Ada County Disclaimer of Interest Form

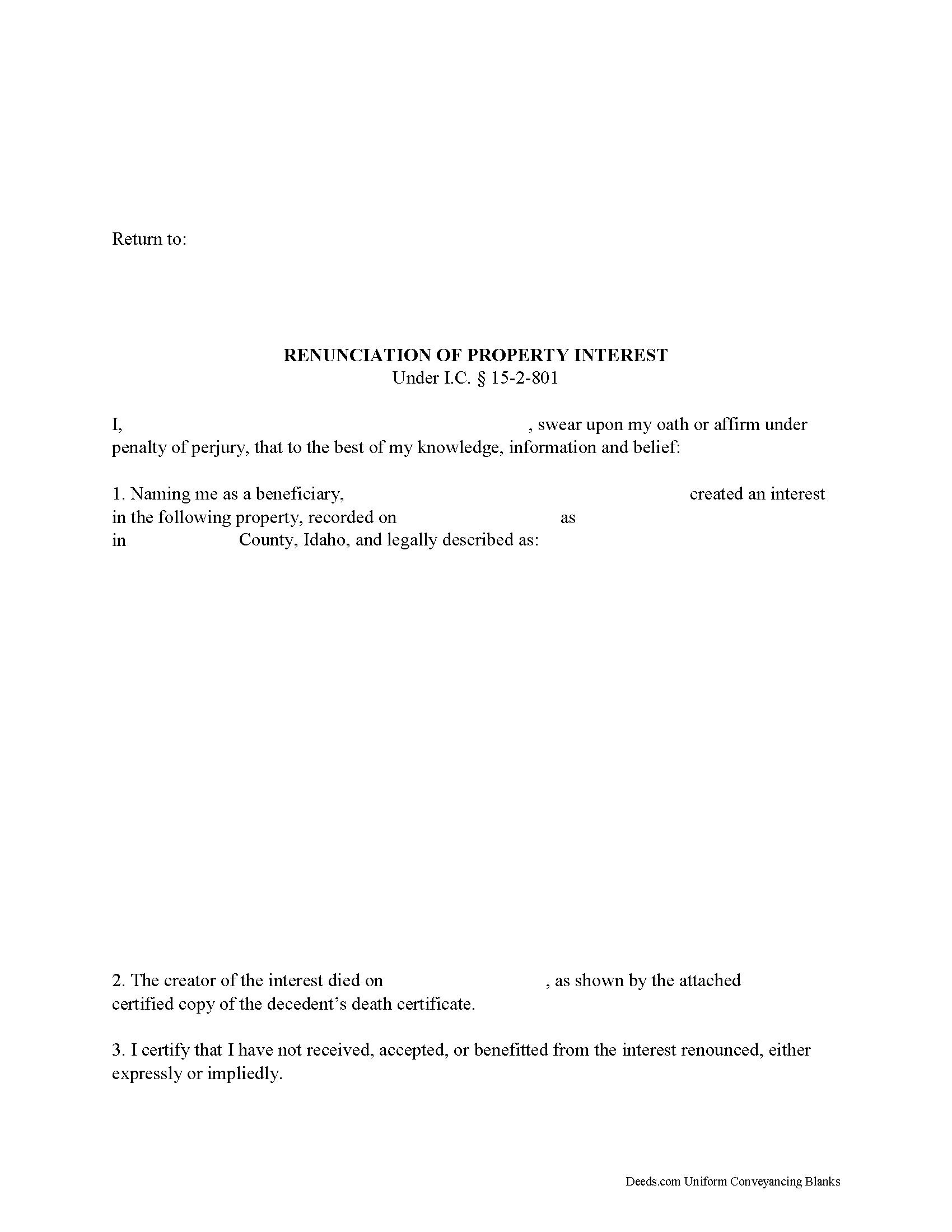

Ada County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

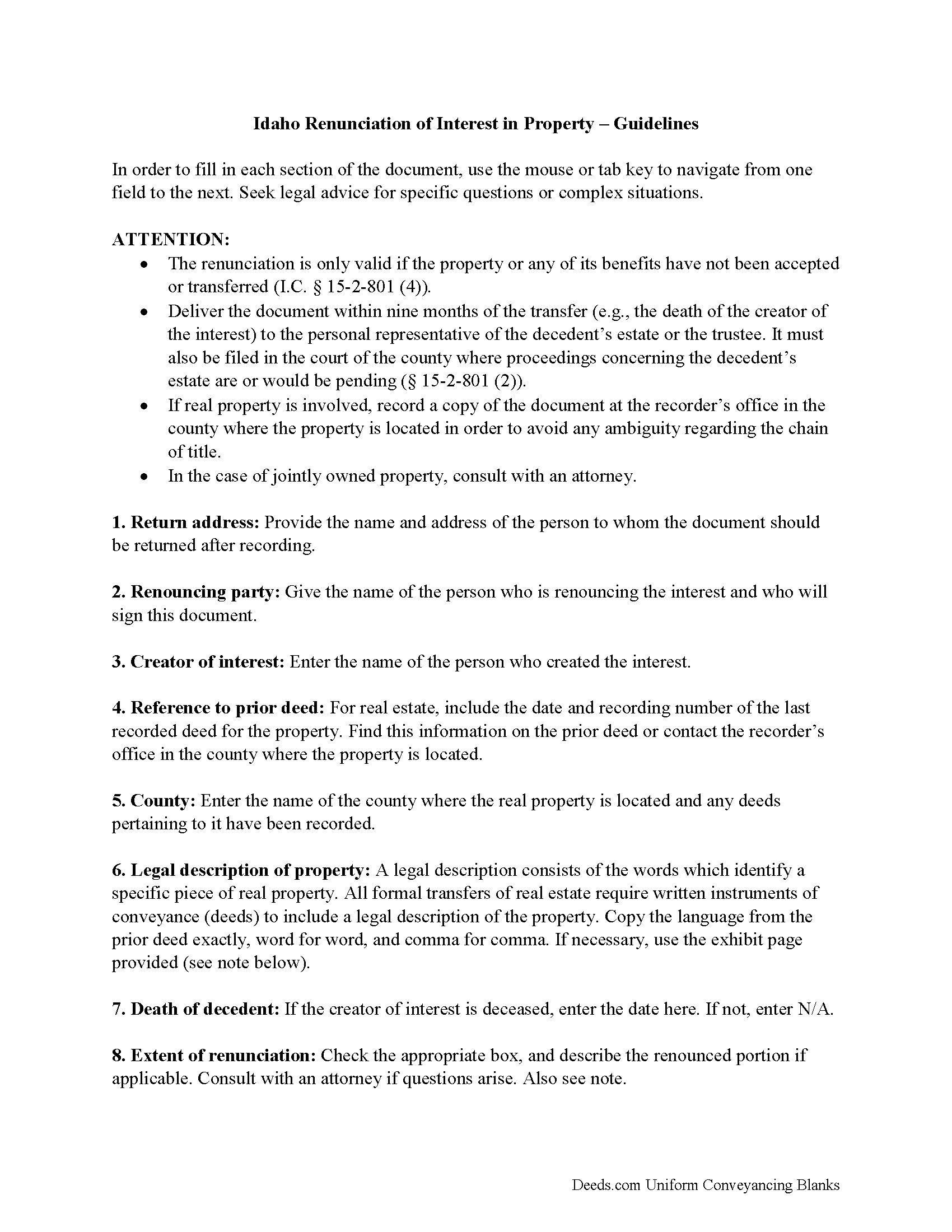

Ada County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

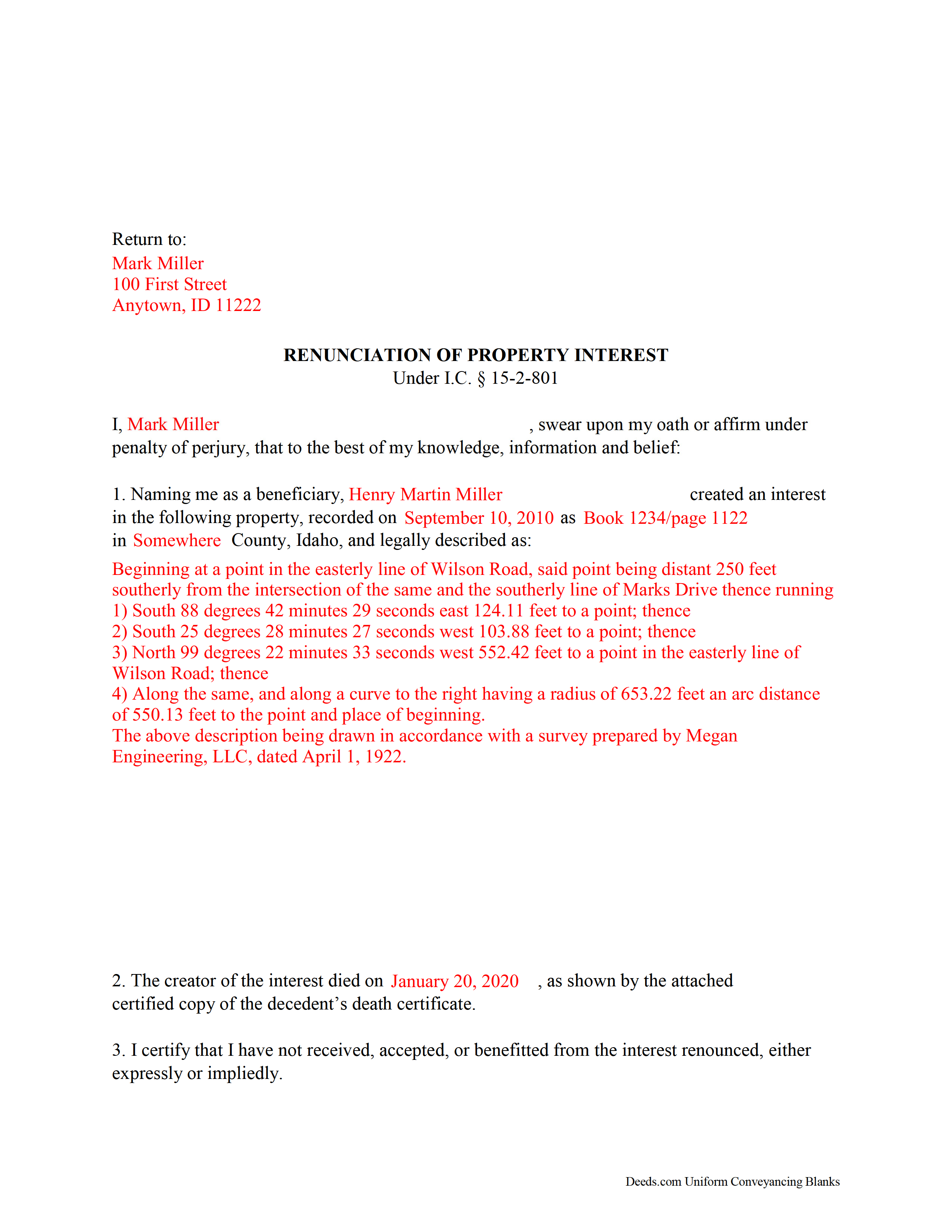

Ada County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Ada County documents included at no extra charge:

Where to Record Your Documents

Ada County Clerk/Auditor/Recorder

Boise, Idaho 83702

Hours: 8:00 a.m. - 5:00 p.m M-F

Phone: (208) 287-6840

Recording Tips for Ada County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- White-out or correction fluid may cause rejection

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Ada County

Properties in any of these areas use Ada County forms:

- Boise

- Eagle

- Garden City

- Kuna

- Meridian

- Star

Hours, fees, requirements, and more for Ada County

How do I get my forms?

Forms are available for immediate download after payment. The Ada County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Ada County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Ada County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Ada County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Ada County?

Recording fees in Ada County vary. Contact the recorder's office at (208) 287-6840 for current fees.

Questions answered? Let's get started!

Idaho Renunciation of Property

Under the Idaho Statutes, the beneficiary of an interest in property may renounce the gift, either in part or in full (I.C. 15-2-801). Note that the option to renounce is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (15-2-801 (4)).

The document must be in writing and include a description of the interest, a declaration of intent to renounce all or a defined portion of the interest, and be signed by the renouncing party (15-2-801 (1) (b)).

Deliver the document within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the trustee. It must also be filed in the court of the county where proceedings concerning the decedent's estate are or would be pending (15-2-801 (2)). If real property is involved, record a copy of the document at the recorder's office in the county where the property is located in order to avoid any ambiguity regarding the chain of title.

A renunciation is irrevocable and binding for the renouncing party and his or her creditors (15-2-801 (6)), so be sure to consult an attorney when in doubt about the drawbacks and benefits of renouncing inherited property. If the renounced interest arises out of jointly-owned property, seek legal advice as well.

Important: Your property must be located in Ada County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Ada County.

Our Promise

The documents you receive here will meet, or exceed, the Ada County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Ada County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

Angela T.

June 21st, 2019

I love this website .. it has been very helpful in so many ways.. thank you so much..

Thank you!

Shihei W.

December 12th, 2024

Loved every step of the process, from the detail explanation of the services/products provided, to the inclusive packet that comes with my purchase of the trust certification form.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

RALPH B.

September 22nd, 2019

THE BEST SERVICE WAS ON TIME AS STATED DID ALL THE WORK NEED IN A VERY PROFESSIONAL MANNER GREAT FOLLOW UP AND THE OFFICE STAFF IS FANTASTIC IN RESPONSE AND DOING WHAT I NEED TO HAVE DONE WOULD RECOMMEND THIS COMPANY TO ANYONE WHO NEEDS THIS SERVICE

Thank you!

Michael F.

May 12th, 2021

I'm not too bright and I made a mess of things when I tried to create my own deed. It was lucky that I found the forms here after so many of my personal failures. It's good that the pros know what they are doing.

Such kind words Michael, thank you.

Barbara D.

November 11th, 2021

Very helpful, clear and precise. The example further clarifies exactly what is needed to be included in information.

Thank you!

Monica T.

January 8th, 2025

Super easy to use. Very pleased. The turn around time was very fast. I have another one pending. Thank you!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Desmond L.

December 27th, 2018

Easy access

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim T.

September 3rd, 2019

Although I am sure that the Quit Claim form was acceptable for my county, I felt that it was not formatted in the manor that I have seen while viewing the other deeds recorded. So that forms that I received were not useful to me.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary K.

September 28th, 2019

Awesome site. Looking for a way to save hiring an attorney. Family doesn't have the money for that so this site is much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Margo M.

February 11th, 2021

So far help has been good given some of the information you don't have as far as making corrections. This is my first time using your service so maybe I will be better at utilizing it if I have to again.

Thank you for your feedback. We really appreciate it. Have a great day!

Anne-Marie B.

December 30th, 2020

This was the first time I have ever e-recorded a document. The process was smooth and simple. I loved being informed at each step along the way. I am glad I chose deeds.com and plan to use them in the future for all my electronic recording of legal documents.

Thank you!

David P.

February 18th, 2019

re: Transfer Upon Death Deed For Valencia County, NM, why not have ONE button to download all necessary forms? Individual buttons are tedious.

Thank you for your feedback David. The short answer is because not everyone needs all the forms. We will look into adding an option for downloading all the provided documents at once.

Paula M.

October 15th, 2021

So far it seems good. I am still trying to send information to this company so they can help me with the deed.

Thank you for your feedback. We really appreciate it. Have a great day!

Samantha S.

April 29th, 2021

I really appreciated Deeds.com. It was quick and easy to use. Saved me substantial time completing my deed recording.

Thank you for your feedback. We really appreciate it. Have a great day!