Santa Barbara County Affidavit of Surviving Spouse Form

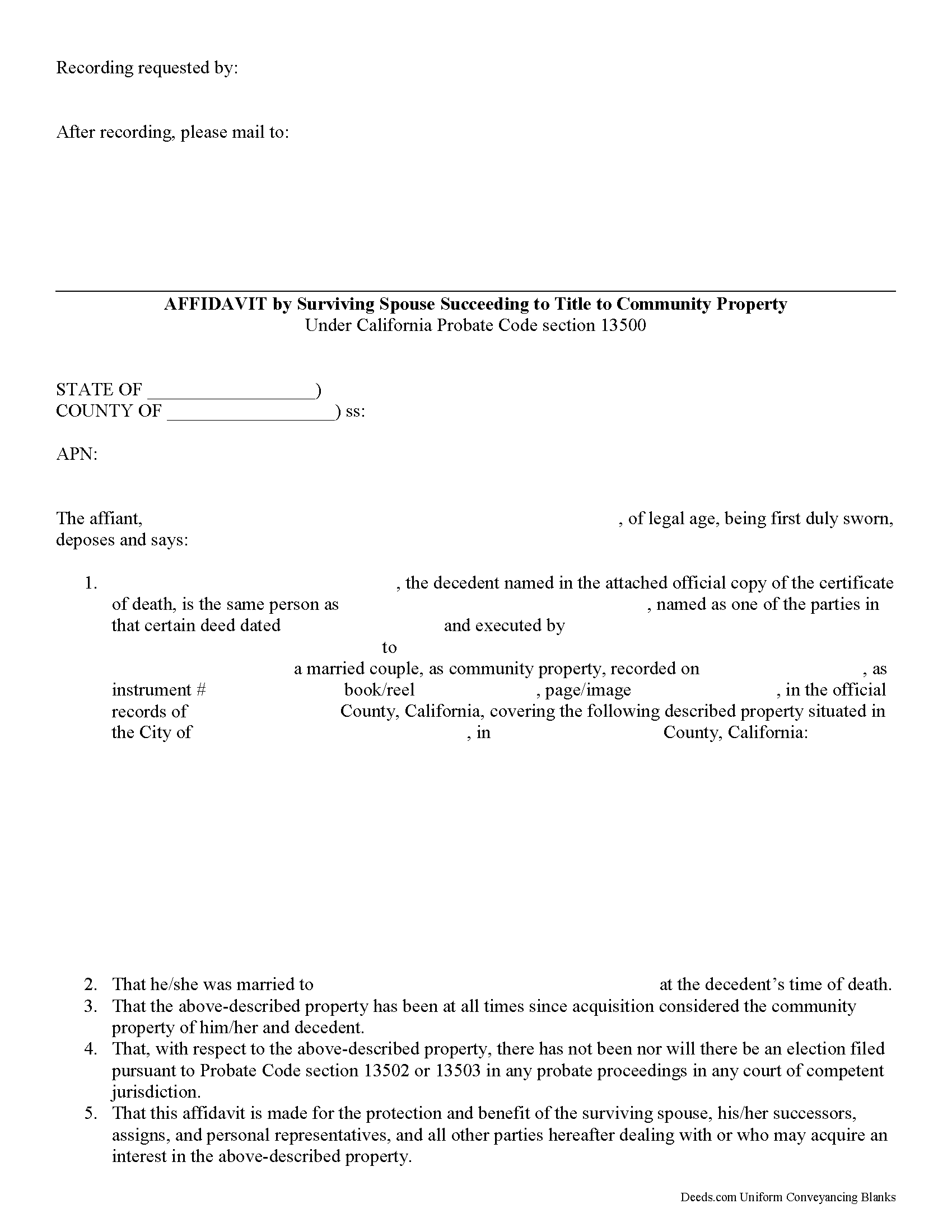

Santa Barbara County Affidavit of Surviving Spouse Form

Fill in the blank form formatted to comply with all recording and content requirements.

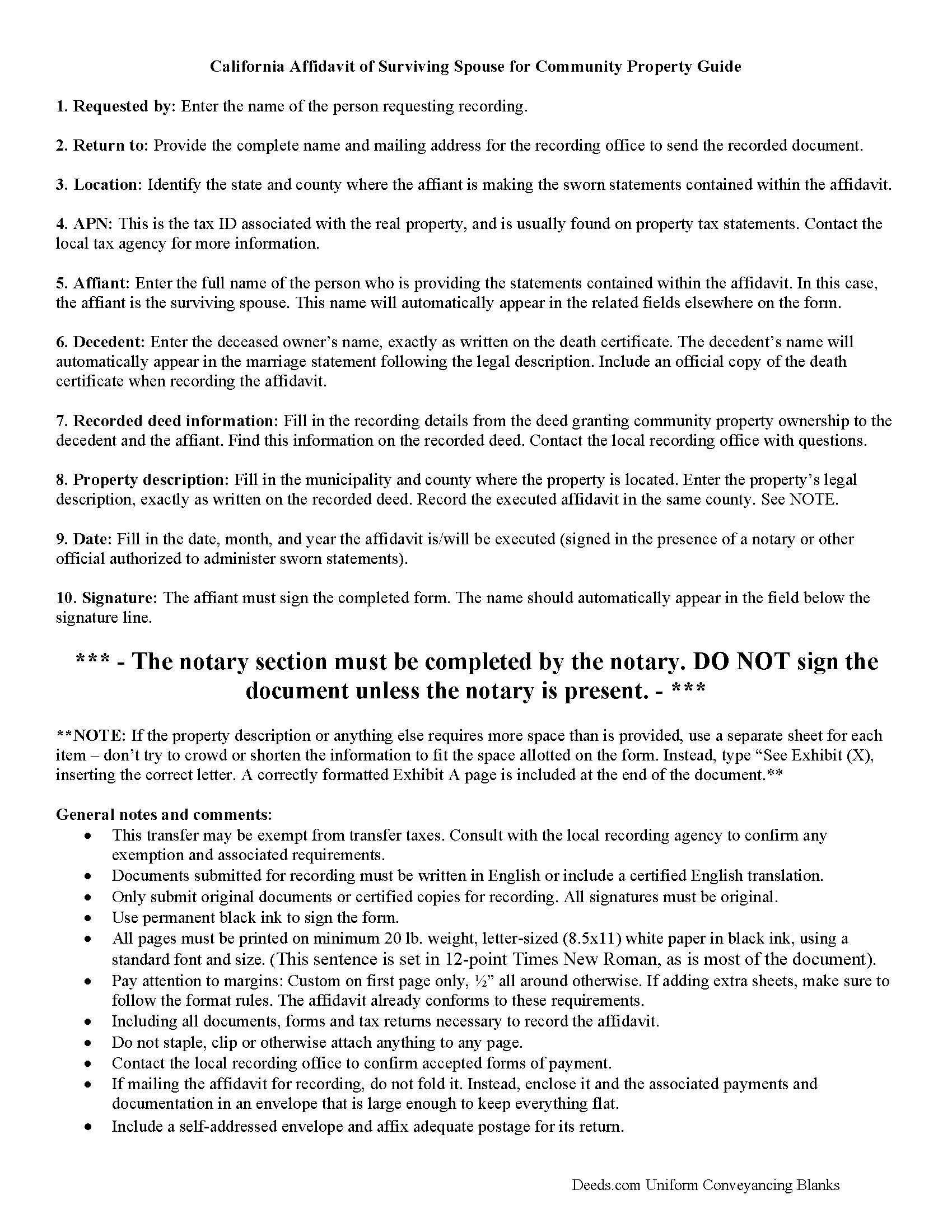

Santa Barbara County Affidavit of Surviving Spouse Guide

Line by line guide explaining every blank on the form.

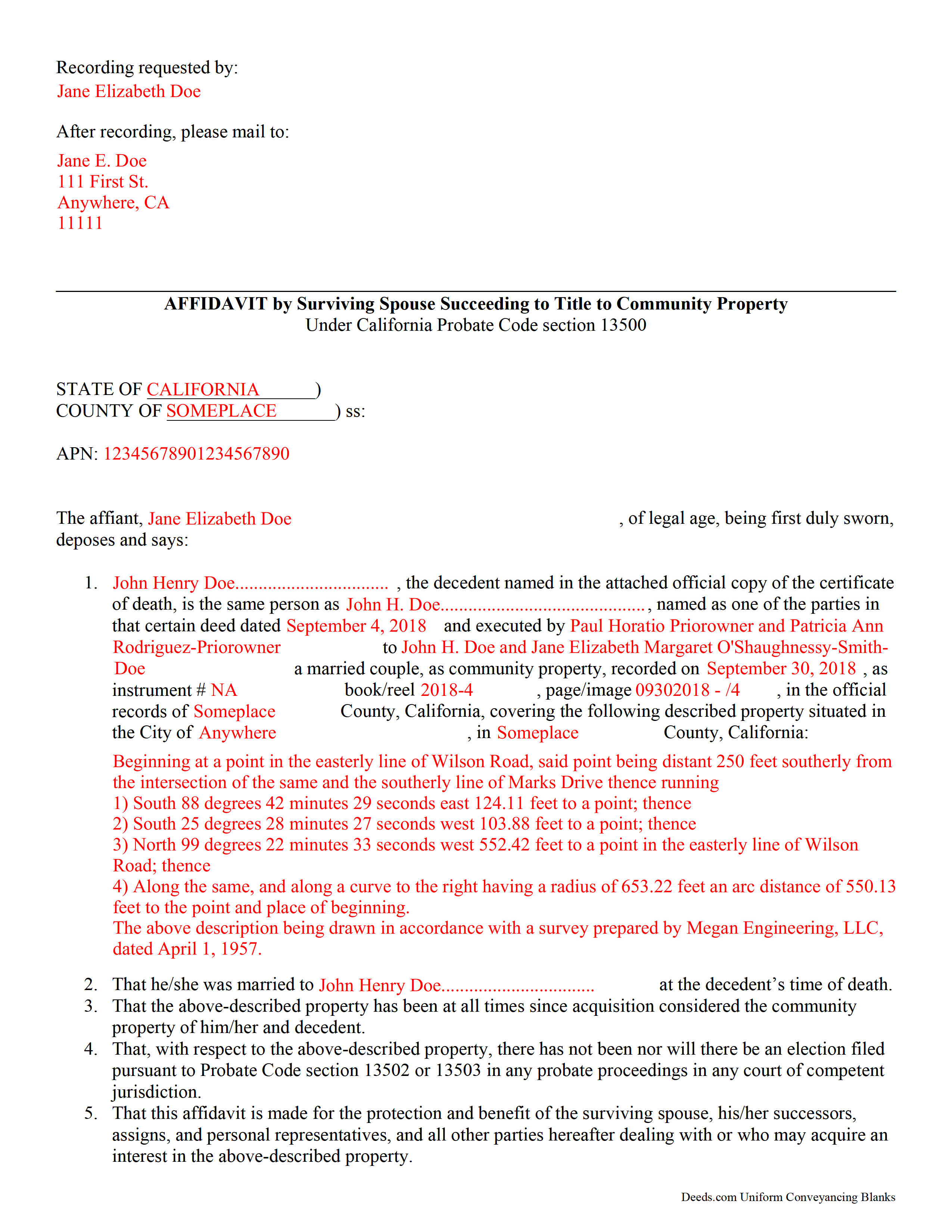

Santa Barbara County Completed Example of the Affidavit of Surviving Spouse Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Santa Barbara County documents included at no extra charge:

Where to Record Your Documents

Lompoc

Lompoc, California 93436

Hours: Monday, Wednesday, Friday: 9:00am - 12:00 & 1:00 - 4:00pm

Phone: (805) 737-7705

Santa Maria

Santa Maria, California 93455-1341

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (805) 346-8370

Hall of Records & Mailing Address

Santa Barbara, California 93101

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (805) 568-2250

Recording Tips for Santa Barbara County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Ask for certified copies if you need them for other transactions

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Santa Barbara County

Properties in any of these areas use Santa Barbara County forms:

- Buellton

- Carpinteria

- Casmalia

- Goleta

- Guadalupe

- Lompoc

- Los Alamos

- Los Olivos

- New Cuyama

- Santa Barbara

- Santa Maria

- Santa Ynez

- Solvang

- Summerland

Hours, fees, requirements, and more for Santa Barbara County

How do I get my forms?

Forms are available for immediate download after payment. The Santa Barbara County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Santa Barbara County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Barbara County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Santa Barbara County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Santa Barbara County?

Recording fees in Santa Barbara County vary. Contact the recorder's office at (805) 737-7705 for current fees.

Questions answered? Let's get started!

Transferring California Community Property to the Surviving Spouse

Section 100(a) of the California Probate Code states that when a married person dies, one-half of the couple's community property belongs to the surviving spouse and the other half stays in the decedent's name, ostensibly for probate distribution. For transfers occurring after July 1, 2001, California property owners gained the option to hold title as community property with the right of survivorship. By vesting this way, the remaining spouse acquires the deceased spouse's portion of the shared property without the need for probate (Cal Civ Code 682.1(a)).

The surviving spouse files an affidavit (a statement of facts, made under oath), along with an official copy of the death certificate, at the recording office for the county where the property is located. The content may vary depending on the circumstances, but it generally contains the names of both spouses, a formal legal description of the shared real estate, and the recording information for the deed transferring ownership to the couple, confirming their intention to hold title as community property. Note that the right of survivorship is not automatic with community property -- it must be written on the face of the deed. To alleviate any questions about the survivorship status, consider including an official copy of the recorded deed.

The affidavit should also confirm, among other things, that the co-owners were married when the decedent died, that there are no probate actions related to the property, and that the surviving spouse is submitting the affidavit to ensure clear title. A clear title is important because it makes future transactions involving the real estate less complicated.

Each case is unique, so contact an attorney with specific questions or for complex situations.

(California Affidavit of Surviving Spouse Package includes form, guidelines, and completed example)

Important: Your property must be located in Santa Barbara County to use these forms. Documents should be recorded at the office below.

This Affidavit of Surviving Spouse meets all recording requirements specific to Santa Barbara County.

Our Promise

The documents you receive here will meet, or exceed, the Santa Barbara County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Barbara County Affidavit of Surviving Spouse form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Kate J.

January 10th, 2022

Easy to use.

Thank you!

Steve M.

January 24th, 2020

I was only able to download the QC form. Had to print the other docs

Thank you for your feedback. We really appreciate it. Have a great day!

scott m.

February 21st, 2021

thanks- easy as pie.

Thank you!

Thelma S.

October 5th, 2019

So easy to navigate.

Thank you!

Denise B.

May 10th, 2019

I highly recommend Deeds.com to be your go-to search website. I was able to get the information that I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Laurentina F.

December 10th, 2020

Great and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dan L.

May 31st, 2024

The only suggestion I have is to include sample of putting quitclaim into a revocable trust.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Martin P.

April 6th, 2019

The DEEDs website is very easy to navigate and find the required documents. I have not yet had an opportunity to review the documents I purchased and downloaded. That is the reason I have assigned a rating of four stars. I fully hope that can raise my rating to five stars after I've used those documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

February 23rd, 2021

Thanks again for such excellent service, and always a pleasure!

Thank you!

Bobette B.

September 26th, 2019

Worked well with clear guide!

Thank you!

Wilma E.

July 18th, 2022

Very satisfied with service and form. Completed form, printed, and submitted to county for processing. Everything went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth C.

September 23rd, 2020

Very happy, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rosie M.

March 13th, 2025

I found exactly what I was looking for, and the documents are a complete package. Great service!

Thank you, Rosie! We're so glad you found exactly what you needed and that the documents met your expectations. We appreciate your kind words and your support! If you ever need anything else, we're here to help.

ian a.

September 28th, 2022

Your website advertising was somewhat deceptive regarding doing a quitclaim on a name change. "If you are transferring the property to yourself under your new name, all you have to do is update the deed from your former name to your current one." This made this sound easy. But when I downloaded the material for my state, expecting to find an example, there was no example of how to do a name change quitclaim deed! I therefore had to figure this out myself. You might have provided a warning about certain uses that were not covered in the material so that people know ahead of time that the use they needed to know about wasn't covered in the material.

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT H.

September 13th, 2020

Quick and easy. A very good value even without COVID complications. Since we DO have COVID complications this is perfect.

Thank you for your feedback. We really appreciate it. Have a great day!