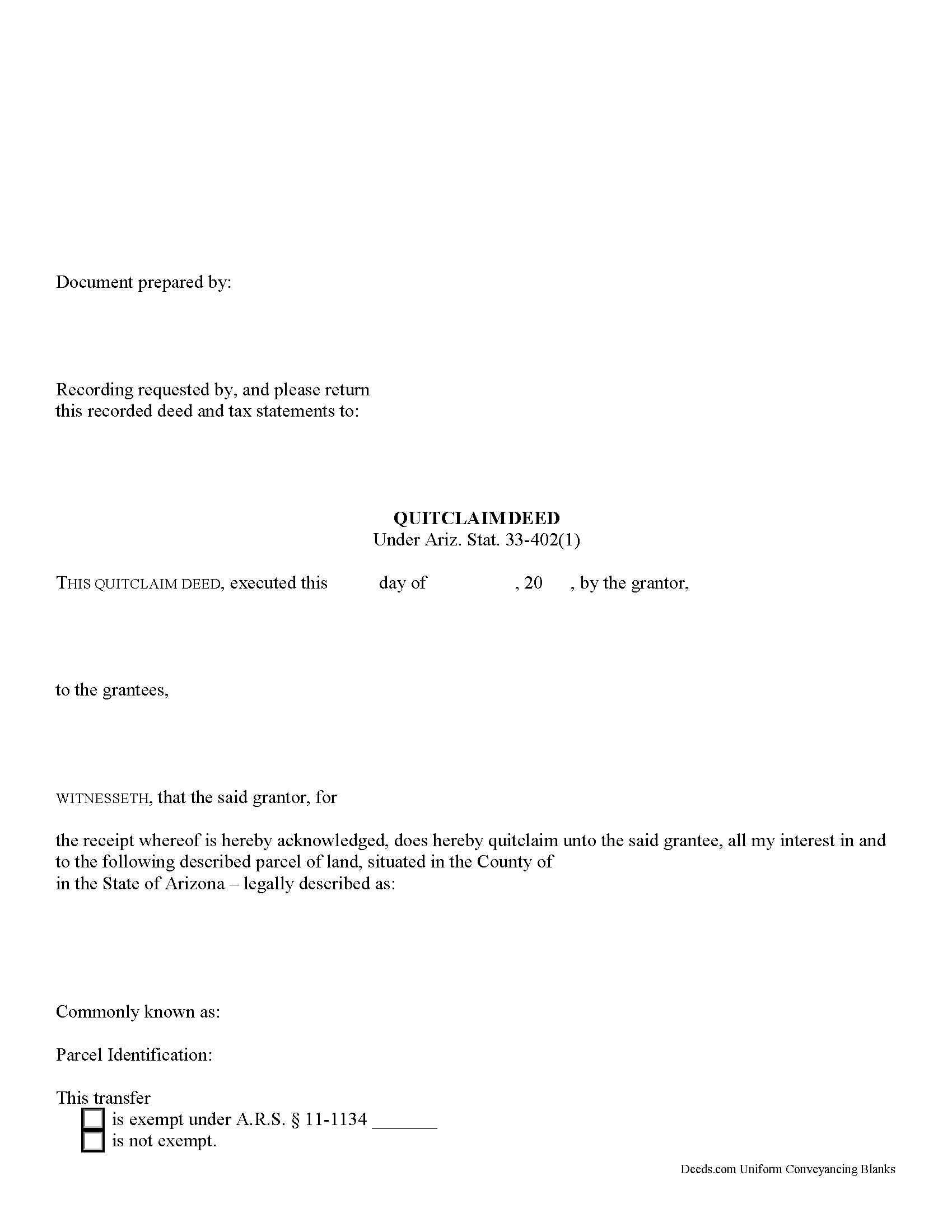

Santa Cruz County Quitclaim Deed Form

Santa Cruz County Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Arizona recording and content requirements.

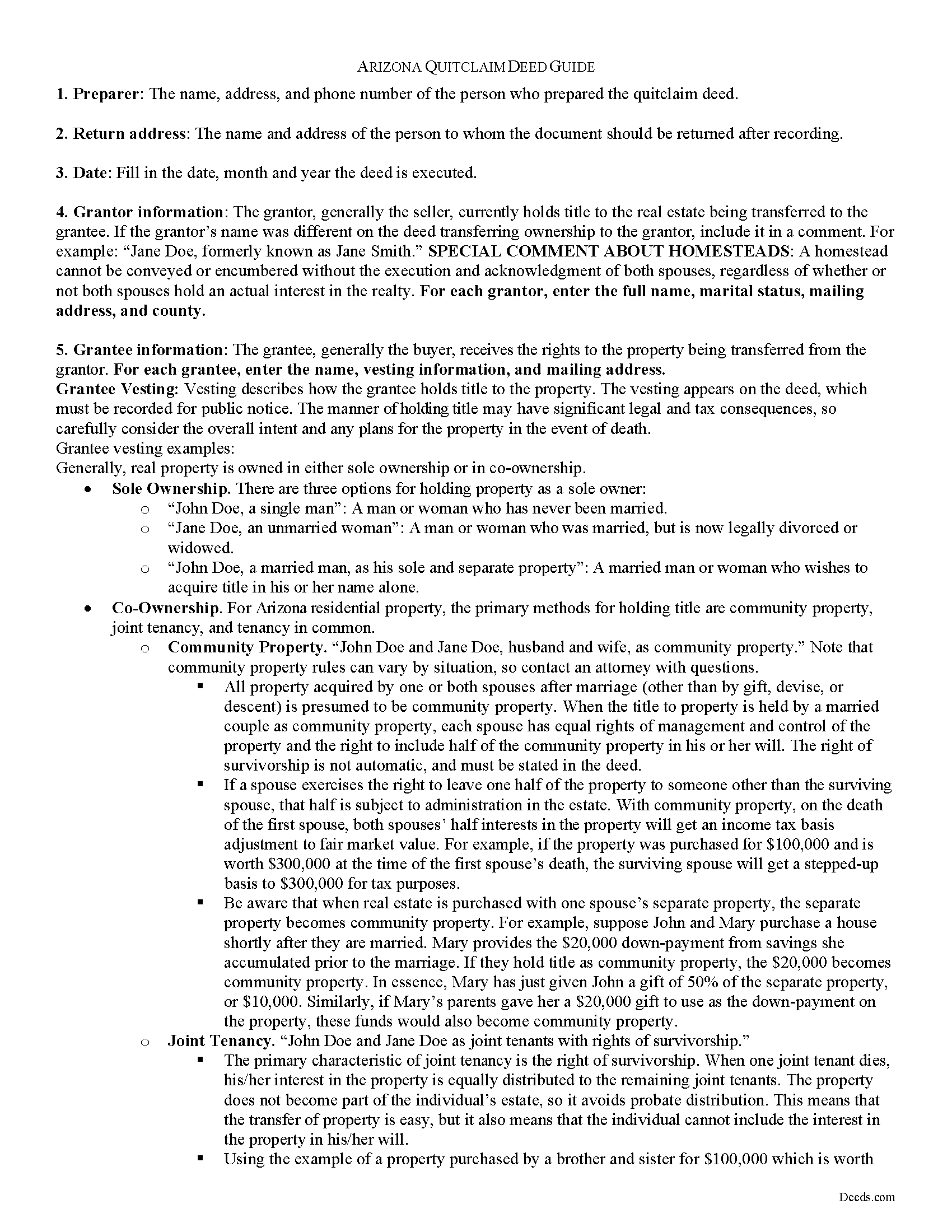

Santa Cruz County Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

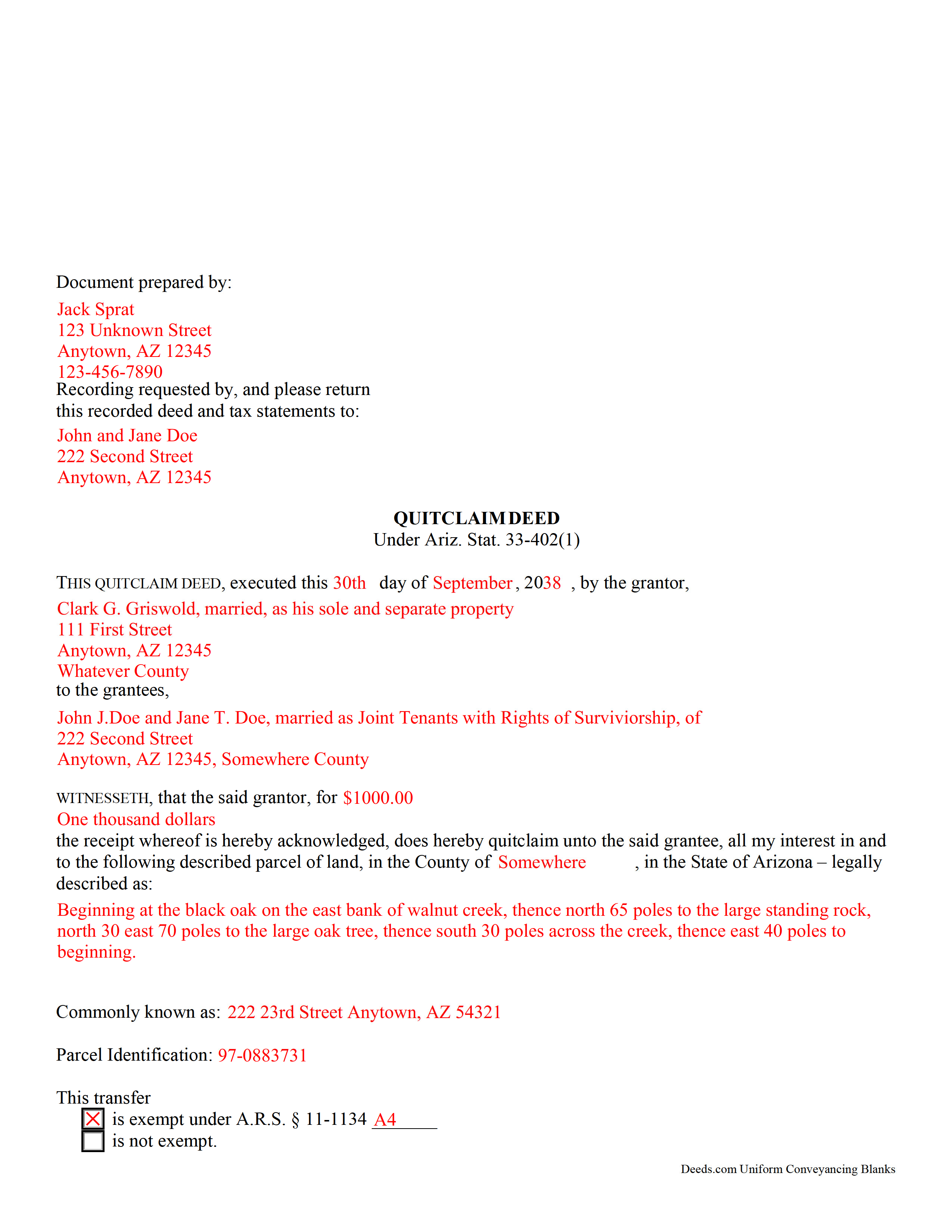

Santa Cruz County Completed Example of the Quitclaim Deed Document

Example of a properly completed Arizona Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arizona and Santa Cruz County documents included at no extra charge:

Where to Record Your Documents

Recorder's Office

Nogales, Arizona 85621

Hours: 8:00am - 5:00pm M-F

Phone: 520-375-7990

Recording Tips for Santa Cruz County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Santa Cruz County

Properties in any of these areas use Santa Cruz County forms:

- Amado

- Elgin

- Nogales

- Patagonia

- Rio Rico

- Sonoita

- Tubac

- Tumacacori

Hours, fees, requirements, and more for Santa Cruz County

How do I get my forms?

Forms are available for immediate download after payment. The Santa Cruz County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Santa Cruz County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Cruz County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Santa Cruz County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Santa Cruz County?

Recording fees in Santa Cruz County vary. Contact the recorder's office at 520-375-7990 for current fees.

Questions answered? Let's get started!

Quitclaim deeds are documents used to transfer the owner's interest (if any) in real property to someone else, with no warranties of title. The transfer may or may not include consideration (something of value, usually money). They are generally used to clear clouded titles, to settle boundary disputes between neighbors, or to make gifts of real property, and include no warranties of title for the new owners. These deeds are also appropriate for situations like divorce, where the idea is simply removing one party's name from a deed, or relinquishing marital rights in real estate.

For Arizona quitclaim deeds under Section 33-402(1) to be valid, they must conform to specific statutory requirements set forth by 33-401, as well as other relevant state and local standards for recording.

The quitclaim deed must be in writing and contain a heading that identifies the nature of the document. Original forms are preferred. LEGIBLE certified copies are also acceptable, but all signatures must be original. The grantor or an authorized agent must sign the deed in front of an officer certified to take acknowledgments. If the deed marks a change in ownership of real property, provide the prior recording information, including date, docket and page of the earlier document, and a complete legal description of the land. Quitclaim deeds should also contain the names and addresses of all grantors and grantees named in the document, as well as a statement clarifying how the grantee wishes to hold title (vesting). Identify the type and amount of consideration exchanged for ownership of the property (usually money). (Ariz. Rev. Stat. 33-401, et al (2012))

Arizona follows a "notice" recording act. This means that any document conveying title to real property must be correctly recorded or the transaction is not complete (Ariz. Rev. Stat. 33-411). In addition, it is the transferor's (grantor) obligation to record the quitclaim deed within sixty days of the transfer or to accept responsibility to defend the transferee (grantee) in any future claims against the grantee's ownership of the land. (Ariz. Rev. Stat. 33-411.01).

(Arizona Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Santa Cruz County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Santa Cruz County.

Our Promise

The documents you receive here will meet, or exceed, the Santa Cruz County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Cruz County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4586 Reviews )

Christine M.

September 8th, 2021

Forms were top notch, easy to complete, printed beautifully, recorded with no revisions. Highly recommend for anyone preparing their own deeds.

Thank you for the kind words Christine. Have an amazing day!

Gretchen R.

November 13th, 2019

I can't think of any suggestions for improvement. The documents I needed were readily available. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

terrance G.

February 11th, 2025

Excellent Service, with quick turnaround times.

Thank you for your positive words! We’re thrilled to hear about your experience.

Laura L.

June 17th, 2025

Used a form from this service. Best part about these forms is that they don't let you get in trouble by removing or changing things that should not be changed. It's easy to look at something and think why is this margin so big, why is this field so small and want to change it only to find out it is incredibly important. That's why they are the deed document pros.

Thank you for the thoughtful review! We're so glad to hear you found our forms reliable and well-structured. It’s true—what might look like an odd margin or a small field is often there for a very specific legal or recording reason. We’ve seen how small changes can lead to big headaches, which is why we design our documents to be both user-friendly and compliant with strict recording standards. We really appreciate you recognizing the care that goes into each one. Thanks again for choosing us!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

December 24th, 2020

Amazingly easy process and excellent response time - very impressed!

Thank you!

Roger W.

August 3rd, 2020

worked very good or me

Thank you Roger, have a great day!

Marlin M.

March 1st, 2025

5 stars!

Thank you!

thomas C.

July 7th, 2020

Thank you for being there for me when I couldn't get it done myself. I was a little confused with the operation at first but then became easy. I will definitely be using you again and again. Even after the pandemic is over.It's approximately 15 miles one way to downtown Orlando to do what you did for me sitting at my house

Glad we could help Thomas, have a great day!

Michael S.

September 16th, 2024

Great product and service. So convenient.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Jeannine G.

June 28th, 2021

Very helpful and just what I needed for the job I was doing.

Thank you!

Jackqueline S.

August 25th, 2020

I received my property deed quickly. All pertinent information required was received in less than 30 minutes.

Thank you for your feedback. We really appreciate it. Have a great day!

Mark R.

September 30th, 2022

All documents were site specific and up-to-date. Not recorded yet but have high hopes.

Thank you for your feedback. We really appreciate it. Have a great day!

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Sarah C.

August 18th, 2022

Great, but I'd like to see the actual filings/documents in my account, PDF, not only the blank forms. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!