Monterey County Quitclaim Deed Form

Monterey County Quitclaim Deed Form

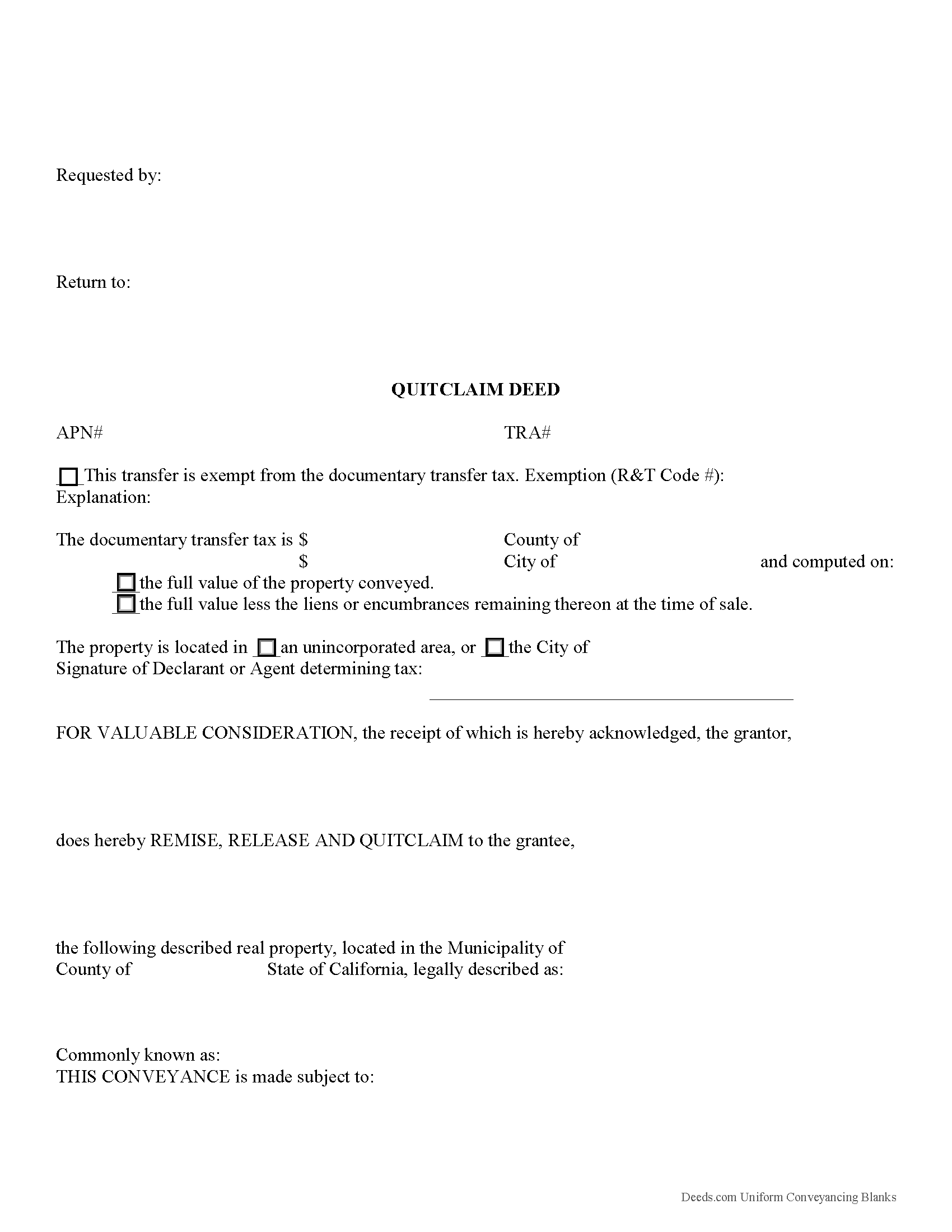

Fill in the blank Quitclaim Deed form formatted to comply with all California recording and content requirements.

Monterey County Quitclaim Deed Guide

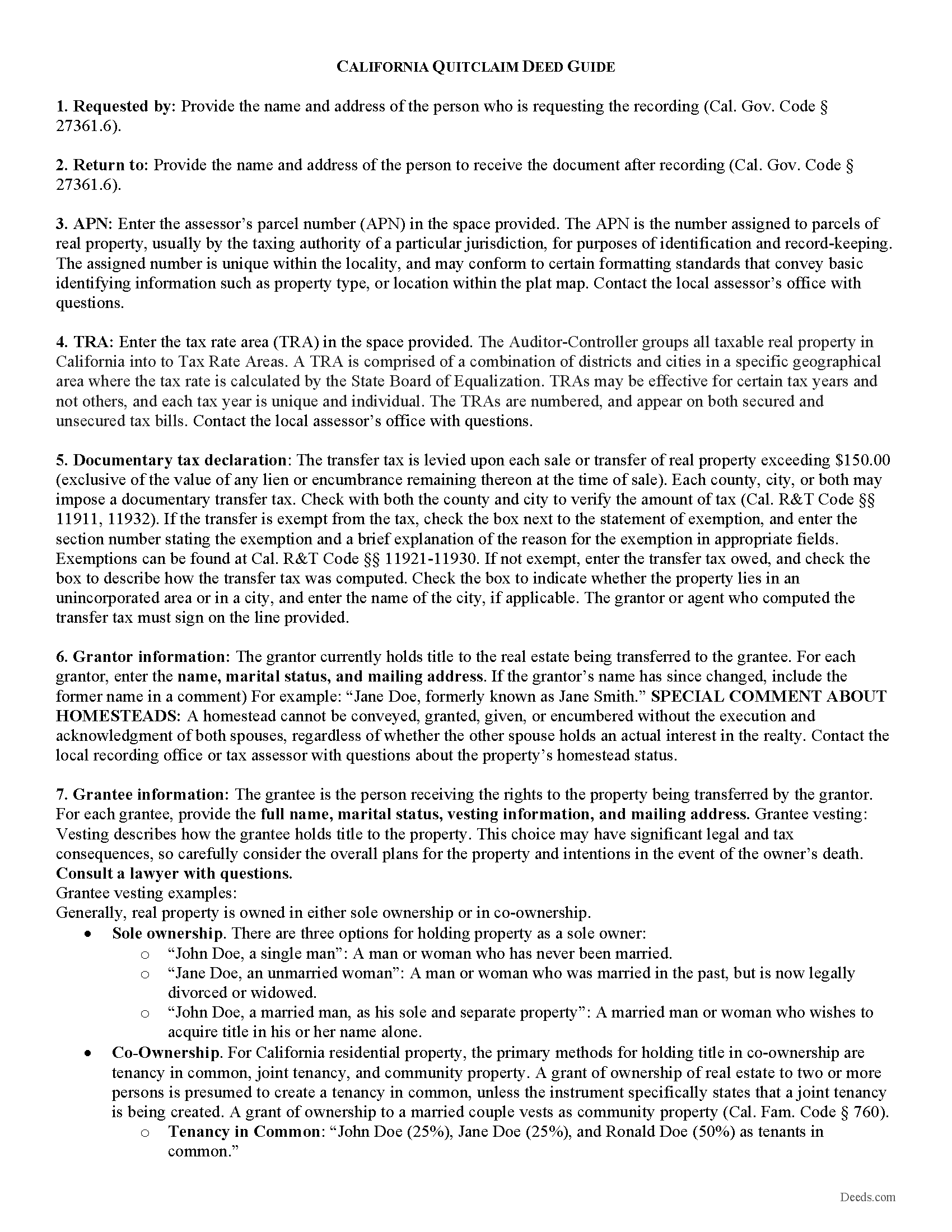

Line by line guide explaining every blank on the Quitclaim Deed form.

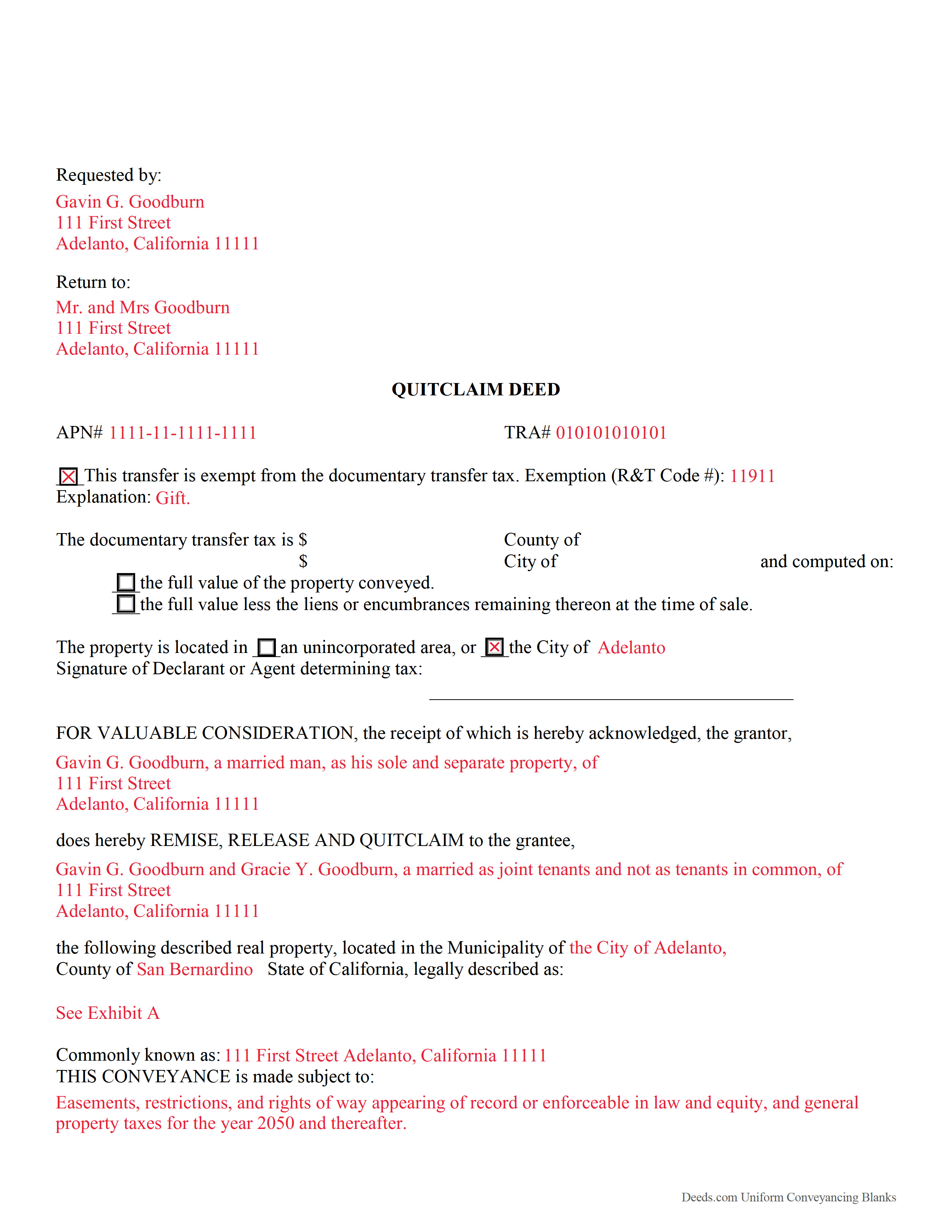

Monterey County Completed Example of the Quitclaim Deed Document

Example of a properly completed California Quitclaim Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Monterey County documents included at no extra charge:

Where to Record Your Documents

Assessor/Recorder/County Clerk

Salinas, California 93902-0570

Hours: Mon-Fri 8:00 am to 5:00 pm / Recording until 4:00 pm

Phone: (831) 755-5041 or toll free from peninsula (831) 647-77

Recording Tips for Monterey County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Monterey County

Properties in any of these areas use Monterey County forms:

- Aromas

- Big Sur

- Bradley

- Carmel

- Carmel By The Sea

- Carmel Valley

- Castroville

- Chualar

- Gonzales

- Greenfield

- Jolon

- King City

- Lockwood

- Marina

- Monterey

- Moss Landing

- Pacific Grove

- Pebble Beach

- Salinas

- San Ardo

- San Lucas

- Seaside

- Soledad

- Spreckels

Hours, fees, requirements, and more for Monterey County

How do I get my forms?

Forms are available for immediate download after payment. The Monterey County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Monterey County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Monterey County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Monterey County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Monterey County?

Recording fees in Monterey County vary. Contact the recorder's office at (831) 755-5041 or toll free from peninsula (831) 647-77 for current fees.

Questions answered? Let's get started!

Quitclaim deeds in California are initially defined by Civ. Code, 1092, 1104-1107, 1113, and further in Gov. Code 27279-27297.7, 27320-27337.

Content:

Each document submitted for recording should have the title near the top of the first page (Gov. Code 27324). Include the name and address of the individual requesting recording as well as a name and return address for use after the quitclaim deed is recorded. Provide the name and address of the individual or entity to receive tax bills at the bottom of the first page. (Gov. Code 27321.5, 27361.6). In addition, every quit claim deed must contain the name and address of everyone with an ownership interest in the property. Be certain to present the names in exactly the same way they're found on the prior deed. If there are any unrecorded changes, provide the original and new names like this: Jane Doe, formerly known as Jane Smith. See Gov. Code 27288.1.

Any document which modifies, releases, or cancels the provisions of a previously recorded document shall state the recorder identification number or the book and page of the document being modified, released, or canceled. (Gov. Code 27361.6). Additionally, Gov. Code 27280.5 requires that the names of parties required to be indexed appearing in any instrument, paper, or notice presented for recordation should be legibly typed or printed near the signature. The names of all persons executing or witnessing a document shall be legibly signed or shall be typed or printed to the side of or below the signature.

While not specifically discussed in the statutes, a valid quit claim deed should also include, at minimum, a complete legal description of the property and the name, address, and vesting choice of the grantee.

Recording:

Note that Gov. Code 27293 requires that quit claim deeds in languages other than English are not suitable for recording. Civ. Code 1169 states that quit claim deeds must be recorded by the County Recorder of the county in which the conveyed real estate is situated.

Civ. Code 1213-1214 discuss California's recording statute, which is classified as "race-notice." Basically, the first bona fide purchaser....will prevail over an earlier purchaser who failed to record the conveyance. So, despite Civ. Code 1217, which states that "an unrecorded instrument is valid as between the parties thereto and those who have notice thereof," just because the parties on the quit claim deed know about it, their knowledge does NOT constitute constructive notice to the public. Therefore, RECORD THE QUIT CLAIM DEED as soon as possible after executing it. This protects the interests of all parties.

Gov. Code 27361.6 formalizes some formatting requirements: The top right 2 " X 5" corner is reserved for the Recorder's use only. The top left 2 " X 3 " corner is reserved for the name of the person requesting recording and a return name and address. The title of the document must appear on the first page immediately below the space reserved for the Recorder.

(California Quitclaim Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Monterey County to use these forms. Documents should be recorded at the office below.

This Quitclaim Deed meets all recording requirements specific to Monterey County.

Our Promise

The documents you receive here will meet, or exceed, the Monterey County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Monterey County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Larry R.

December 8th, 2020

I appreciate the opportunity to take care of business without the hassle of parking, security checks and lines. It was all done quickly and easily.

Thank you!

William C.

August 28th, 2019

Great service and fast also

Thank you!

ROBERT W.

June 30th, 2019

Very good service .I recommend it if you need your documentation on a weekend or when offices are closed.Very fast service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cindy A.

August 28th, 2025

Needed a deed and the form provided with example and guide were of the most help. Thank you

Thank you, Cindy! We’re so glad the form, example, and guide were helpful in getting your deed taken care of. We appreciate your feedback!

Anthony J S.

July 30th, 2022

It was nice to find a form to use for leaving my house without having my kids deal with Probate Court. The price was a lot cheaper than paying for a Lawyer to set up a transfer of ownership.

Thank you for your feedback. We really appreciate it. Have a great day!

richard s.

March 26th, 2020

had exactly what i needed and good price

Thank you Richard! Have an amazing day.

Jonathon K.

September 1st, 2023

Recording deeds from the comfort of my office has never been simpler thanks to Deeds.com. The service is affordable, fast, and extremely user friendly. I highly recommend anyone who needs a deed recorded in the state of Florida to look into this website, it has made my job much easier.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christina D.

March 31st, 2025

The papers allowed me to get done what I needed. But for the price I would expect a spell check. There were spelling errors when there should not have been any. Please proof read

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Jason B.

May 9th, 2019

Providing .doc versions would be much easier than trying to jam information into a non-editable PDF.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael G. S.

January 3rd, 2019

The process was quite easy, following the instructional guide. I have yet to find out if the deed was accepted, but your site was very user friendly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Noal S.

May 18th, 2025

The download package is very thorough and complete for the Corrective Deed I needed to file. The material is state/county specific and includes a completed example. The price is reasonable compared to an attorney fee from $400 to $600

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eldridge S.

August 5th, 2019

very pleased to attain this important document

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jaynell B.

June 25th, 2021

This website was most helpful and easy to use. Glad the information I needed was available

Thank you!

GARY K.

April 28th, 2021

I AM THRILLED THAT I FOUND YOU. I HAVE BOOKMARKED YOU FOR THE FUTURE. I USED YOU FOR A LIS PENDENS AND IT WAS EASY TO FOLLOW AND FILL IN.I WILL HIGHLY RECOMMEND YOU TO MY ASSOCIATES. THANK YOU

Thank you!

Charles R.

December 18th, 2018

No review provided.

Thank you for your review. Have a fantastic day!