Lafayette County Mortgage Secured by Promissory Note Form

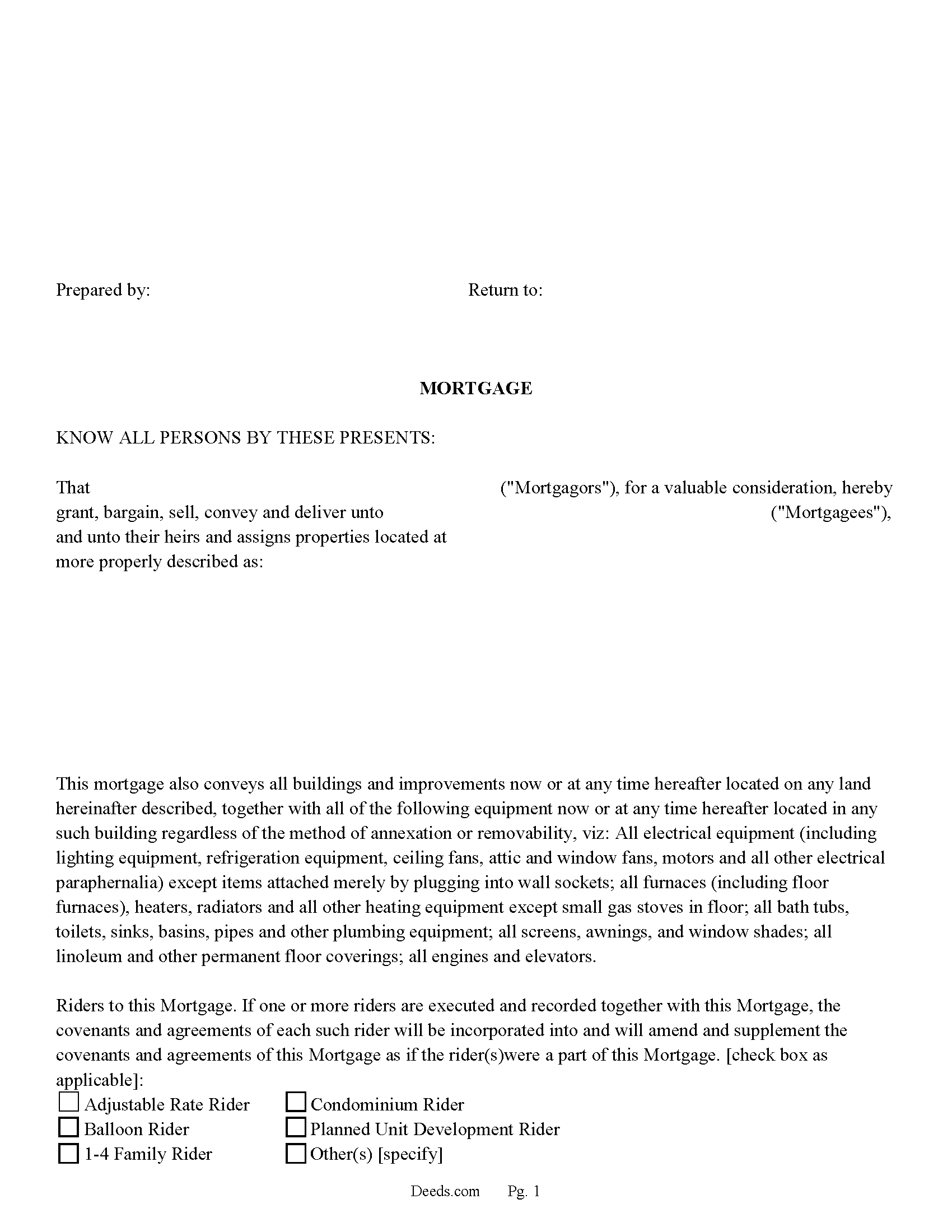

Lafayette County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

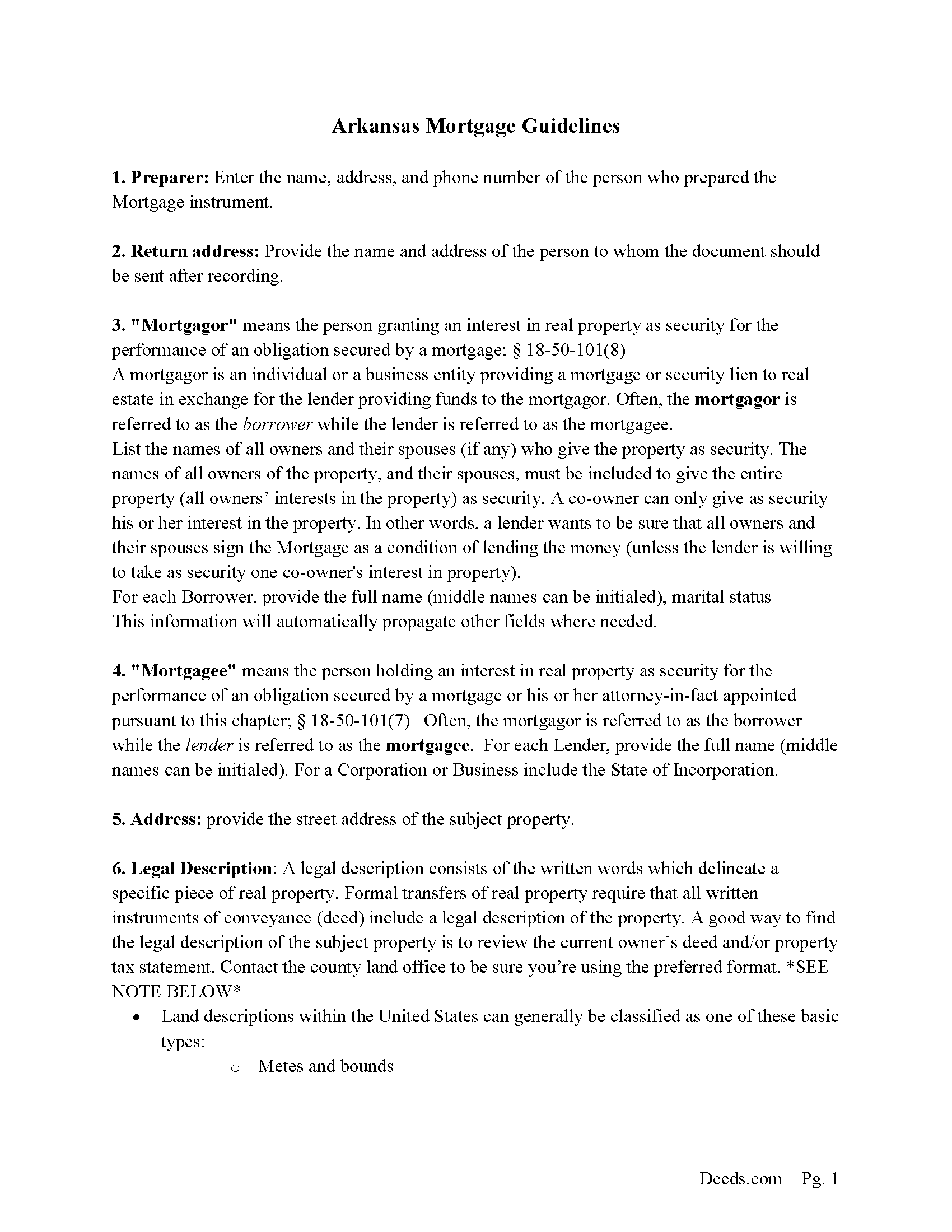

Lafayette County Mortgage Guide

Line by line guide explaining every blank on the form.

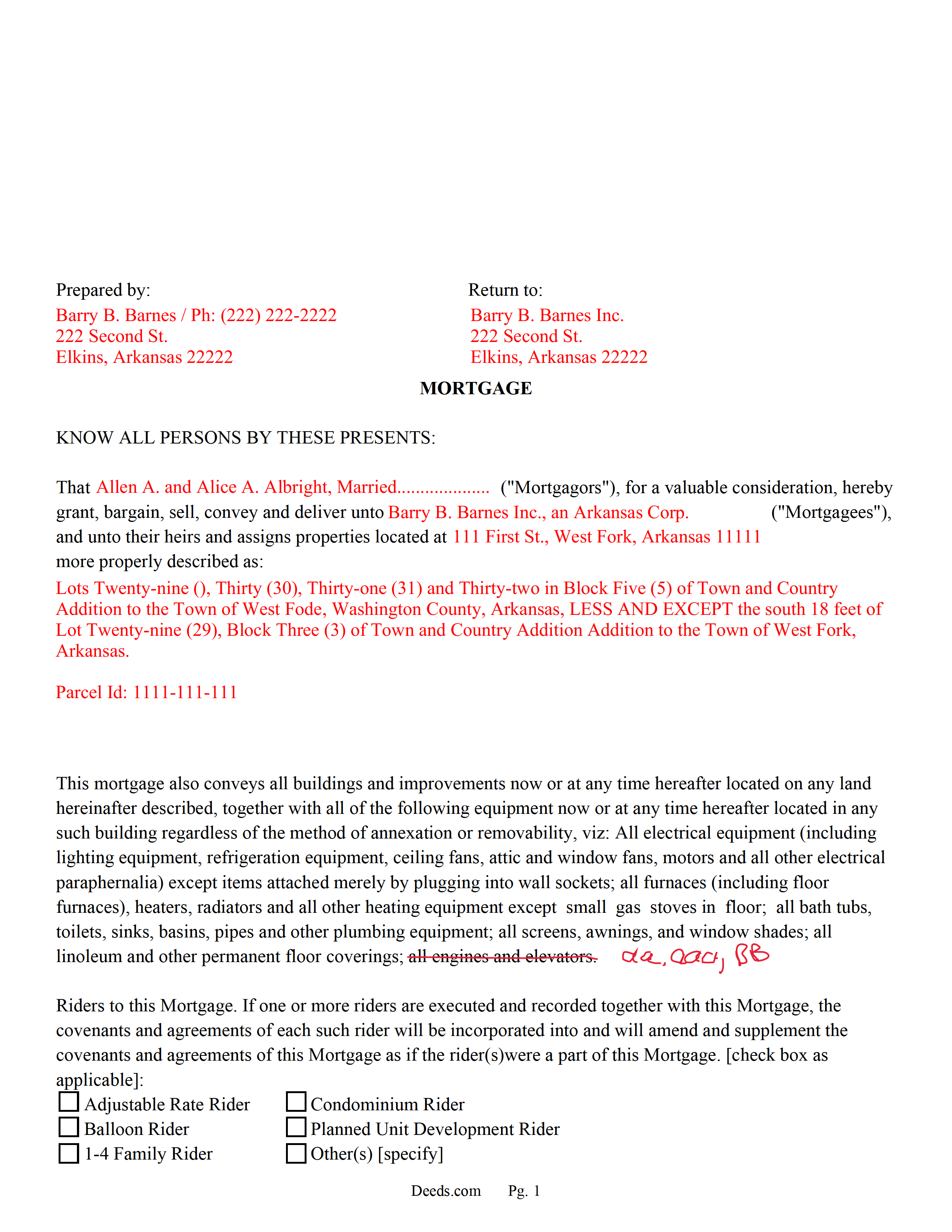

Lafayette County Completed Example of the Mortgage Document

Line by line guide explaining every blank on the form.

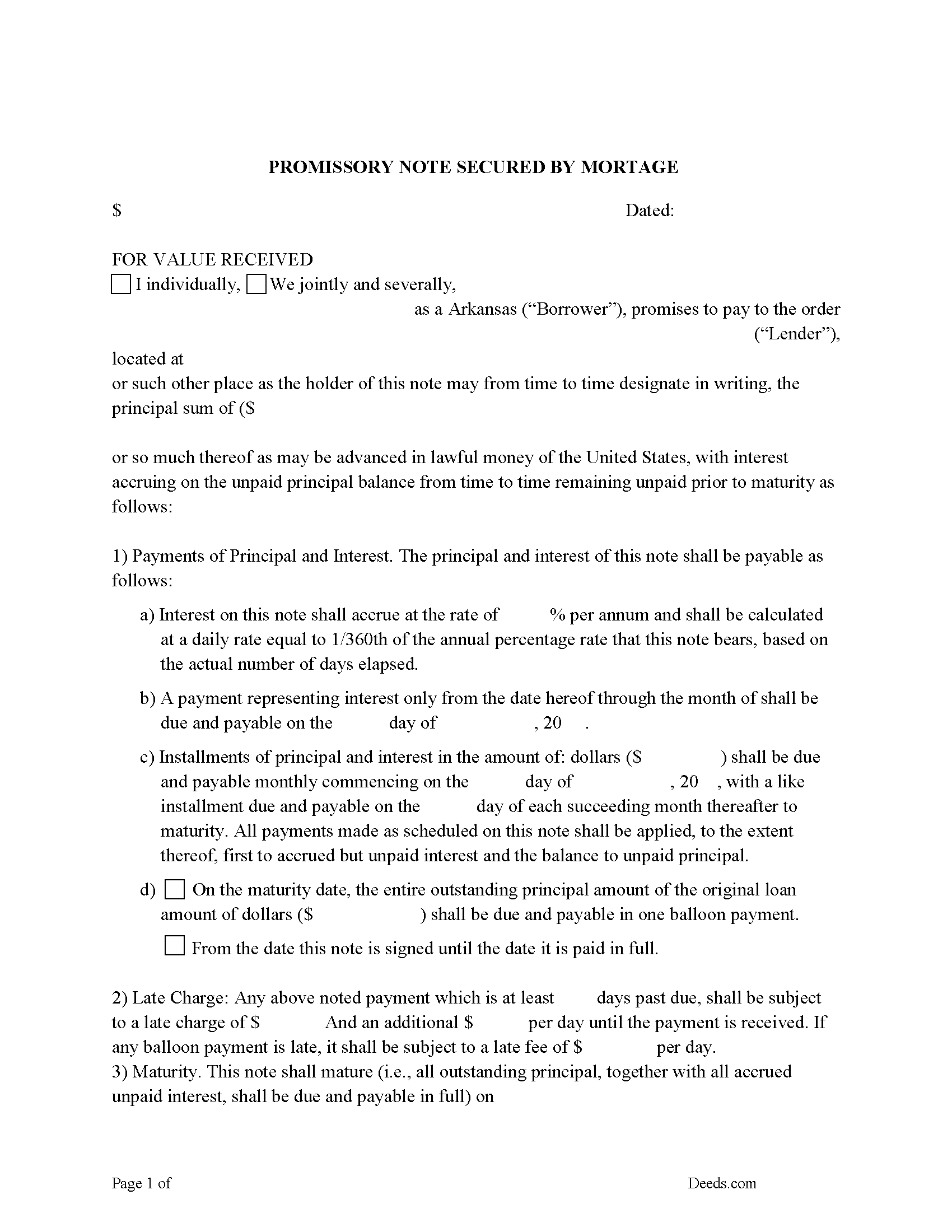

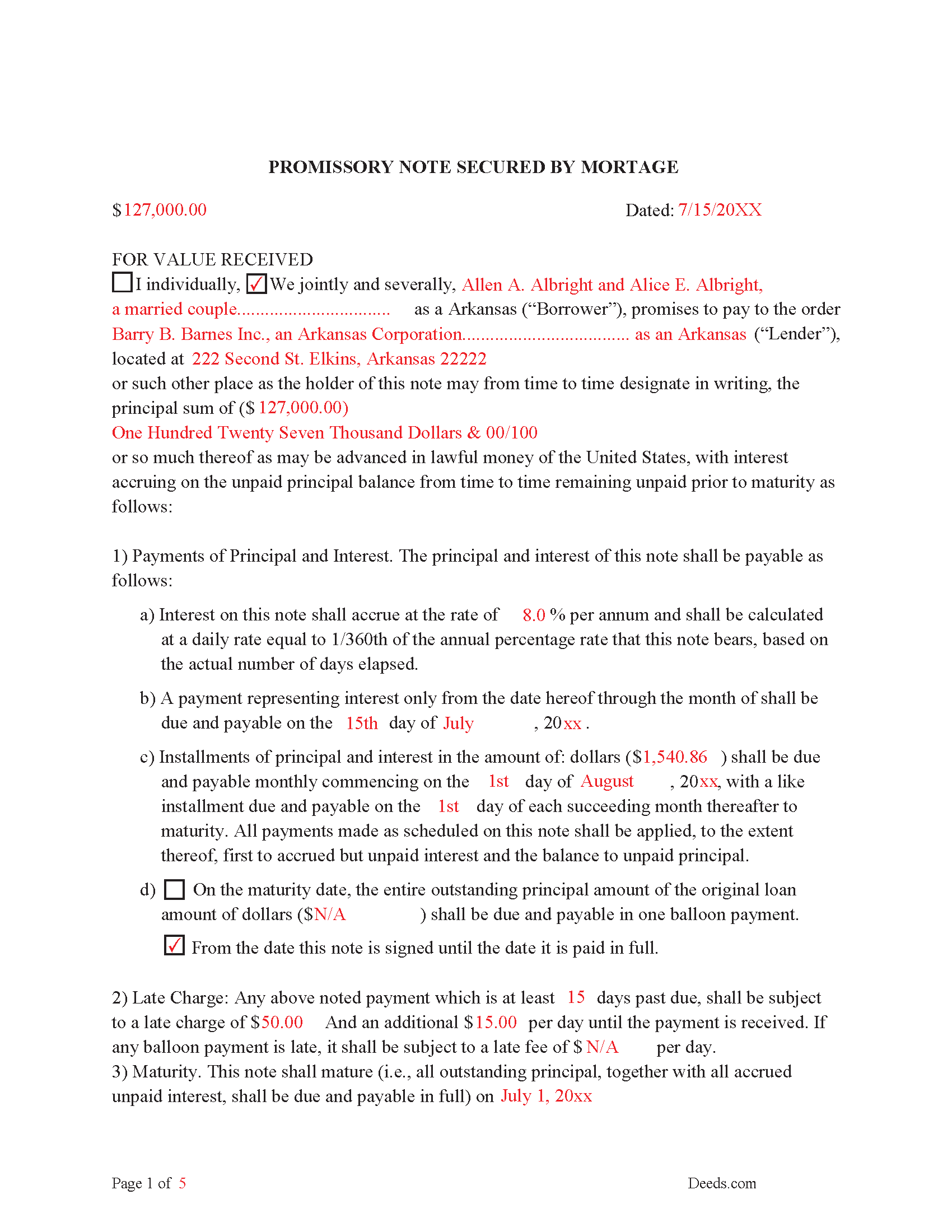

Lafayette County Promissory Note Form

Fill in the Blank Form.

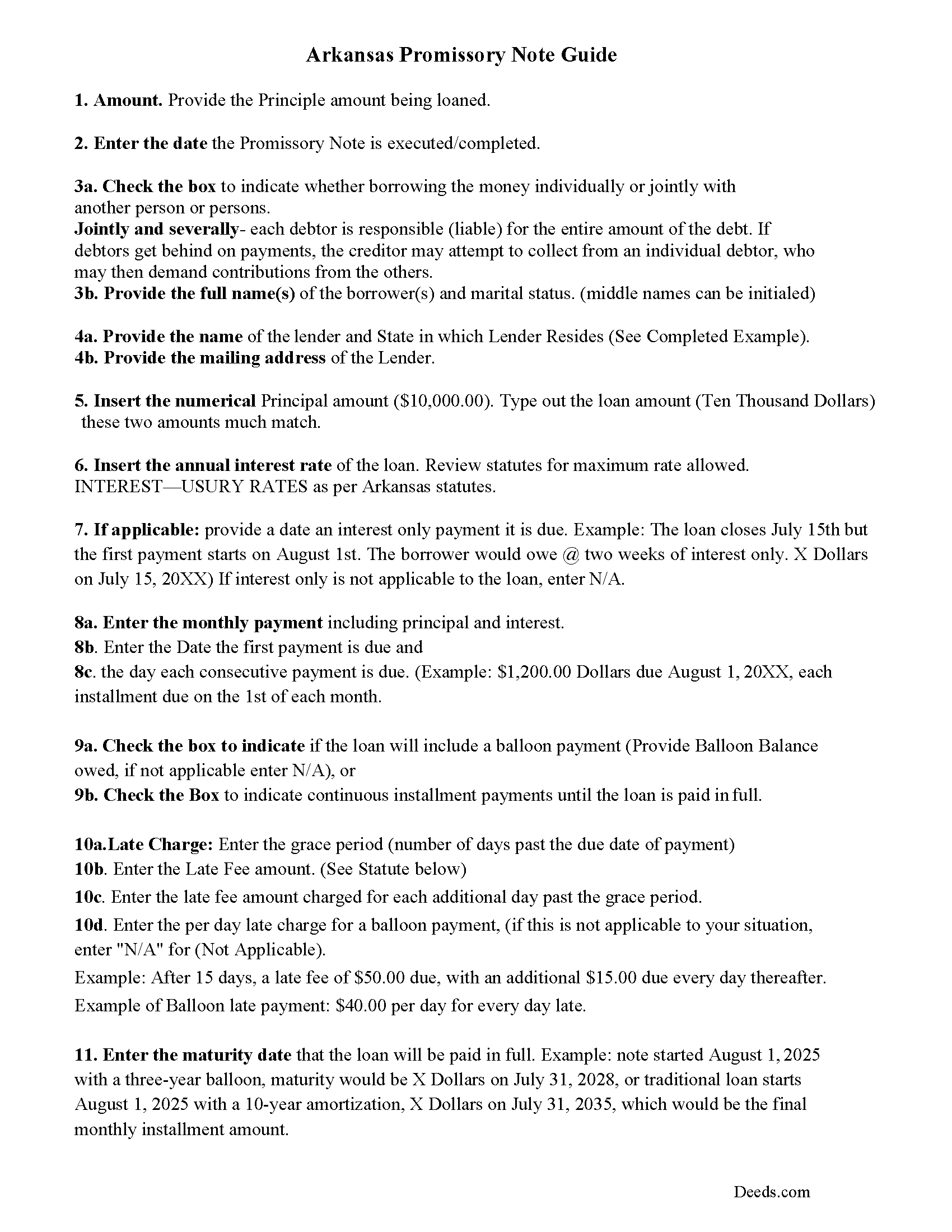

Lafayette County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Lafayette County Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

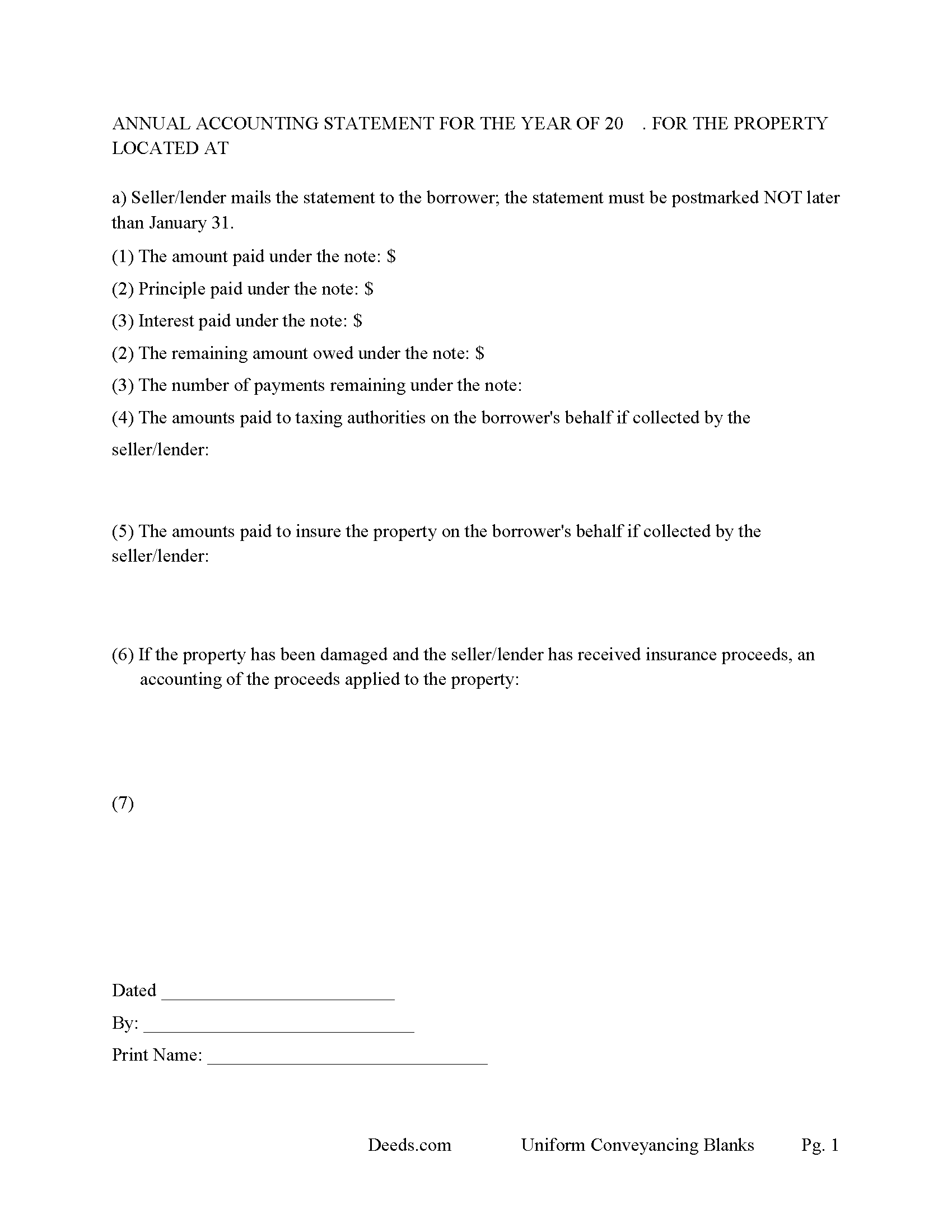

Lafayette County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Lafayette County documents included at no extra charge:

Where to Record Your Documents

Lafayette County Circuit Clerk

Lewisville, Arkansas 71845

Hours: 8:00 to 4:30 M-F

Phone: (870) 921-4878

Recording Tips for Lafayette County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Lafayette County

Properties in any of these areas use Lafayette County forms:

- Bradley

- Buckner

- Lewisville

- Stamps

Hours, fees, requirements, and more for Lafayette County

How do I get my forms?

Forms are available for immediate download after payment. The Lafayette County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lafayette County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lafayette County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lafayette County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lafayette County?

Recording fees in Lafayette County vary. Contact the recorder's office at (870) 921-4878 for current fees.

Questions answered? Let's get started!

("Mortgage" means the grant of an interest in real property to be held as security for the performance of an obligation by the mortgagor or other person.) (18-50-101 (4))

Once (filed in the recorder's office) the mortgage becomes a (lien on the mortgaged property). (The filing shall be notice to all persons of the existence of the mortgage.) (18-40-102)

The (Mortgagor)/ Borrower grants (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (8))

The (Mortgagee)/Lender holds (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (7))

The borrower must also complete a promissory note. A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. It defines the amount and specific terms of the loan between the borrower and the lender (interest rates, default rate, late payment fee, etc.), and must be completed at the same time as the security instrument. Many lenders retain the promissory note for the duration of the mortgage and return it to the borrower after the debt is repaid.

Use these forms for real property, land, single family, condominiums, small commercial and rental units (up to 4). The promissory note can be used for traditional installment and balloon payments. In Arkansas, the Mortgagor/Borrower has the right to redeem the property if it is sold through decree of the circuit court/foreclosure. (This may be done at any time within one (1) year from the date of sale). [The mortgagor may waive the right of redemption in the mortgage so executed and foreclosed.] In this form the Mortgagor/Borrower releases their right of redemption. They also relinquish their rights of homestead (if any). These terms can be beneficial to the Mortgagee/Lender if default occurs. (18-49-106 (2)) [18-49-106 (b)]

(Arkansas Mortgage Package includes forms, guidelines, and completed examples) For use in Arkansas Only.

Important: Your property must be located in Lafayette County to use these forms. Documents should be recorded at the office below.

This Mortgage Secured by Promissory Note meets all recording requirements specific to Lafayette County.

Our Promise

The documents you receive here will meet, or exceed, the Lafayette County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lafayette County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jesse K.

October 30th, 2020

Very simple to use website for remote recording of documents. I will definately use this platform for future recordings.

Thank you for your feedback. We really appreciate it. Have a great day!

Charles D.

December 14th, 2023

The included instructions and example made the document easy to complete. And the additional documents for no additional charge were nice.

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie P.

October 16th, 2021

Fantastic deed forms, formatting was spot on, nice not to have to worry about it considering how picky our clerk is. Great job you guys and gals!

Thank you for the kind words Leslie!

Galina K.

June 9th, 2023

Was fast and easy to get the forms with instructions on how to fill them out.

Thank you for the kind words Galina. We appreciate you. Have an amazing day!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

wayne s.

March 25th, 2020

Wonderful forms! Thanks for making this available.

Thank you Wayne, have a great day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Gerry C.

February 6th, 2021

Forms appear to be most current and instructions clear. Inserting grantor/grantee information onto form a bit "clunky" however no major issues. I will be using services again.

Thank you!

Jin L.

December 27th, 2019

Your service is pretty awesome! I needed to get my docs recorded before year end, and you guys were on it. Thank you very much for the quick turnaround!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARISSA G.

December 22nd, 2024

I recomemed this webside

Thank you for your feedback. We really appreciate it. Have a great day!

Archie POA G.

January 25th, 2020

got what I ordered, as expected, in good time

Thank you!

DOYCE F.

September 25th, 2019

Very helpful.Thank you

Thank you!

Gina M.

August 25th, 2021

Wow, great forms. They do have some protections in place to keep you from doing something stupid but if you use the forms as intended they will work perfectly for you.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann E Grace S.

June 22nd, 2021

Forms and instructions are very easy to access. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Suzette D.

February 20th, 2020

easy to use and gave examples!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!