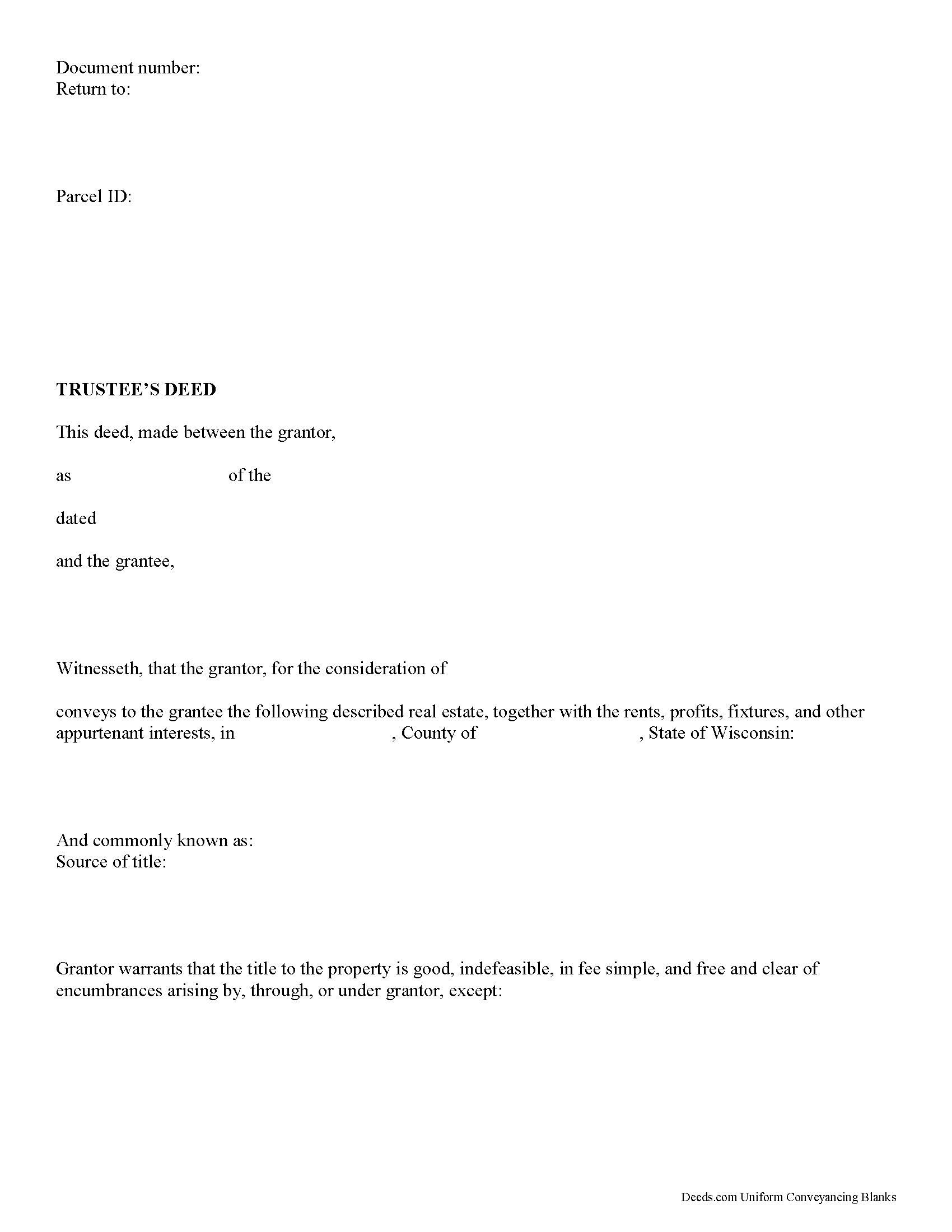

Dunn County Trustee Deed Form

Dunn County Trustee Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

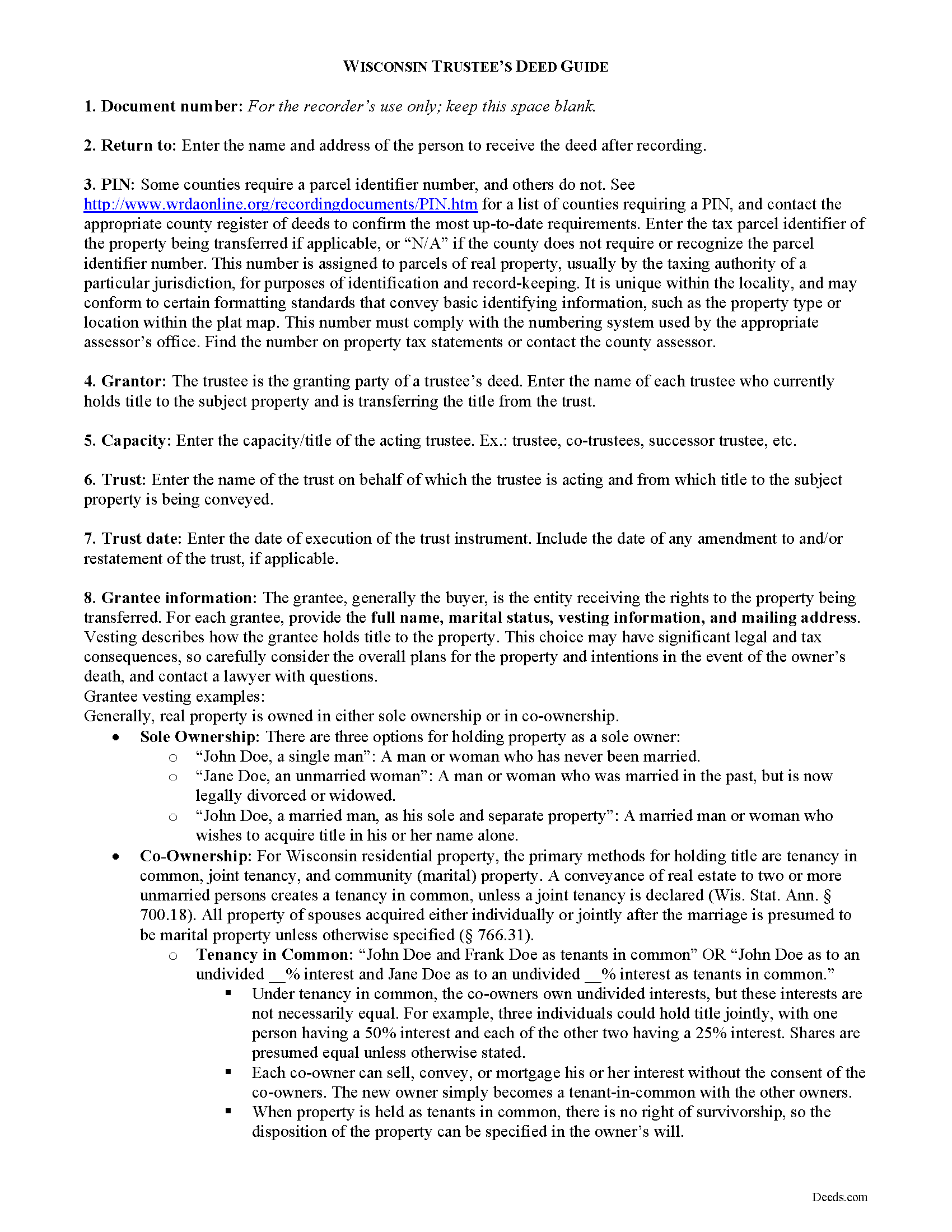

Dunn County Trustee Deed Guide

Line by line guide explaining every blank on the form.

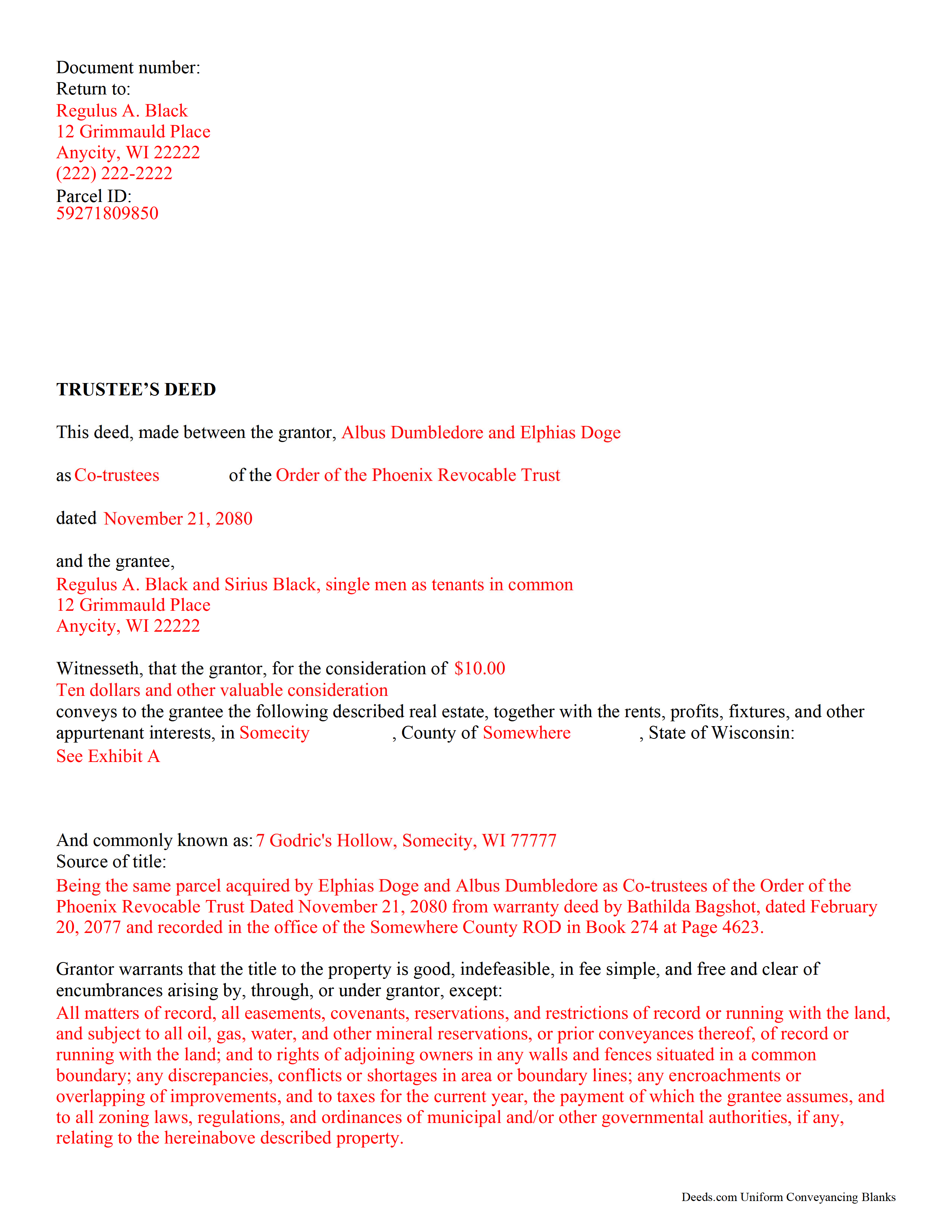

Dunn County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wisconsin and Dunn County documents included at no extra charge:

Where to Record Your Documents

Dunn County Register of Deeds

Menomonie, Wisconsin 54751

Hours: Monday - Friday 8:00 am - 4:30 pm

Phone: (715) 232-1228

Recording Tips for Dunn County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Verify all names are spelled correctly before recording

- Leave recording info boxes blank - the office fills these

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Dunn County

Properties in any of these areas use Dunn County forms:

- Boyceville

- Colfax

- Downing

- Downsville

- Eau Galle

- Elk Mound

- Knapp

- Menomonie

- Ridgeland

- Rock Falls

- Sand Creek

- Wheeler

Hours, fees, requirements, and more for Dunn County

How do I get my forms?

Forms are available for immediate download after payment. The Dunn County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Dunn County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Dunn County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Dunn County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Dunn County?

Recording fees in Dunn County vary. Contact the recorder's office at (715) 232-1228 for current fees.

Questions answered? Let's get started!

In a living trust, a grantor (settlor) transfers title to property to another person (trustee) for the benefit of a third (beneficiary). A settlor often serves as the original trustee (sometimes along with a spouse) and initial beneficiary of a living trust during his lifetime, and nominates a successor to take over fiduciary duties upon his death or incapacity, though this is not always the case. The settlor establishes the trust by executing a trust document, an unrecorded instrument outlining the scope and terms of the trust, including the settlor's estate plans. In transfers of real property into trust, the settlor executes a deed titling the property in the name of the trustee on behalf of the trust.

In order to convey real property from the trust during the settlor's lifetime, the trustee must execute a deed vesting title in the name of the grantee. In Wisconsin, a trustee's deed is a special warranty deed that has simply been named after the capacity of the granting party. The trustee's deed is identical in form to a special warranty deed, supplying in addition the name and date of the trust on behalf of which the grantor is conveying title. The deed contains the language that the grantor "warrants that the title to the property is good, indefeasible, in fee simple, and free and clear of encumbrances arising by, through, or under grantor" [2].

As noted by the Wisconsin Realtors Association, "personal representatives and other fiduciaries such as trustees and guardians...[who] are not sufficiently familiar with the history of the property to give a warranty deed" use a special warranty deed to convey title [1]. A special warranty deed contains the covenant that the title is free and clear of encumbrances only arising by, through, or under grantor, with any exceptions expressly noted in the conveyance.

The form should meet all content requisites for conveyancing instruments under 706.02, including the name of each party; a legal description of the property subject to conveyance; and original signatures of the grantors. All recordable documents should also meet formatting requisites established at 59.43(2m). The deed must be signed in the presence of a notary public before recording in the appropriate county register of deeds. Additional documentation confirming the trustee's authority may be required (see Wisconsin Trust Code 701.1013 for certification of trust).

Consult a lawyer with questions regarding transfers by trust in Wisconsin, as each situation is unique.

(Wisconsin TD Package includes form, guidelines, and completed example)

Important: Your property must be located in Dunn County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Dunn County.

Our Promise

The documents you receive here will meet, or exceed, the Dunn County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Dunn County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

David D.

September 20th, 2022

Two thumbs up!

Thank you!

Joseph N.

September 17th, 2020

The site is easy to navigate and exceptional services. Unfortunately, they could find no information on a tract of land that I own, and they canceled the search and refunded my payment.

Sorry we were unable to help you find what you were looking for Joseph.

Karen T.

April 22nd, 2019

Thank you for the feedback. I reviewed this with my client/friend and she is following up with the appropriate people, including the Police and a lawyer. Thank you for your help.

Thank you!

Mark M.

October 20th, 2022

Quick, easy everything that i was looking for and then some.

Thank you for your feedback. We really appreciate it. Have a great day!

Patricia D.

January 5th, 2019

I looked around for forms and came to this site. I had to do 15 deeds and this form was very useful to completing that. Very impressed. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Blanche S.

March 25th, 2022

Thank you I hope I've done it all right!!

Thank you!

james B.

May 10th, 2021

Downloaded quickly and saved to hard drive easily. I then opened in Adobe Acrobat Reader DC then was able to enter and save data in appropriate blanks. Yes, worth $22.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Beverly H.

February 13th, 2019

Thanks!!

Thank you!

Rose M.

February 2nd, 2021

Easy to understand and complete. Lower cost than many others who offer same. Thanks so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jamie F.

March 13th, 2020

Your service was very helpful as we were able to obtain a form for another state for our client.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Camesha Y.

January 10th, 2019

Was working with a notary client that need to do a deed. We got on this site, ordered the blank forms, he filled them out and we printed them so he could sign. Really clean forms, easy to understand and complete in a hurry. I will be letting all my clients know about this site.

That's terrific Camesha, glad to hear. Have a great day!

Mary D.

March 29th, 2021

LOVE this site.. easy to use and very very quick to record

Thank you for your feedback. We really appreciate it. Have a great day!

Rosa S.

June 6th, 2019

I am pleased with how easy it was to download the will. Now just have to get it filled in and filed at Tax Office. Thank you for making it simple to use.

Thank you for your feedback. We really appreciate it. Have a great day!

M. TIMOTHY P.

February 17th, 2021

EXCELLENT service! Deed came back within minutes!

Thank you for your feedback. We really appreciate it. Have a great day!

Deirdre K.

July 19th, 2020

Fantastic! So helpful, got my deed recorded with no problem.

Thank you!