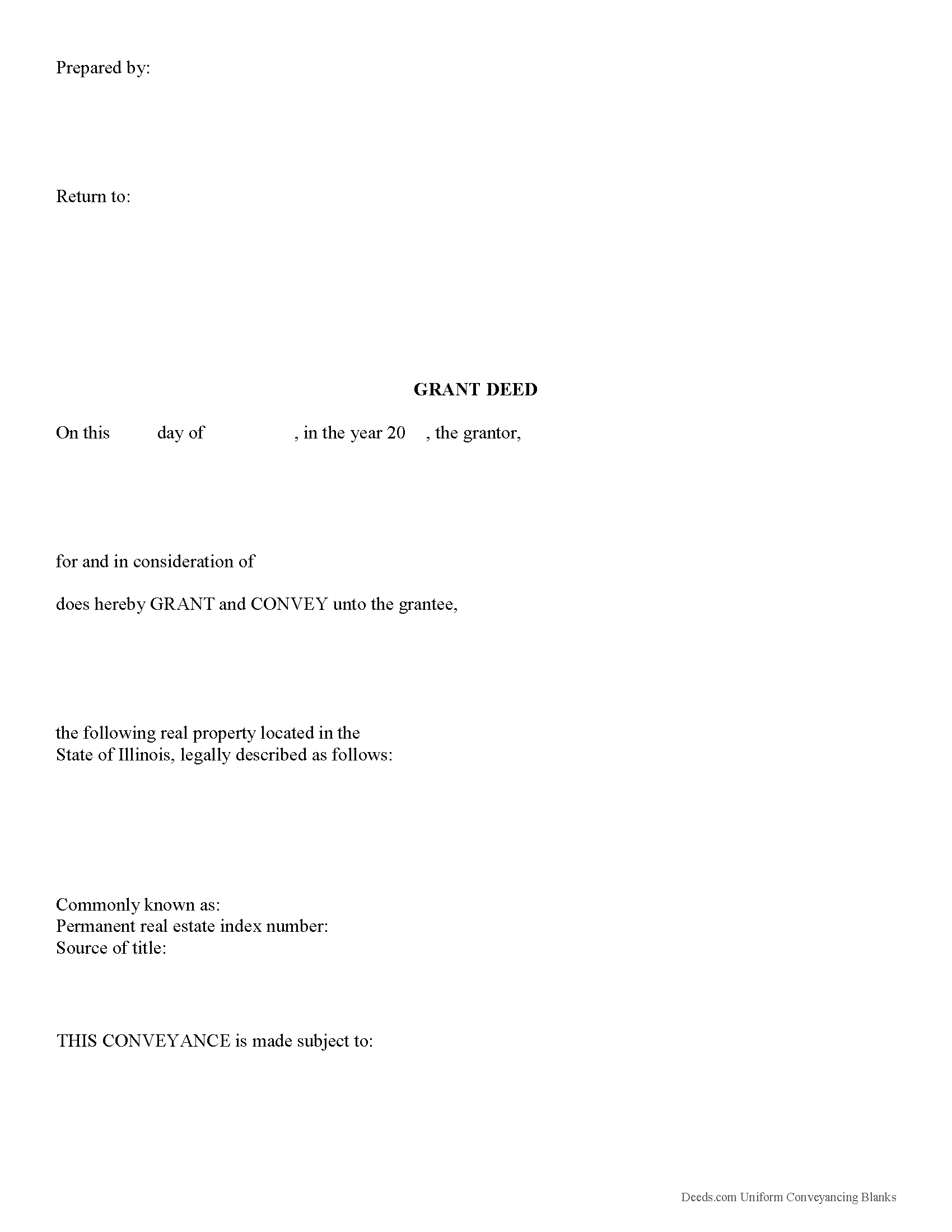

Perry County Grant Deed Form

Perry County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

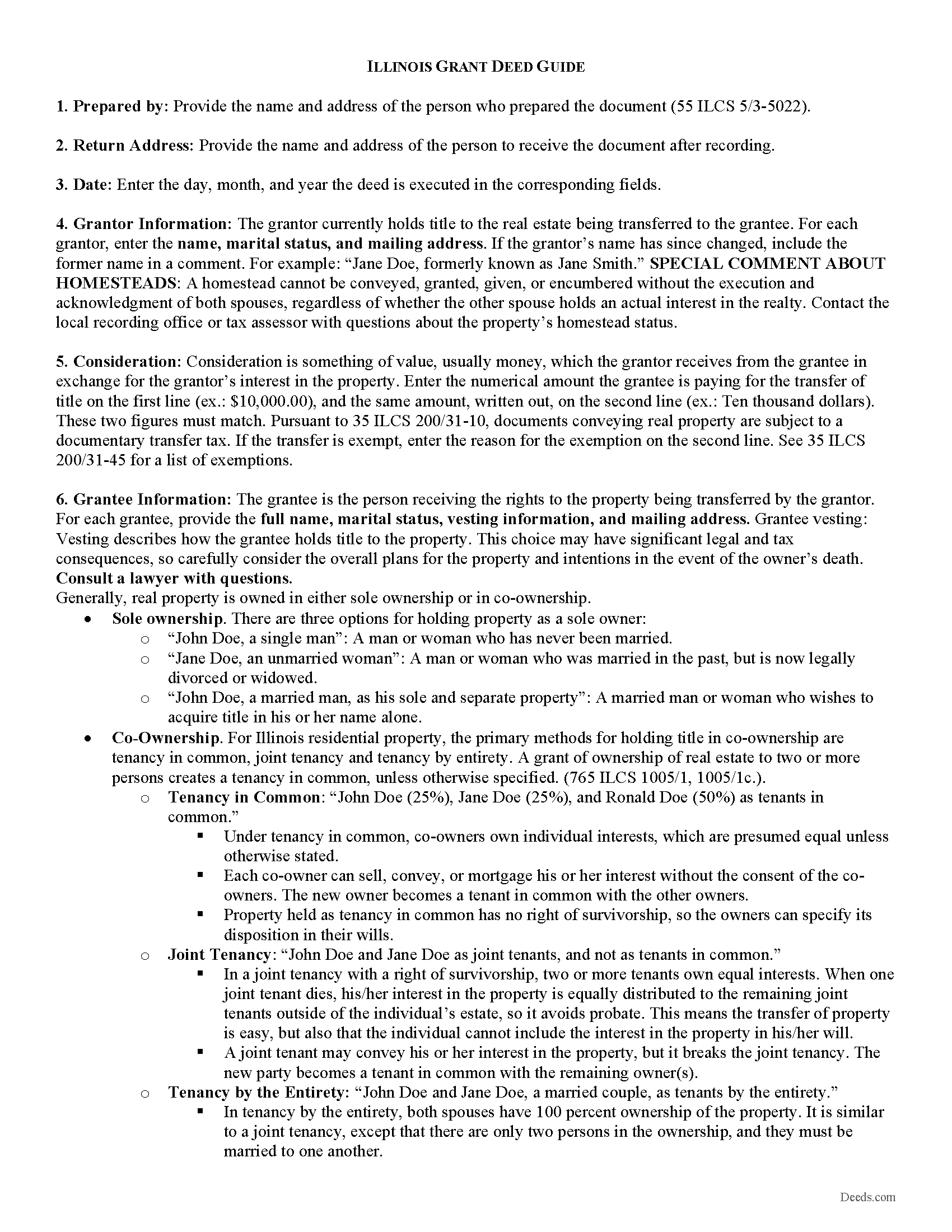

Perry County Grant Deed Guide

Line by line guide explaining every blank on the form.

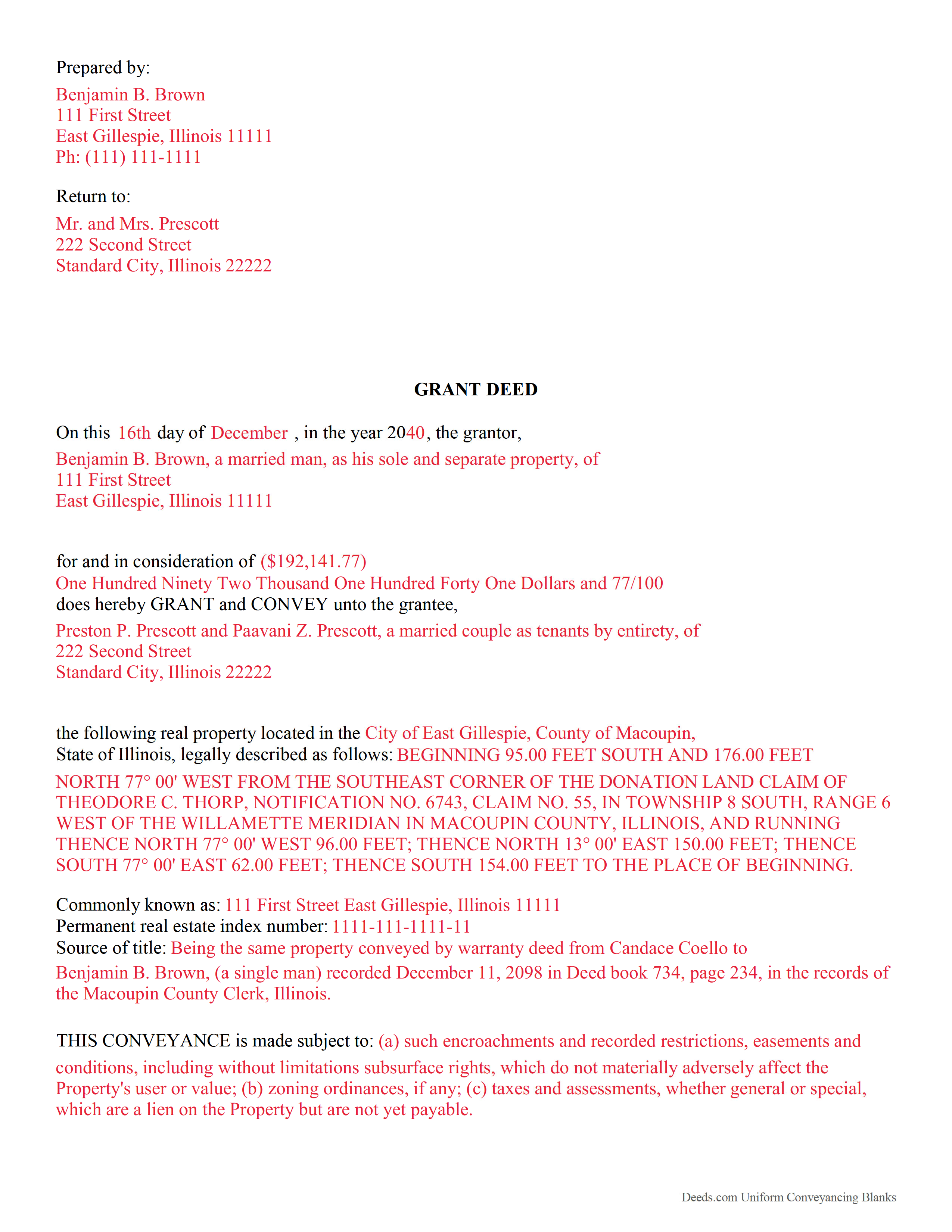

Perry County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Perry County documents included at no extra charge:

Where to Record Your Documents

Perry County Clerk & Recorder

Pickneyville, Illinois 62274-0438

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 357-5116

Recording Tips for Perry County:

- White-out or correction fluid may cause rejection

- Ask if they accept credit cards - many offices are cash/check only

- Leave recording info boxes blank - the office fills these

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Perry County

Properties in any of these areas use Perry County forms:

- Cutler

- Du Quoin

- Pinckneyville

- Tamaroa

- Willisville

Hours, fees, requirements, and more for Perry County

How do I get my forms?

Forms are available for immediate download after payment. The Perry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Perry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Perry County?

Recording fees in Perry County vary. Contact the recorder's office at (618) 357-5116 for current fees.

Questions answered? Let's get started!

A grant deed, also referred to as a bargain and sale deed, is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). It contains covenants that the grantor has not previously sold the real property interest being conveyed to the grantee, and warrants that the property is conveyed to the grantee without any liens or encumbrances except for those specifically disclosed in the deed. Therefore, if the grantee later discovers that the grantor has sold the property to a third party, or if there are undisclosed encumbrances, the grantee may be able to sue the grantor for damages.

Lawful deeds include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Illinois residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless a joint tenancy or tenancy by the entirety is specified. (765 ILCS 1005/1, 1005/1c.).

As with any conveyance of real estate, a grant deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. The deed must meet all state and local standards for recorded documents. Finally, the grantor signs the completed document in front of a notary. Once acknowledged, record the deed in the recorder's office in the county where such lands are located. Make sure to include all relevant documents, affidavits, forms, and fees.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about grant deeds or for any other issues related to the transfer of real property in Illinois.

(Illinois Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Perry County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Perry County.

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4583 Reviews )

Kent B.

February 25th, 2019

Disappointed on most recent order. Format did not permit changing the "boilerplate" language to change "grantor" to "grantors". In so restricting, could not use pre-printed form to make a joint party conveyance.

Sorry to hear of your disappointment. We've canceled your order and payment for the warranty deed document. Have a wonderful day.

Greg S.

August 19th, 2022

The Beneficiary Deed is easy to fill out, expecially with the examples/explanations provided. The only recommendation I would make is to state that the Parcel ID and the Assessor's ID are one in the same. I looked everywhere for something that mentions "Assessor's ID" in my paperwork to no avail. Upon calling the Maricopa Assessor's number in Maricopa I was told that they are the same.

Thank you for your feedback. We really appreciate it. Have a great day!

Taylor W.

February 2nd, 2021

This was the quickest NOC recording i have ever done. I will definitely be using deeds.com from here on out for recordings!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Claudia S.

October 18th, 2022

The site is very user friendly. Where can I get a copy of all the invoices that were paid? Thank you. Claudia

Thank you for your feedback. We really appreciate it. Have a great day!

Deanna S.

May 6th, 2020

I loved the fact that the forms came with examples of the required info. That was helpful and made filling out the forms so much easier. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Peter M.

July 30th, 2020

GREAT! site, had everything we needed to complete our estate planning for our children

Thank you for your feedback. We really appreciate it. Have a great day!

Beryl B.

January 5th, 2019

This was an easy and convenient site to obtain documents. I really appreciated the fact that after paying the fee, the site stayed available to me for access to samples, examples, forms, etc

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Benjamin A.

November 27th, 2019

This method seems simple for me to complete. Wish me luck.

Thank you for your feedback. We really appreciate it. Have a great day!

Melinda L.

April 23rd, 2022

Easy to find what I needed and a good price. Very satisfied.

Thank you for your feedback. We really appreciate it. Have a great day!

John K.

June 21st, 2023

Very pleased. Responsive staff and fast recordation.

Thank you for the kind words John. Our staff appreciates you and your feedback. Have an amazing day!

RICKY N.

July 10th, 2020

Fast Speedy great communication worry-free

Thank you!

CHERYL G.

April 11th, 2022

After my county rejected a deed from another company, I researched better and purchased my Lady Bird Deed from Deeds.com. Very simple, received everything immediately. Printed out sample and guide sheets and filled out my deed. Very thorough and easy to understand. All the additional forms were awesome. And the best part is, my county recorded my deed this morning! WooHoo! Very happy customer! Thank you!

Glad to hear! Thanks for taking the time to leave your review. We appreciate you. Have a great day.

Raymond N.

September 7th, 2023

The process of obtaining the forms that I wanted was very easy and the cost reasonable. The site is easy to follow and explains everything. Thank you for being here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane J.

October 20th, 2021

Worked great very quick and easy without the sample model for my state would have been difficult for me thank's

Thank you for your feedback. We really appreciate it. Have a great day!

Joni S.

February 6th, 2024

Excellent service, no hassle, easy to use, affordable, best service -- hands down. I thought it would be difficult for me to record a deed in Florida while residing in California but you made it so easy. I will tell everyone about your service. Thank you.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!