Wayne County Release of Lis Pendens Notice Form

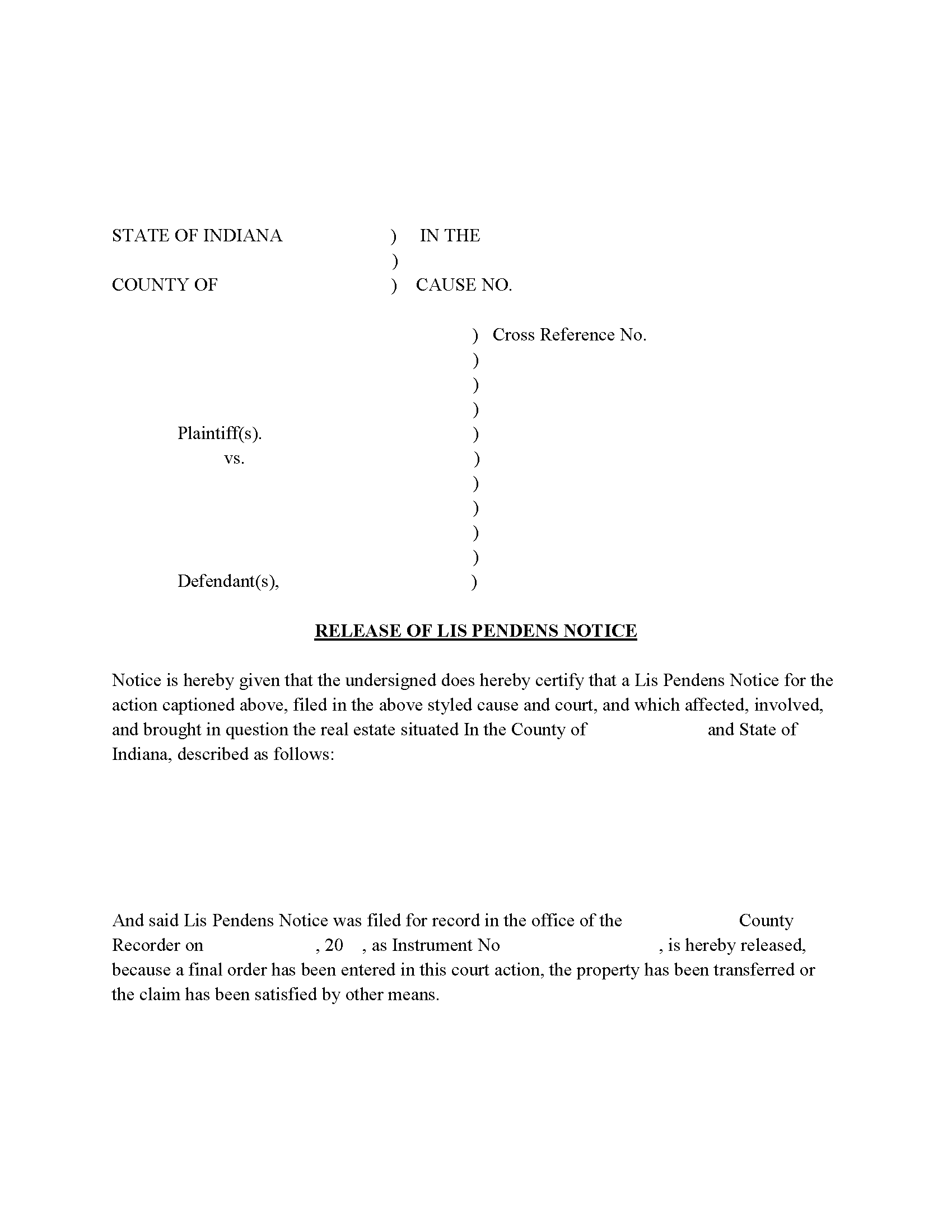

Wayne County Release of Lis Pendens Form

Fill in the blank form formatted to comply with all recording and content requirements.

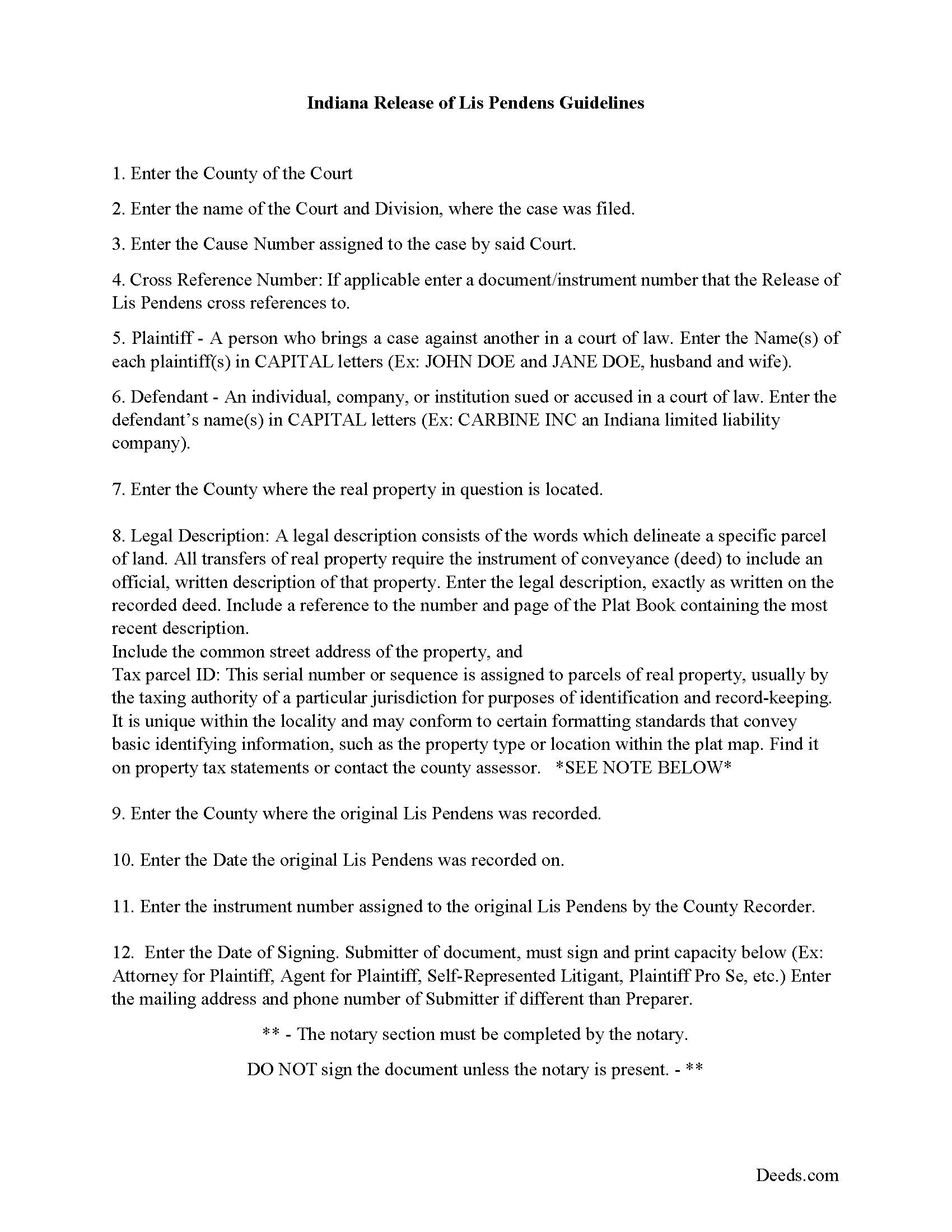

Wayne County Release of Lis Pendens Guide

Line by line guide explaining every blank on the form.

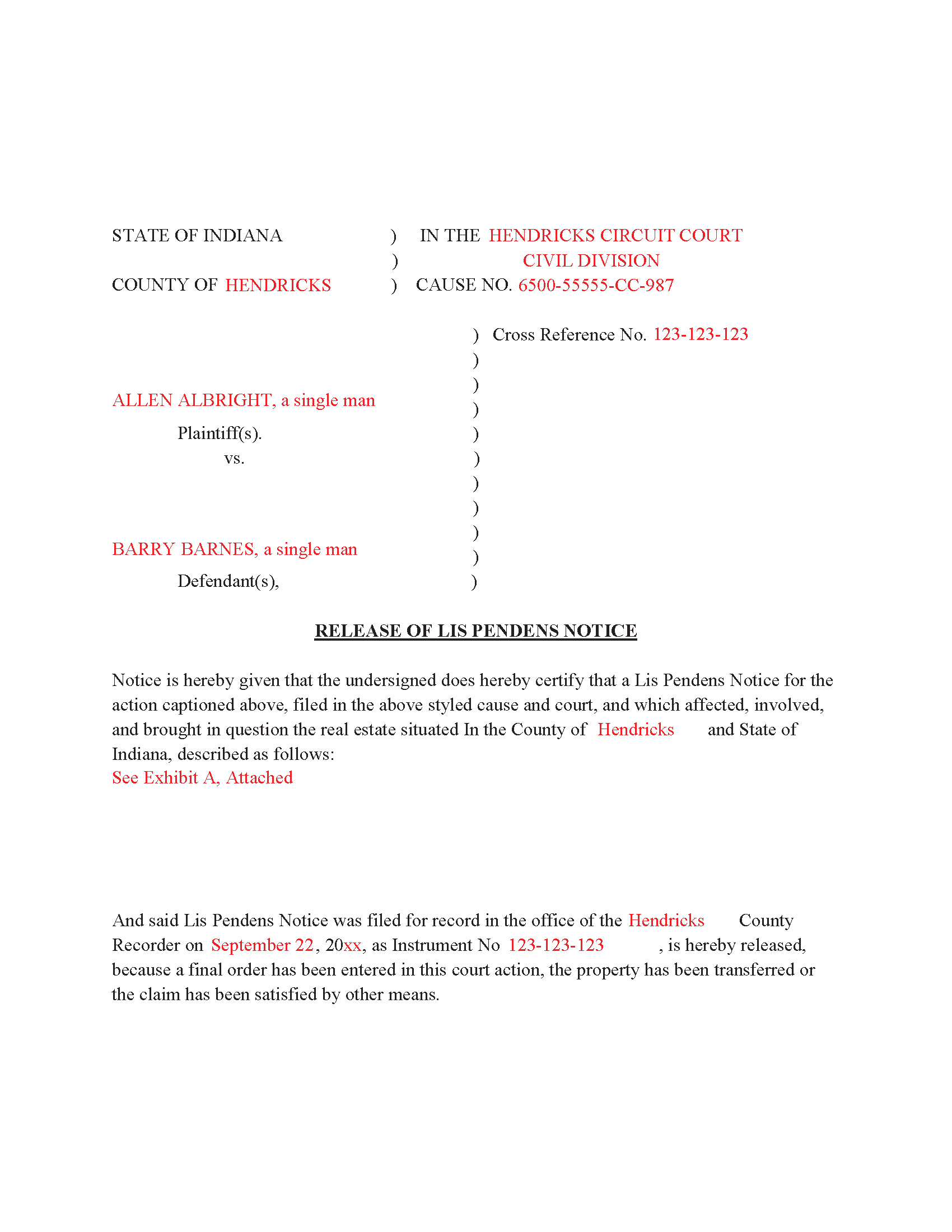

Wayne County Completed Example of the Release of Lis Pendens document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Recorder

Richmond, Indiana 47374

Hours: Monday 8:30 to 5:00; Tuesday through Friday 8:30 to 4:30

Phone: (765) 973-9235

Recording Tips for Wayne County:

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Boston

- Cambridge City

- Centerville

- Dublin

- Economy

- Fountain City

- Greens Fork

- Hagerstown

- Milton

- Pershing

- Richmond

- Webster

- Williamsburg

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (765) 973-9235 for current fees.

Questions answered? Let's get started!

Use this form to release a previously recorded Lis Pendens Notice.

(Indiana Release of Lis Pendens Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Release of Lis Pendens Notice meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Release of Lis Pendens Notice form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Michael B.

June 5th, 2020

Amazing! I was able to submit my documentation and it was on record within one hour! Highly Recommend.

Thank you for your feedback. We really appreciate it. Have a great day!

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly S.

April 21st, 2022

I wasted a lot of my time because I didn't do any research to know what I needed. Nobody fault but mine.

Thank you!

Brad T.

November 9th, 2019

I didn't spend a lot of time there but seems to be a good site with a valuable service.

Thank you!

Ronnie W T.

September 16th, 2022

Very fast and efficient as soon as we paid for the document, it was downloaded to us immediately.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RUTH A.

November 8th, 2024

I truly appreciate the service that you have for the customers. This very convenient and easy to follow. Thank you very much for this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Vicki C.

March 10th, 2023

I purchased a Deed on Death for Washington State. Very user friendly site. Thank you 5star

Thank you for your feedback. We really appreciate it. Have a great day!

Reitman R.

November 15th, 2020

Ordering, payment, and downloads went without a hitch. I appreciated the guide and examples. Than k you for hosting a good, working site.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret P.

May 15th, 2025

EXCELLENT WEBSITE AND SERVICE, HIGHLY RECOMMENDED.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jamie P.

July 28th, 2022

The forms are easy to download. Easy to fill out. The information on the site and on the web provided by Deeds.com have been immensely helpful.

Thank you!

Terrill M.

January 10th, 2020

Great forms and information

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Doris S.

September 12th, 2021

Pleased with efficiency and expediency of website. Added value is the respective county requirements for Florida. I needed a quitclaim deed between family members. Highly recommended. We hope to record signed and executed document next week in Florida. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara W.

June 9th, 2021

Easy website to navigate. Found the form I needed within seconds. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Leslie S.

July 29th, 2020

After over a month of turmoil and feeling like "you can't get there from here",you solved my problem in a little over an hour. Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!