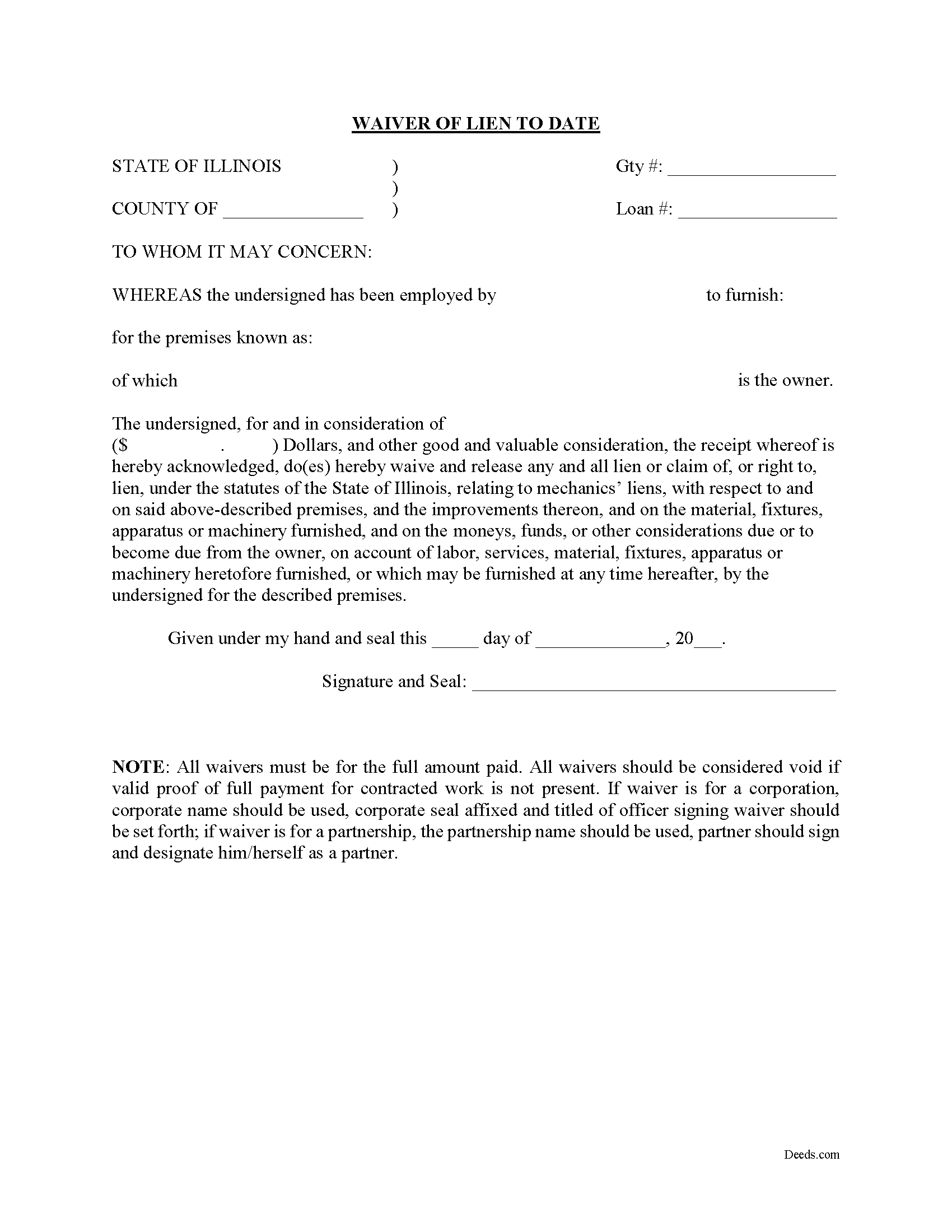

Shelby County Waiver of Lien to Date Form

Shelby County Waiver of Lien to Date Form

Fill in the blank Waiver of Lien to Date form formatted to comply with all Illinois recording and content requirements.

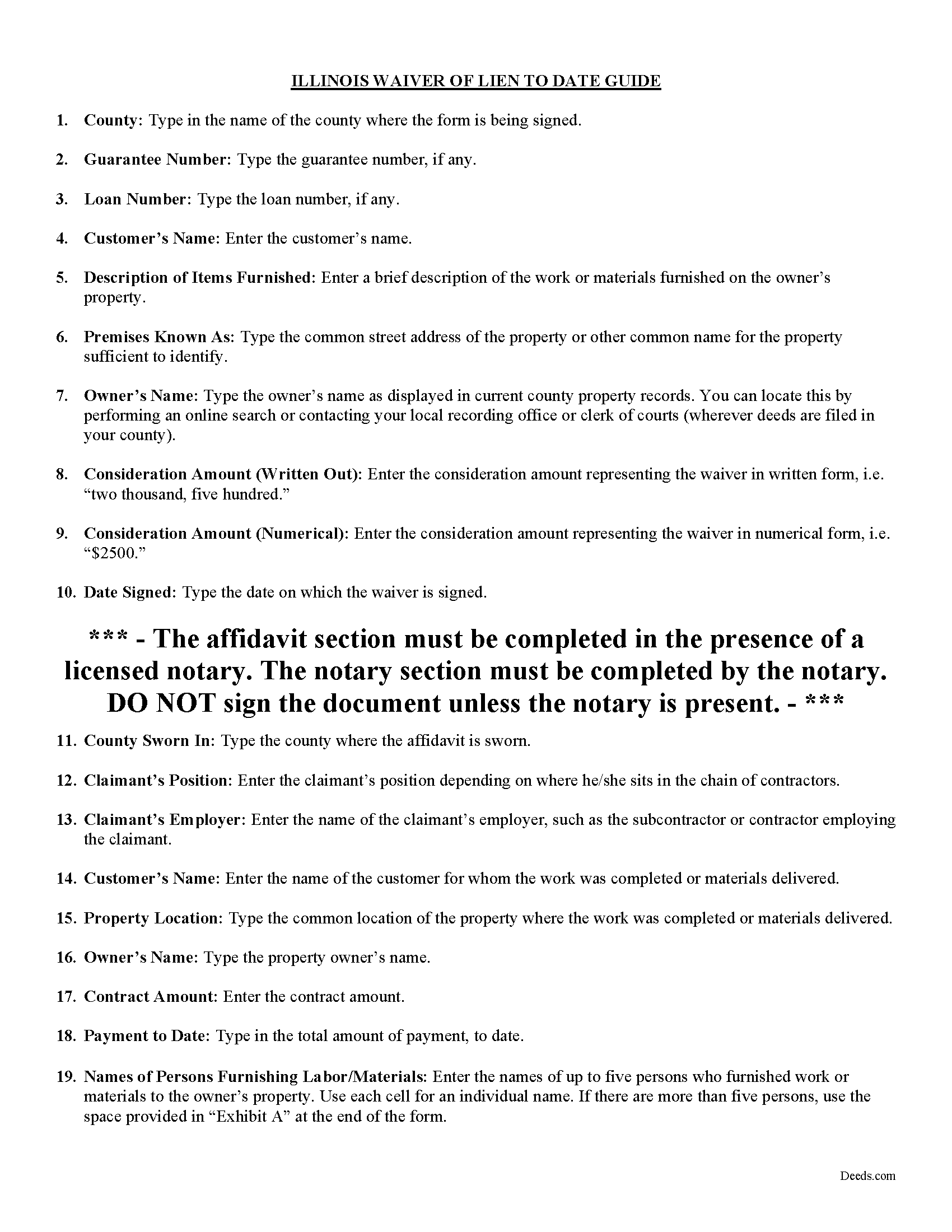

Shelby County Waiver of Lien to Date Guide

Line by line guide explaining every blank on the form.

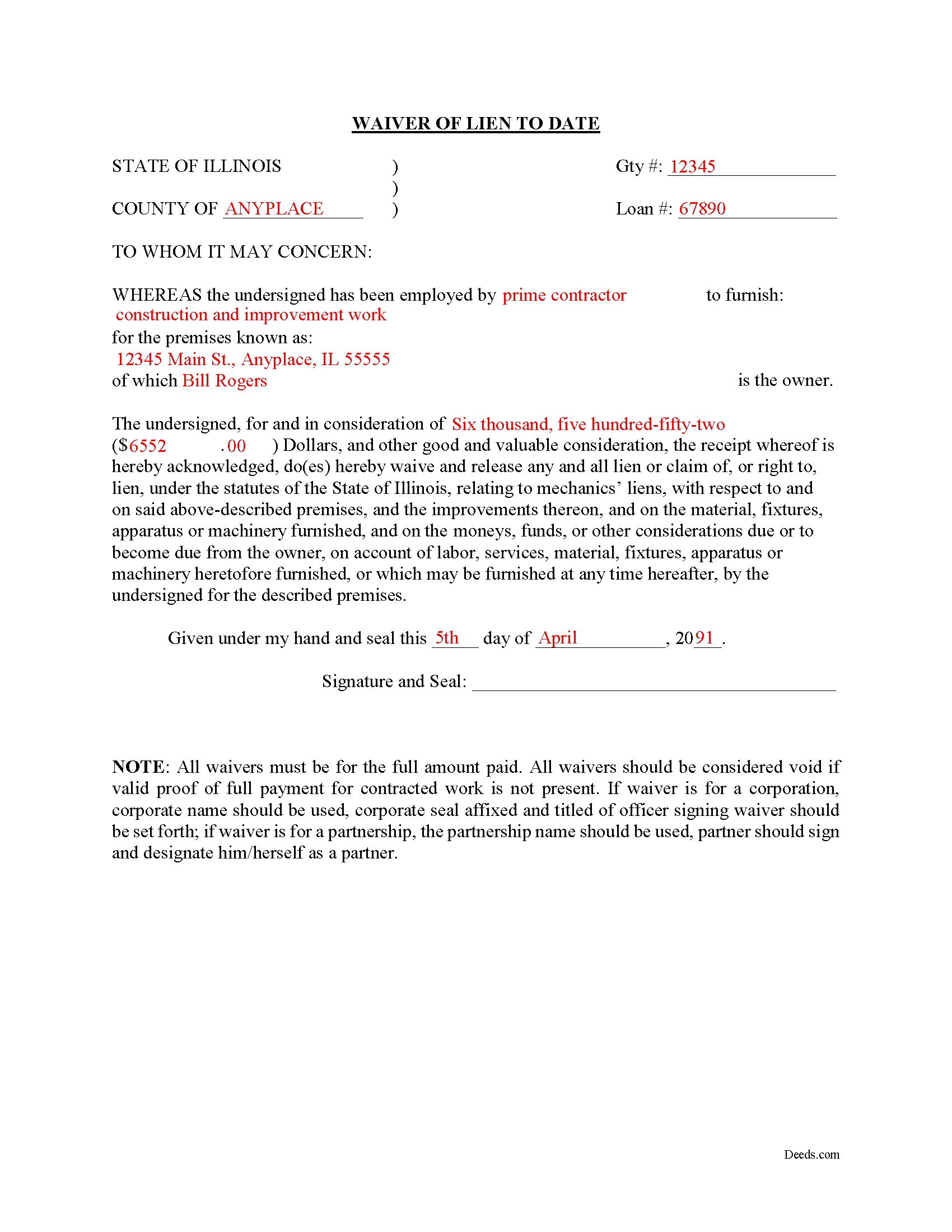

Shelby County Completed Example of the Waiver of Lien to Date Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Shelby County documents included at no extra charge:

Where to Record Your Documents

Shelby County Clerk/ Recorder

Shelbyville, Illinois 62565

Hours: 8:00 to 4:00 M-F

Phone: (217) 774-4421

Recording Tips for Shelby County:

- Ensure all signatures are in blue or black ink

- Recording fees may differ from what's posted online - verify current rates

- Check margin requirements - usually 1-2 inches at top

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Shelby County

Properties in any of these areas use Shelby County forms:

- Cowden

- Findlay

- Herrick

- Lakewood

- Mode

- Oconee

- Shelbyville

- Sigel

- Stewardson

- Strasburg

- Tower Hill

- Windsor

Hours, fees, requirements, and more for Shelby County

How do I get my forms?

Forms are available for immediate download after payment. The Shelby County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Shelby County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Shelby County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Shelby County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Shelby County?

Recording fees in Shelby County vary. Contact the recorder's office at (217) 774-4421 for current fees.

Questions answered? Let's get started!

Under 770 ILCS 60, Illinois' Mechanic's Lien Act, lien waivers are a type of document used between a contractor (including a sub or general) and a property owner to induce or encourage final or partial payments in exchange for forfeiting the claimant's right to a mechanic's lien.

A lien waiver is useful for property owners because it assures them that a lien will not be placed on their property, and for contractors because presenting the waiver can encourage the owner to pay. Therefore, a waiver offers a quid pro quo arrangement with benefits for both sides. Waivers can be conditional, meaning they go into effect based upon actual receipt of payment as a triggering event, or unconditional, meaning the waiver takes effect upon being sent to the owner or prime contractor.

The Waiver of Lien to Date is for a subcontractor and contractor to sign upon receipt of a partial payment from the customer. The parties should ensure the payment has been made (meaning any check has been deposited and cleared) before signing the waiver. The Waiver of Lien to Date includes an affidavit to be completed by the contractor listing all parties contracted with, the contract amounts, payment amounts, and balance remaining due. Finally, sign the completed lien waiver in front of a notary public.

Contact an attorney for more information about lien waivers, or any other issues related to mechanic's liens in Illinois.

Important: Your property must be located in Shelby County to use these forms. Documents should be recorded at the office below.

This Waiver of Lien to Date meets all recording requirements specific to Shelby County.

Our Promise

The documents you receive here will meet, or exceed, the Shelby County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Shelby County Waiver of Lien to Date form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Margo M.

February 11th, 2021

So far help has been good given some of the information you don't have as far as making corrections. This is my first time using your service so maybe I will be better at utilizing it if I have to again.

Thank you for your feedback. We really appreciate it. Have a great day!

John T.

May 5th, 2022

Great site, I was able to navigate with ease. We appreciate all those who contributed in making this possible

Thank you!

Cindy H.

October 22nd, 2021

Very easy to use and organized. When I needed the form I needed it immediately. I didn't want to get locked into a monthly subscription. Deeds.com met that need. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maurice C.

September 14th, 2023

This is a great service! Very much needed.

Thank you!

Robert C.

November 20th, 2020

Great service! Easy to navigate and the instructions were perfectly understandable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Meredith B.

January 5th, 2021

Clean and easy process. Super attentive and helpful.

Thank you!

Anne B.

July 29th, 2020

Great experience! It was so easy and quick. We will definitely use the service again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Daniel R.

August 26th, 2020

It all looked pretty easy to navigate. Forms are just now downloaded so I'll see how opening, filling-out goes. I'm encouraged. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberly H.

March 27th, 2020

Very fast and easy to use!

Thank you Kimberly. Have a fantastic day.

Peter F.

February 25th, 2021

It was outstanding, seriously, I had 3 e mail correspondences asking for information and providing feedback within 2 hours and was ready for submission at that point. I paid the invoice online and by the end of the day I had electronic verification that Registry of Deeds had processed my documents. That work is good stuff ! Pete

Glad we could be of assistance Peter, thank you for the kinds words. Have an amazing day!

Terry S.

March 23rd, 2022

Worked well for us except for not being able to edit. Got it completed and recorded with the county clerk! Having the instructions and example made it easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Donna M.

November 22nd, 2021

Appreciated the ability to not only download the form but the instruction's AND a sample.

Thank you for your feedback. We really appreciate it. Have a great day!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Rocio G.

December 8th, 2020

Better than in person service, I recommend this service 100%.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas K.

December 26th, 2020

Very easy to navigate, download,and print forms!

Thank you!