Rock Island County Statutory Short Form Power of Attorney for Property Form

Rock Island County Statutory Power of Attorney Form

Fill in the blank form formatted to comply with all recording and content requirements.

Rock Island County Power of Attorney Guidelines

Line by line guide explaining every blank on the form.

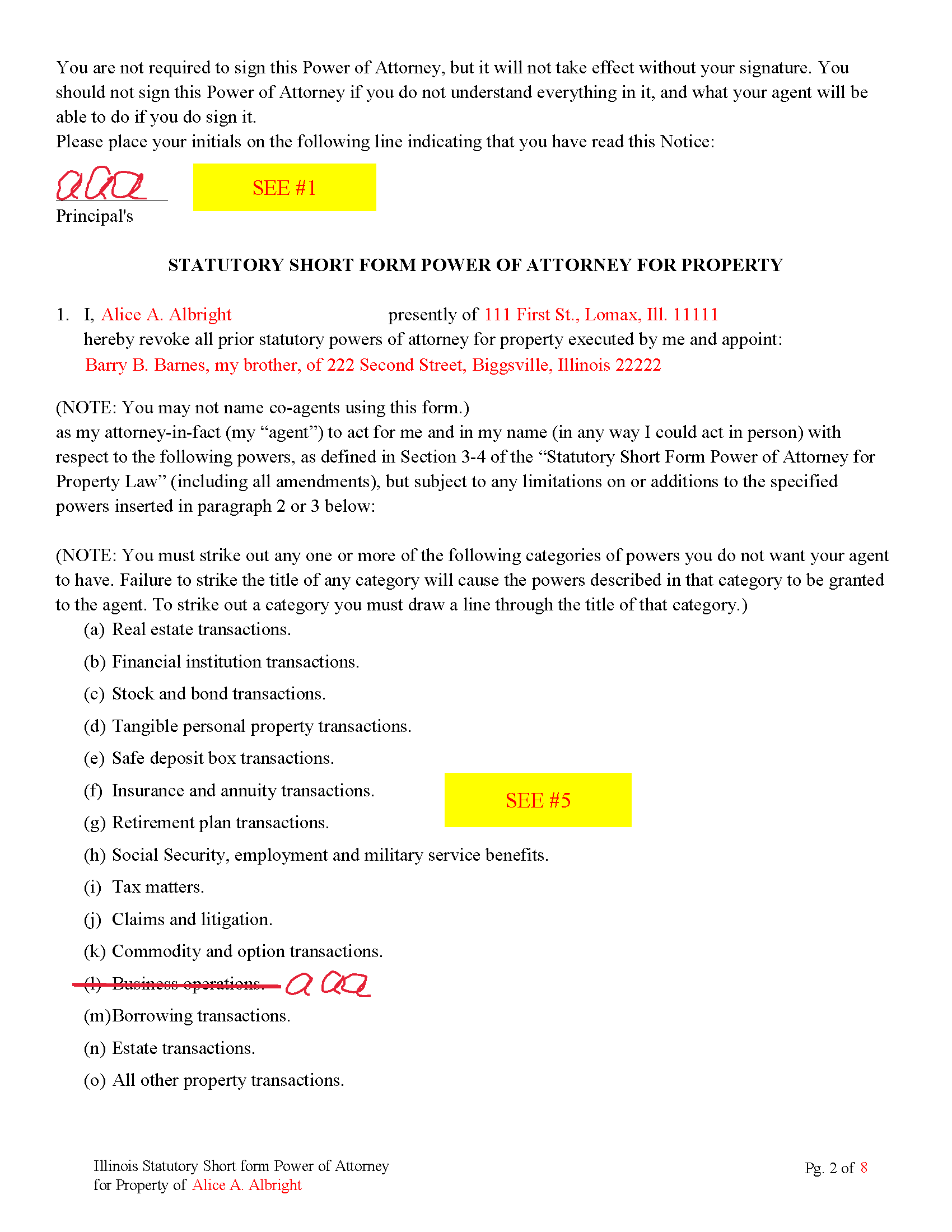

Rock Island County Completed Example of the Power of Attorney

Example of a properly completed form for reference.

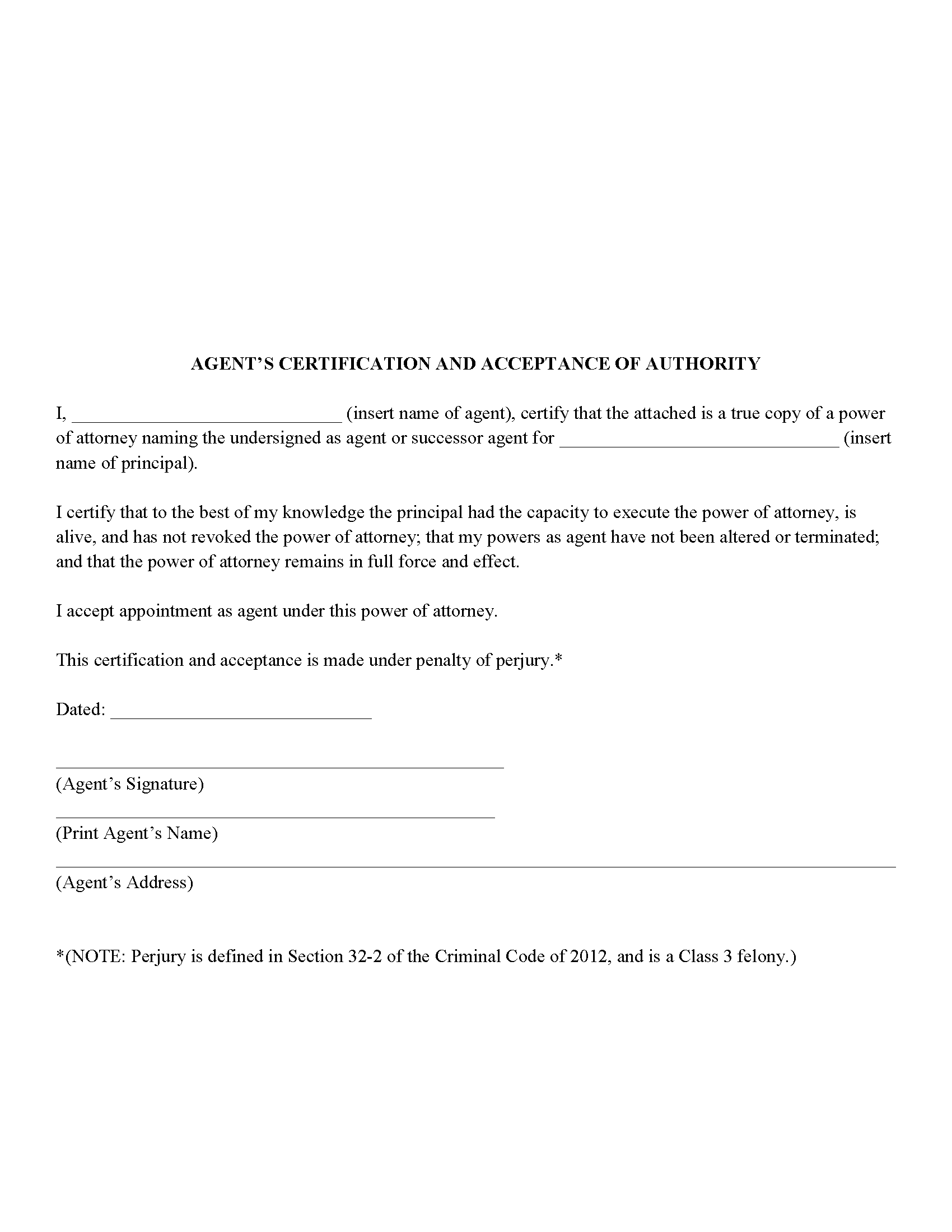

Rock Island County Agents Certification Form

Agent certifies he/she is authorized to act. Often required by third parties.

All 4 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Rock Island County documents included at no extra charge:

Where to Record Your Documents

Rock Island County Recorder

Rock Island, Illinois 61201

Hours: 8:00am to 4:30pm M-F

Phone: (309) 558-3360

Recording Tips for Rock Island County:

- Check margin requirements - usually 1-2 inches at top

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Rock Island County

Properties in any of these areas use Rock Island County forms:

- Andalusia

- Barstow

- Buffalo Prairie

- Carbon Cliff

- Coal Valley

- Cordova

- East Moline

- Hampton

- Hillsdale

- Illinois City

- Milan

- Moline

- Port Byron

- Rapids City

- Reynolds

- Rock Island

- Silvis

- Taylor Ridge

Hours, fees, requirements, and more for Rock Island County

How do I get my forms?

Forms are available for immediate download after payment. The Rock Island County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Rock Island County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rock Island County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Rock Island County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Rock Island County?

Recording fees in Rock Island County vary. Contact the recorder's office at (309) 558-3360 for current fees.

Questions answered? Let's get started!

This short for power of attorney allows for a primary agent and successor agents (agents who will act if the primary agent can't or won't act)

Categories that your agent can or can NOT perform. Each governed by Illinois Statutes.

(a) Real estate transactions.

(b) Financial institution transactions.

(c) Stock and bond transactions.

(d) Tangible personal property transactions.

(e) Safe deposit box transactions.

(f) Insurance and annuity transactions.

(g) Retirement plan transactions.

(h) Social Security, employment and military service benefits.

(i) Tax matters.

(j) Claims and litigation.

(k) Commodity and option transactions.

(l) Business operations.

(m) Borrowing transactions.

(n) Estate transactions.

(o) All other property transactions. (755 ILCS 45/3-4)

This is a recordable document, if you allow your agent to transfer real property, Title Companies and/or other third parties will usually require the power of attorney to be recorded before a transfer of real property can take place if it has not been done so previously. This power of attorney includes an addendum page to list real property.

(Illinois Statutory POA Package includes form, guidelines, and completed example)

Important: Your property must be located in Rock Island County to use these forms. Documents should be recorded at the office below.

This Statutory Short Form Power of Attorney for Property meets all recording requirements specific to Rock Island County.

Our Promise

The documents you receive here will meet, or exceed, the Rock Island County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rock Island County Statutory Short Form Power of Attorney for Property form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Rachel S.

January 25th, 2021

It would be nice to get a reply in a small window that says "Your request package has been submitted." That way I can log out and wait for the email. I do love the efficient service.

Thank you!

Aron H.

September 17th, 2020

Impressed with how quick the process was to e-record our documents. Will recommend this service to anyone needing to record a document.

Thank you!

Rechantell A.

August 1st, 2020

It was quick and easy. Trust worthy. Very satisfied and would recommend. Thank you for your services.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony F.

April 7th, 2020

quick, easy and simple. Also thank you for having the e-submission area particularly with the Covid-19 /Shelter in place things happening.

Thank you for your feedback. We really appreciate it. Have a great day!

Karen O.

June 2nd, 2021

I often think I am smarter than I am. Thankfully there are people that know what they are doing so I can focus on my business and the big picture without worrying about the little things.

Thank you!

Lori A.

February 14th, 2023

It was quick and easy. A little expensive but convient

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracey H.

November 10th, 2020

The transaction was easy and the download was immediately, What a great service to provide for a reasonable price. I highly recommend this service.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas K.

July 25th, 2020

I never did this before and I found the service easy however confusing about the process and expectations. I had a trust prepared and needed to record our home deed to the trust. Now that I am almost finished waiting for the Maricopa county record the deed it seems so easy.

Thank you!

Caroline M. L.

January 3rd, 2020

Hopefully, I am on the correct site to transfer ownership of a time share to my son. I am a senior, and this site is easy to follow if I am on the correct site. : )

Thank you for your feedback. We really appreciate it. Have a great day!

lee s.

March 21st, 2019

Over all quality of document was good. The issue I had was where it states claimant did not have a contract with the owner or their agent. I did have a contract with their agent, and there was no option for both. So had improvise.

Thank you for your feedback. We really appreciate it. Have a great day!

Vickie M.

April 24th, 2022

The website was easy to use even for me with little computer knowledge.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Khadija K.

March 2nd, 2023

Great Service. Not only the required form, but also the state guidelines. Thank you for making it easy.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathleen S.

September 30th, 2020

The process was easy and the Staff was very helpful. Document was recorded quickly.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lowell P.

May 26th, 2020

Exceptionally helpful instruments that are compliant with State law and anticipate various contingencies. Very pleased.

Thank you for your feedback. We really appreciate it. Have a great day!