Will County Transfer on Death Instrument Form

Last validated December 29, 2025 by our Forms Development Team

Will County Transfer on Death Instrument

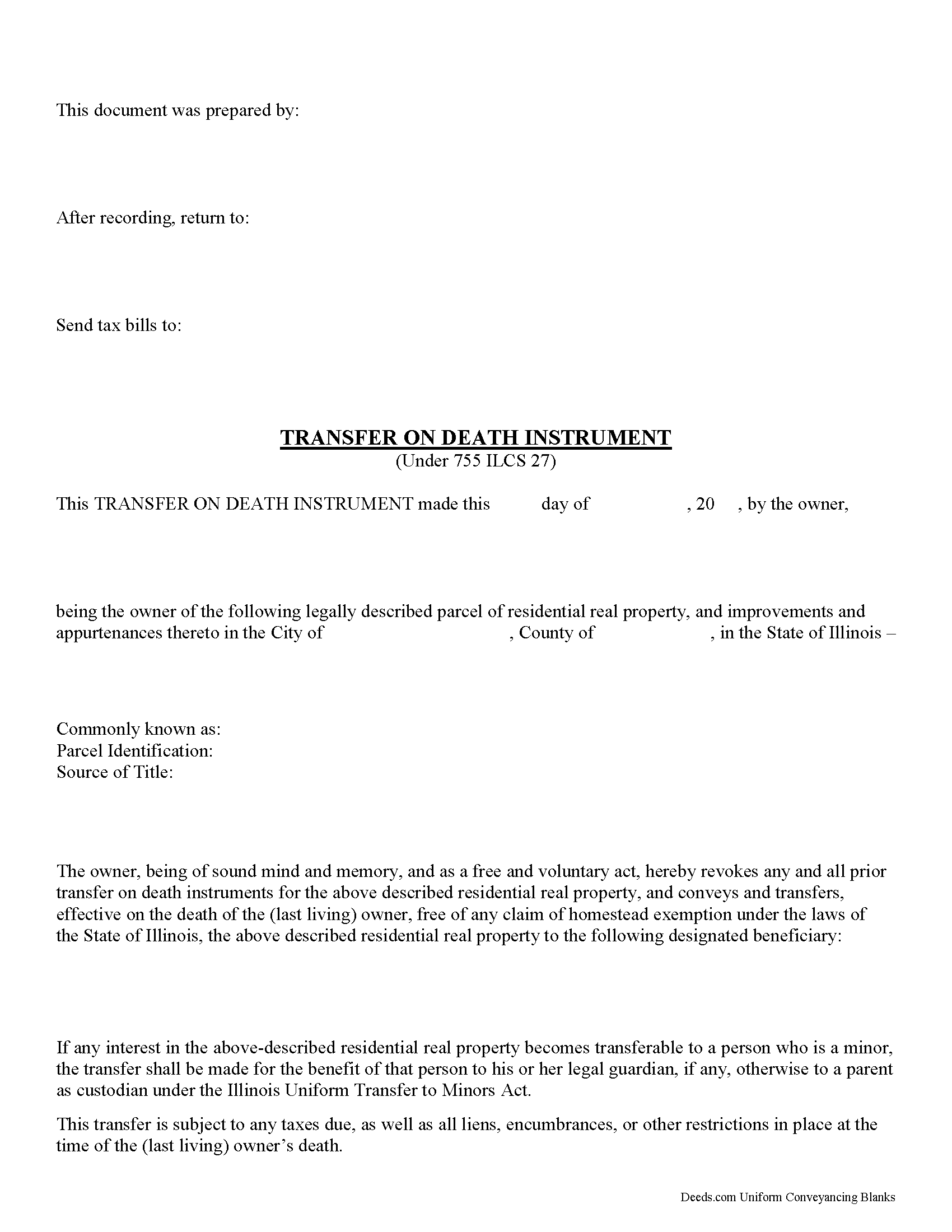

Fill in the blank form formatted to comply with all recording and content requirements.

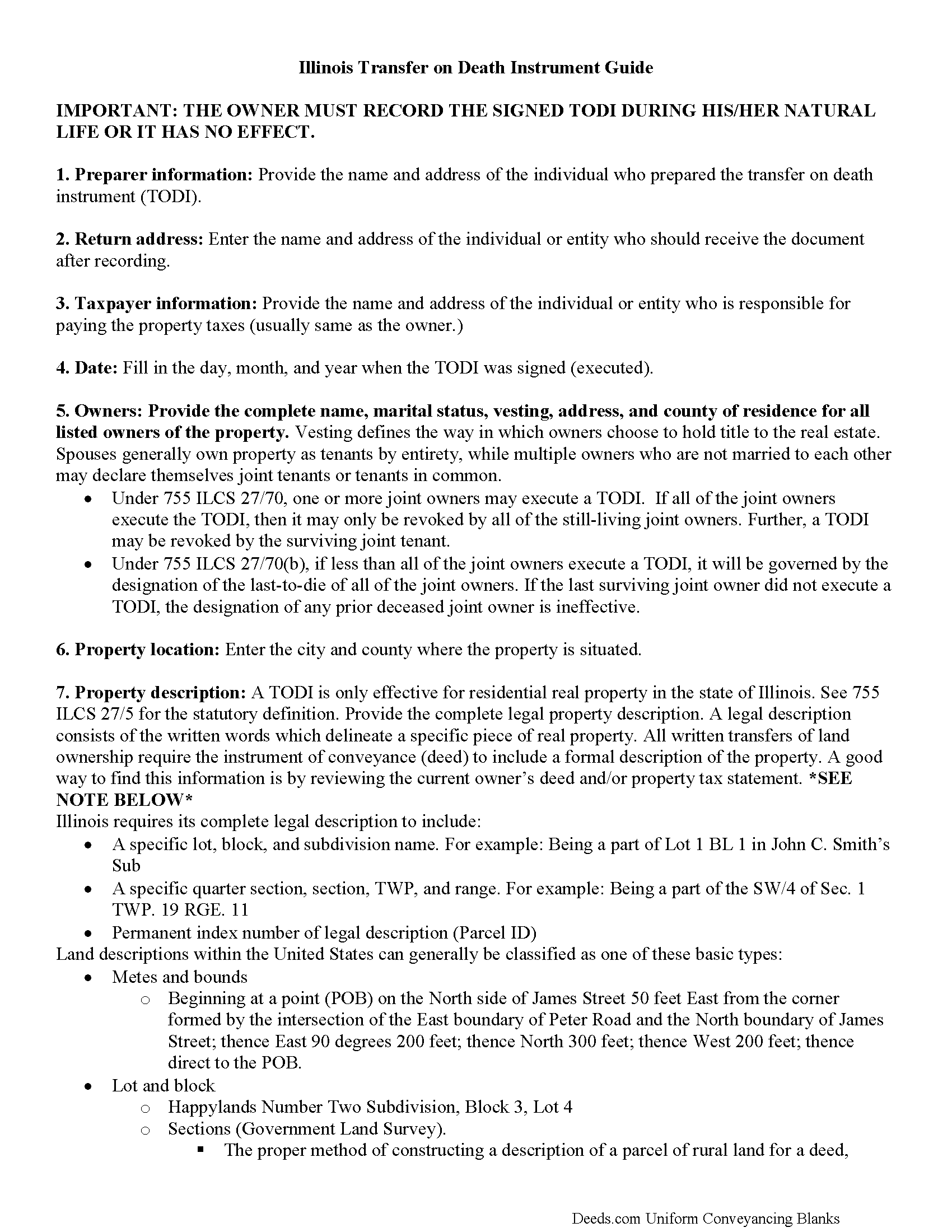

Will County Transfer on Death Instrument Guide

Line by line guide explaining every blank on the form.

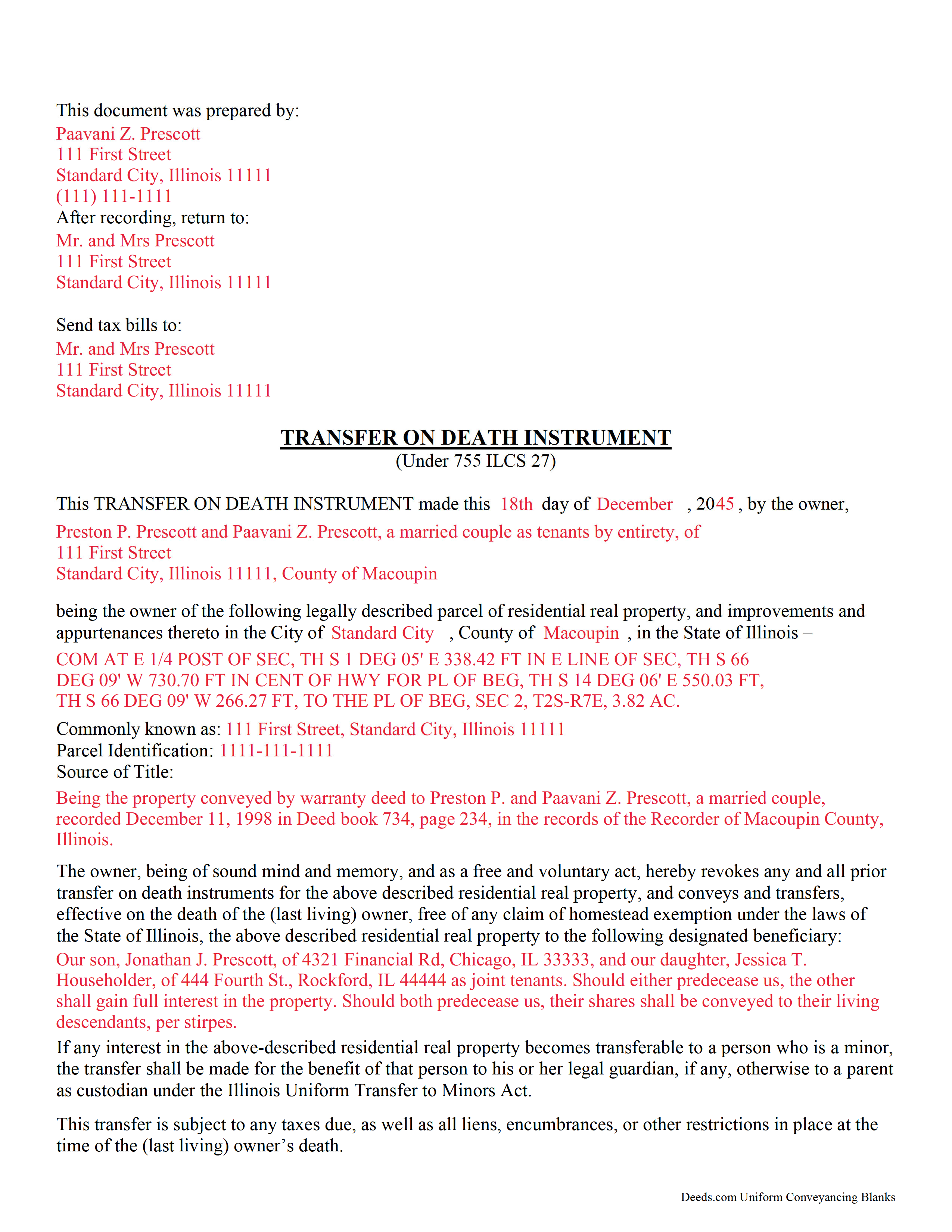

Will County Completed Example of the Transfer on Death Instrument Document

Example of a properly completed Illinois Transfer on Death Instrument document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Will County documents included at no extra charge:

Where to Record Your Documents

Will County Recorder - Joliet Office

Joliet, Illinois 60432-4143

Hours: 8:30 to 4:30 Monday through Friday

Phone: (815) 740-4637

Bolingbrook Office

Bolingbrook, Illinois 60440

Hours: Mon, Tue, Thu, Fri 8:30 to 1:00 & 2:00 to 4:30

Phone: (630) 759-5780

Recording Tips for Will County:

- Ensure all signatures are in blue or black ink

- Recording fees may differ from what's posted online - verify current rates

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Will County

Properties in any of these areas use Will County forms:

- Beecher

- Bolingbrook

- Braidwood

- Channahon

- Crest Hill

- Crete

- Elwood

- Frankfort

- Homer Glen

- Joliet

- Lockport

- Manhattan

- Mokena

- Monee

- Naperville

- New Lenox

- Peotone

- Plainfield

- Romeoville

- Shorewood

- Wilmington

Hours, fees, requirements, and more for Will County

How do I get my forms?

Forms are available for immediate download after payment. The Will County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Will County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Will County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Will County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Will County?

Recording fees in Will County vary. Contact the recorder's office at (815) 740-4637 for current fees.

Questions answered? Let's get started!

Comparable to Ladybird, beneficiary, and enhanced life estate deeds, these instruments permit homeowners to name a beneficiary to gain title to their residential real property following the owner's death, while retaining absolute possession of and control over the property while alive. Because the Illinois document DOES NOT transfer ownership when it's executed, the owner may revoke the transfer at will, and is allowed to reallocate, sell, or otherwise dispose of the real estate as desired with no penalties, restrictions or obligation.

(Illinois Transfer on Death Package includes form, guidelines, and completed example)

Important: Your property must be located in Will County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Instrument meets all recording requirements specific to Will County.

Our Promise

The documents you receive here will meet, or exceed, the Will County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Will County Transfer on Death Instrument form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4625 Reviews )

Kimberly E.

July 6th, 2019

It was very easy to order,download, and print. The only issue I have is that the guide that came with my form really did not help me filling it out. I feel the explanations could have been better and suited more for the standard person. I was still confused when filling it out and will probably have to get a lawyer to make sure it's filled out correctly

Thank you for your feedback. We really appreciate it. Have a great day!

FE P.

March 4th, 2023

Looked into a good number of DIY deeds on the internet. Very glad that I chose Deeds.com. They made it easy to make your own deed based on your state and the process based on the sample included was easy to follow. Also the cost was very reasonable. Great company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda F.

August 1st, 2025

I can't recommend working with Deeds.com enough. I had been given incorrect information from another document service. The helpful staff member at Deeds.com that assisted in the submission of the recording was exceptionally helpful in making sure what I was submitting included the necessary elements required by the county. I am very thankful I chose Deeds.com for my eRecording service. Thank you!!

Thank you, Linda! We’re so glad our team could assist in making sure your submission met the county’s requirements. It means a lot that you chose Deeds.com after a frustrating experience elsewhere. We appreciate your trust and kind words!

raquel f.

July 28th, 2021

Wow!!! that was super easy to record a mechanic lien! I will definitely use your service again but I hope I won't have to.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jerri S.

February 28th, 2019

Very helpful. Print out go to court house spent less then 15 minutes there and done! Thanks will use again.

Thank you Jerri, we appreciate your feedback.

TIFFANY C.

May 20th, 2020

It would be nice if the notary State was fillable, we are having to notarize in another State. Also, need more room to add 2 beneficiaries with two different addresses.

Thank you for your feedback. We really appreciate it. Have a great day!

Sterling H.

September 17th, 2024

I liked being able to drill down to state and county. Just simply the search for all property records

We welcome your positive feedback and are thrilled to have met your expectations. Thank you for choosing our services.

Michael M.

November 3rd, 2020

This company gets it right! All the forms you need for your jurisdiction along with guides, and more

Thank you for your feedback. We really appreciate it. Have a great day!

Cary C.

February 8th, 2021

I am very grateful for this service! But I was quite surprised to see the fees went up over 50%! The last 5 or 6 recordings I have done we each only $25.00. Thank you, Sally Center

Thank you for your feedback. We really appreciate it. Have a great day!

Bradley B.

May 3rd, 2021

Just as advertised.

Thank you for your feedback. We really appreciate it. Have a great day!

Cheryl C.

November 19th, 2020

So far this looks like exactly what I need and at a reasonable price. Glad it was so easy to find online. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Della M.

July 7th, 2019

Very easy to purchase with immediate use of all of the forms that you need for probate of property. My parents had died and left equal shares of their home to my 2 brothers and I.

Thank you!

Kimberly M.

November 12th, 2019

Love Deeds.com. So easy to work with and quick as well.

Thank you again for your kind words! Have a fantastic day!

Diana T.

July 15th, 2022

Very helpful Got information and form I wanted.

Thank you for your feedback. We really appreciate it. Have a great day!

Geoffrey M.

February 17th, 2021

Very convenient online document recording with great and quick service. Thank you!

Thank you!