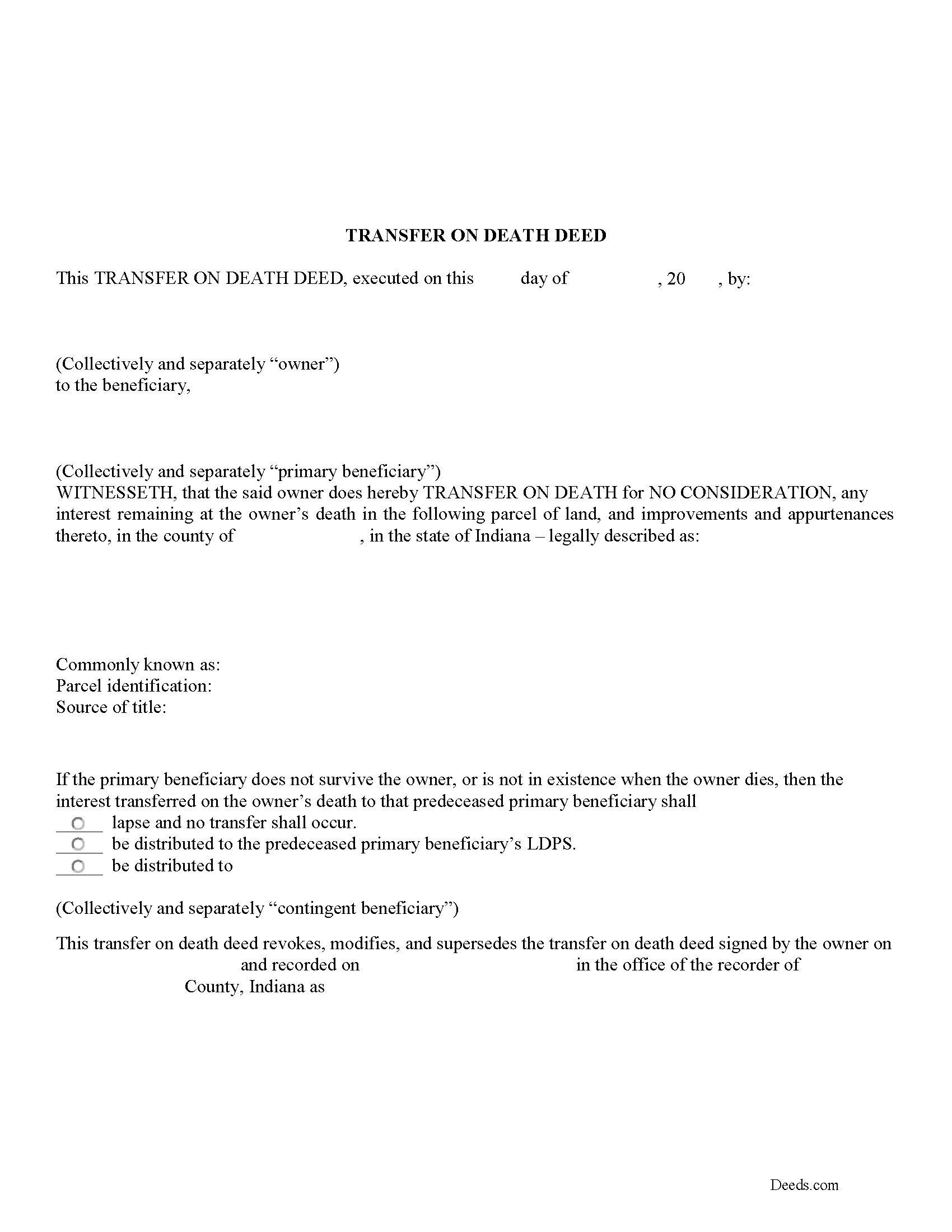

Wayne County Transfer on Death Deed Form

Wayne County Transfer on Death Deed Form

Fill in the blank Transfer on Death Deed form formatted to comply with all Indiana recording and content requirements.

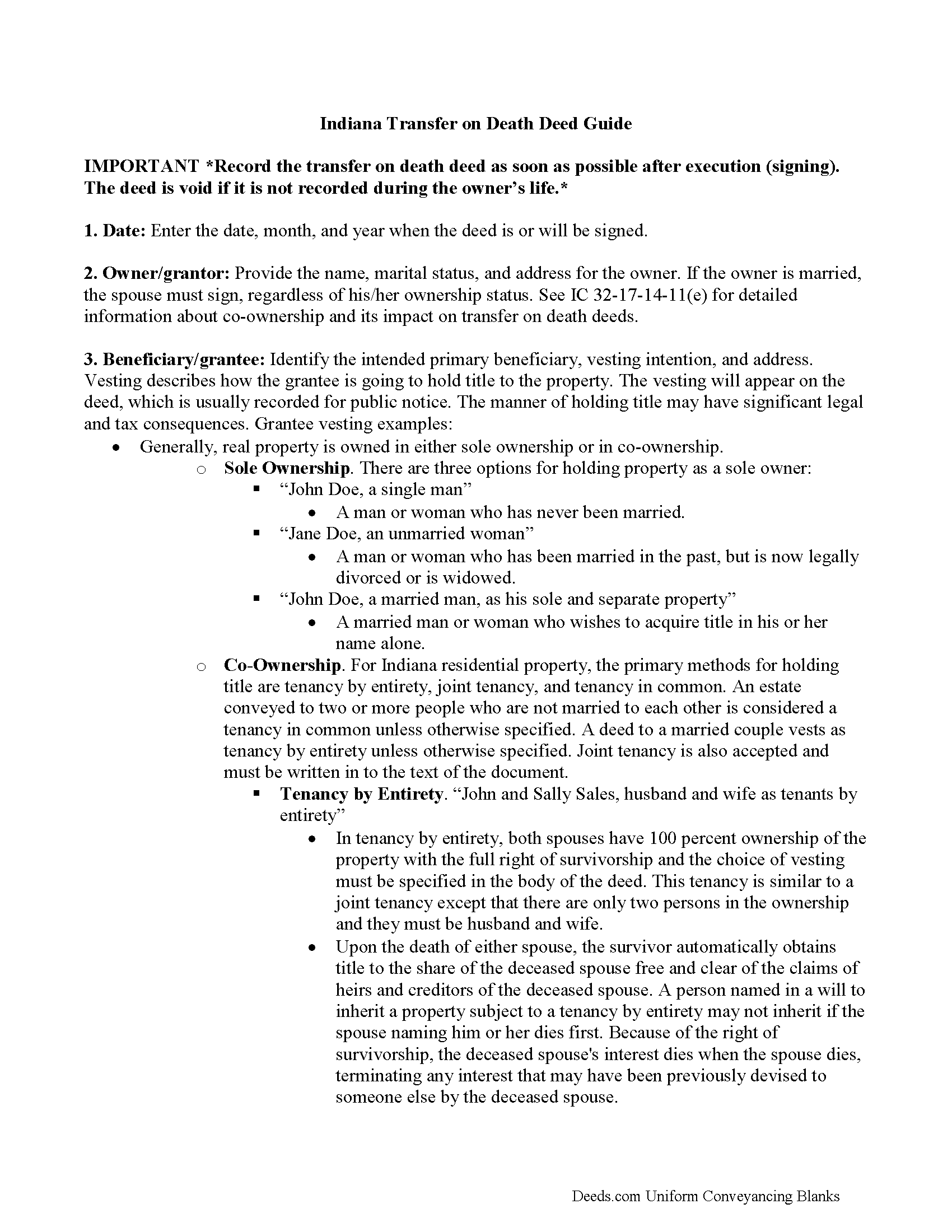

Wayne County Transfer on Death Deed Guide

Line by line guide explaining every blank on the Transfer on Death Deed form.

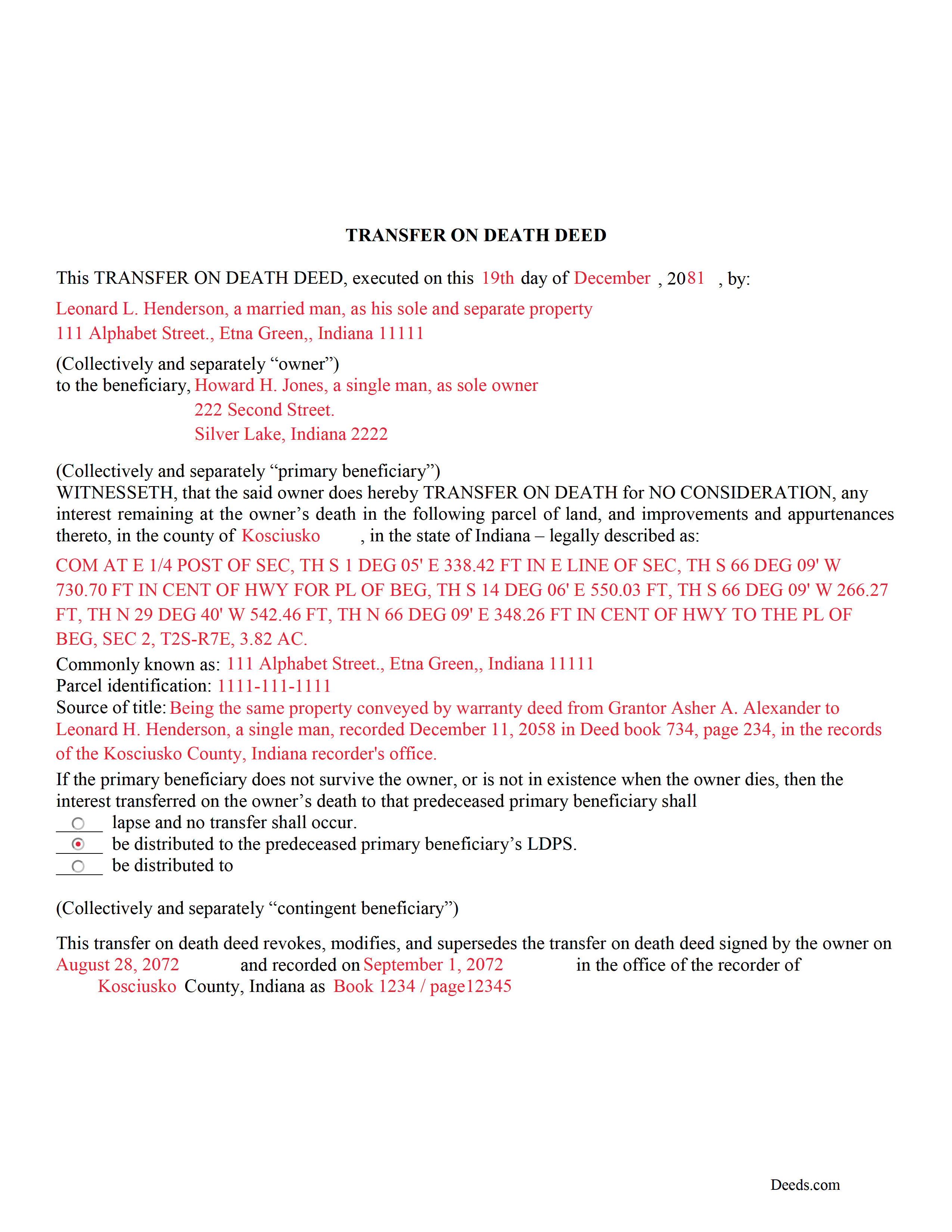

Wayne County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Wayne County documents included at no extra charge:

Where to Record Your Documents

Wayne County Recorder

Richmond, Indiana 47374

Hours: Monday 8:30 to 5:00; Tuesday through Friday 8:30 to 4:30

Phone: (765) 973-9235

Recording Tips for Wayne County:

- Documents must be on 8.5 x 11 inch white paper

- Leave recording info boxes blank - the office fills these

- Check margin requirements - usually 1-2 inches at top

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Wayne County

Properties in any of these areas use Wayne County forms:

- Boston

- Cambridge City

- Centerville

- Dublin

- Economy

- Fountain City

- Greens Fork

- Hagerstown

- Milton

- Pershing

- Richmond

- Webster

- Williamsburg

Hours, fees, requirements, and more for Wayne County

How do I get my forms?

Forms are available for immediate download after payment. The Wayne County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wayne County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wayne County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wayne County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wayne County?

Recording fees in Wayne County vary. Contact the recorder's office at (765) 973-9235 for current fees.

Questions answered? Let's get started!

Indiana outlines the rules for its transfer on death deed in I.C. 32-17-14 -- the "Transfer on Death Property Act."

Indiana transfer on death deeds transfer ownership rights of real property to a predetermined beneficiary after the owner's death. This enables Indiana residents to pass their real estate to their heirs outside of probate. The owners keep full control over the property during their lives -- the conveyance only occurs after the owners die -- so they may sell, rent or use the land as they wish. They may change the designated beneficiary or cancel the entire transfer by simply executing a revocation that redefines their wishes.

Note that this is only valid when it is executed (signed) and recorded WHILE THE OWNER IS STILL ALIVE. If not, the deed is void and the property passes through probate with the rest of the owner's estate.

These conveyances might also have an impact on taxes and eligibility for healthcare programs. Carefully review all aspects of estate planning when considering a transfer on death deed.

(Indiana Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Wayne County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Wayne County.

Our Promise

The documents you receive here will meet, or exceed, the Wayne County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wayne County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

Karen F.

June 6th, 2022

The documents' format contained information needed to complete the necessary paperwork for filing with Georgia. However, the fields were not large enough to put the legal description in, and there was no way to enlarge the area. These were only semi-helpful in providing what I needed per Georgia's filing requirement.

Thank you!

Linda D.

May 12th, 2021

This is a very nice service. Easy to use and reasonable. I especially appreciated the helpful explanations of each of the fields on the form. I will positively use this service again.

Thank you for your feedback. We really appreciate it. Have a great day!

STEVEN J.

October 18th, 2019

Great , easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Marcell E.

October 21st, 2022

I am not very happy about the fact that I paid 27.00 to not even have the forms filled out. I thought that it was going to be all done for me and I was told that I need a lawyer to have the form filled out properly.

The order you placed for the do it yourself forms has been canceled. We do hope that you find the $27 attorney you deserve. Have a wonderful day.

EVE A.

October 31st, 2022

Site was easy to navigate. I found the lien discharge form I was looking for immediately and the download and completion was simple. Thank you for having a great site.

Thank you for your feedback. We really appreciate it. Have a great day!

Julia C.

May 18th, 2025

Deeds.com was such a blessing in order for me to get something done that my lawyers could not get done. Transferring a mineral right from my deceased parents to me and my husband. The mineral company person I worked with went above and beyond helping me fill the paperwork out perfectly so that it had “right of survivorship” (and other things phrased properly) so that either my husband or I won’t have the issue I have had. Had it not been for deeds.com I don’t think I would have been able to complete this process. I hope anyone that ever needs something such as this learns about I deeds.com.

Thank you, Julia, for your kind and thoughtful review. We're truly honored to have played a role in helping you and your husband secure your mineral rights — especially after such a frustrating experience elsewhere. It’s great to hear that our team and resources were able to guide you through the process with clarity and care. Your words mean a lot to us, and we hope others in similar situations find the support they need through Deeds.com, just like you did. Wishing you continued peace of mind and security with your property.

Nancy C.

January 15th, 2021

Simple and easy to download. After reading the instructions/sample pages I did still have some questions regarding the beneficiary deed for the state of MO.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Helen A.

April 11th, 2022

Well not sure yet since I have only downloaded these forms but I read the reviews and this helped me determine if I will use your web site. I will gladly give a good review if this form serves me well!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Charles F.

March 12th, 2025

I found the information easy to understand, and the forms to be correct for my needs.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Michael R.

September 15th, 2019

This was just TOO easy to do and use!! Thank you so much for your service!

Thank you!

Gregory K.

October 18th, 2021

Easy to work with. Fair price. Nice, efficient service. Would definitely use Deeds.com again for any legal documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathy P.

November 25th, 2019

I like that the quit claim form was fill in the blank on my computer instead of online, made it so much easier than having to do everything at once, at the mercy of the internet connection. Will refer others here.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert C.

February 10th, 2022

Wow! Wish I had found DEEDS.com a few hours earlier. Quickly was able to pay a reasonable fee for some documents/templates along with an explanation. Very pleased

Thank you for your feedback. We really appreciate it. Have a great day!

Freddy S.

August 2nd, 2019

great job

Thank you!

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.