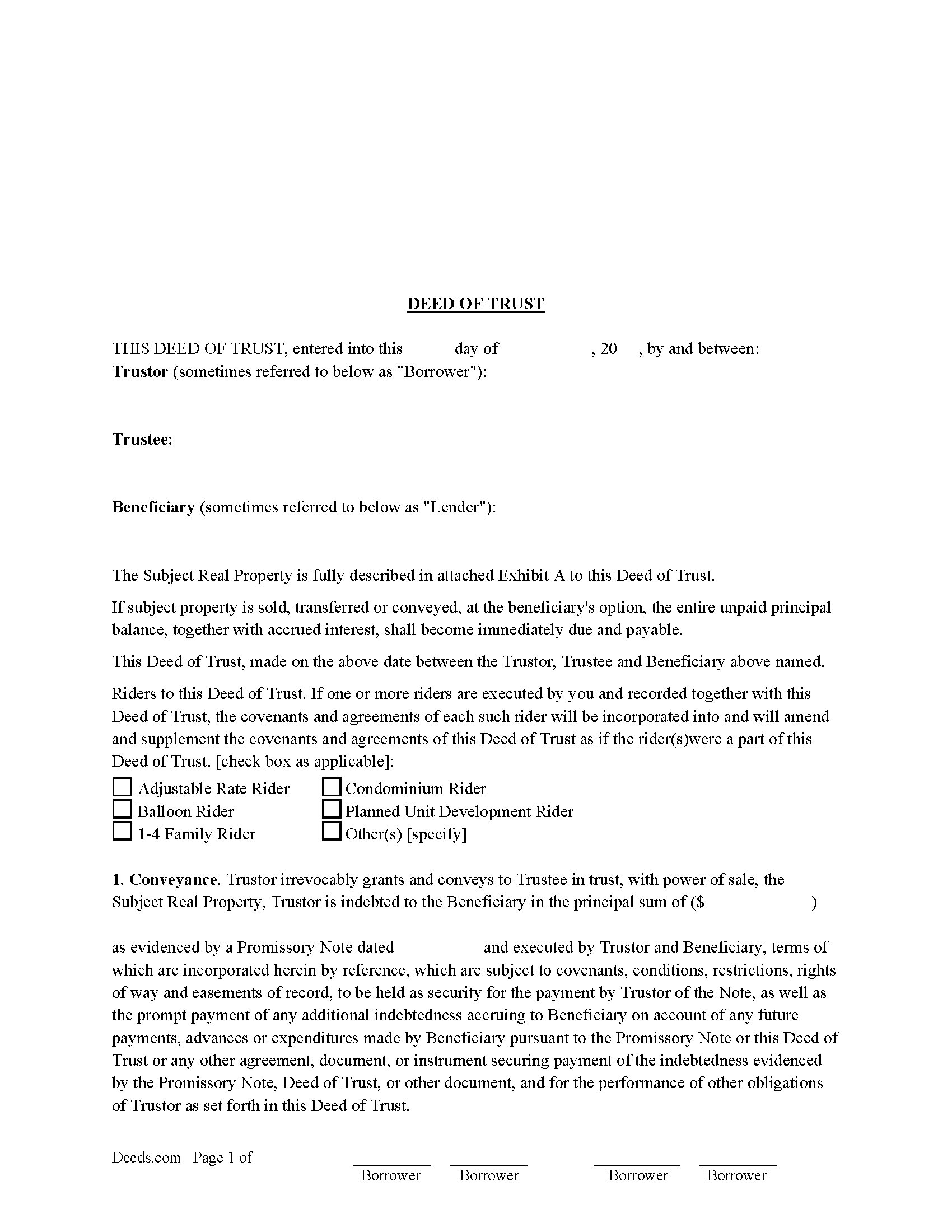

Marshall County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

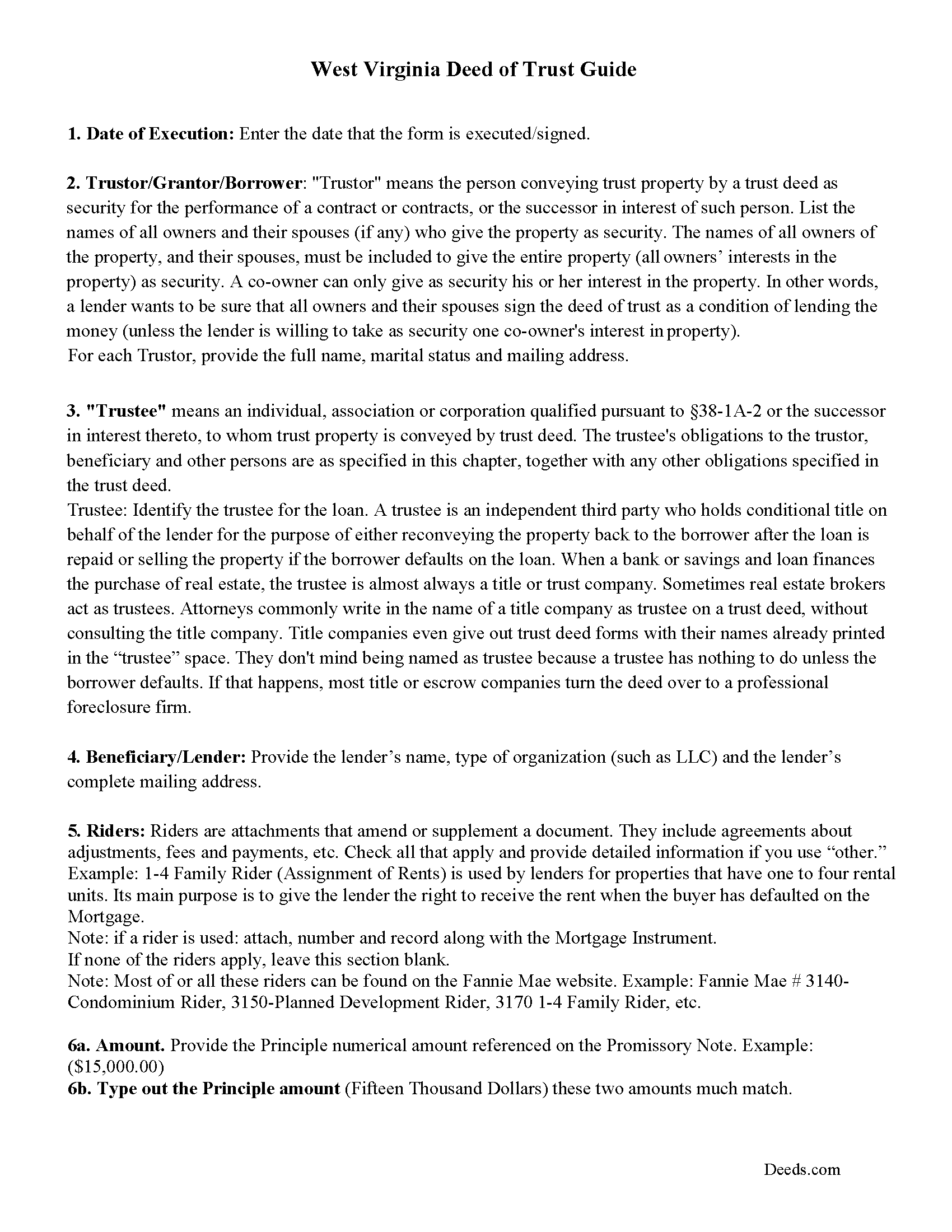

Marshall County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

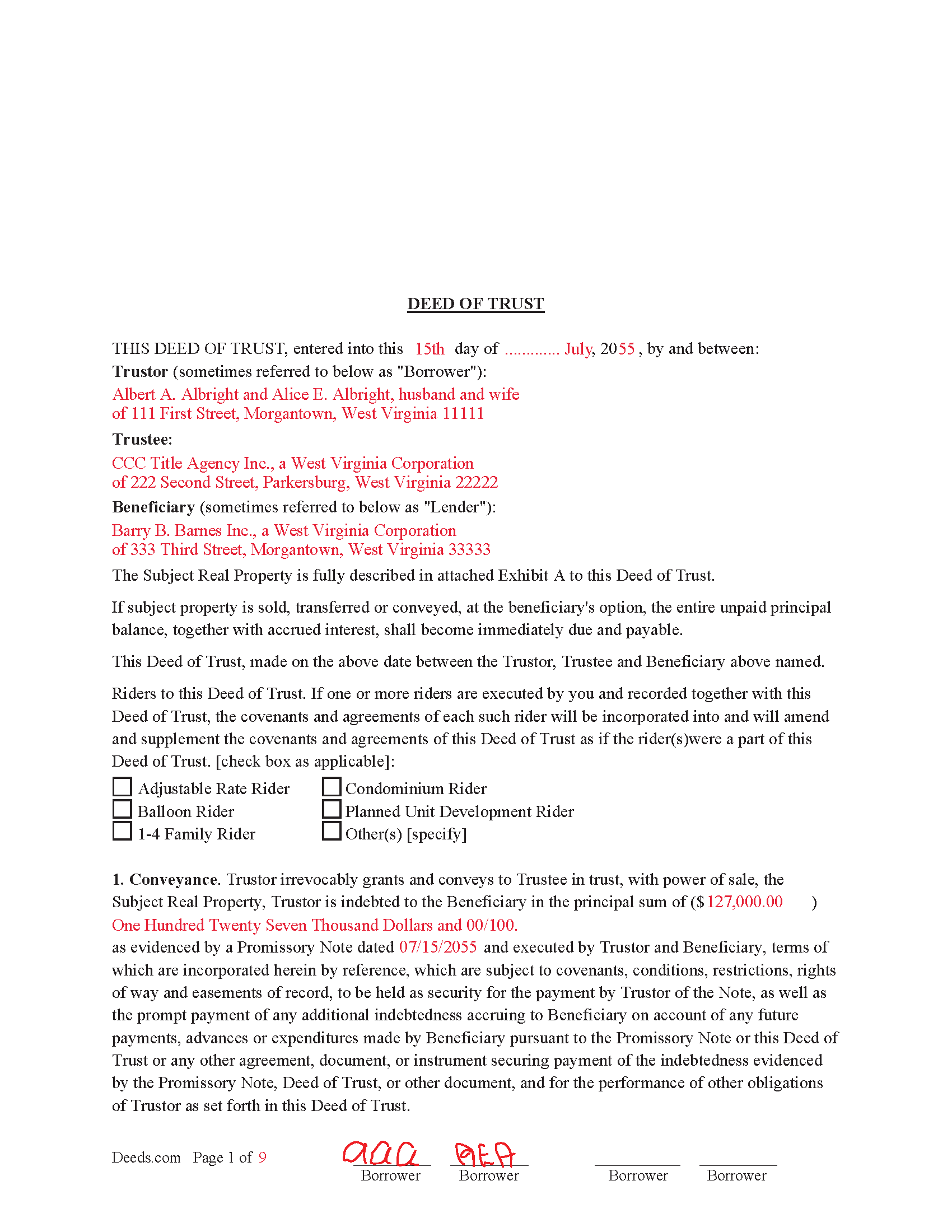

Marshall County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

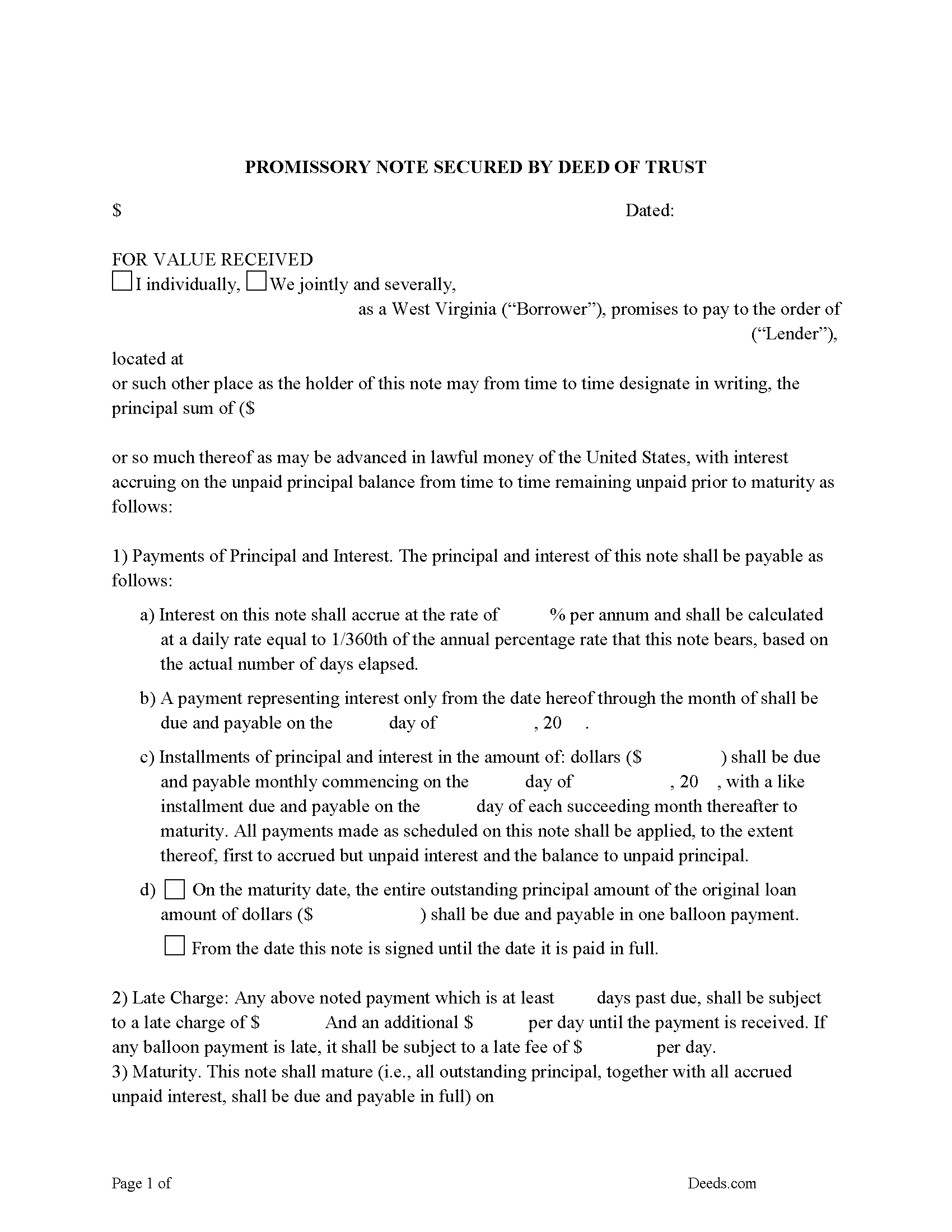

Marshall County Promissory Note Form

Note that is secured by the Deed of Trust.

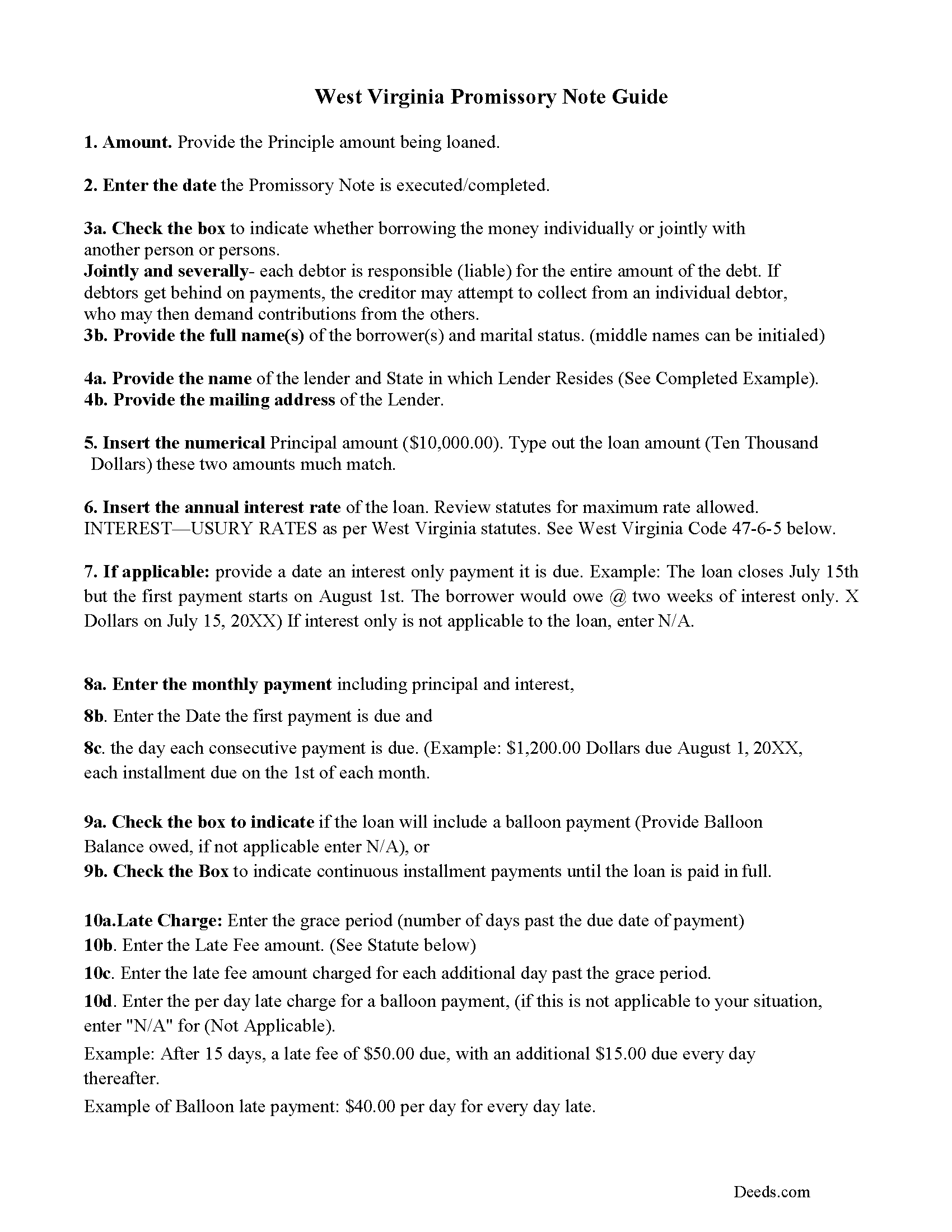

Marshall County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

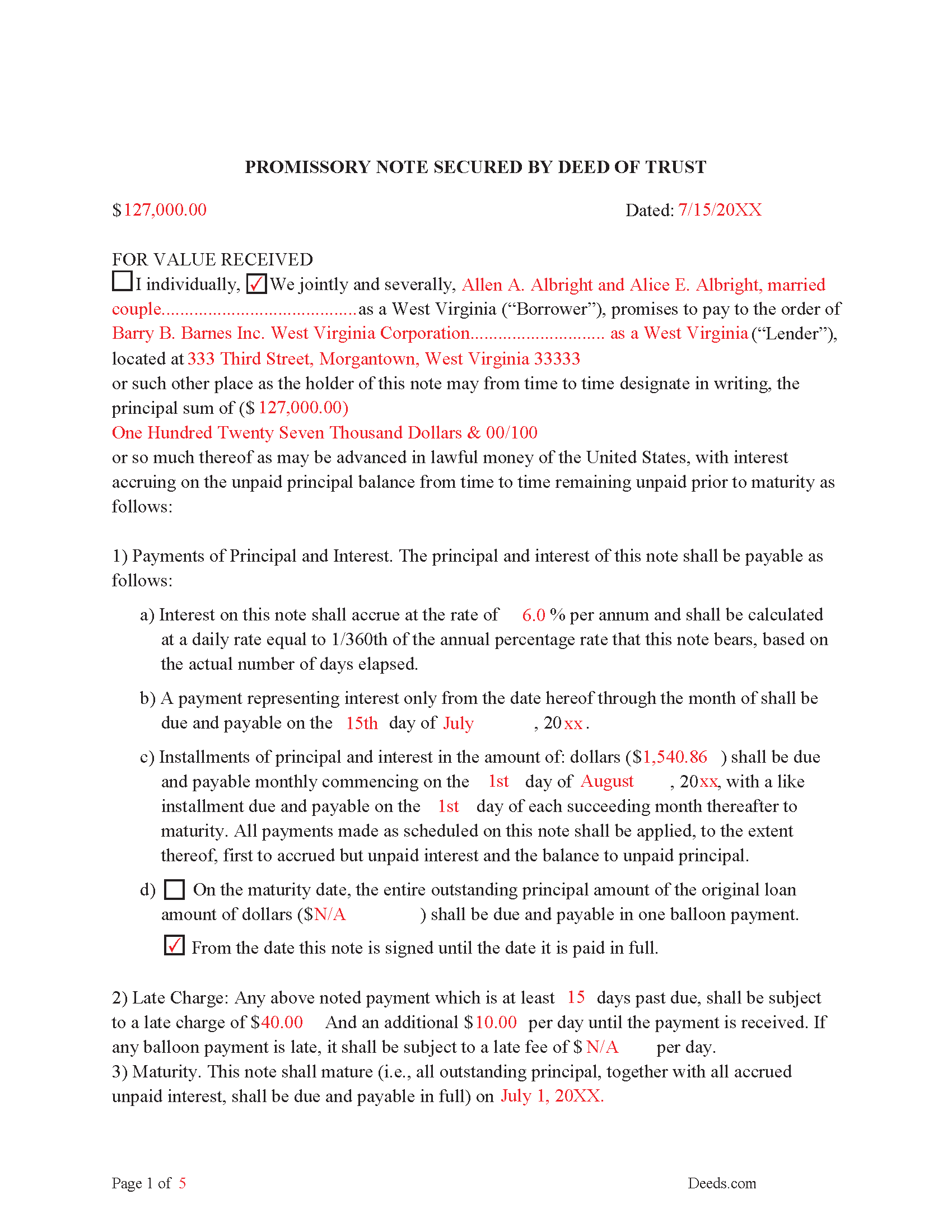

Marshall County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

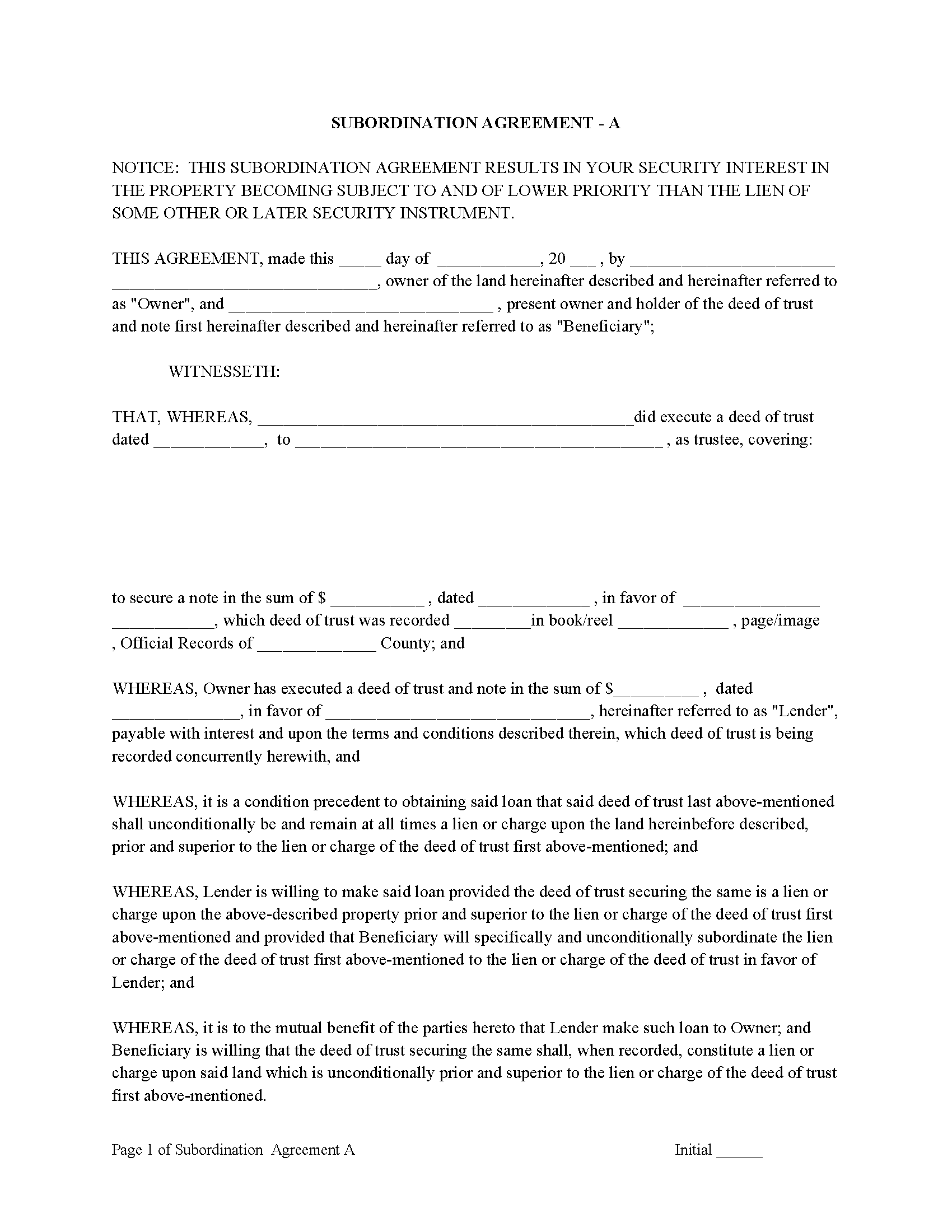

Marshall County Subordination Agreements

Used to place priority on claim of debt. Included are 4 clauses for unique situations. If needed, add to Deed of Trust as an addendum or rider.

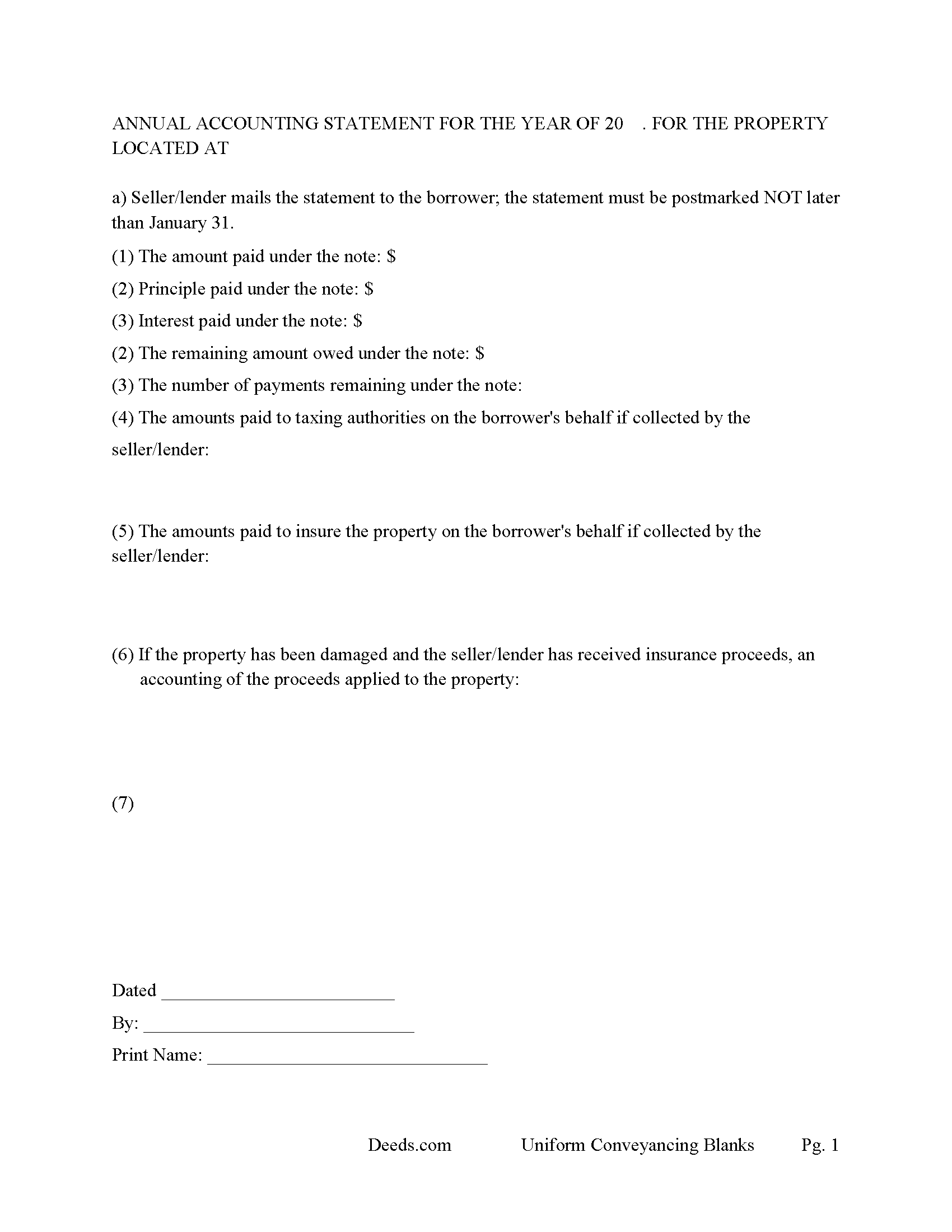

Marshall County Annual Accounting Statement

Mail to borrower for fiscal year reporting.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional West Virginia and Marshall County documents included at no extra charge:

Where to Record Your Documents

Marshall County Clerk

Moundsville, West Virginia 26041

Hours: 8:30 to 4:30 Mo-Th & 8:30 to 5:30 Fr

Phone: (304) 845-1220

Recording Tips for Marshall County:

- Bring your driver's license or state-issued photo ID

- Verify all names are spelled correctly before recording

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Marshall County

Properties in any of these areas use Marshall County forms:

- Benwood

- Cameron

- Dallas

- Glen Dale

- Glen Easton

- Mcmechen

- Moundsville

- Proctor

Hours, fees, requirements, and more for Marshall County

How do I get my forms?

Forms are available for immediate download after payment. The Marshall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marshall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marshall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marshall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marshall County?

Recording fees in Marshall County vary. Contact the recorder's office at (304) 845-1220 for current fees.

Questions answered? Let's get started!

There are three parties in this Deed of Trust:

1- The Trustor (Borrower)

2- Beneficiary (Lender) and a

3- Trustee (Neutral Third Party)

Basic Concept. The Trustor (Borrower) conveys property title to a Trustee (Neutral Party). A Trustee or beneficiary/Lender can take action against any person for damages.

In West Virginia, a Deed of Trust (DOT) is the most commonly used instrument to secure a loan. If the DOT has a "Power of Sale" clause, foreclosure can be done non-judicially, saving time and expense, because the trustee doesn't require the court's involvement. This process is called a Trustee Sale. Explained in WV Statute 38-1-3. "Sales under trust deeds."

Proceeds of Trustee Sale: After deducting all costs, fees and expenses of Trustee and of this trust, including the cost of evidence of title in connection with the sale and reasonable attorney's fees, trustee shall apply the proceeds of sale to payment of all sums then secured hereby and all other sums due under the terms hereof, with accrued interest, and the remainder, if any, to the persons legally entitled thereto or as provided by W. VA. ARTICLE 1, 38-1-7.

(38-1-2. Form of deed of trust; memorandum of deed of trust may be recorded.) This Form is fully formatted for W.VA. recording requirements.

Promissory Note secured by Deed of Trust.

In general, the lender can charge 6% with no written contract and 8% with a written contract. Exceptions are made, see W. VA. Statute 47-6-5, "Legal rate of interest".

Terms:

A- Principle Owed and Maturity Date of Loan

B- Payments - Traditional Installment or installments with a Balloon Payment.

C- Late Payments: So much $ owed after X number of days, plus $ for each day after.

D- Default Rate: If payment is at least 30 days past due, then the principal balance shall bear interest at default rate of $$$.

E- Overdue Loan Fee: In addition to any other remedies available to Lender if this Note is not paid in full at the Maturity Date, Borrowers shall pay to Lender an Overdue Loan Fee.

F- Default Terms: If any of the following events of default occur, this Note and any other obligations of the Borrower to the Lender, shall become due immediately, without demand or notice:

1) the failure of the Borrower to pay the principal and any accrued interest when due;

2) the filing of bankruptcy proceedings involving the Borrower as a debtor;

3) the application for the appointment of a receiver for the Borrower;

4) the making of a general assignment for the benefit of the Borrower's creditors;

5) the insolvency of the Borrower;

6) a misrepresentation by the Borrower to the Lender for the purpose of obtaining or extending credit.

7) In addition, the Borrower shall be in default if there is a sale, transfer, assignment, or any other disposition of any real estate pledged as collateral for the payment of this Note, or if there is a default in any security agreement which secures this Note.

G- Venue: If legal action is required, Lender provides the County of such actions.

This package can be used for financing of residential property, a condominium, a small office building and rental property (up to 4 units). A Promissory Note secured by a Deed of Trust with strong default terms can be beneficial to the Lender. This form has terms and conditions defined by W. VA. Statutes, for use in W. VA only.

(West Virginia DOT Package includes forms, guidelines, and completed examples)

Important: Your property must be located in Marshall County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Marshall County.

Our Promise

The documents you receive here will meet, or exceed, the Marshall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marshall County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Therese L.

September 20th, 2019

Good instructions and example

Thank you!

Lorie C.

April 15th, 2023

Easy and effective...surely saved hundreds by avoiding a lawyer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Gertrude H.

October 1st, 2019

I used this form and guide a couple years ago and found it helpful and easy to fill out. Had good results at the Recorder's Office. Would recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Darlene P.

November 12th, 2021

Deeds.com was a money saver for me. It made a daunting task of preparing a Quit Claim Deed a very simple task. I was happy that my documentation was accepted by my state and County first round. Thank you Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

irene a.

February 8th, 2019

good forms thanks, irene

Thank you Irene.

Daniel Z.

September 13th, 2022

All is well that ends well and this form service seemed to work quite smoothly, even though my printer gives me fits at times, having to hand feed the blank paper.

Thank you for your feedback. We really appreciate it. Have a great day!

Kecia L.

February 9th, 2021

Great place to find much needed documents. A huge thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

FELISA J.

December 18th, 2019

I liked the ease of locating the document I needed and the sample document was extremely helpful. I would have liked the acknowledgement to be on the same page as the rest of the document. It costs for each page recorded.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Caroline K.

August 16th, 2019

SIMPLE, THAT IS GOOD

Thank you for your feedback. We really appreciate it. Have a great day!

Mary S.

February 14th, 2024

Very helpful and an easy site to use so far.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol A.

February 6th, 2023

great

Thank you!

Dakota H.

December 19th, 2021

Brilliant idea. Beats working with an attorney who charges $250+ per hour. Thanks.

Thank you!

Christine B.

April 16th, 2021

The site was easy to navigate.

Thank you!

Tressa P.

November 17th, 2020

This online service was very easy to use. I highly recommend Deeds.com. The quick response from the representative upon submitting your document is quick. If something needed to be adjusted they will send you message and you can in turn respond right away with a message. The pricing of this service is very reasonable.

Thank you!

Coby A.

May 26th, 2021

great service and quick filing.

Thank you!