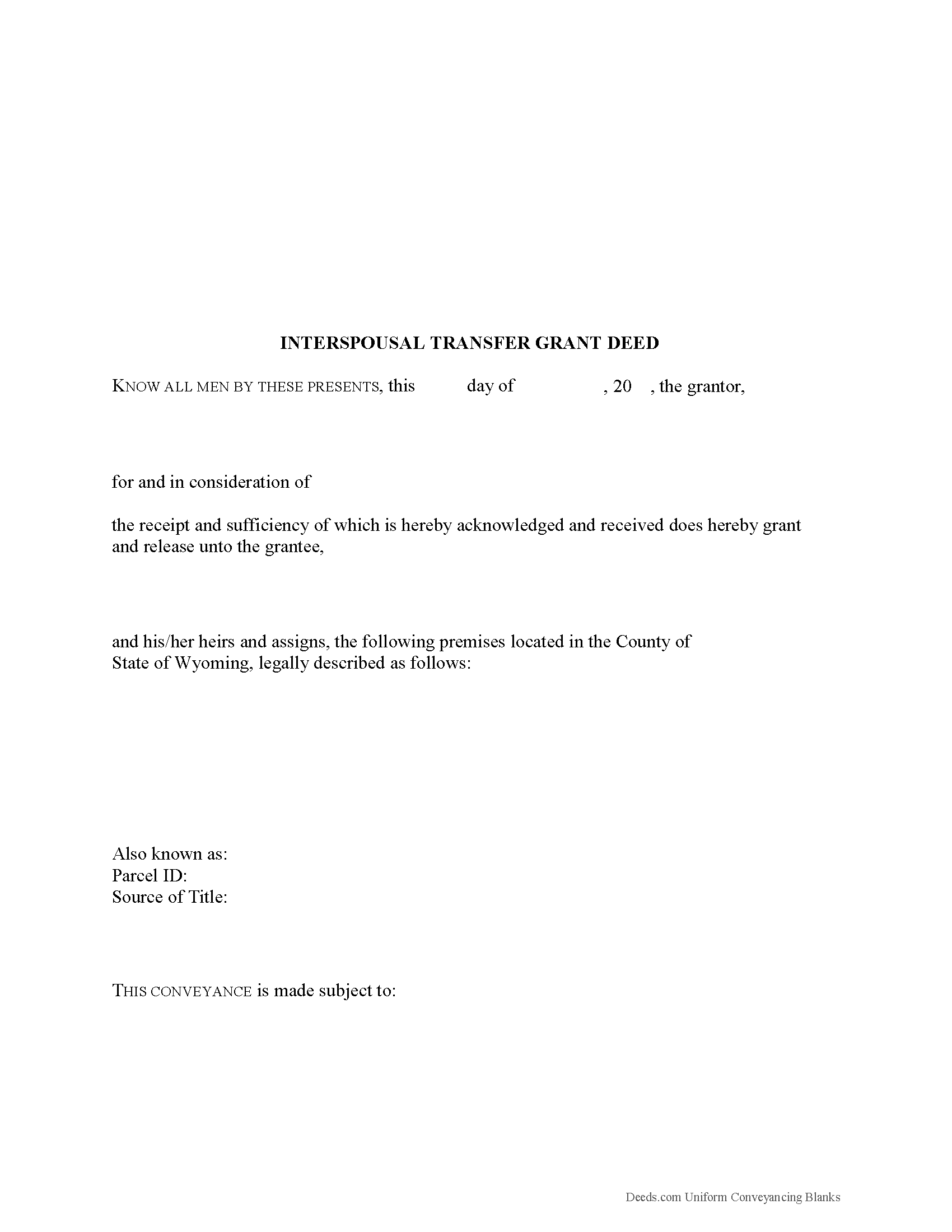

Weston County Interspousal Transfer Grant Deed Form

Weston County Interspousal Transfer Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

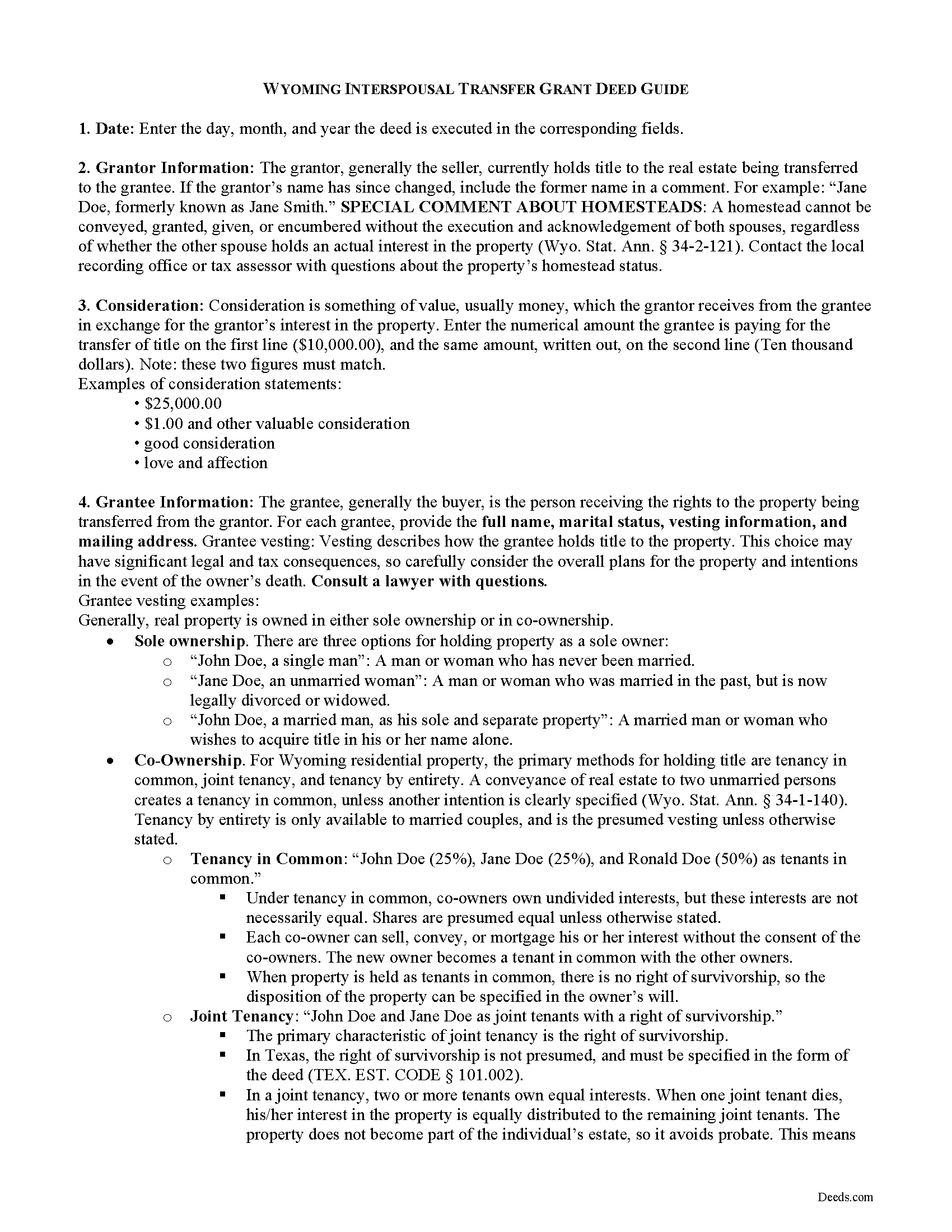

Weston County Interspousal Transfer Grant Deed Guide

Line by line guide explaining every blank on the form.

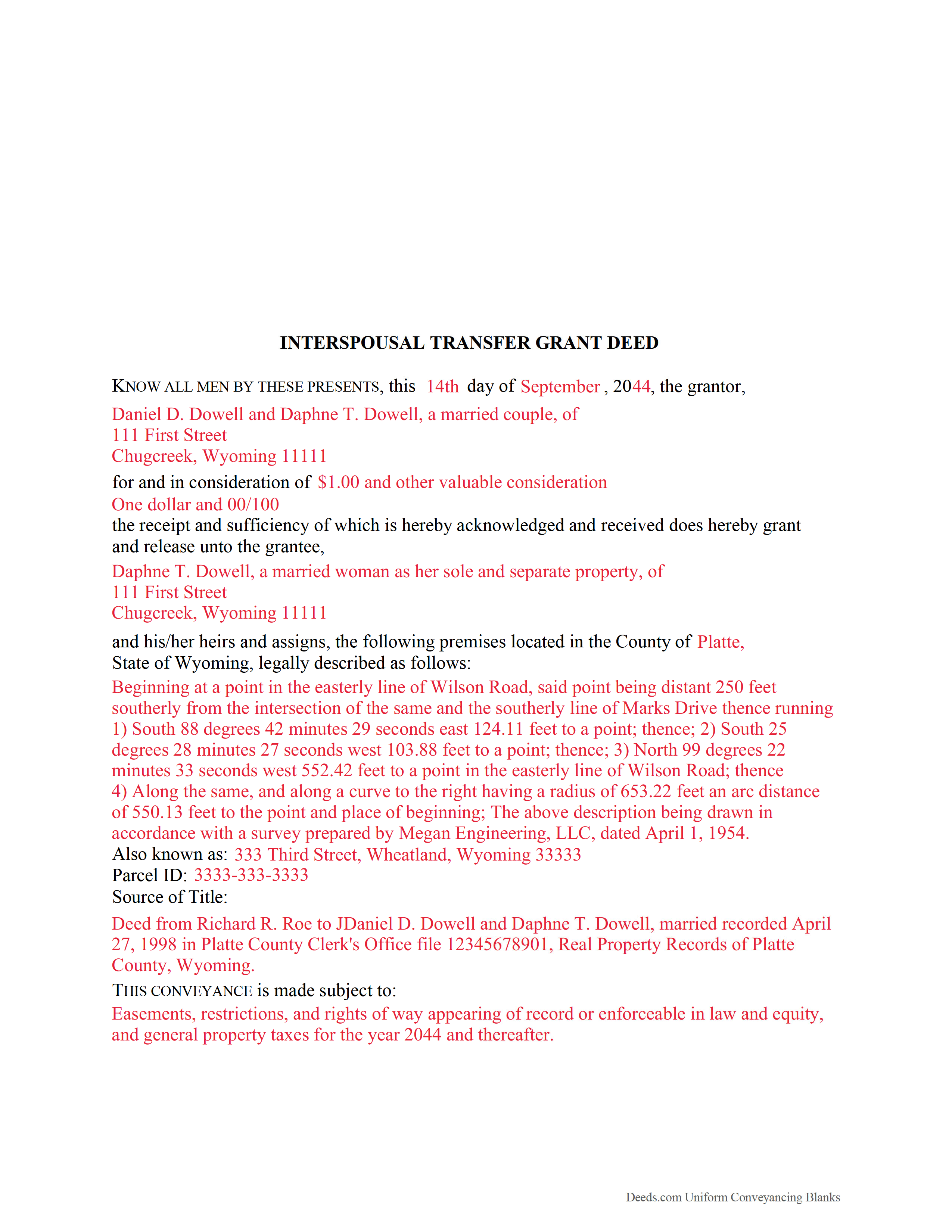

Weston County Completed Example of the Interspousal Transfer Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Wyoming and Weston County documents included at no extra charge:

Where to Record Your Documents

Weston County Clerk

Newcastle, Wyoming 82701

Hours: Monday - Friday 8:00am - 5:00pm

Phone: (307) 746-4744

Recording Tips for Weston County:

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Weston County

Properties in any of these areas use Weston County forms:

- Four Corners

- Newcastle

- Osage

- Upton

Hours, fees, requirements, and more for Weston County

How do I get my forms?

Forms are available for immediate download after payment. The Weston County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Weston County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Weston County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Weston County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Weston County?

Recording fees in Weston County vary. Contact the recorder's office at (307) 746-4744 for current fees.

Questions answered? Let's get started!

Transferring Real Property between Spouses in Wyoming

In Wyoming, spouses have options for voluntary transfers of title to real property from one to the other. Quitclaim deeds can serve that purpose without specific guarantees, but an interspousal transfer grant deed offers more protection. In addition, using this type of deed avoids the necessity for property tax reassessment. They can also be used in situations where both spouses hold title to real estate and one transfers his or her interest in the property to the other. It can also be used in situations where one spouse holds title to real estate in sole ownership and voluntarily transfers his or her interest in the property to his or her spouse [1].

Unlike a quitclaim deed, a grant deed guarantees that the grantor (seller) has a present interest in the property, and, when recorded, provides evidence of a change of title to the grantee (buyer). It also includes a warranty that the property is not encumbered by any undisclosed liens or restrictions, which means that there are no legal claims to the title by third parties.

A lawful grant deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Wyoming residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two unmarried persons creates a tenancy in common, unless another intention is clearly specified (Wyo. Stat. Ann. 34-1-140). Tenancy by entirety is only available to married couples, and is the presumed vesting unless otherwise stated.

As with any conveyance of realty, a grant deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Guarantees and responsibilities must be stated in the deed as well. These guarantees indicate that the grantor owns the property free and clear of encumbrances, and the seller assumes the responsibility for settling any future claims. If there is a time limit on the guarantees, it must also be incorporated in the deed. The finished copy of the deed must be duly signed by the parties and notarized. Record the original completed deed, along with any additional materials, with the clerk's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

All Wyoming conveyances require a completed Statement of Consideration. Find this form on the county clerk's website, or through the Wyoming State Board of Equalization website. It is the responsibility of the buyer (or the buyer's agent) to fully complete the Statement of Consideration (Wyo. Stat. Ann 34-1-142) and to pay any applicable transfer taxes.

In some cases, there is no exchange of consideration when the property is transferred using an interspousal transfer grant deed. The federal government may identify such transfers as gifts, and which are potentially subject to the federal gift tax. The transfer of property from a spouse or former spouse isn't subject to gift tax if it meets any of the following exceptions: It is made in settlement of marital support rights, it qualifies for the marital deduction, it is made under a divorce decree, or it is made under a written agreement, and the couple is divorced within a specified period. If the transfer of property doesn't qualify for an exemption, or only qualifies in part, report that the transfer is subject to gift tax on IRS Form 709 [2], [3].

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a Wyoming lawyer with any questions about interspousal transfers or other matters related to the transfer of real property.

[1] https://www.boe.ca.gov/proptaxes/pdf/ah401.pdf

[2] https://www.irs.gov/businesses/small-businesses-self-employed/frequently-asked-questions-on-gift-taxes

(Wyoming ITGD Package includes form, guidelines, and completed example)

Important: Your property must be located in Weston County to use these forms. Documents should be recorded at the office below.

This Interspousal Transfer Grant Deed meets all recording requirements specific to Weston County.

Our Promise

The documents you receive here will meet, or exceed, the Weston County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Weston County Interspousal Transfer Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Mary G.

March 7th, 2021

Deeds.com was a fast and easy site to use the staff answered my questions online efficiently

Thank you!

MIchelle S.

June 18th, 2021

You had the generic document that I was looking for Yay! The "example" page was helpful and reassuring. The auto input sections of my document looked ok until i printed it and then it appeared to be out of alignment which is why my rating is lowered to 4 stars it would be nice to have the ability to correct the title (created by me) when downloading PDFs for an e-filing

Thank you for your feedback. We really appreciate it. Have a great day!

Larry P.

October 14th, 2020

Very nice, they include a guide download that tells you all the lawyer speak!! I'll be using them again.

Thank you for your feedback. We really appreciate it. Have a great day!

Terrence R.

January 24th, 2020

So far so good I was able to find the documents I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa J.

November 29th, 2019

Thank you so much for your time.

Thank you!

Lisa H.

April 18th, 2021

My recent experience with Deeds.com has been outstanding. I especially appreciated the sample filled-out deed but even more the explanation of the questions. i recommend to download both. It was very easy and fast. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dale Mary G.

July 14th, 2020

This was an easy site to use - saving so much time and allowing me to complete what I needed to do. All the added information, guidelines and even a sample completed form. Great!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shelba M.

July 26th, 2023

The web site is alright, not the easiest to navigate and the wording on the papers could be simpler to understand.

Thank you for your feedback! We appreciate your input regarding the website's navigation and the wording on our documents. We'll definitely take your suggestions into account to improve the user experience and make the content more accessible and easier to understand. Your insights are valuable to us as we strive to enhance our services. If you have any further suggestions or concerns, please feel free to share them with us. Thank you again for your feedback!

John H.

September 13th, 2021

Quality product. Forms are as advertised. Easy to use site.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Eppie G.

October 19th, 2021

Perfect

Thank you!

Ann C.

October 18th, 2023

Very responsive and helpful. Made a big task quite easy and effecient. I would highly recommend. Reasonable fees as well

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Shantu S.

December 1st, 2022

Easy to follow directions and complete the Deed.

Thank you!

Joe B.

August 29th, 2022

Fantastic service -- very clear

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!