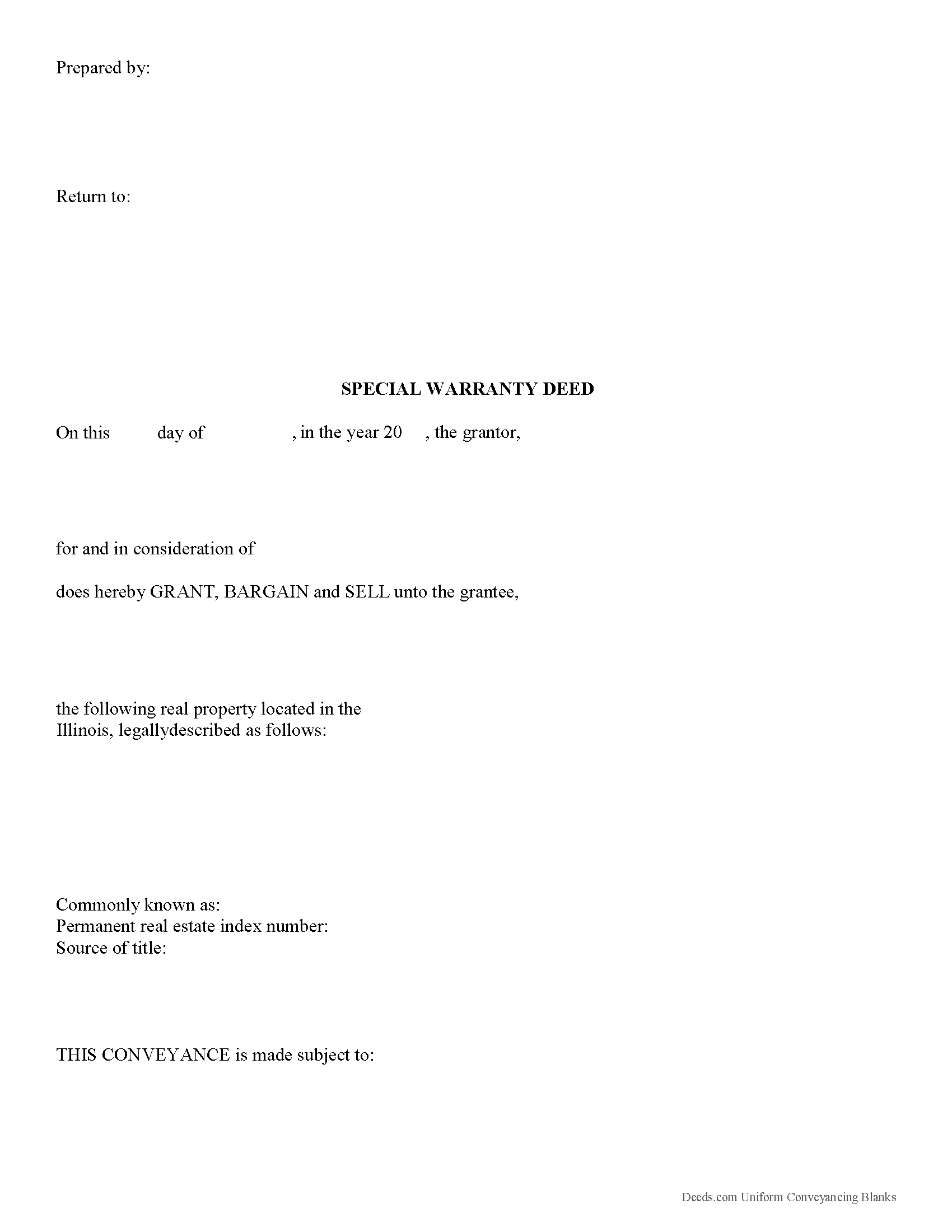

Perry County Special Warranty Deed Form

Perry County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

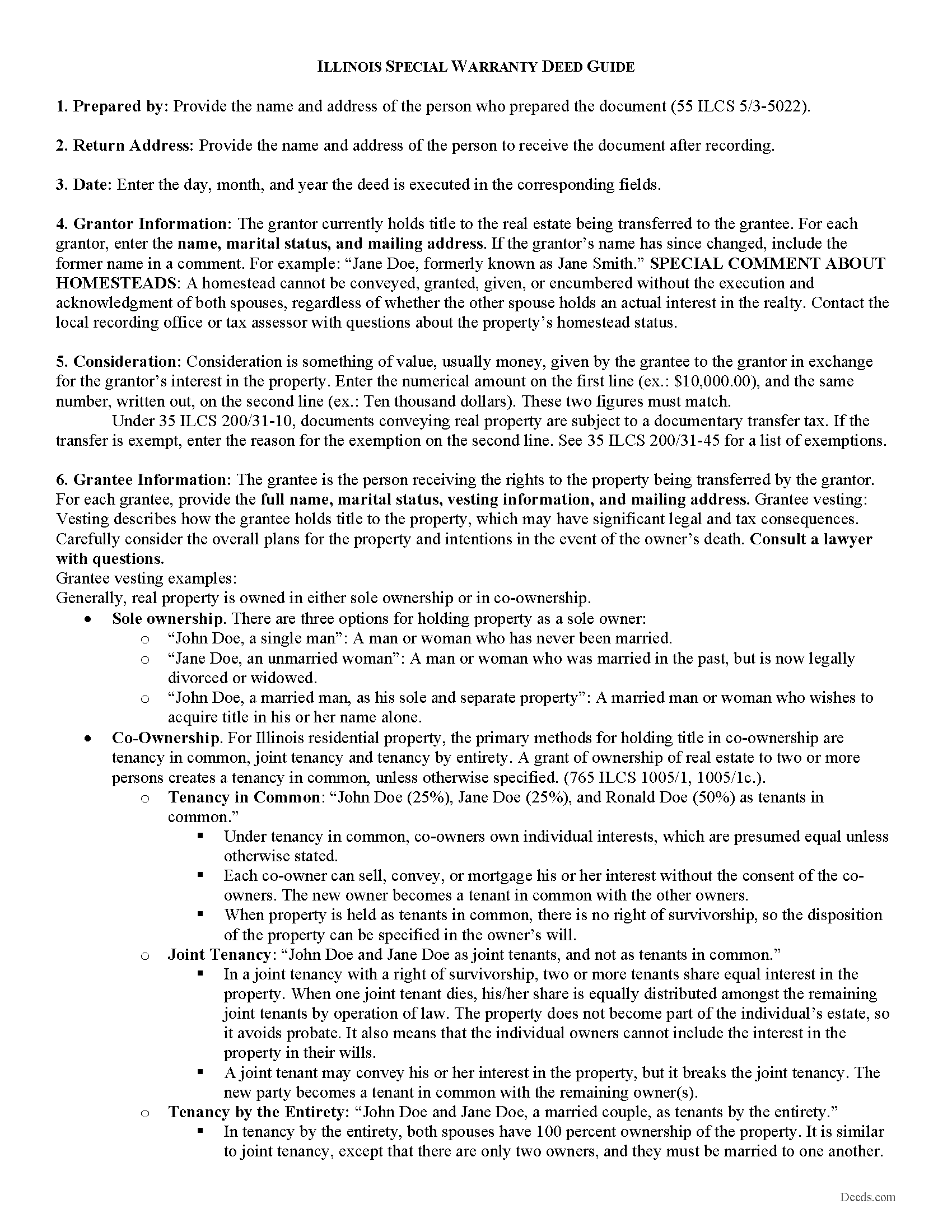

Perry County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

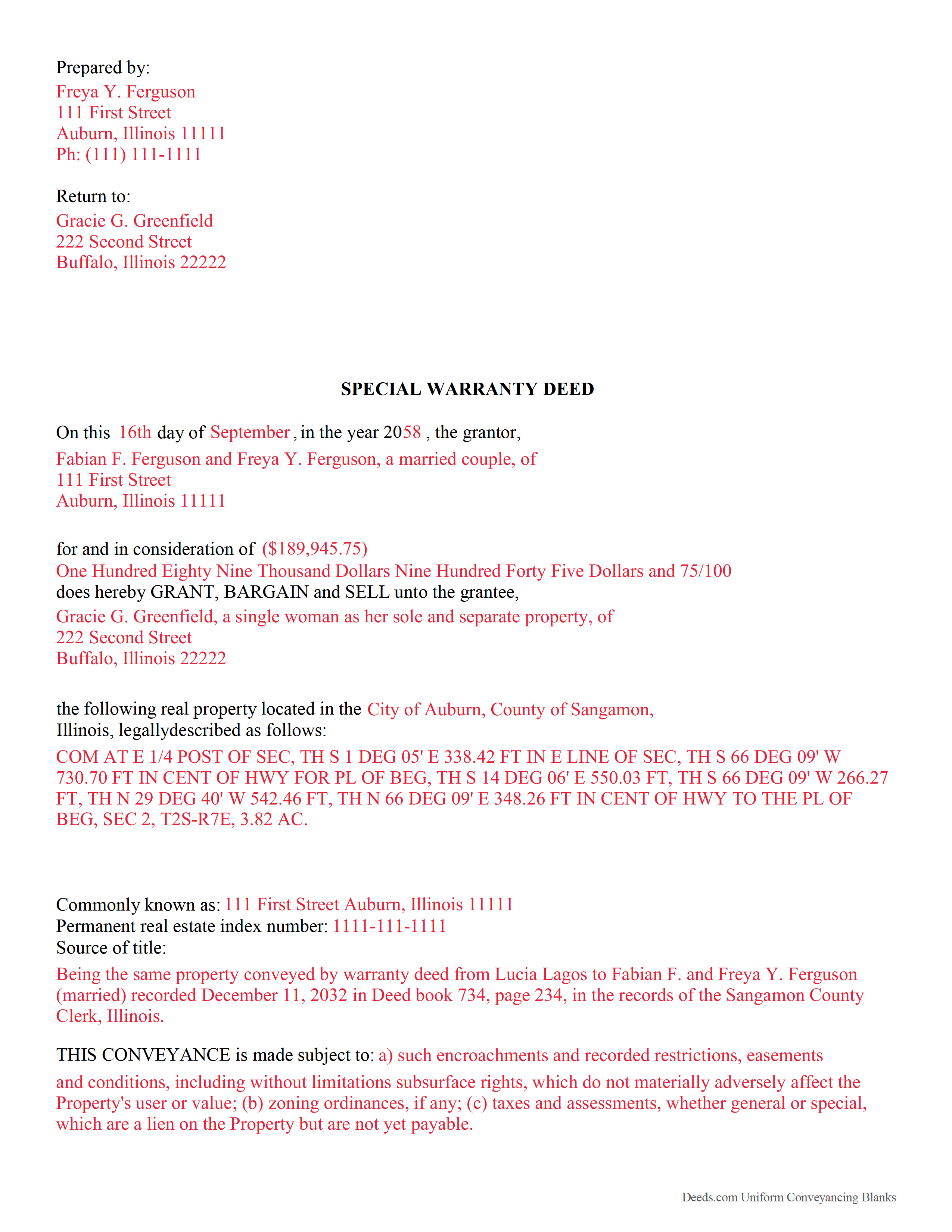

Perry County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Perry County documents included at no extra charge:

Where to Record Your Documents

Perry County Clerk & Recorder

Pickneyville, Illinois 62274-0438

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 357-5116

Recording Tips for Perry County:

- Ensure all signatures are in blue or black ink

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Avoid the last business day of the month when possible

Cities and Jurisdictions in Perry County

Properties in any of these areas use Perry County forms:

- Cutler

- Du Quoin

- Pinckneyville

- Tamaroa

- Willisville

Hours, fees, requirements, and more for Perry County

How do I get my forms?

Forms are available for immediate download after payment. The Perry County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Perry County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Perry County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Perry County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Perry County?

Recording fees in Perry County vary. Contact the recorder's office at (618) 357-5116 for current fees.

Questions answered? Let's get started!

A special warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). Also referred to as a limited warranty deed, this type of deed provides significant liability protection for the grantor (seller), and less protection for the grantee (buyer). In a special warranty deed, the grantor only warrants against defects in the title during his or her ownership, and that he or she has an actual right to the title, and is authorized to sell it. Unlike a deed with full warranty, however, it does not guarantee that there are no other claims on the title of the property before the grantor owned the property, nor does it bind the grantor to defend against them. Because of the risk of unknown claims on the title, special warranty deeds are less common than traditional warranty deeds for residential real estate transactions.

A special warranty deed, once acknowledged, should be recorded in the recorder's office in the county where such lands are located. If it is acknowledged in Illinois, acknowledgements may be taken before a notary public, United States commissioner, county clerk, or any court, judge, clerk, or deputy clerk of such court. When they are taken before a notary public or United States commissioner, they must be attested by his or her official seal; and if taken before a judge or clerk of a court, the acknowledgements must be attested by the seal of the court (765 ILCS 5/20).

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Illinois residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless a joint tenancy or tenancy by the entirety is specified. (765 ILCS 1005/1, 1005/1c.).

As with any conveyance of real estate, special warranty deeds must comply with all state and local recording standards, including a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property.

Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording as well. Pursuant to 35 ILCS 200/31-10, documents conveying real property are subject to a documentary transfer tax. An Illinois Real Estate Transfer Declaration is required (35 ILCS 200/31-25), unless an exemption is claimed. See 35 ILCS 200/31-45 for a list of exemptions.

A Notarial Record Form is also required, unless an exemption is claimed. A list of exempt conveyances can be found on page 1 of the Notarial Record Form (5 ILCS 312/3-102). Some Illinois counties require a Plat Act Affidavit of Metes and Bounds pursuant to 765 ILCS 205/1 with all deeds, assuring that the land has not been divided or identifies specific types of division according to the plat act. Contact the local recorder for additional details about supplemental document requirements.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Consult an attorney with questions about special warranty deeds or for any other issues related to the transfer of real property.

(Illinois Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Perry County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Perry County.

Our Promise

The documents you receive here will meet, or exceed, the Perry County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Perry County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Denise S.

September 5th, 2019

Took all the guesswork out of what we were trying to accomplish, and gave us peace of mind that we would have the correct documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

james h.

June 15th, 2020

Service was quick and easy to use. I got not only the necessary forms, but instructions and sample forms filled out. Highly recommended.

Thank you!

Steven C.

May 1st, 2019

Easy but a little overpriced

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane P.

July 22nd, 2022

Form was very easy to use and was processed/ recorded with no issue. Thank you it saved me from having to contact an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen M.

April 14th, 2020

Your Service was excellent. Very responsive. Thank you.

Thank you!

Nicole w.

July 22nd, 2022

Awesome and very fast service!!!

Thank you!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Elizabeth P.

October 20th, 2020

Perfect quitclaim form. Easy to fill in with the required information and all the required information has a place (no easy feat in our county!). It is helpful that they include exhibit pages for larger blocks of information (our legal is 2 pages long). Great job folks!

Thank you for the kind words Elizabeth. Have an amazing day!

Samuel Shera Singh B.

November 6th, 2022

I found the documents I needed and so many more that I will utilize for business, personal and family needs. Also I made a purchase of an additional document I did not need that serves the same purpose as one I purchased and Deeds.com had no issue refunding the unnecessary document in an unbelievably quick response and refund. I would recommend this document provider to everyone including legal office management.

Thank you for your feedback. We really appreciate it. Have a great day!

Pegi B.

January 24th, 2022

This service is fast and easy to use. We will definitely use this service again. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jo A B.

June 18th, 2022

Clean crisp website with helpful information; however. If the site states the following files are included, a single .zip, .rar, , ,download should be available instead of individual.

Thank you for your feedback. We really appreciate it. Have a great day!

Yvonne R.

December 1st, 2020

Quick and easy, however, I couldn't get the guide to download.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott W.

September 21st, 2021

World class forms and service! Wish I had known about this site years ago, woulda saved me lots of headaches. Thank you.

Thanks for the kinds words Scott, have an amazing day!

Scott W.

February 5th, 2024

Quick and simple.

Thank you!