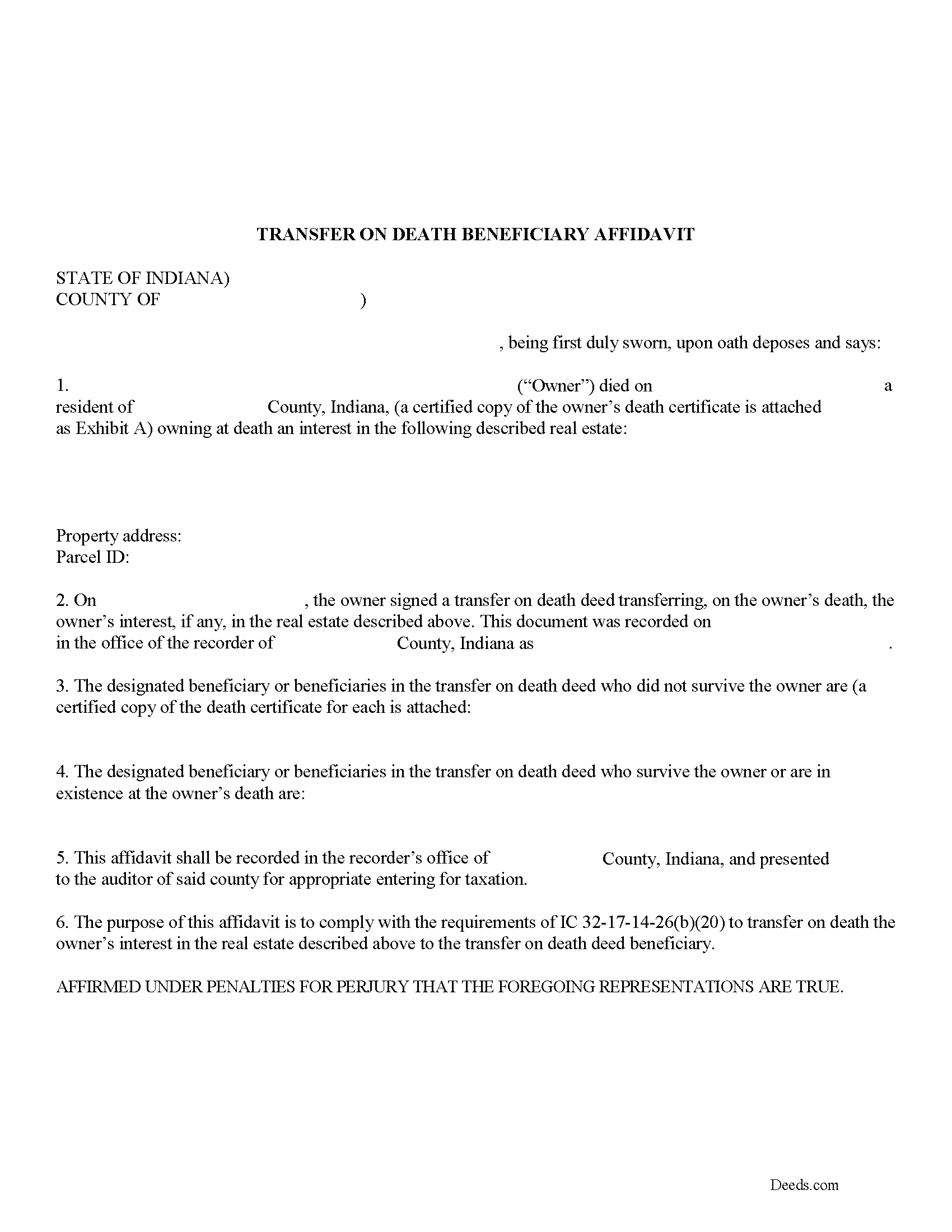

Wayne County Transfer on Death Deed Beneficiary Affidavit Form

Wayne County Transfer on Death Deed Beneficiary Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

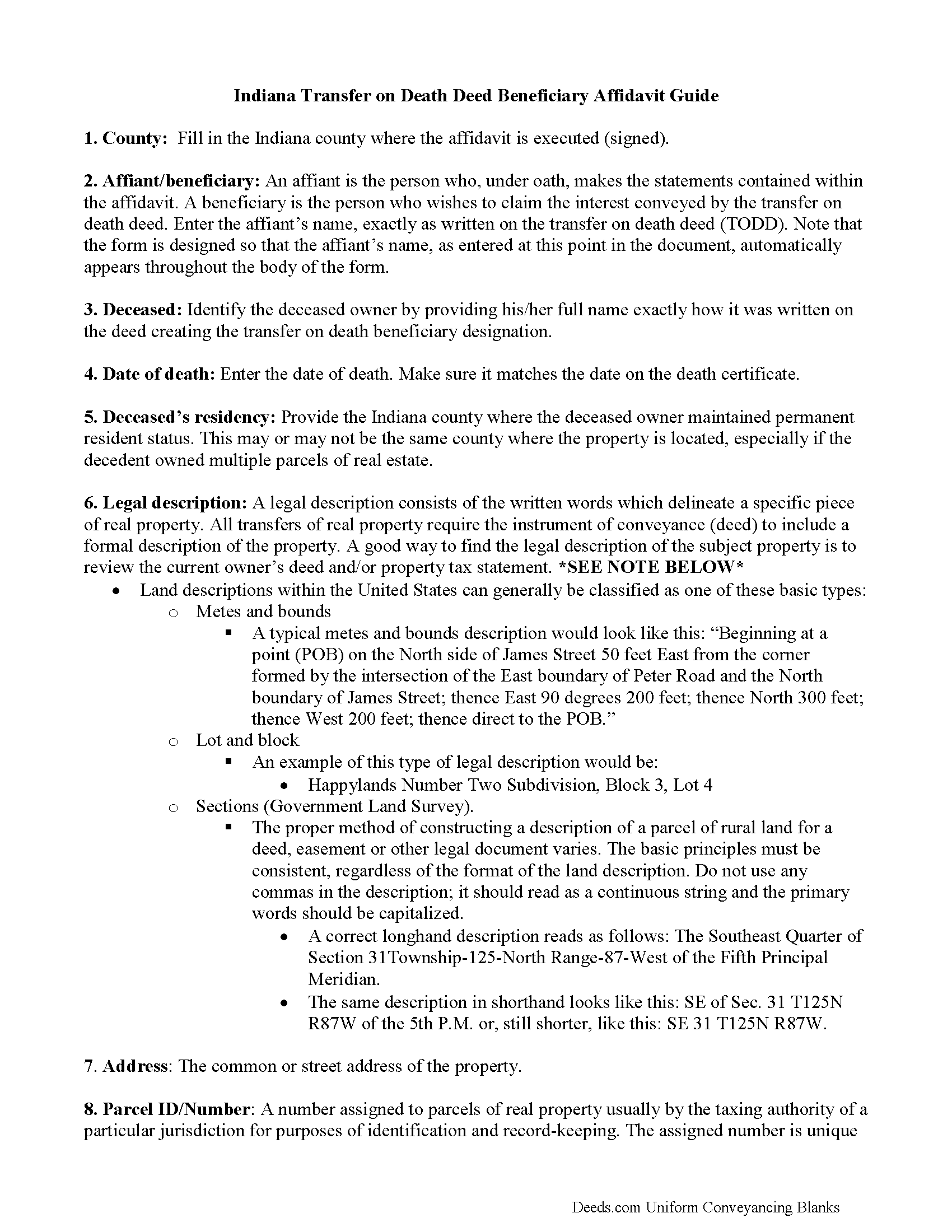

Wayne County Transfer on Death Deed Beneficiary Affidavit Guide

Line by line guide explaining every blank on the form.

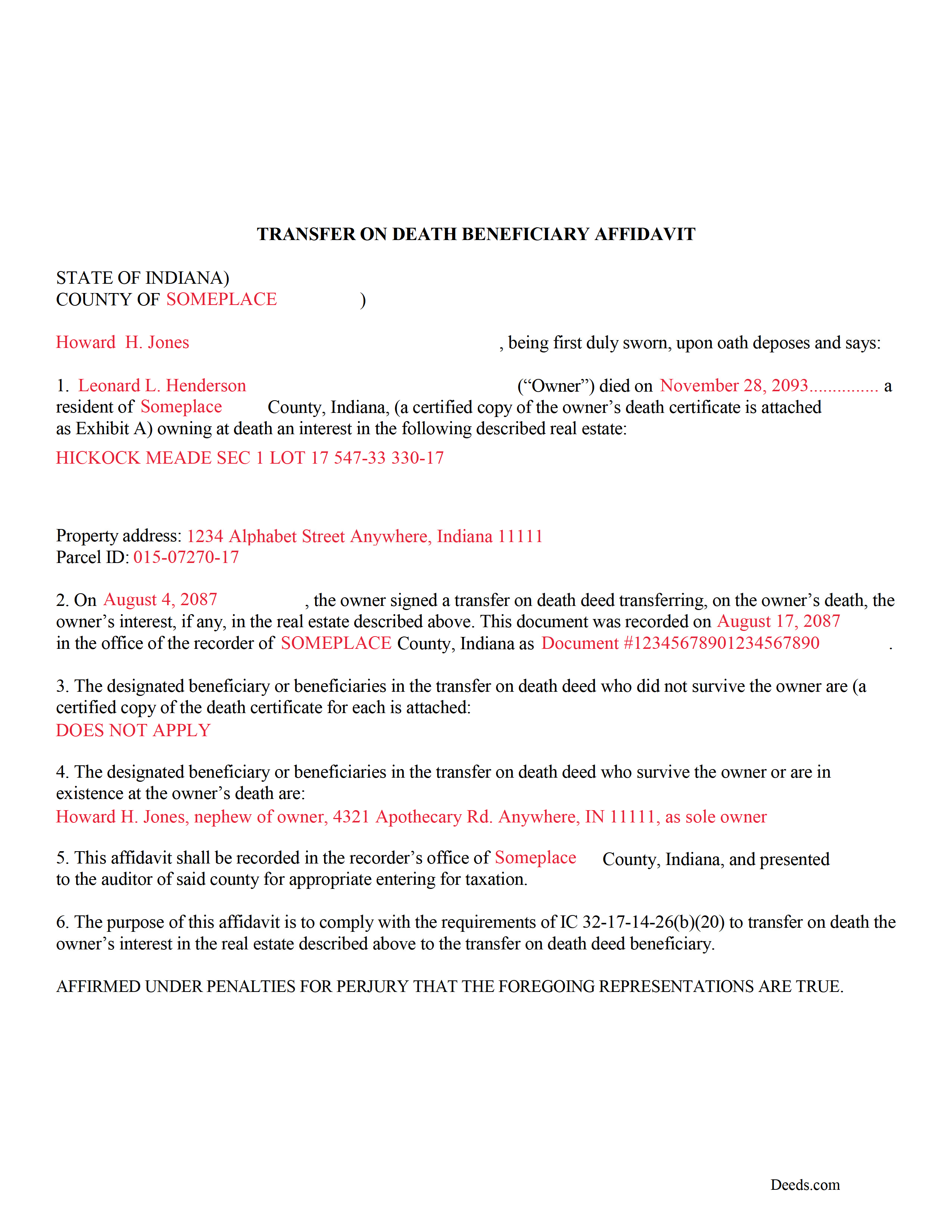

Wayne County Completed Example of the Transfer on Death Deed Beneficiary Affidavit Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Recorder

Richmond, Indiana 47374

Hours: Monday 8:30 to 5:00; Tuesday through Friday 8:30 to 4:30

Phone: (765) 973-9235

Recording Tips for Wayne County:

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

- Consider using eRecording to avoid trips to the office

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Boston

- Cambridge City

- Centerville

- Dublin

- Economy

- Fountain City

- Greens Fork

- Hagerstown

- Milton

- Pershing

- Richmond

- Webster

- Williamsburg

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (765) 973-9235 for current fees.

Questions answered? Let's get started!

Indiana's transfer on death deeds are a useful way to convey ownership rights to property without the need for probate. The rules for claiming the property are defined in IC 32-17-14-26(b)(20). Primarily, the statute explains that the beneficiary must complete a transfer on death beneficiary affidavit containing specific details of the deed, present that affidavit to the local auditor to verify any transfer taxes, and then submit it to the county recorder who will enter it, and therefore the finalized conveyance, into the public record.

Beneficiaries listed on Indiana transfer on death deeds may use this form, which meets the statutory requirements, to claim ownership of the real property described in the deed.

(Indiana TOD Deed Beneficiary Affidavit Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed Beneficiary Affidavit meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Transfer on Death Deed Beneficiary Affidavit form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Robert H.

March 17th, 2021

Just what I needed to file in Orange County. East to use and reasonably priced. Will use again if needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ben C.

December 8th, 2024

Easy and Quick,Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Angel T.

August 26th, 2021

First the convenience to get forms without going or calling Recorder's office is outstanding. Suggest that Recorder's staff be able to guide or assist users in filling up the forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew F.

August 18th, 2022

The process was terrific. Much better than hiring someone local to process deeds, as deeds.com got back to me right away with corrections before submitting.

Thank you for your feedback. We really appreciate it. Have a great day!

Kimberley H.

July 14th, 2021

This was crazy easy to do...such a fantastic service! Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim T.

November 6th, 2023

Straightforward and handy. Spacing of the spaces I filled out was not pretty, but it all worked.

We are motivated by your feedback to continue delivering excellence. Thank you!

Nicole T.

February 9th, 2021

Absolutely Amazing Service! I learned about Deeds.com, created my Account, uploaded my documents into my Recording Package, paid my Invoice and received my Three Recorded Deeds all in less than two hours! Awesome!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Justin H.

June 10th, 2021

Couldn't pull a simple deed for a legal description.

Thank you for your feedback Justin. We do hope that you were able to find something more suitable to your needs elsewhere. Have a wonderful day.

Gretchen R.

November 13th, 2019

I can't think of any suggestions for improvement. The documents I needed were readily available. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth B.

November 22nd, 2020

Very efficient

Thank you!

Gene K.

April 24th, 2019

I am still in the trial stage. I am an older lawyer. Any help I can get is worth it. Once you get used to the format and data fill in the deed thing is excellent. Very professional if not a little slow. I have only done three deeds in one state so I will have to see how it goes. I like the product and their attitude towards pleasing the customer. We'll see when I try the recording part.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dorothea H.

November 23rd, 2020

I am so glad I chose Deeds.com for my forms! The directions were clear and comprehensive, and the form allowed for customization far beyond the free forms I had looked at before. I highly recommend this site!

Thank you for your feedback. We really appreciate it. Have a great day!

Lillian F.

September 13th, 2019

Very well satisfy with my results. I could not ask for better service d

Thank you for your feedback. We really appreciate it. Have a great day!

Albo A.

September 25th, 2020

Deeds.com was fast and easy to file documents

Thank you!

Terry M.

December 2nd, 2021

Application is not well laid out. I guess it does the job but leaves a lot to be desired. Hard to follow

Thank you for your feedback. We really appreciate it. Have a great day!