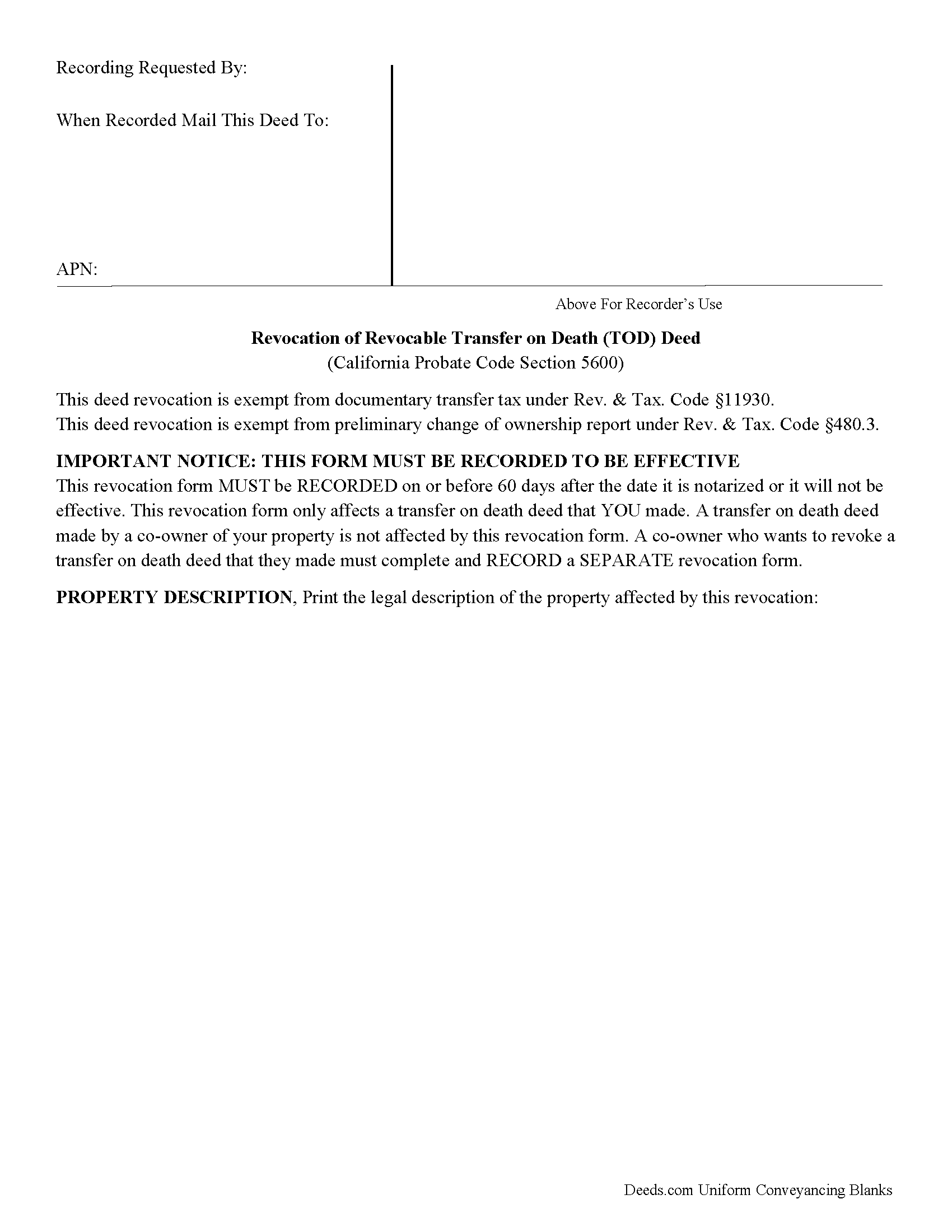

Inyo County Transfer on Death Revocation Form

Inyo County Revocation of Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

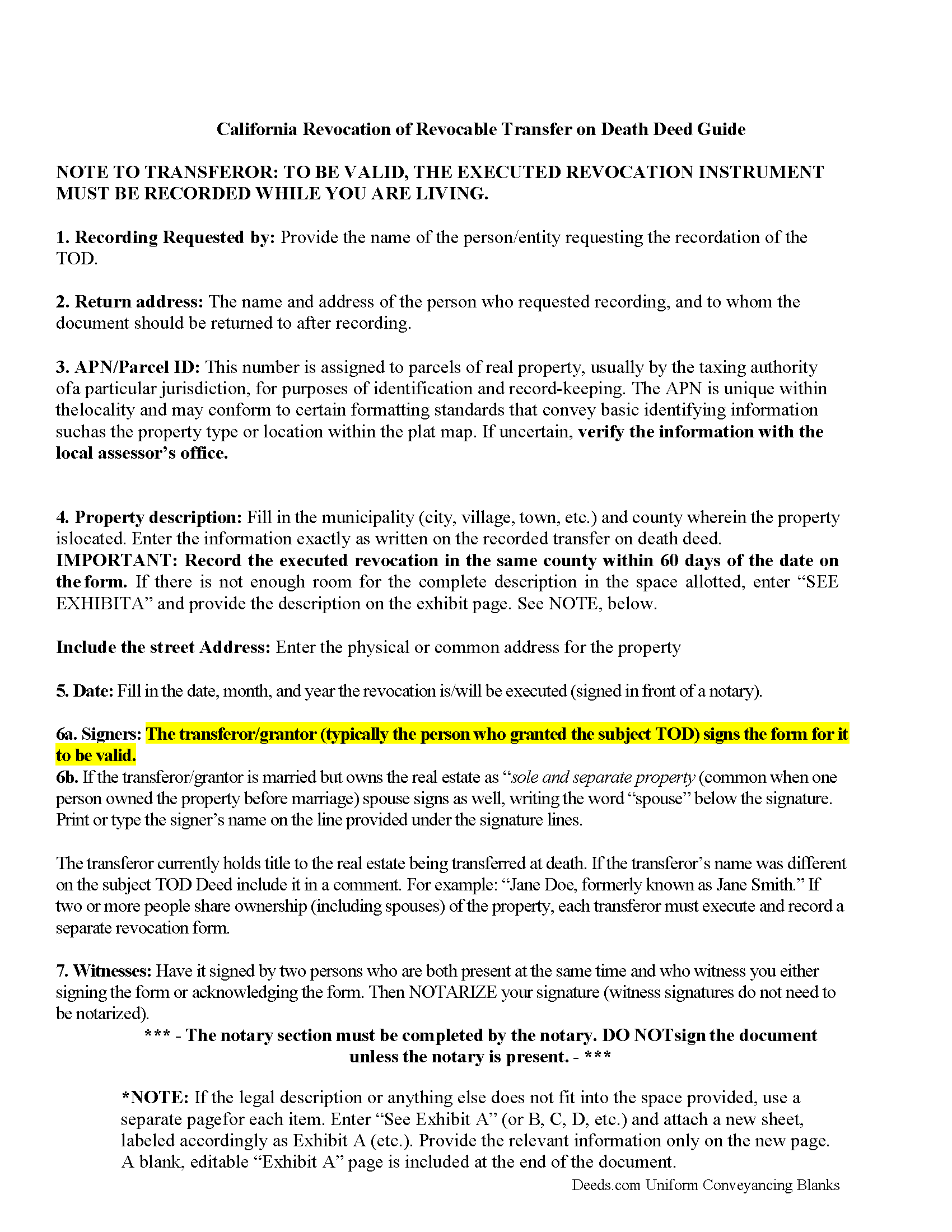

Inyo County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

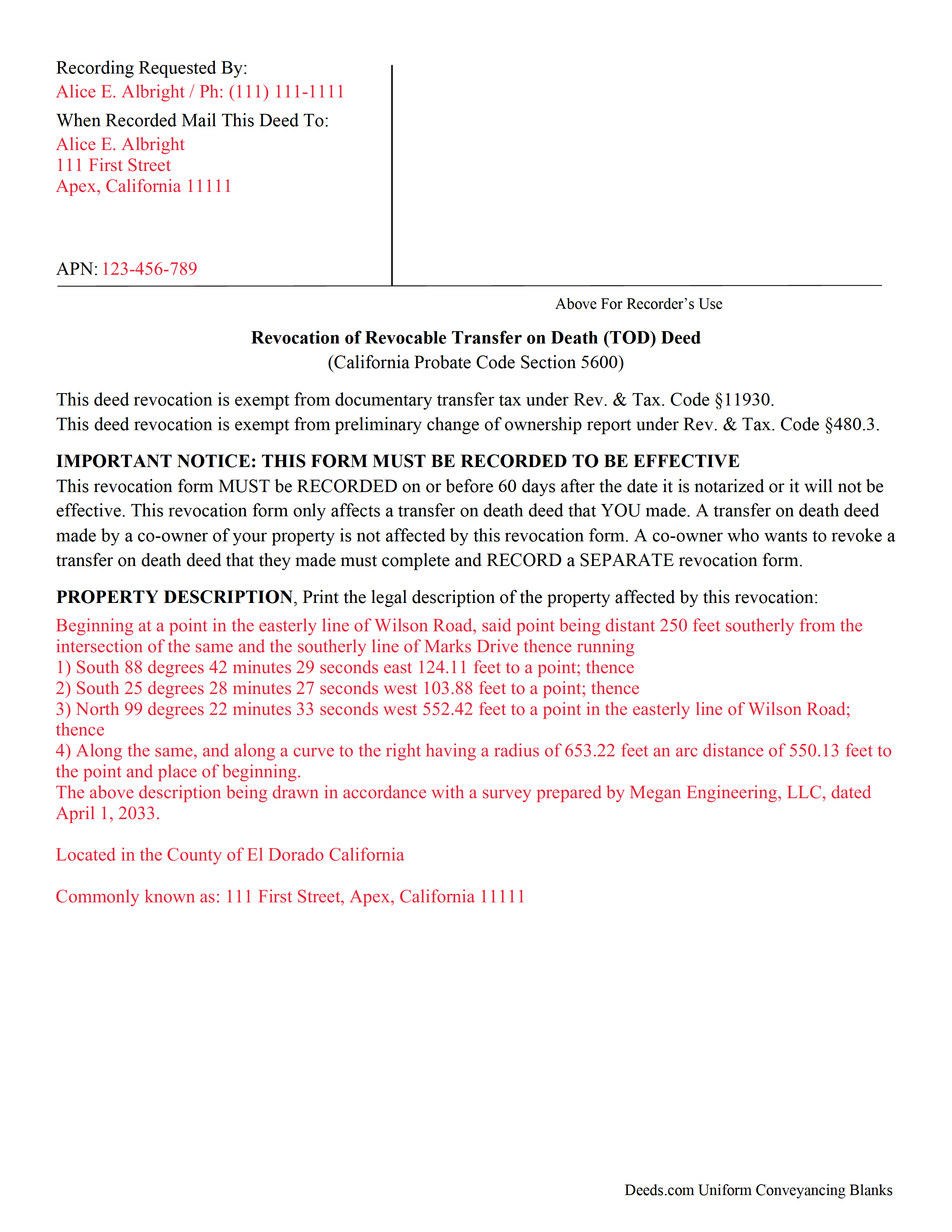

Inyo County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Inyo County documents included at no extra charge:

Where to Record Your Documents

Inyo County Clerk/Recorder

Independence, California 93526

Hours: Mon-Fri: 8:30am-4:00pm (closed 12-1pm for lunch)

Phone: (760) 878-0222

Recording Tips for Inyo County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Inyo County

Properties in any of these areas use Inyo County forms:

- Big Pine

- Bishop

- Darwin

- Death Valley

- Independence

- Keeler

- Little Lake

- Lone Pine

- Olancha

- Shoshone

- Tecopa

Hours, fees, requirements, and more for Inyo County

How do I get my forms?

Forms are available for immediate download after payment. The Inyo County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Inyo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Inyo County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Inyo County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Inyo County?

Recording fees in Inyo County vary. Contact the recorder's office at (760) 878-0222 for current fees.

Questions answered? Let's get started!

Revoking a Transfer on Death Deed in California

Transfer on death deeds allow individual landowners to transfer their real estate when they die, but outside of a will and without the need for probate. The transferor simply executes a TODD form, then records it during the course of his/her natural life, and within 60 days of the signing date (5626(a)). Unlike grant deeds or quitclaim deeds, however, there is no change in ownership when a transfer on death deed is recorded (5650).

As with transfer on death deeds, any change or revocation must be recorded DURING THE TRANSFEROR'S LIFE or it will be void.

Revocability is one of the unique features of transfer on death deeds. By retaining title to the property, it's easier for the transferor to respond to changes in circumstances or intentions. There are three ways to revoke a recorded TODD: transfer the real estate outright (in other words, use a standard deed, such as a grant or quitclaim deed, to convey the title away from the transferor); execute and record a new TODD, which automatically supersedes the previous document; or execute and record an instrument of revocation (5628-5632, 5660(c)).

While the statute allows three options for revocation, to maintain a clear title, it makes sense to record an instrument of revocation before either of the other two options. This provides a clear endpoint to the beneficiary's potential future interest, which reduces the chances for future claims against the title. Once the revocation is in place, the transferor may sell or redirect the property without worrying about the prior TODD.

Be aware, too, that the TODD is NOT affected by provisions in the owner's will (5642(b)). Best practices dictate that any change to an estate plan initiates a review of the whole thing, so to reduce the chance for conflict, make sure that the transfer on death deed, as well as any modifications or revocations, reinforces the will and other related documents.

Revoking a recorded transfer on death deed is a fairly simple process. Even so, it may not be appropriate in all cases. Contact an attorney for complex situations or with any questions.

Effective January 1, 2022 by California Senate Bill 315

A Revocation of a Revocable Transfer on Death Deed shall be signed by two persons who are both present at the same time and who witness you either signing the form or acknowledging the form. Then NOTARIZE your signature (witness signatures do not need to be notarized). RECORD the form in the county where the property is located.

(California Transfer on Death Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Inyo County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Revocation meets all recording requirements specific to Inyo County.

Our Promise

The documents you receive here will meet, or exceed, the Inyo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Inyo County Transfer on Death Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Karen M.

June 16th, 2020

Nicely Done - Blank Deeds, Guidelines, examples, etc. Thank you as a former paralegal, I am impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lana B.

August 25th, 2019

Was very helpful!

Thank you!

Timothy C.

January 19th, 2022

Excellent service. Pay your fee, download the form and fill out according to specific instructions. Then, again according to instructions, take it to the county clerk's office and have it recorded. It could not be easier.

Thank you!

Laurie R.

August 31st, 2022

FIVE STARS !!! Clear instructions Easy to navigate Thanks for making this easy for those of us who are not tech savvy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Terry S.

February 14th, 2023

I was very happy with the document package that I purchased. It contained all of the necessary documents and a few extras I had not thought about. Perhaps if you provided a link to download all of the documents with one click, it would make it a little easier.

Thank you for your feedback. We really appreciate it. Have a great day!

Ma Luisa R.

July 2nd, 2020

Great service and fast

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELIZABETH M.

January 10th, 2020

Great service! Training was fast and we went over very detail.

Thank you!

Maria C.

June 3rd, 2022

Amazing service truly great to work with your team on a difficult filing!

Thank you!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles C.

July 8th, 2021

Easy to use. Good price. I like that it came with instructions and an example.

Thank you for your feedback. We really appreciate it. Have a great day!

Barry B.

July 16th, 2021

Convenient and easy.

Thank you!

Marilyn C.

March 16th, 2021

Fillable documents, after a download, would be helpful. Very good to have all these forms online and accessible for an overall fee.

Thank you!

Patricia W.

October 1st, 2020

The technology and service was excellent. The content was too limited. I was seeking to find out about 61b deeds on the property and that was not provided.

We appreciate your feedback Patricia.

Dale K.

August 11th, 2020

A very user friendly website!

Thank you!

Sharon B.

August 11th, 2022

My questions were answered promptly. I was not able to locate the deed I was searching for because my county has not uploaded the documents to be accessed through this system. I am sure I could have found what I was looking for had the information been available through the system. Thank you for your assistance.

Thank you!