Montgomery County Notice to Owner Form

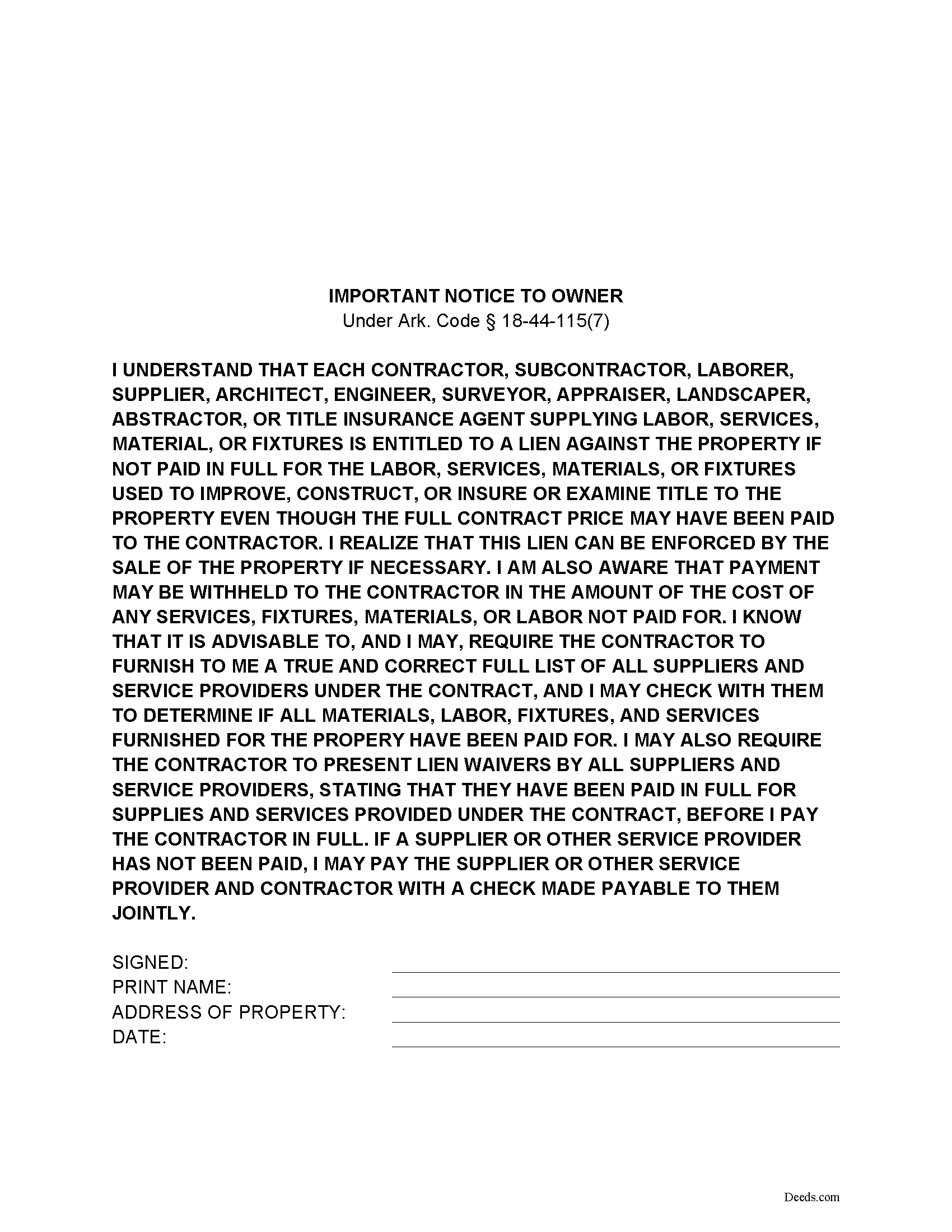

Montgomery County Notice to Owner

Fill in the blank form formatted to comply with all recording and content requirements.

Montgomery County Notice to Owner Guide

Line by line guide explaining every blank on the form.

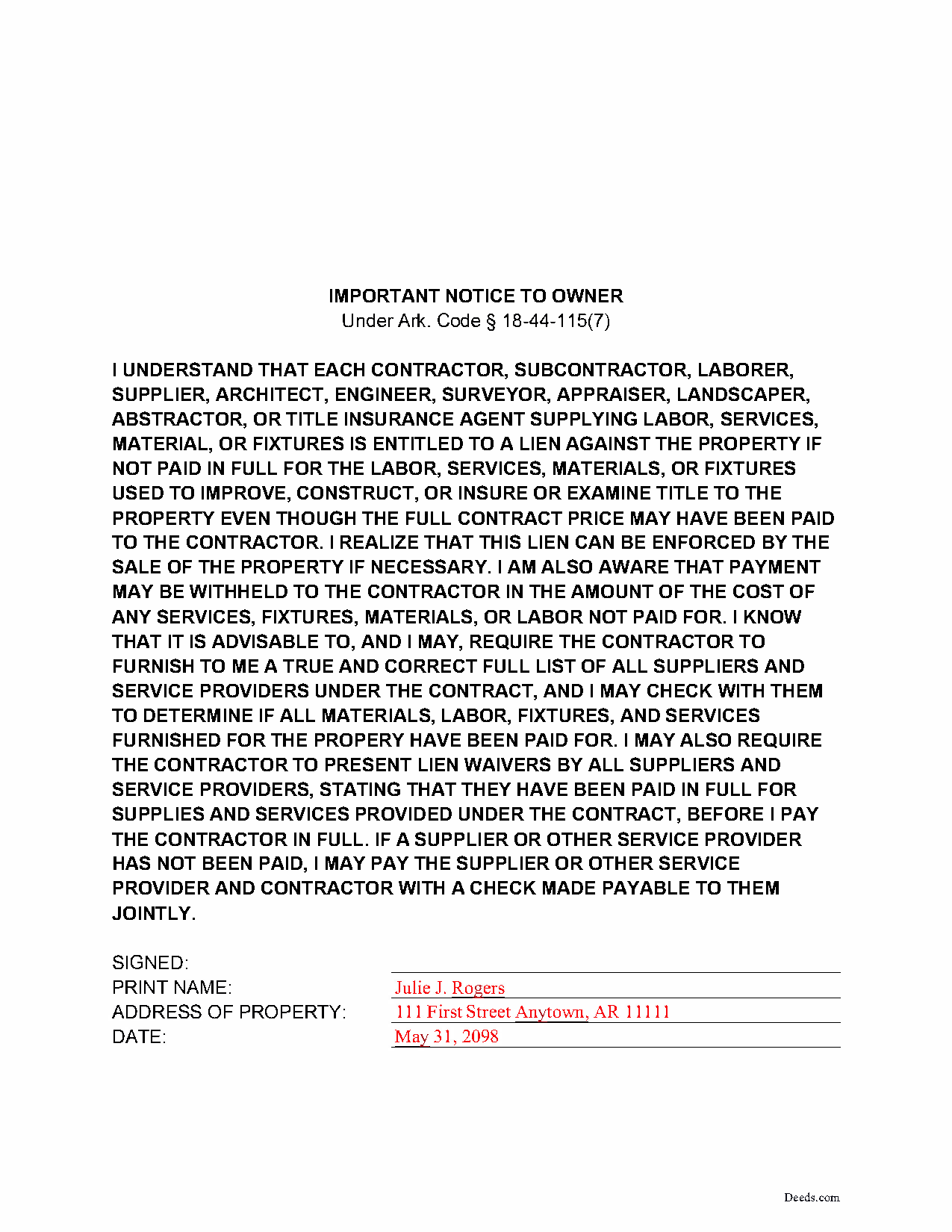

Montgomery County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Montgomery County documents included at no extra charge:

Where to Record Your Documents

Circuit and County Clerk

Mount Ida, Arkansas 71957

Hours: 8:00am to 4:30pm M-F

Phone: (870) 867-3521

Recording Tips for Montgomery County:

- Check that your notary's commission hasn't expired

- Recording fees may differ from what's posted online - verify current rates

- Have the property address and parcel number ready

Cities and Jurisdictions in Montgomery County

Properties in any of these areas use Montgomery County forms:

- Caddo Gap

- Mount Ida

- Norman

- Oden

- Pencil Bluff

- Sims

- Story

Hours, fees, requirements, and more for Montgomery County

How do I get my forms?

Forms are available for immediate download after payment. The Montgomery County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Montgomery County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Montgomery County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Montgomery County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Montgomery County?

Recording fees in Montgomery County vary. Contact the recorder's office at (870) 867-3521 for current fees.

Questions answered? Let's get started!

The Notice to Owner by Claimant under Ark. Code Sec. 18-44-115 is a preliminary notice that must be delivered to the owner prior to commencing construction under a contract.

The notice states that contractors, subcontractors, suppliers, and other parties supplying labor, services, materials, or fixtures for the improvement of real property under a contract with the owner are entitled to a lien against the property if not paid in full for their services. It also states that the owner is entitled to ask the contractor for a list of all suppliers and service providers under the contract, the receipt of which allows the owner to determine that all materials, labor, fixtures, and services have been paid for. Without delivering this notice, a potential claimant forfeits its right to file a lien against the property.

Typically, this notice is made part of the contract. However, when the owner does not reside in the same county or state as the property under contract, the claimant can record the notice in the property records of the circuit court clerk's office where the subject property is located (Ark. Code Sec. 18-44-116).

The document should contain the address of the property and the date of signing and comply with the standardized document form act, codified at Ark. Code Sec. 14-15-402.

The notice is signed by the owner as evidence that he or she has received the notice from the potential claimant. Arkansas law does not require the notice to be notarized. The contractor also signs the notice certifying that the owner has received the notice and that the owner or owner's agent's signature appears on the notice.

This notice is not required if the contractor supplies a bond or if the transaction is a direct sale to the property owner (as in, the property owner orders materials or services from the lien claimant) (18-44-115(a)(8)).

Consult a lawyer with questions about preliminary lien notices or mechanic's liens in the State of Arkansas.

Important: Your property must be located in Montgomery County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Montgomery County.

Our Promise

The documents you receive here will meet, or exceed, the Montgomery County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Montgomery County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Rebecca G.

May 25th, 2022

Very user friendly. Forms professional and acceptable to state applicable to. Appreciate the sample & instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Joseh R.

May 6th, 2020

Very pleased! Forms easy to understand and use. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Gary M.

February 13th, 2024

This was such an easy experience

We are grateful for your feedback and looking forward to serving you again. Thank you!

Wayne A.

June 10th, 2021

good service but pricey.

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia S.

May 24th, 2025

Thank you for making my life easier!!

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa C.

December 5th, 2023

Thank you. Very easy!

We are delighted to have been of service. Thank you for the positive review!

Maria S.

January 10th, 2019

The paperwork/forms are fine, but there isn't enough explanation for me to figure out how to file the extra forms (which I do need in my case). The main form, Deed Upon Death is fine. I think the price is pretty high for these forms. I wouldn't have purchased it because there are places to get them for much cheaper (about 6 dollars), but this site had the extra forms I wanted (property in a trust and another form). Unfortunately these were included as a "courtesy" and there are no instructions for them. So three stars for being clear about what was in the package, having the right forms that I need, but instructions for putting them to use and price took a couple of stars off. Downloading was easy and once you download you can type the info into the PDF--that makes working with the forms much easier.

Thank you for the feedback Maria. Regarding the supplement documents, it is best to get assistance from the agency that requires them. These are not legal documents, they should provide full support and guidance for them.

William J. T.

July 9th, 2019

Satisfied with downloaded documents.

Thank you!

Robert B.

August 14th, 2021

The forms were easy to download and fill.

Thank you!

Karen C.

April 6th, 2020

Very easy site to use and reasonably priced. My document was received by the county and filed within 1/2 hour.

Thank you for your feedback. We really appreciate it. Have a great day!

Connie E.

December 25th, 2018

Great service! Easy to download and view. Florida should have the Revocable Transfer on Death (TOD)deed, that many other States have. That's the one I really wanted. This one will do in the meantime.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hugh B R.

February 24th, 2021

Very user friendly and fast. Pleasure using this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Vertina B.

June 14th, 2022

The website is well established and easy to use. I got everything I was supposed to get. I had no problem downloading the forms. All of the forms printed well.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patricia M.

August 19th, 2019

Very easy site to navigate and very helpful information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!