Santa Barbara County Trustee Deed Form

Santa Barbara County Trustee Deed Form

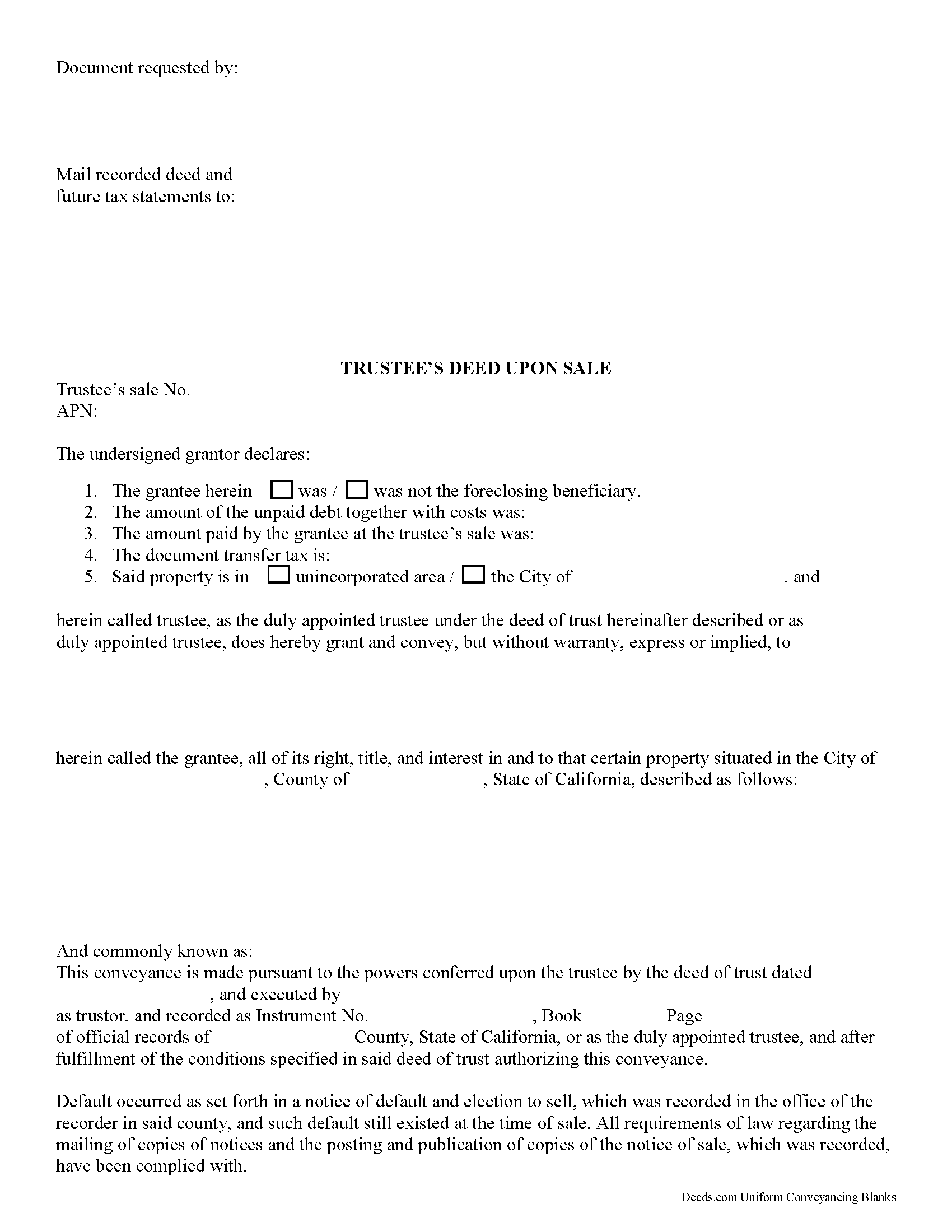

Fill in the blank form formatted to comply with all recording and content requirements.

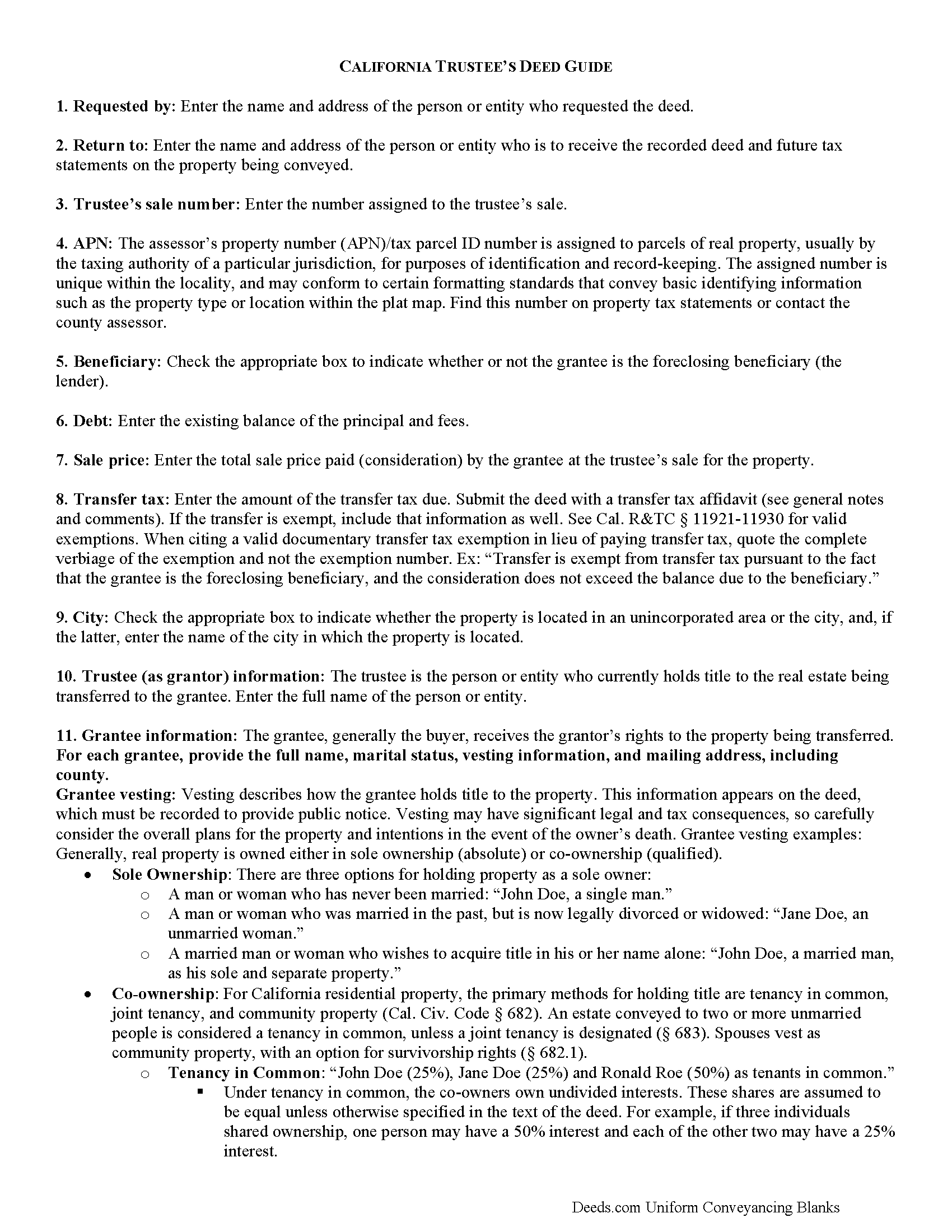

Santa Barbara County Trustee Deed Guide

Line by line guide explaining every blank on the form.

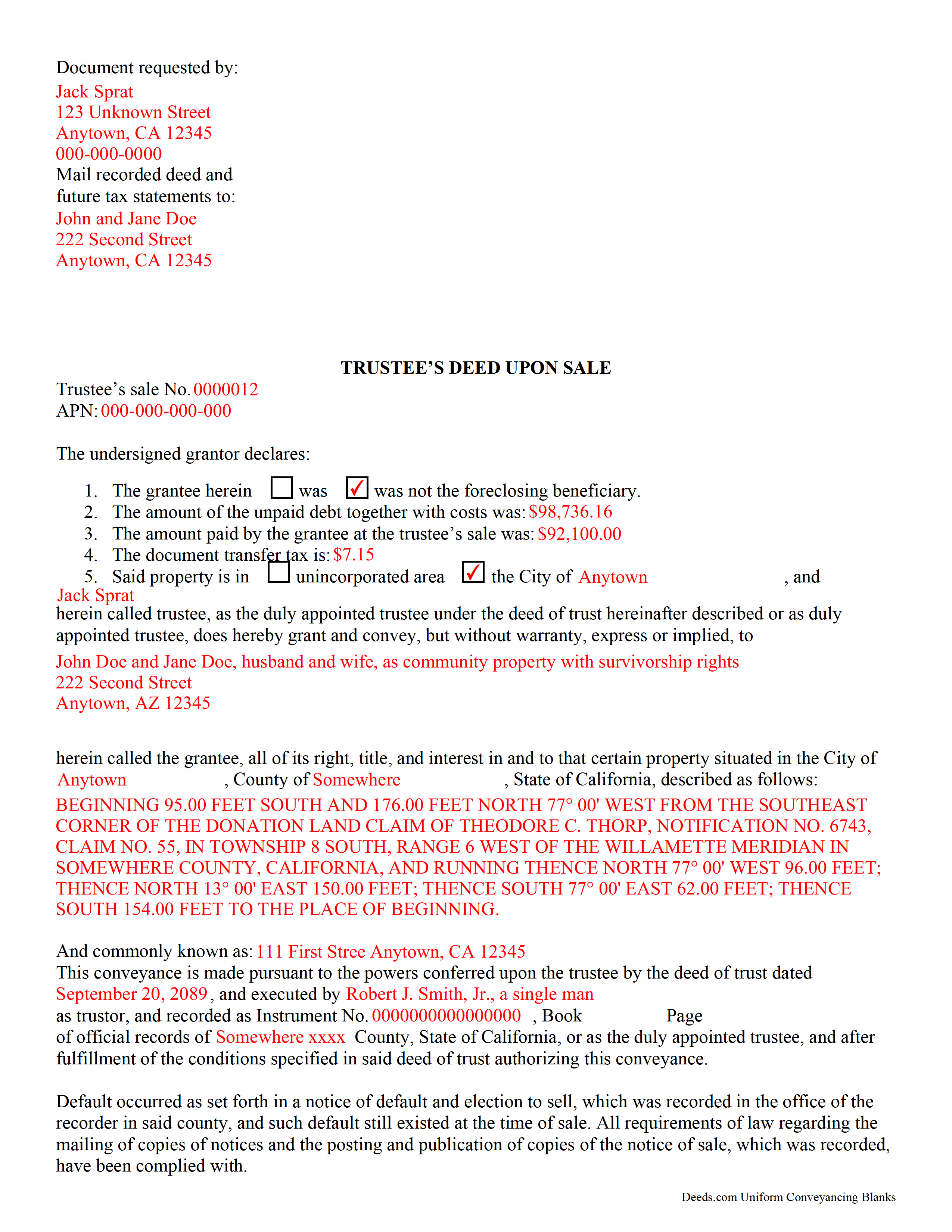

Santa Barbara County Completed Example of the Trustee Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional California and Santa Barbara County documents included at no extra charge:

Where to Record Your Documents

Lompoc

Lompoc, California 93436

Hours: Monday, Wednesday, Friday: 9:00am - 12:00 & 1:00 - 4:00pm

Phone: (805) 737-7705

Santa Maria

Santa Maria, California 93455-1341

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (805) 346-8370

Hall of Records & Mailing Address

Santa Barbara, California 93101

Hours: Monday through Friday 8:00 am to 4:30 pm

Phone: (805) 568-2250

Recording Tips for Santa Barbara County:

- Check that your notary's commission hasn't expired

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Check margin requirements - usually 1-2 inches at top

Cities and Jurisdictions in Santa Barbara County

Properties in any of these areas use Santa Barbara County forms:

- Buellton

- Carpinteria

- Casmalia

- Goleta

- Guadalupe

- Lompoc

- Los Alamos

- Los Olivos

- New Cuyama

- Santa Barbara

- Santa Maria

- Santa Ynez

- Solvang

- Summerland

Hours, fees, requirements, and more for Santa Barbara County

How do I get my forms?

Forms are available for immediate download after payment. The Santa Barbara County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Santa Barbara County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Santa Barbara County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Santa Barbara County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Santa Barbara County?

Recording fees in Santa Barbara County vary. Contact the recorder's office at (805) 737-7705 for current fees.

Questions answered? Let's get started!

In California, a deed of trust is used as a mortgage alternative to secure a loan for real property. The borrower is the trustor of a deed of trust, and a trustee (usually an agent of the lending institution) is named as grantee, with the lending institution (secured lender) as the beneficiary (Cal. Civ. Code 2929.5(e)(1),(5)). The trustee's duty is to either reconvey the title upon satisfaction of the loan, or to initiate foreclosure as directed by the beneficiary.

Under the terms of the deed of trust, the beneficiary can initiate a non-judicial foreclosure if the trustor defaults on the loan or fails to satisfy the terms of the trust. The trustee is obligated to carry out certain steps before the foreclosure sale can take place. These processes, as well as mandates for the sale, are governed by Cal. Civ. Code 2924-2924h. Once the sale ends, the highest bidder receives a trustee's deed confirming the transfer of title. The trustee's deed is named for the trustee, who executes the deed and acts as the grantor.

The trustee's deed confirms the information from the deed of trust, including the trustor name (the borrower), the trustee, and the beneficiary (lender) under the deed of trust, in addition to vesting title in the grantee's name. If the property receives no bids at public auction, title reverts to the beneficiary of the deed of trust.

The deed must comply with format and content requirements for instruments concerning real property (warranty deed, quitclaim deed, etc.) laid out in Chapter 6 of the Government Code, and be signed by the trustee and notarized with an all-purpose acknowledgment before it is recorded and filed in the county where the property is located.

Note that a deed of trust is separate from a living trust. While the deed of trust functions as a sort of mortgage, a living trust is used for estate planning. In living trusts, a trustee uses a quitclaim deed or special warranty deed to convey property into and out of the trust and has other duties in managing the living trust. The trustee under a deed of trust is not bound by statutes governing a general trust.

Because foreclosures can be complicated, contact a lawyer with any questions or for help regarding your unique situation.

(California Trustee Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Santa Barbara County to use these forms. Documents should be recorded at the office below.

This Trustee Deed meets all recording requirements specific to Santa Barbara County.

Our Promise

The documents you receive here will meet, or exceed, the Santa Barbara County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Santa Barbara County Trustee Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Gina G.

April 17th, 2024

This service is fantastic! Took a few tries to scan the document correctly, but their patience and quick turn around made this a far better experience than going to the County myself.

We are delighted to have been of service. Thank you for the positive review!

GARY K.

April 28th, 2021

I AM THRILLED THAT I FOUND YOU. I HAVE BOOKMARKED YOU FOR THE FUTURE. I USED YOU FOR A LIS PENDENS AND IT WAS EASY TO FOLLOW AND FILL IN.I WILL HIGHLY RECOMMEND YOU TO MY ASSOCIATES. THANK YOU

Thank you!

Albert G.

December 7th, 2019

Download was smooth. I'll post an update after I get a change to work with the forms.

Thank you!

Marlene S.

May 22nd, 2019

This service seems simple and reasonably priced. The deed I requested was not available, and they let me know immediately and refunded the fee. I would try to use this service again, if I had need.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

March 27th, 2020

Very fast and easy to use!

Thank you Kimberly. Have a fantastic day.

George L. W.

August 30th, 2022

Where have you been all my life?

Thank you!

James M.

June 3rd, 2021

Very good experience.

Thank you!

Eppie G.

October 19th, 2021

Perfect

Thank you!

Jubal T.

November 27th, 2024

This is the most comprehensive, helpful real estate tool I have seen. I was at first worried because the 330# didn’t have live operators but I received messages in my account as quickly as a conversation had by text and was able to download a deed and record it the same day in a county 1,300 miles away. Highly recommended!

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Christine M.

September 8th, 2021

Forms were top notch, easy to complete, printed beautifully, recorded with no revisions. Highly recommend for anyone preparing their own deeds.

Thank you for the kind words Christine. Have an amazing day!

Alain L.

June 15th, 2021

deeds.com was able to turnaround my document in a matter of hours. I was also surprised at how easy their website was to navigate, considering other websites that offered the same service were so convoluted. Thank you again for the quick turnaround.

Thank you!

jeann p.

September 19th, 2024

The site was extremely helpful.

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Monique C.

August 21st, 2020

Very quick and efficient service! I will continue to use them for future reference.

Thank you!

Dennis K.

June 9th, 2020

Easily downloaded and filled out form for quit claim deed was approved as soon as i dropped it off.

Thank you for your feedback. We really appreciate it. Have a great day!