Monterey County Deed Corrective Affidavit Form

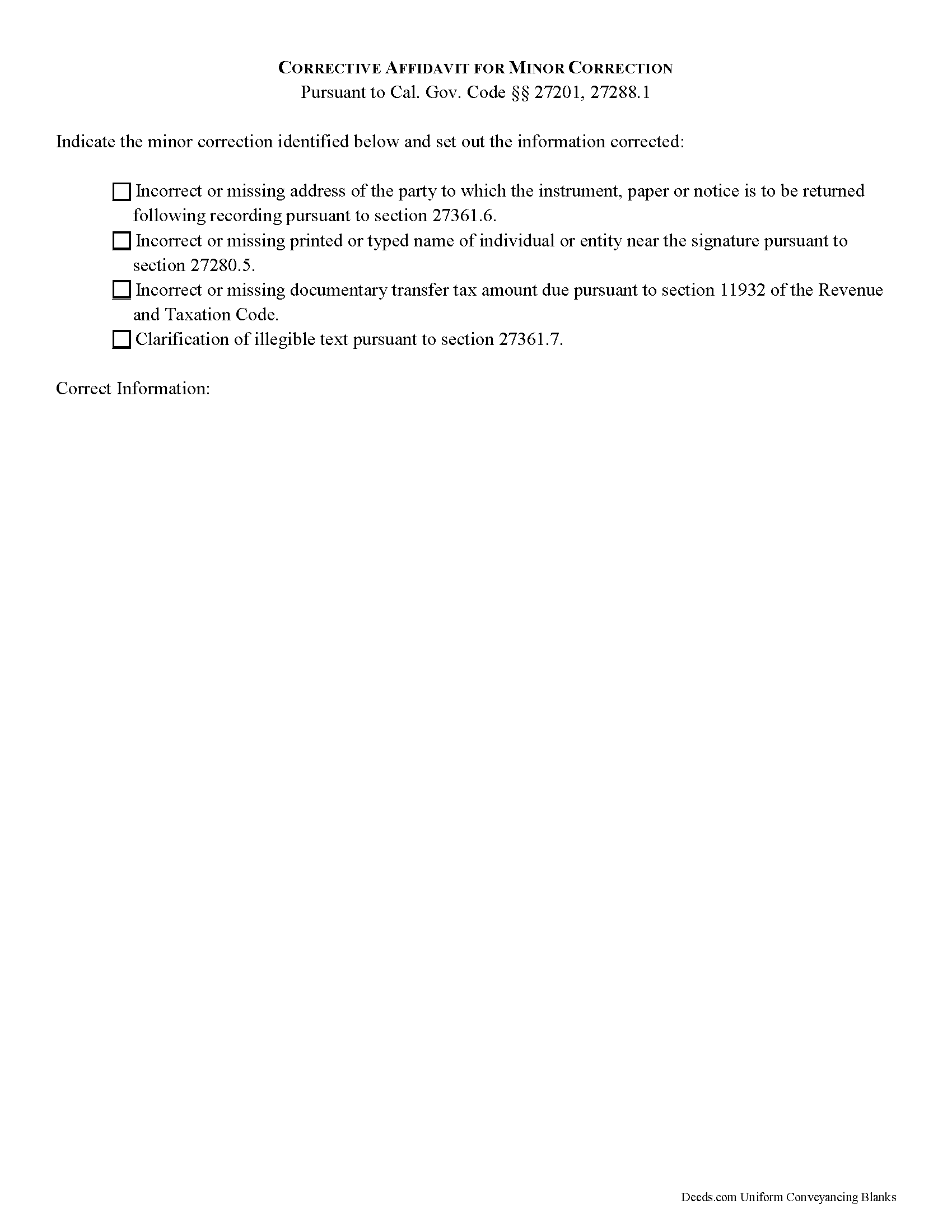

Monterey County Corrective Affidavit for Minor Correction Form

Fill in the blank form formatted to comply with all recording and content requirements.

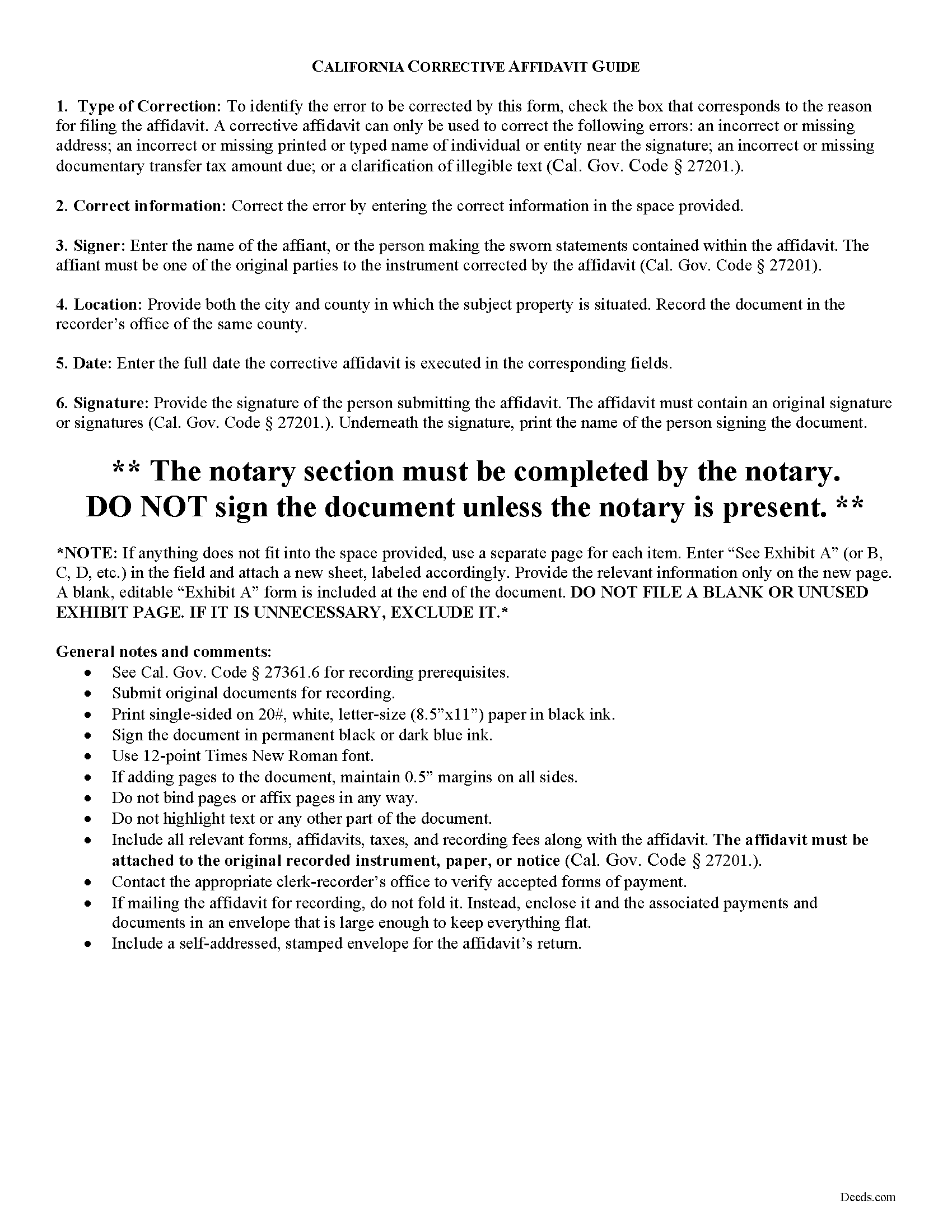

Monterey County Corrective Affidavit Guide

Line by line guide explaining every blank on the form.

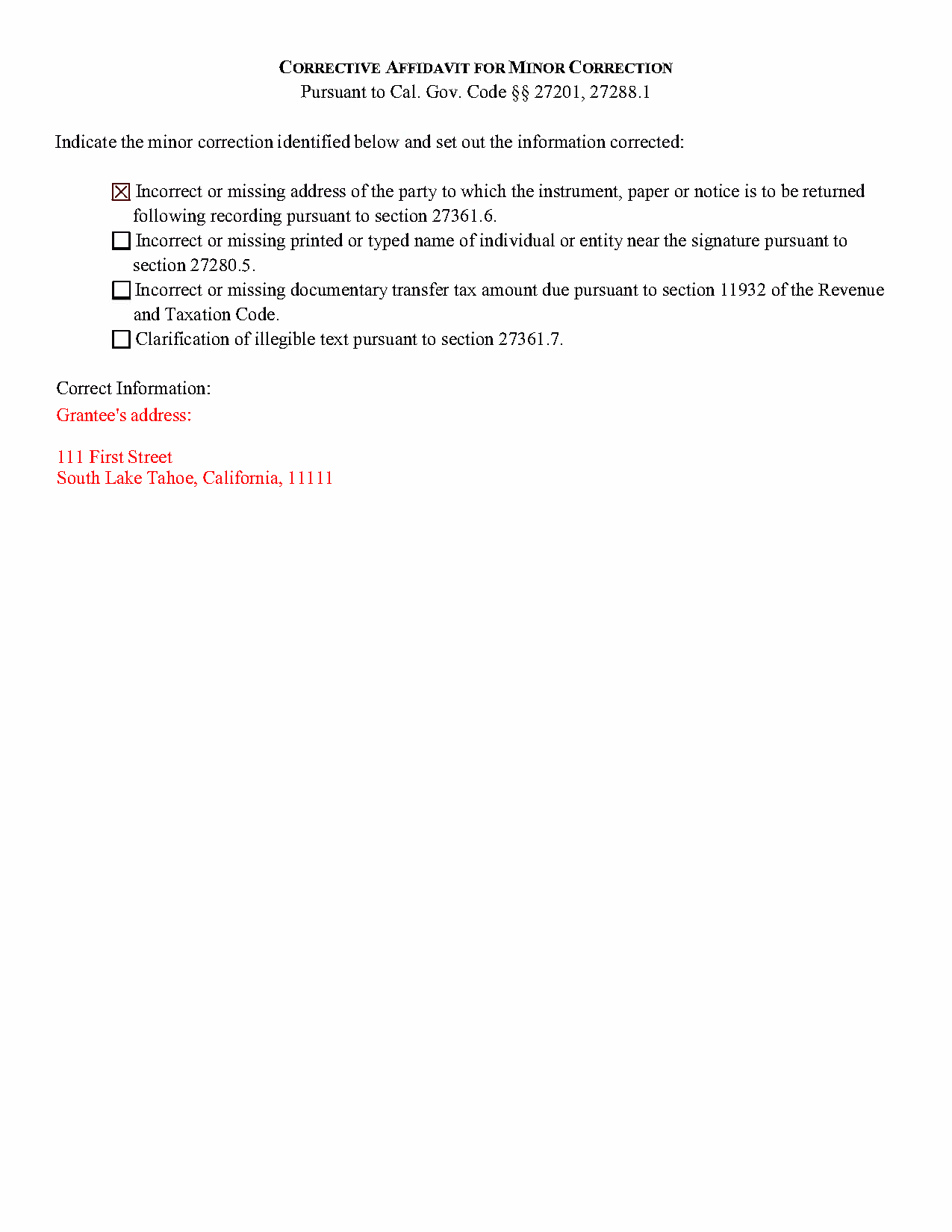

Monterey County Completed Example of the Corrective Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Monterey County documents included at no extra charge:

Where to Record Your Documents

Assessor/Recorder/County Clerk

Salinas, California 93902-0570

Hours: Mon-Fri 8:00 am to 5:00 pm / Recording until 4:00 pm

Phone: (831) 755-5041 or toll free from peninsula (831) 647-77

Recording Tips for Monterey County:

- Bring extra funds - fees can vary by document type and page count

- Both spouses typically need to sign if property is jointly owned

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Monterey County

Properties in any of these areas use Monterey County forms:

- Aromas

- Big Sur

- Bradley

- Carmel

- Carmel By The Sea

- Carmel Valley

- Castroville

- Chualar

- Gonzales

- Greenfield

- Jolon

- King City

- Lockwood

- Marina

- Monterey

- Moss Landing

- Pacific Grove

- Pebble Beach

- Salinas

- San Ardo

- San Lucas

- Seaside

- Soledad

- Spreckels

Hours, fees, requirements, and more for Monterey County

How do I get my forms?

Forms are available for immediate download after payment. The Monterey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Monterey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Monterey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Monterey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Monterey County?

Recording fees in Monterey County vary. Contact the recorder's office at (831) 755-5041 or toll free from peninsula (831) 647-77 for current fees.

Questions answered? Let's get started!

Corrective Affidavits in California

Typically, any rerecorded document must be resigned and acknowledged as a new document. However, an erroneous document will not be recorded as a new document if it is presented with a corrective affidavit (Cal. Gov. Code 27201.). A corrective affidavit is a statutory device under Cal. Gov. Code 27201, used to correct a minor error in a document that has been recorded at an earlier date.

Minor errors are those that, when corrected, cause no actual change in the substance of the document. Section 27201 of the Government Code states that a corrective affidavit can only be used to correct the following: an incorrect or missing return address; a clarification of illegible text; an incorrect or missing printed or typed name near the signature; or an incorrect or missing documentary transfer tax amount due.

More extensive corrections to recorded documents typically require a new deed. Adding or removing a grantee, for example, or making material changes to the legal description, may all require a new document of conveyance. When in doubt about the appropriate vehicle to address the error, consult with a lawyer.

A correction deed is exempt from transfer tax because no transfer is being made, and no consideration is exchanged (Cal. Rev. and Tax. Code 11911). Some counties demand a documentary transfer tax affidavit stating the reason for the exemption, to be filed in addition to the other documents being recorded, so check the county recorder's website to confirm any local requirements.

For the correction to be valid, the affidavit must be attached to the original recorded document with a cover sheet complying with Cal. Gov. Code 27361.6, stating the reason for rerecording on the cover sheet, by the person who submitted the original document for recording (Cal. Gov. Code 27201.).

The affidavit itself must include the information corrected, be certified by the party submitting the affidavit under penalty of perjury, and be acknowledged pursuant to Cal. Gov. Code 27287. The affidavit can be acknowledged by any one of the officials listed in Cal. Civ. Code 1181. Finally, the form must meet all state and local standards for recorded documents. Submit the completed affidavit, along with any necessary supporting materials, to the local recording office to correct and update the public data.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about corrective affidavits, or for any other issues related to real property in California.

(California Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Monterey County to use these forms. Documents should be recorded at the office below.

This Deed Corrective Affidavit meets all recording requirements specific to Monterey County.

Our Promise

The documents you receive here will meet, or exceed, the Monterey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Monterey County Deed Corrective Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Marilyn C.

August 18th, 2021

A great service, making it fast and easy to prepare warranty deeds for property transfer sales. I recommend this to everyone who needs this help.

Thank you!

Ronald W.

July 23rd, 2021

Easy to use and very helpful

Thank you!

Joyce D.

October 29th, 2021

Great service. Fast and efficient.

Thank you!

Ed H.

June 28th, 2025

I filled out the Kansas form and presented it to the Clerk of Deeds in Rawlins Co and there were no problems and no expensive attorney involved for a simple transaction.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Elizabeth W.

February 9th, 2023

would have been smart to give each pdf a name instead of unintelligible numbers...

Thank you for your feedback. We really appreciate it. Have a great day!

matt k.

March 16th, 2022

you guys/girls are the bestest..

Thank you!

STANLEY F.

March 25th, 2019

Forms were spot on and able to save over $100 by not going to an attorney to complete the same documents. There were templates on how forms are supposed to be completed. You just need a notary to sign.

Thank you Stanley, we really appreciate your feedback.

Brian W.

February 1st, 2020

Easy, but it would be nice if there was an option for font size. It looks tiny, like 6 or 8.

Thank you for your feedback. We really appreciate it. Have a great day!

Harry W B.

January 11th, 2021

This is a very valuable resource. It was user friendly and made transfer happen in a day!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Colleen P.

May 4th, 2020

It was frustrating to get the scans done but that might have been due to a learning curve. After 4 tries they were accepted. I couldn't figure out how to delete or close the failed attempts. Waiting to see if Recorder office has changed the title.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

September 3rd, 2021

The website was very easy to work. The documents were just what I needed and everything that my state and county required.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christopher G.

August 20th, 2020

thank you - your service is awesome - i sent documents to the county - after 2 plus weeks they returned them with 'errors' - i went to your site - signed up - uploaded documents and submitted in less than 3 minutes - had it approved by the county in under 12 hours - THANK YOU - great service!!!!

Thank you Christopher, glad we could help. Have a great day!

Richard S.

August 13th, 2020

Not user friendly, and not an Adobe fan. The first page of Quitclaim Deed form cuts off the Parcel Identification line on the bottom. Also quite a few forms showed up to be downloaded , after I paid, so I was unsure if all the forms were part of the quitclaim package. I have adobe but was unable to locate the forms in adobe on my computer after I downloaded them. Just wanted to print out one quitclaim deed form, which would have taken less that 3 minutes. instead it took 97 minutes. Thank you, though, for having the form there.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly F.

April 22nd, 2020

Ordered and received the quitclaim form. Exactly what I expected, perfect.

Thank you for your feedback. We really appreciate it. Have a great day!

Dana Y.

October 22nd, 2019

Purchased and used the quitclaim form. I have no complaints with any aspect. The forms, instructions, and example all came together to make the process very easy.

Thank you Dana. Have a great day!