Marin County Long Form Deed of Trust Form

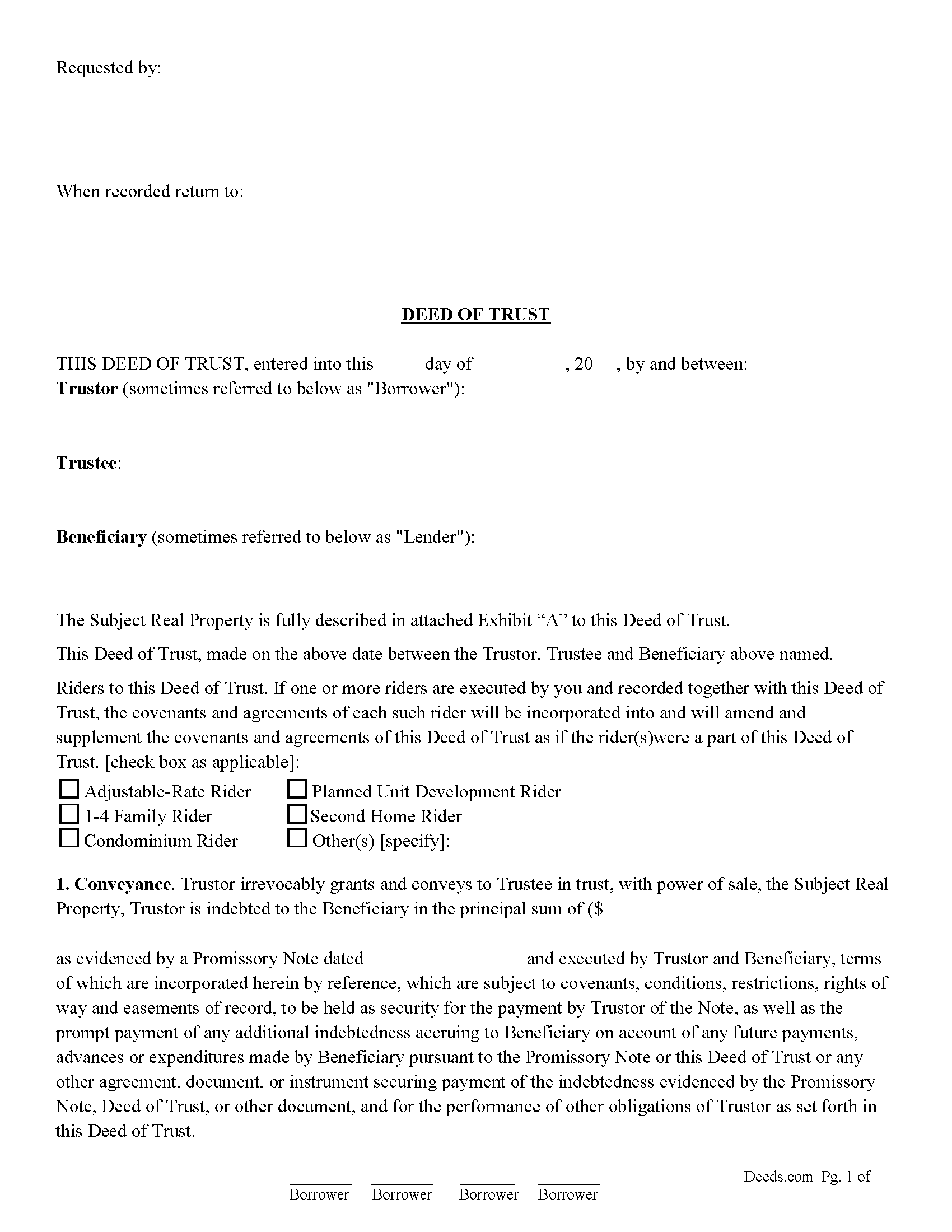

Marin County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

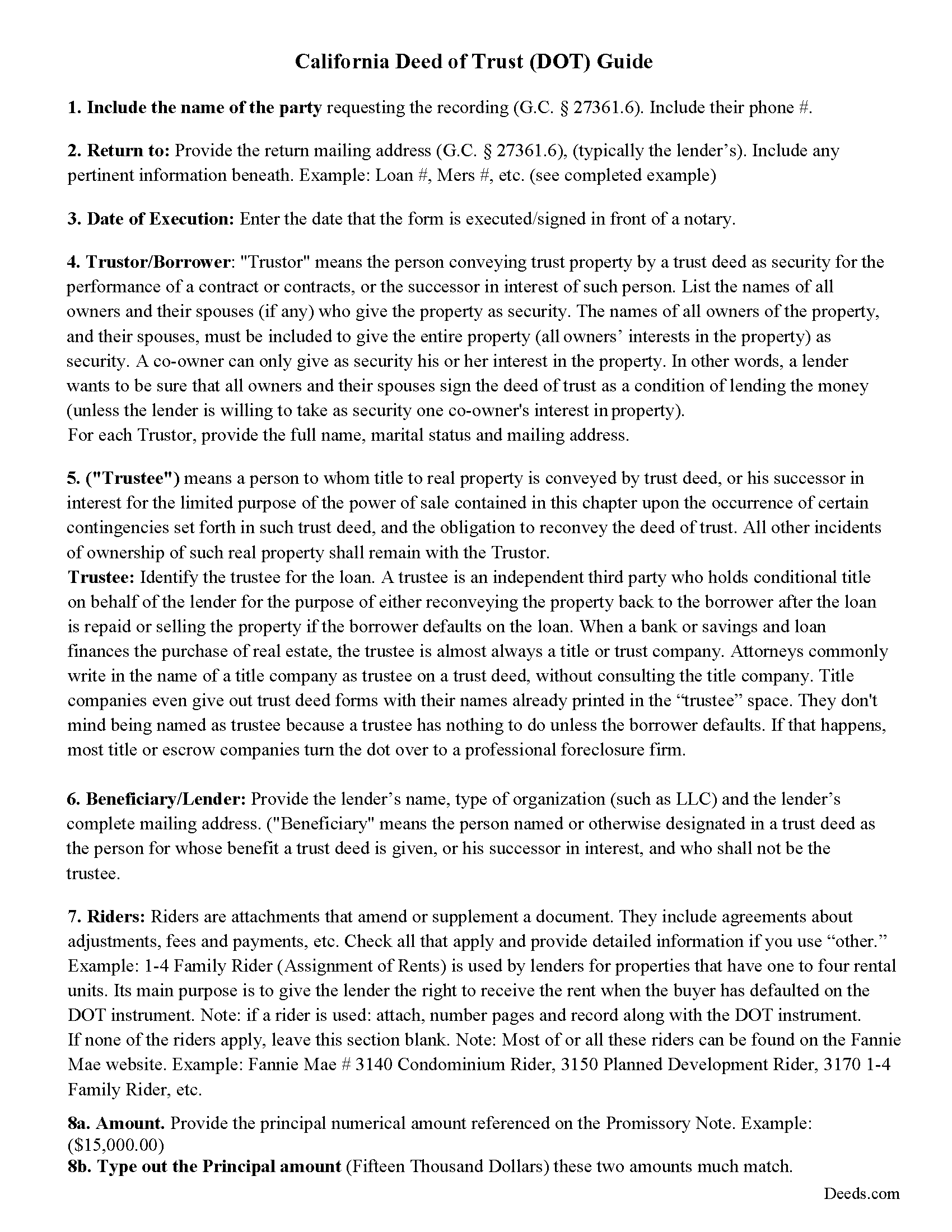

Marin County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

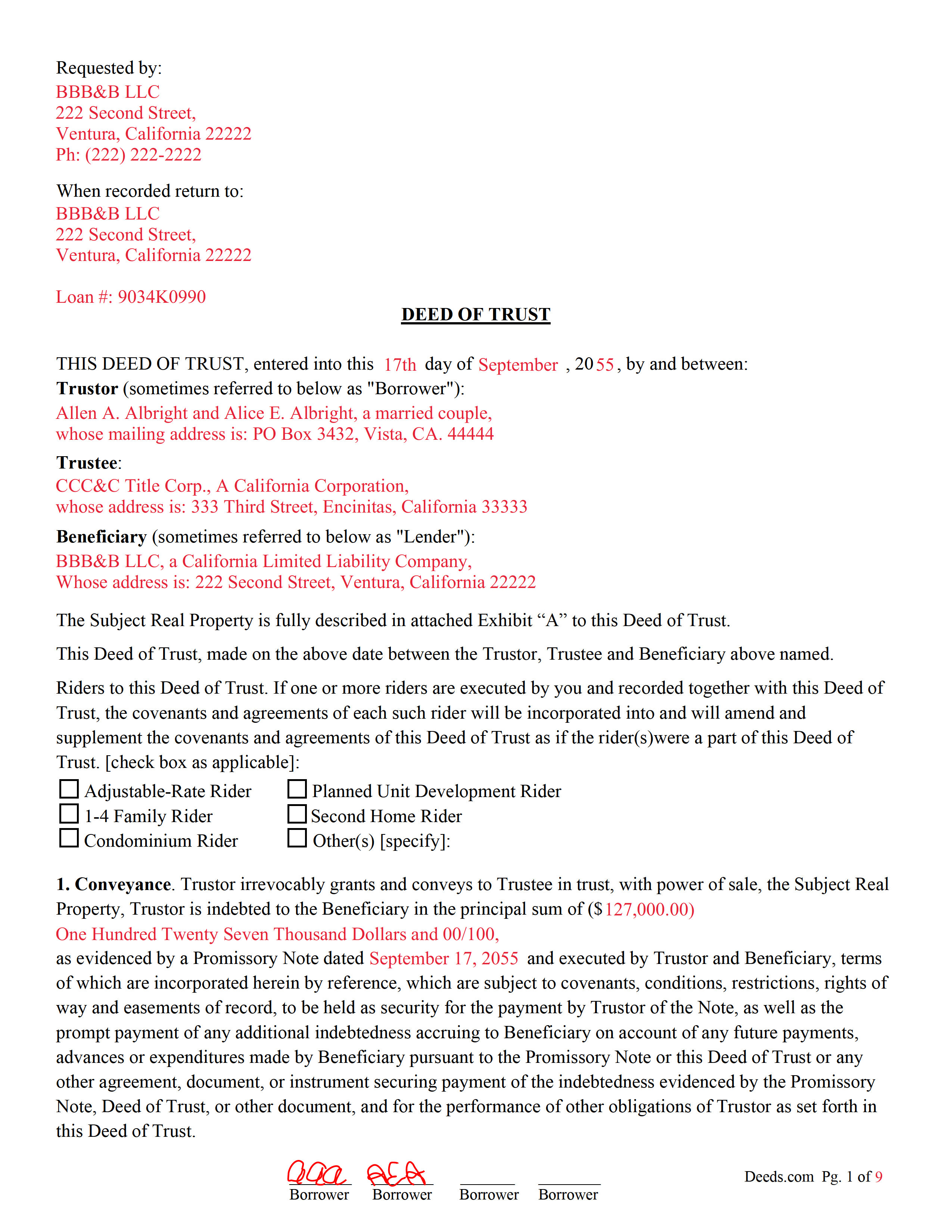

Marin County Completed Example of the Deed of Trust Document

Example of a properly completed form for reference.

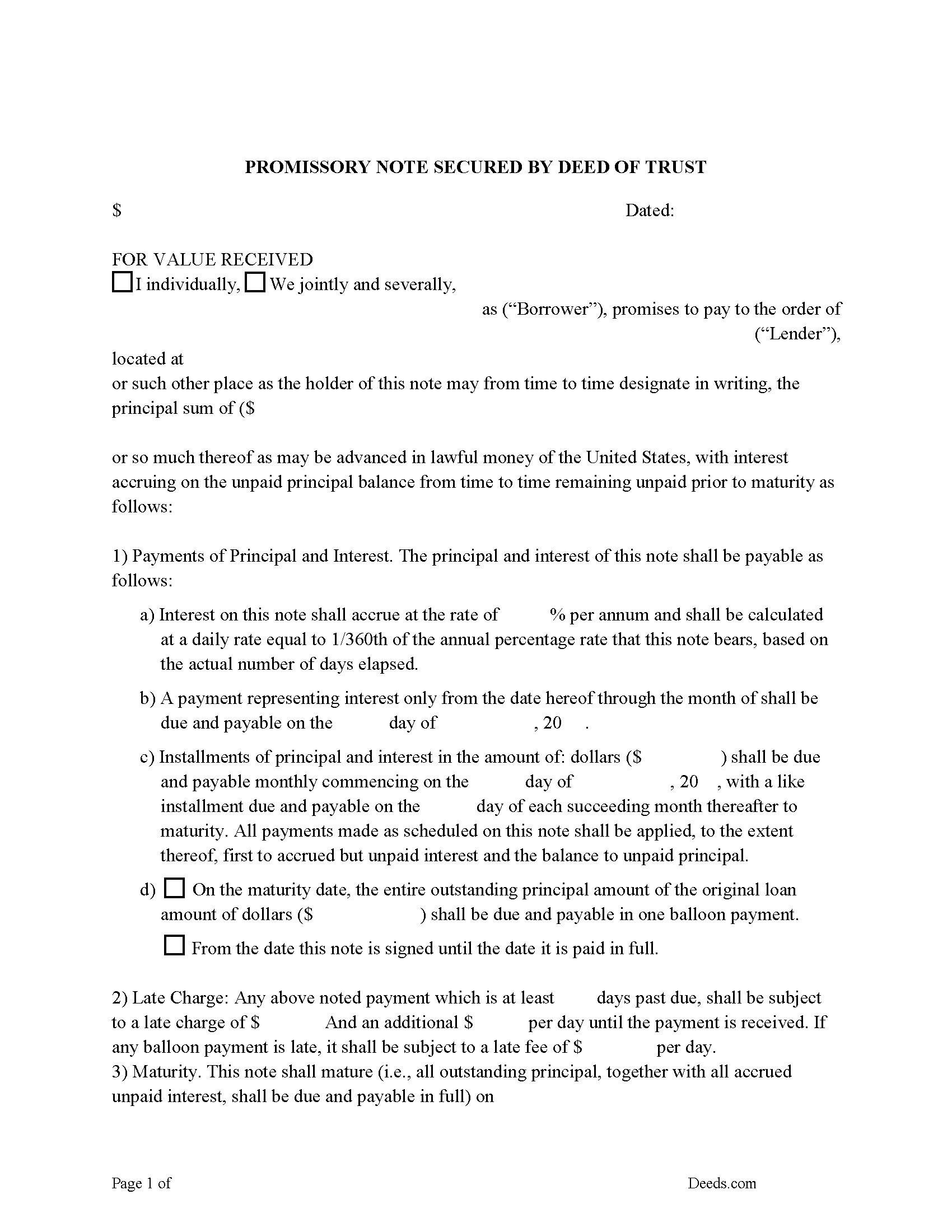

Marin County Promissory Note Form

Note that is secured by the Deed of Trust.

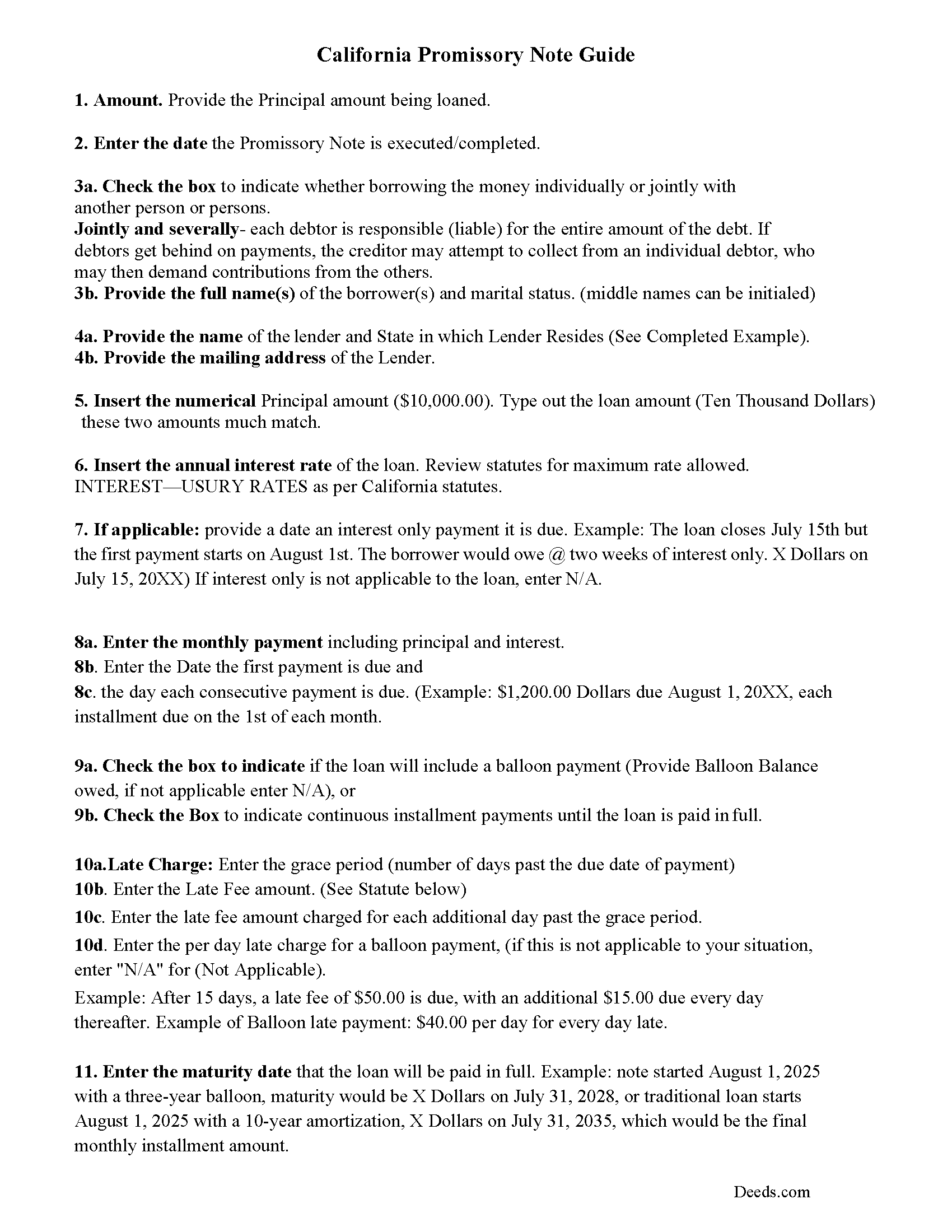

Marin County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

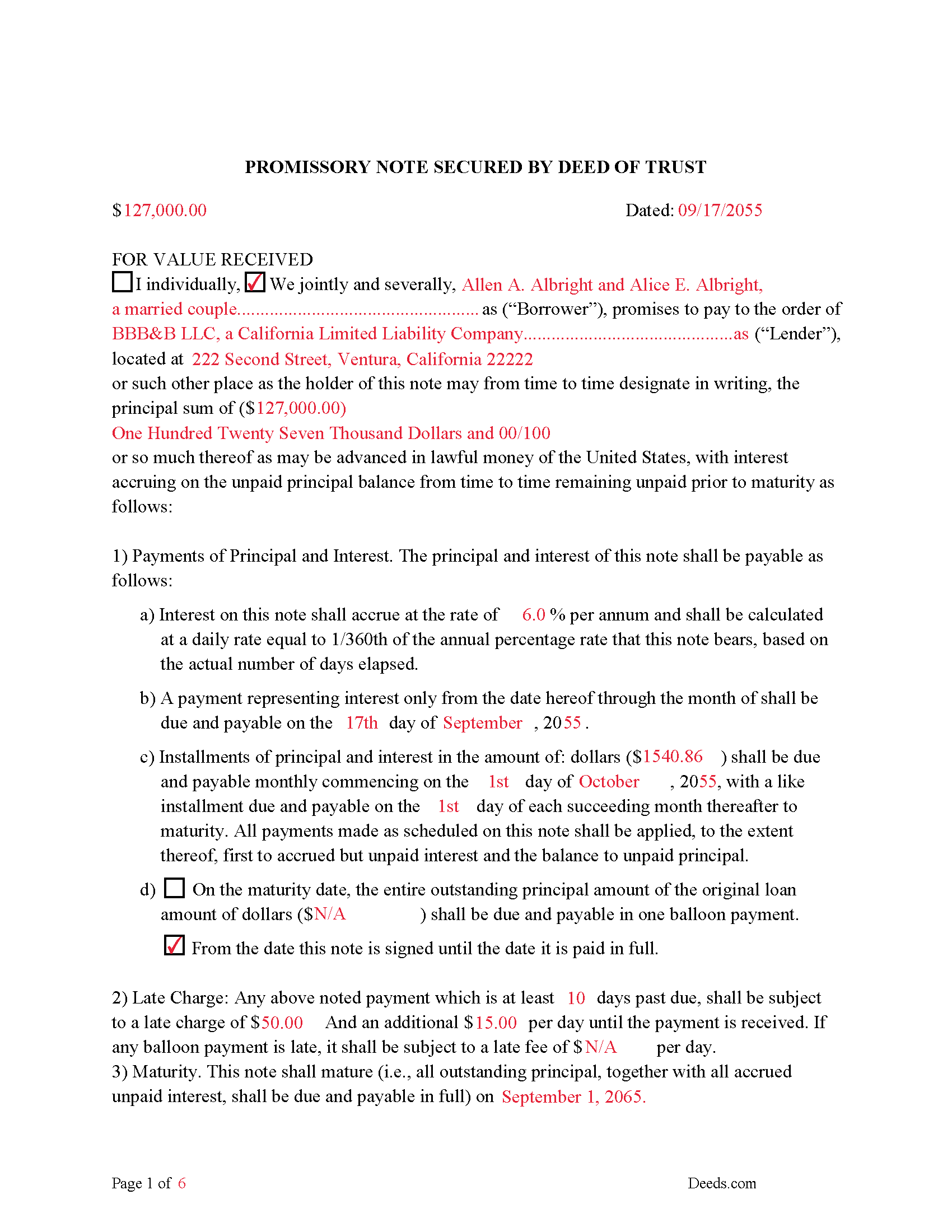

Marin County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

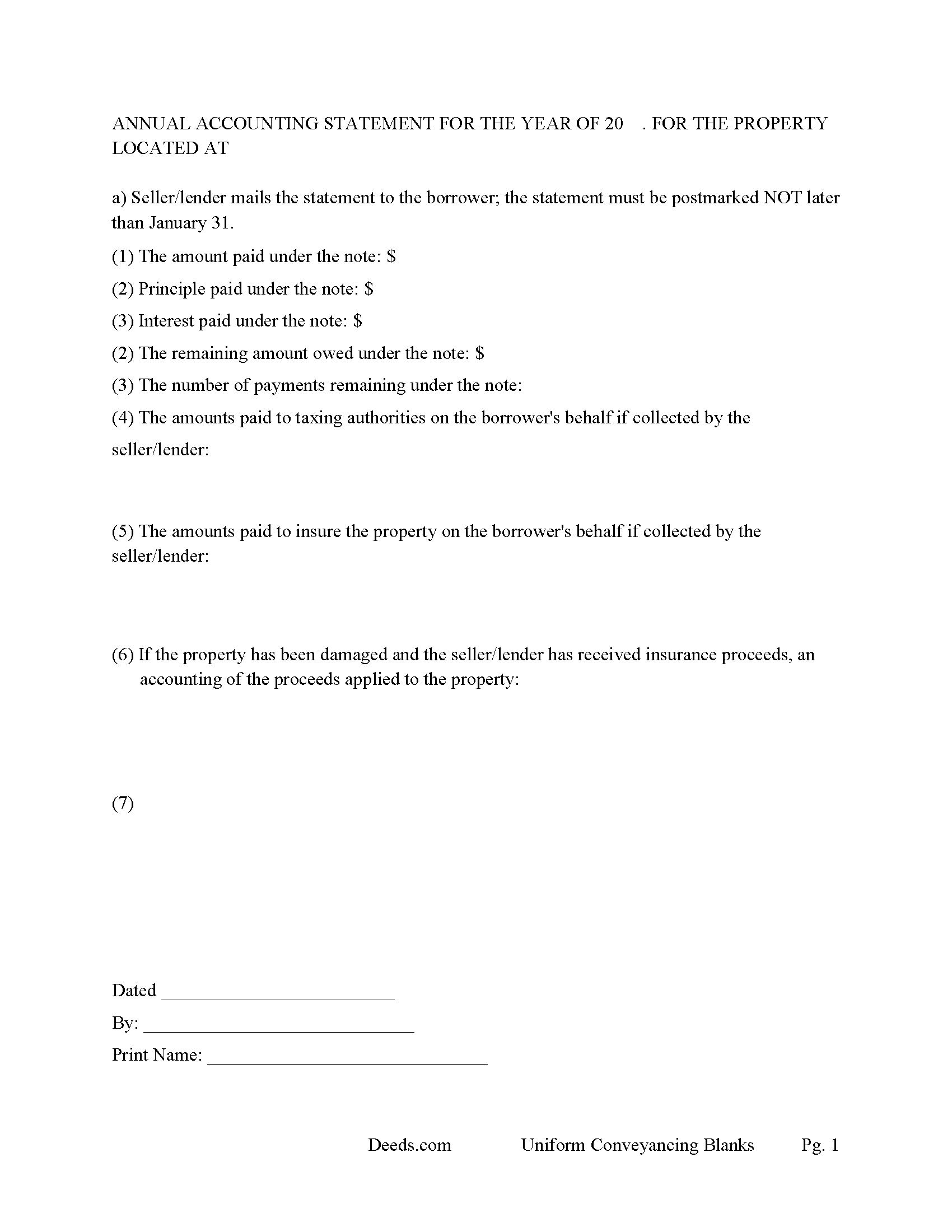

Marin County Annual Accounting Statement Form

Mail to borrower(s) for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Marin County documents included at no extra charge:

Where to Record Your Documents

Marin County Recorder

San Rafael, California 94903

Hours: M-F: 8:00 am - 4:00 pm / Recording until 3:00 pm only

Phone: (415) 473-6092

Recording Tips for Marin County:

- Check that your notary's commission hasn't expired

- Ask about their eRecording option for future transactions

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Marin County

Properties in any of these areas use Marin County forms:

- Belvedere Tiburon

- Bolinas

- Corte Madera

- Dillon Beach

- Fairfax

- Forest Knolls

- Greenbrae

- Inverness

- Kentfield

- Lagunitas

- Larkspur

- Marshall

- Mill Valley

- Nicasio

- Novato

- Olema

- Point Reyes Station

- Ross

- San Anselmo

- San Geronimo

- San Quentin

- San Rafael

- Sausalito

- Stinson Beach

- Tomales

- Woodacre

Hours, fees, requirements, and more for Marin County

How do I get my forms?

Forms are available for immediate download after payment. The Marin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marin County?

Recording fees in Marin County vary. Contact the recorder's office at (415) 473-6092 for current fees.

Questions answered? Let's get started!

A deed of trust (DOT), also known as a trust deed, is a document that conveys title to real property to a trustee as security for a loan until the grantor (borrower) repays the lender according to terms defined in the promissory note. It's similar to a mortgage but differs in that mortgages only include two parties (borrower and lender). The laws of each state determine whether to use a deed of trust or a mortgage.

This form may be used for residential property, condominiums, second homes, vacant land, planned unit developments, small commercial and rental property with up to 4 units, if more than 4 units-attach our assignment of leases and rents form.

This DOT contains a Power of Sale Clause allowing for a non-judicial foreclosure, saving time and expense for the lender. The promissory note can be used for installment or balloon payments. A deed of trust and promissory note containing stringent default terms can be beneficial to the Beneficiary/Lender.

(California Long Form Deed of Trust Package includes forms, guidelines, and completed examples) For use in California only.

Important: Your property must be located in Marin County to use these forms. Documents should be recorded at the office below.

This Long Form Deed of Trust meets all recording requirements specific to Marin County.

Our Promise

The documents you receive here will meet, or exceed, the Marin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marin County Long Form Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4596 Reviews )

Tami C.

May 11th, 2021

Excellent service, easy to follow instructions.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Katherine D.

August 22nd, 2022

Once I found your site it was very easy to understand, order and copy the forms. It is very helpful that you included an example of a completed form. Thank you. This form helps hundreds of seniors avoid lawyers, probate and the fear of losing their homes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darryl S.

April 16th, 2020

These guys saved the day! Very good at what they do and deliver AS ADVERTISED!! My county's recorder's office was closed to the public due to the COVID-19 pandemic, and the recorder's office did not offer the service I needed online. Attempting to close on a home the following day, I was in immediate need of a deed for property that I previously owned to provide to the underwriters for my pending loan. I thought I was dead in the water and would miss my next day closing date. Strolling the internet for options, I came upon DEEDS.COM. After reading the posted reviews, I thought I would give them a try. Within 10 minutes of placing my order, I received ALL the information I requested about the property I previously owned. Thank you DEEDS.COM for the prompt, courteous, and professional service. You guys are ROCK STARS!!! I closed on my new home.

Thank you so much for your kinds words Darryl, glad we were able to help.

Robert W.

March 26th, 2020

Easier than I thought. No problem Nice service

Thank you!

Neil W.

December 17th, 2019

This looks easy enough. Thanks. Very simple and efficient navigating the site.

Thank you for your feedback. We really appreciate it. Have a great day!

LETICIA N.

August 23rd, 2022

I AM VERY PLEASED WITH YOUR WEBSITE. EASY AND I WAS GIVEN A SAMPLE OF THE FORM AND INSTRUCTIONS. I AM VERY PLEASED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen R.

June 9th, 2023

Easy to access and reasonable pricing, thank you deeds.com!

Thank you!

sean m.

April 28th, 2021

Wow everything I need in one place... what a concept. thanks Deeds.com for the deeds, the guides and the transfer certificate all included for a great price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelynne H.

December 3rd, 2020

The service was quick and easy to use. Which is something I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cody M.

May 28th, 2024

They respond fast, the process is simple, and it's obviously convenient. I'm not sure what else there is to say, other than it's I would say a reasonable fee to pay them to do it.

Thank you for your positive words! We’re thrilled to hear about your experience.

edward d.

March 19th, 2023

used before awesome forms

Thank you!

Roy W.

April 29th, 2020

It's fine

Thank you!

Yvette D.

January 15th, 2021

Excellent service and customer support. Thank you for your help and time.

Thank you!

Ming W.

December 22nd, 2020

couldn't believe how efficient and perfect job you have done!! I will recommend your website to all friends.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly L.

June 27th, 2020

Great to have online resources! I will most definitely refer others! Best regards,

We appreciate your business and value your feedback. Thank you. Have a wonderful day!