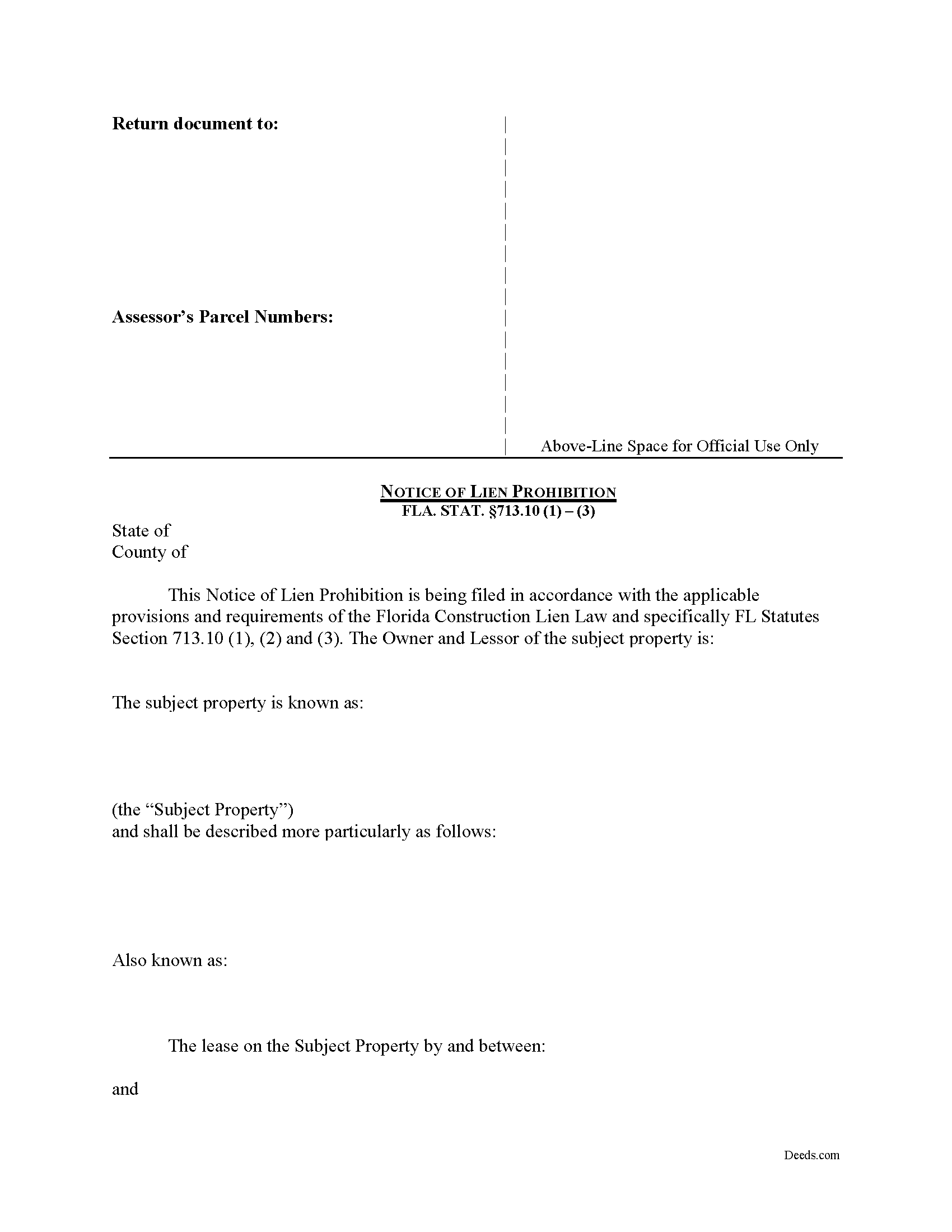

Bay County Notice of Lien Prohibition Form

Bay County Notice of Lien Prohibition Form

Fill in the blank form formatted to comply with all recording and content requirements.

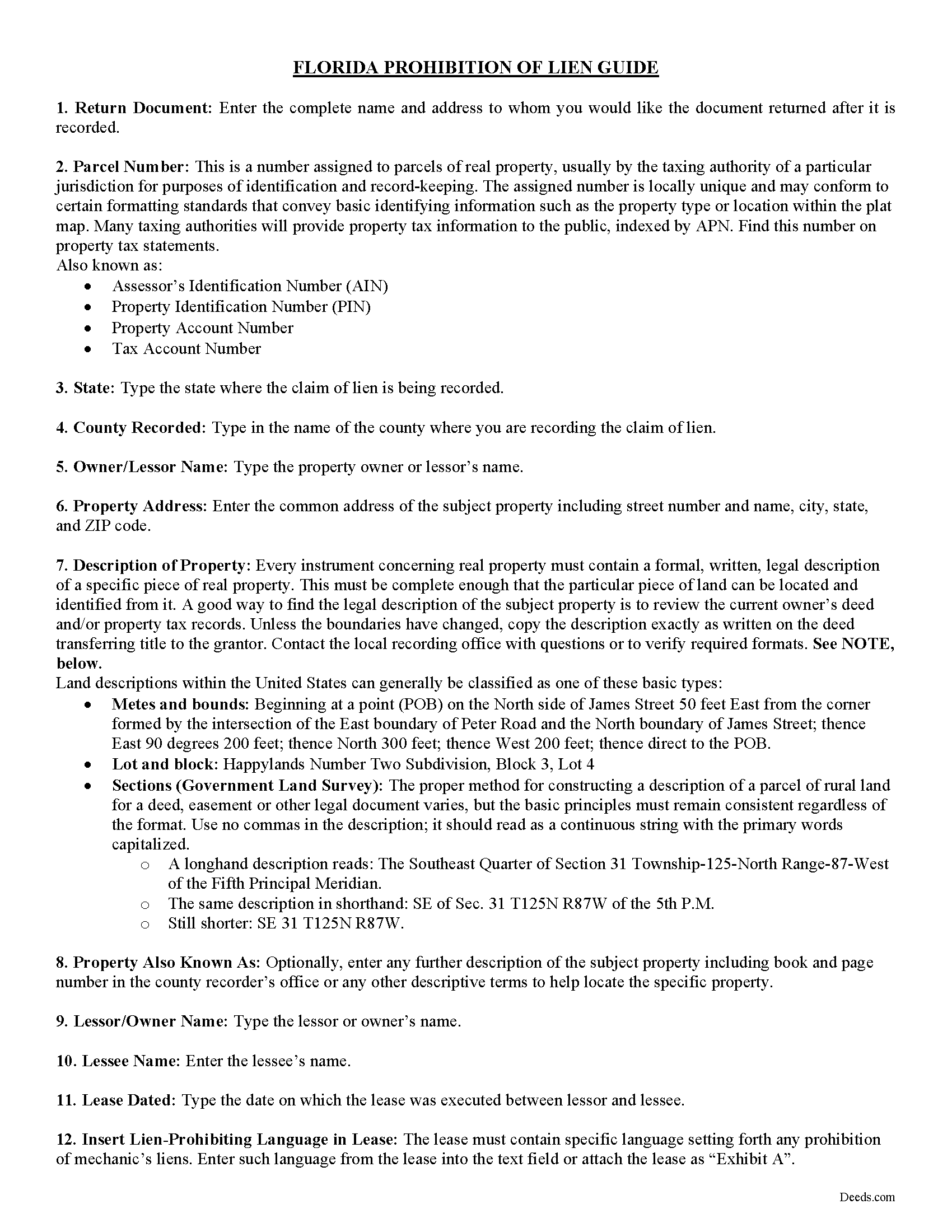

Bay County Notice of Lien Prohibition Guide

Line by line guide explaining every blank on the form.

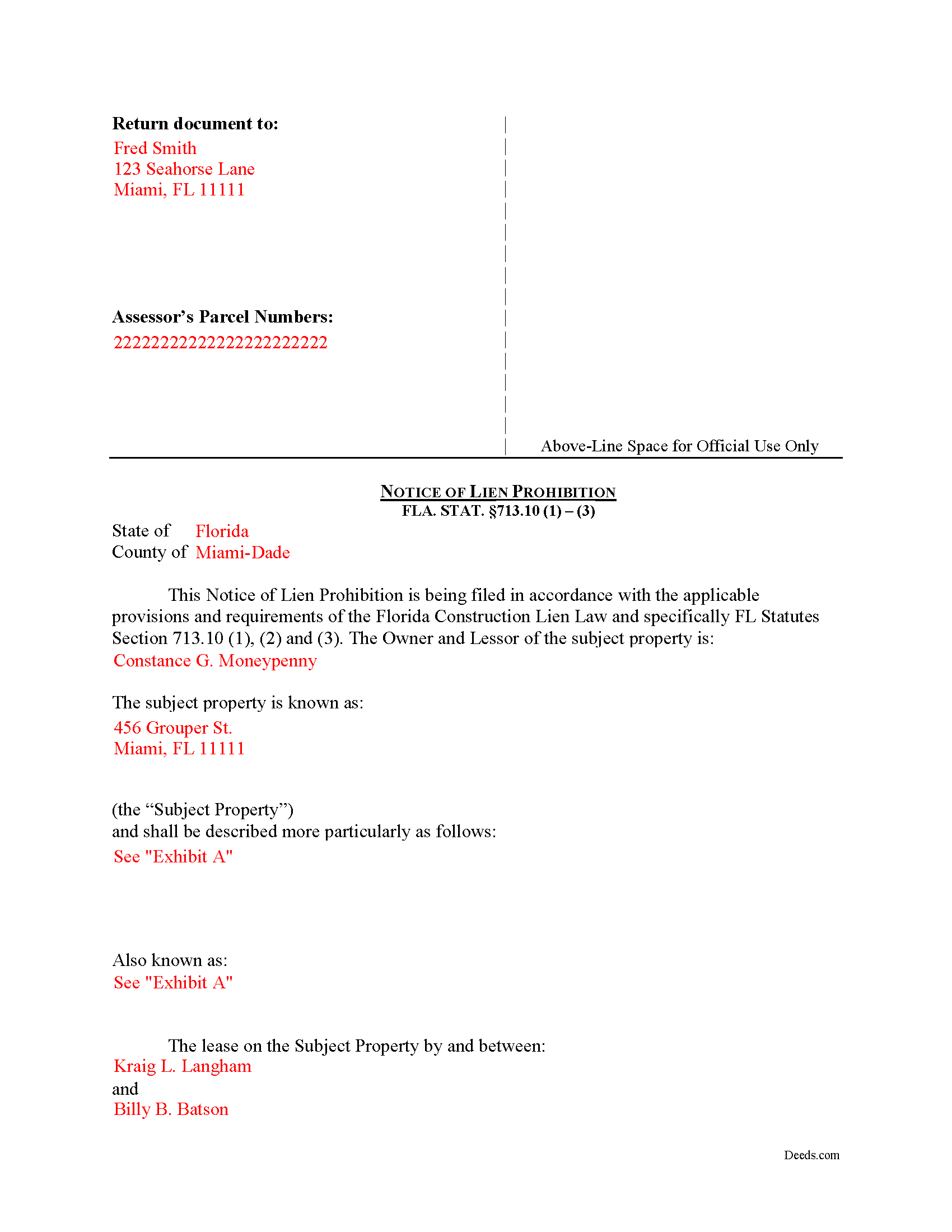

Bay County Completed Example of the Notice of Lien Prohibition Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Bay County documents included at no extra charge:

Where to Record Your Documents

Bay County Clerk of the Court

Panama City, Florida 32401

Hours: 8:00am - 4:30pm M-F

Phone: (850) 763-9061

Recording Tips for Bay County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Verify all names are spelled correctly before recording

- Make copies of your documents before recording - keep originals safe

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Bay County

Properties in any of these areas use Bay County forms:

- Fountain

- Lynn Haven

- Mexico Beach

- Panama City

- Panama City Beach

- Youngstown

Hours, fees, requirements, and more for Bay County

How do I get my forms?

Forms are available for immediate download after payment. The Bay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bay County?

Recording fees in Bay County vary. Contact the recorder's office at (850) 763-9061 for current fees.

Questions answered? Let's get started!

Prohibiting Mechanic's Liens on Leased Property

As a landlord, it's important to ensure tenants don't incur any encumbrance on your property. Tenants might engage a contractor in labor or delivery of materials that can result in a lien placed on your real estate. A notice of lien prohibition puts any potential claimant on notice that the tenant is prohibited from subjecting the property to a lien.

Under state law, a lien shall extend to, and only to, the right, title, and interest of the person who contracts for the improvement as such right, title, and interest exists at the commencement of the improvement or is thereafter acquired in the real property. FLA. STAT. 713.10(1). When an improvement is made by a lessee in accordance with an agreement between such lessee and her or his lessor, the lien shall extend also to the interest of such lessor. Id.

When the lease expressly provides that the interest of the lessor shall not be subject to liens for improvements made by the lessee, the lessee shall notify the contractor making any such improvements of such provision or provisions in the lease, and the knowing or willful failure of the lessee to provide such notice to the contractor shall render the contract between the lessee and the contractor voidable at the option of the contractor. FLA. STAT. 713.10(2)(a).

The interest of the lessor is not subject to liens for improvements made by the lessee when: (1) the lease, or a short form or a memorandum of the lease that contains the specific language in the lease prohibiting such liability, is recorded in the official records of the county where the premises are located before the recording of a notice of commencement for improvements to the premises and the terms of the lease expressly prohibit such liability; or (2) the terms of the lease expressly prohibit such liability, and a notice advising that leases for the rental of premises on a parcel of land prohibit such liability has been recorded in the official records of the county in which the parcel of land is located before the recording of a notice of commencement for improvements to the premises. FLA. STAT. 713.10(2)(b).

The Notice must include the following information: (a) the name of the lessor; (b) the legal description of the parcel of land to which the notice applies; (c) the specific language contained in the various leases prohibiting such liability; and (d) a statement that all or a majority of the leases entered into for premises on the parcel of land expressly prohibit such liability. FLA. STAT. 713.10(2)(b)(2).

The interest of the lessor is also not subject to liens for improvements made by the lessee when the lessee is a mobile home owner who is leasing a mobile home lot in a mobile home park from the lessor. FLA. STAT. 713.10(2)(b)(3).

This Notice effectively prohibits liens for improvements made by a lessee even if other leases for premises on the parcel do not expressly prohibit liens or if provisions of each lease restricting the application of liens are not identical. Id.

Any contractor or lienor under contract to furnish labor, services, or materials for improvements being made by a lessee may serve written demand on the lessor for a copy of the provision in the lease prohibiting liability for improvements made by the lessee. FLA. STAT. 713.10(3). The demand must identify the lessee and the premises being improved and must be in a document that is separate from the notice to the owner. Id.

The interest of any lessor who does not serve a verified copy of the lease provision within 30 days after demand, or who serves a false or fraudulent copy, is subject to a lien under this part by the contractor or lienor who made the demand if the contractor or lienor has otherwise complied with this part and did not have actual notice that the interest of the lessor was not subject to a lien for improvements made by the lessee. Id.

This article is provided for informational purposes only and is not legal advice. Do not rely on this article as a substitute for consulting with a licensed attorney. If you have any questions about prohibiting liens on property or about mechanic's liens, please speak with an attorney.

Important: Your property must be located in Bay County to use these forms. Documents should be recorded at the office below.

This Notice of Lien Prohibition meets all recording requirements specific to Bay County.

Our Promise

The documents you receive here will meet, or exceed, the Bay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bay County Notice of Lien Prohibition form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John H.

September 13th, 2021

Quality product. Forms are as advertised. Easy to use site.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda W.

January 22nd, 2021

Fast service. From the time I sent my Quit Claim Deed to deeds.com, and six hours later my deed was recorded. It was painless, great convenience.

Thank you!

constance t.

December 30th, 2019

Excellent service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tony W.

May 27th, 2022

I have not completed the forms yet but they appear to be exactly what I need for the purpose they are intended. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

January 31st, 2022

Thought I knew what I was doing but it turns out I was in way over my head. Thankfully customer service pointed me in the right direction to get the help I needed.

Glad to hear you are seeking the assistance you need. Have a wonderful day.

Heidi S.

August 5th, 2021

I had prompt service thank you

Thank you!

Greg M.

March 16th, 2020

This is a great site! Very easy to use and has all the documents I required. Thank you!

Thank you!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Marc T.

August 19th, 2021

Excellent service

Thank you!

Nancy S.

July 6th, 2021

Terrific service, I found just what I needed, and priced reasonably. The decision to purchase a form instead of trying to create one of my own was easy to make. I will return to this service again.

Thank you!

Robert M.

September 14th, 2021

Great service. Easy to use and affordable.

Thank you!

Jeffrey W.

April 29th, 2020

One of the most user-friendly services I have used. HIGHLY reccomended.

Thank you!

Paul B.

March 13th, 2025

Very efficient and easy to use process

Paul, we’re glad to hear you had a smooth and efficient experience! Making things easy for our customers is always our goal.