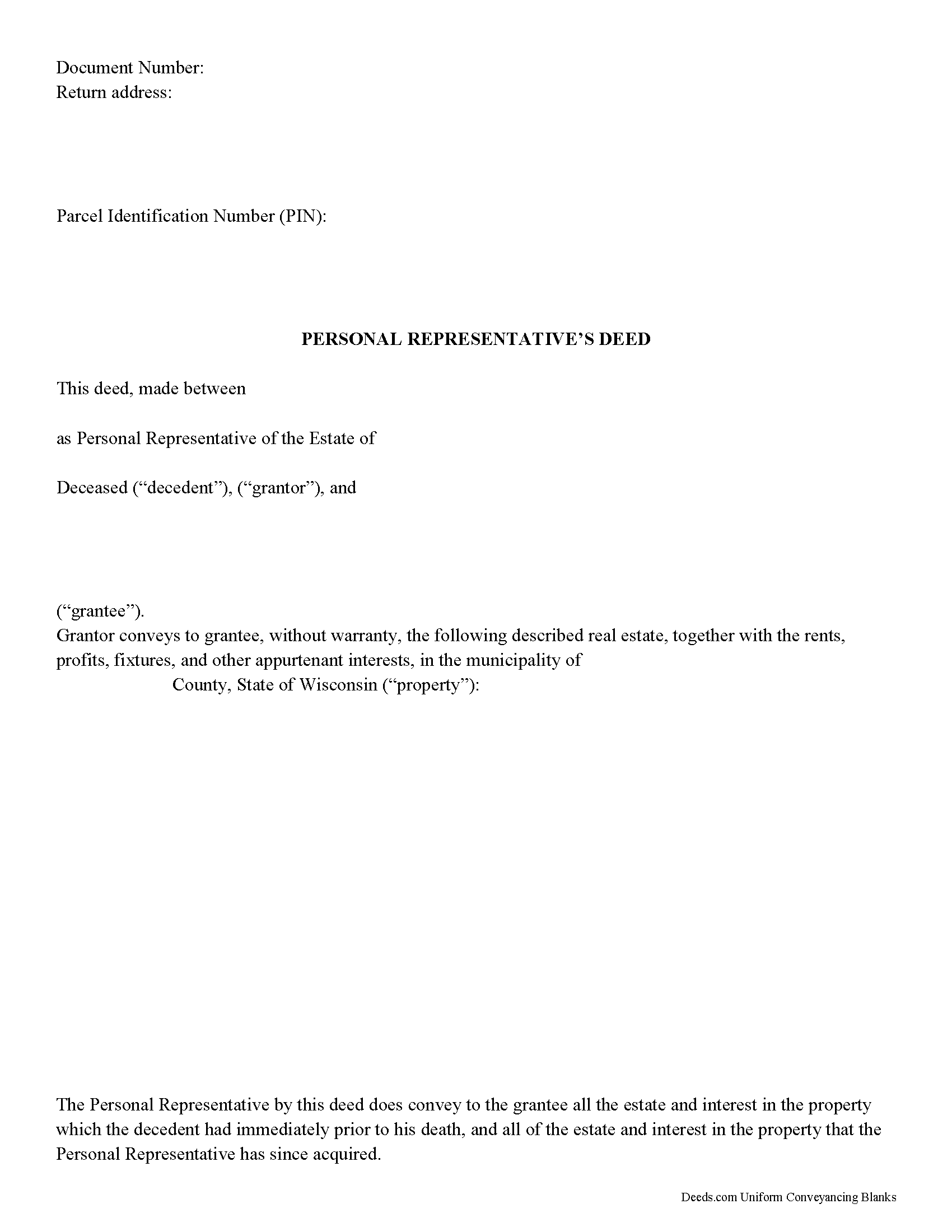

Calumet County Personal Representative Deed Form

Calumet County Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

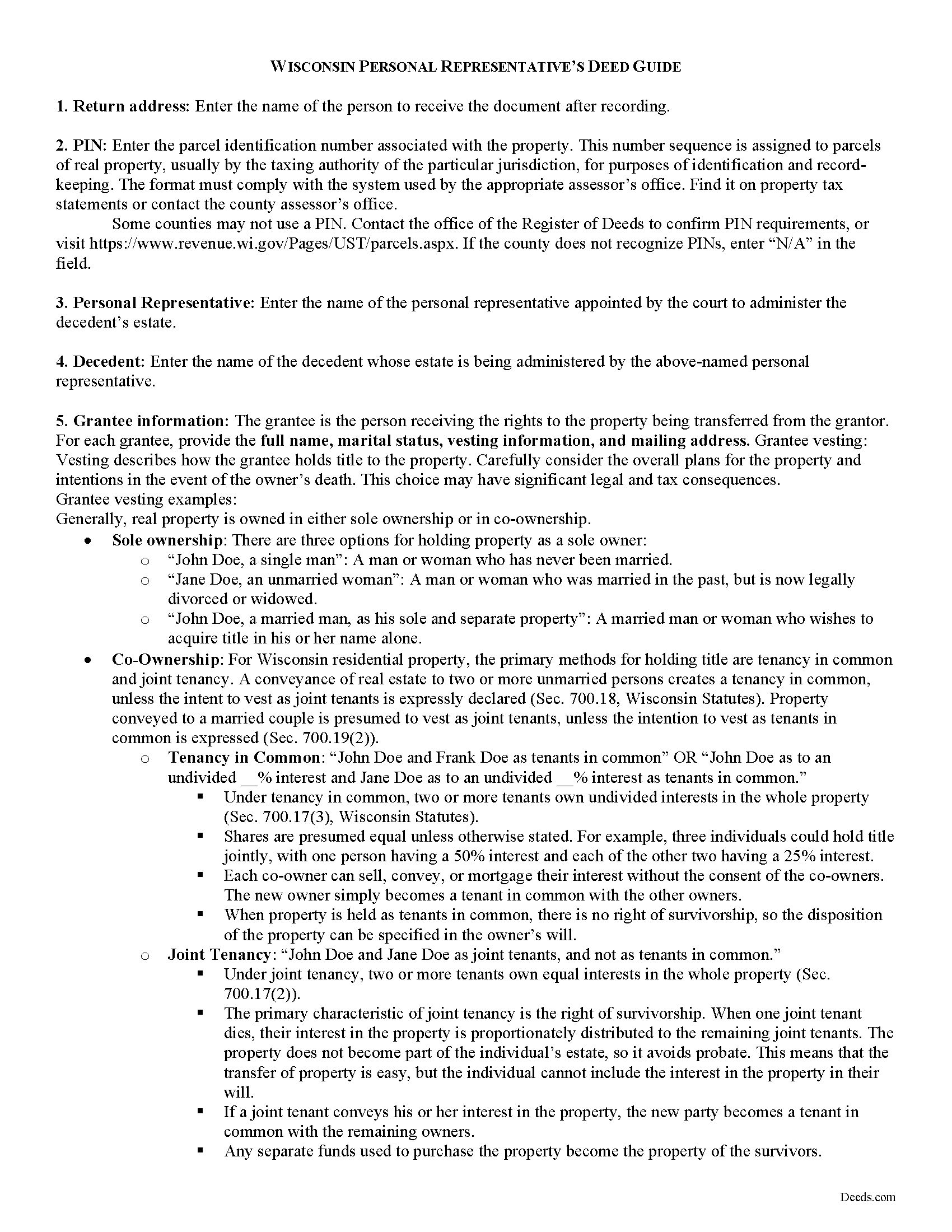

Calumet County Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

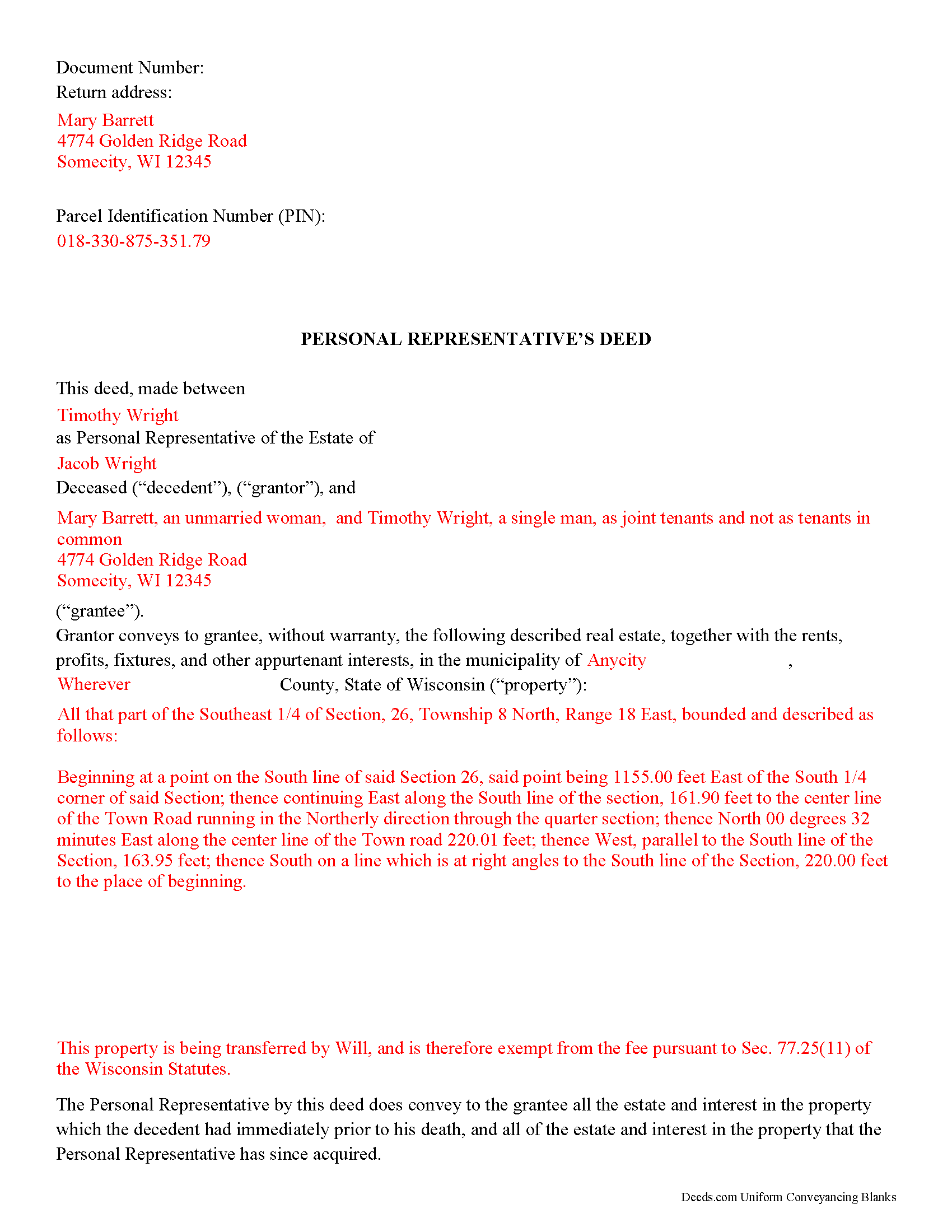

Calumet County Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Calumet County documents included at no extra charge:

Where to Record Your Documents

Calumet County Register

Chilton, Wisconsin 53014

Hours: Monday - Friday 8:00am - 4:30pm / Recording until 4:00pm

Phone: (920) 849-1441

Recording Tips for Calumet County:

- Bring your driver's license or state-issued photo ID

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Calumet County

Properties in any of these areas use Calumet County forms:

- Brillion

- Chilton

- Forest Junction

- Hilbert

- New Holstein

- Potter

- Sherwood

- Stockbridge

Hours, fees, requirements, and more for Calumet County

How do I get my forms?

Forms are available for immediate download after payment. The Calumet County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Calumet County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Calumet County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Calumet County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Calumet County?

Recording fees in Calumet County vary. Contact the recorder's office at (920) 849-1441 for current fees.

Questions answered? Let's get started!

Transfer or Sale of a Decedent's Real Estate in Wisconsin

At its most basic, probate means to prove a decedent's will. The term "probate," however, is frequently used to describe the legal process of estate administration, which includes intestate estate succession in addition to probating wills. Estates are called intestate when the decedent (deceased person) does not leave a will. Probate ensures that a decedent's estate is lawfully transferred pursuant to the provisions of his will or to the state's laws of intestate succession.

Property that does not transfer by means of a survivorship or beneficiary designation is subject to probate. Estates requiring formal or informal probate involve the appointment of a personal representative (PR), a fiduciary appointed by the court to administer the estate in accordance with Wisconsin's Probate Code, located at Chs. 851-882 of the Wisconsin Statutes. This article will focus on informal administration; formal administration may be necessary depending on such factors as specifications in the will and whether all persons having an interest in the estate agree on the administration. Consult a lawyer with questions.

The first step to administration is opening the estate by submitting a petition for administration in the circuit court of the county where the decedent resided at the time of death. If there is a will, it must be delivered to the probate registrar. If the testator (person making a will) has filed the will with the court for safekeeping, the court shall contact the person named in the will to administer the estate (Wis. Stat. Sec. 856.03). Upon petition, the court will set a time for proving the will (if applicable), determining heirship, and appointing a personal representative (Sec. 856.11).

To evidence the authority of a PR to act on behalf of the estate, the court grants Domiciliary Letters to the qualifying person. The person named in the decedent's will has priority in appointment, followed by any person interested in the estate or the person's nominee, under discretion of the court (Sec. 856.21). With the issuance of letters, the PR is granted the general powers and duties of a personal representative under Ch. 857, Wisconsin Statutes, to administer the estate as required by law.

Among the PR's powers is the power to "sell, mortgage or lease any property in the estate without notice, hearing or court order" under Sec. 860.01, unless restricted or prohibited by the decedent's will (Sec. 860.11). The beneficiary of property specifically devised to him by the decedent must join in the sale of such property (Sec. 860.11(2)). If the will contains any such limitations as to the sale of real property, yet the PR is unable to pay allowances, expenses of administration, or claims on the estate within those limitation, he can petition the court for sale (Sec. 860.11(4)).

To sell or transfer an interest in real estate, the PR executes a personal representative's deed. A PR deed passes title to the named grantee free and clear of the rights of creditors that have been filed and allowed in the estate under Ch. 859 (Sec. 860.05). The PR has no statutory power to make warranties in any sale of real estate binding on the PR or on the estate (Sec. 860.07). The deed conveys all the estate and interest in the property the decedent had immediately prior to his death, and all the estate and any interest in the property the PR has since acquired.

A lawful deed should meet the requirements for content established at Sec. 706.02, identifying the parties and the land involved, the interest conveyed, and any conditions. The grantor must sign and have the deed properly acknowledged under Sec. 706.06. All deeds in Wisconsin require the name of the person who drafted the instrument and full legal description of the property and meet statutory and local standards for formatting recorded instruments (Sec. 59.43).

Record the deed in the office of the register of deeds in each county where the property is situated. Conveyances of real property offered for recording must be accompanied by receipt of an electronic real estate transfer return or note an exemption on the face of the document 706.05(12)). Exemptions to the real estate transfer fee are codified at Sec. 77.25, and include transfers by will, descent, or survivorship (Sec.77.25(11)).

Consult an attorney about personal representative's deeds and informal probate procedures in Wisconsin, as each situation is unique.

(Wisconsin PRD Package includes form, guidelines, and completed example)

Important: Your property must be located in Calumet County to use these forms. Documents should be recorded at the office below.

This Personal Representative Deed meets all recording requirements specific to Calumet County.

Our Promise

The documents you receive here will meet, or exceed, the Calumet County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Calumet County Personal Representative Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Timothy K.

April 7th, 2021

Excellent service. Fast turnaround within one day. Reasonable pricing for services.

Thank you!

Ken S.

March 14th, 2019

Easy to downloand. Instructions were helpful and easy to follow. Made the process a lot easier for me.

Thanks Ken.

Richard B.

April 27th, 2023

Excellent! I was able to complete the documents especially using the instructions as a guide. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Donald C.

August 7th, 2020

As promised, my forms were immediately ready for download. The forms were exactly what i wanted. I couldnt be happier and i cant even guess how much money i saved. They were even formatted to the exact font, spacing and margin used by my county. It is obvious a lot of time and effort was put into the preparation of these documents. They are absolutely perfect. Check it out, you wont be disappointed and the price is much less than i expected. Don caldwell

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ruth L.

August 18th, 2021

Easy to use form. I filled it out and took it to the county office. Entire process took less than 20 min.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vernon A L.

March 23rd, 2022

They are forms....no magic there. I still have to round up the details.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

chris m.

March 10th, 2022

Was warned by attorney that forms from internet have lots of mistakes. But after looking all over, took a chance on here. So far, I am satisfied, and actually happy that I got something that (I believe) meets my state and local requirements. Haven't filed the deed yet, or had to put it into effect, but being able to pick the local area, and have the relevant state law listed on the deed, gives me confidence. Also, got the whole package of possibly relevant forms, and a very good guide how to prep the deed with a sample completed deed - greatly appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Bertha V. G.

May 17th, 2019

Great information and very easy to understand.

Thank you for your feedback. We really appreciate it. Have a great day!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!

Tim G.

April 23rd, 2020

Pretty good all in all. I do wish I could download forms to a word doc instead of a .pdf. Word is more 'accessable'.

Thank you!

Michael K.

January 11th, 2021

The link for the note guidelines just shows the same directions as for the mortgage. Other than that, very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Brett B.

July 12th, 2022

easy to use

Thank you!

Robert K.

August 1st, 2020

I used your TOD document to deed my home to my daughter. Your sample document was very helpful. I had to do it a few times but finally got it right. I didn't check but It was surely cheaper than a lawyer fee.

Thank you for your feedback. We really appreciate it. Have a great day!

Reida S.

September 29th, 2020

Have used two times. Smooth transaction both times. Fast, simple and easy to use system. Would use them again in the future.

Thank you for your feedback. We really appreciate it. Have a great day!