Osceola County Correction Deed Form

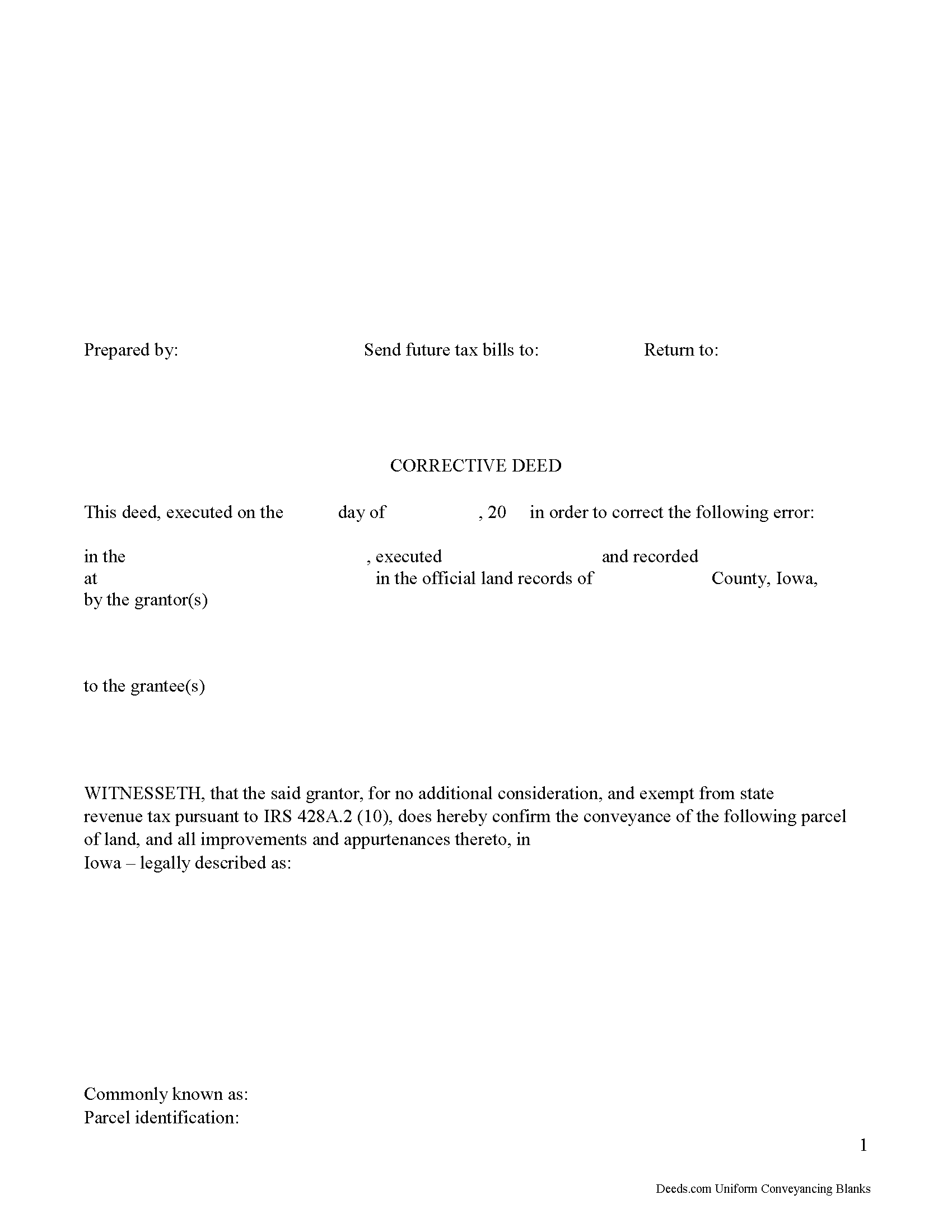

Osceola County Corrective Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

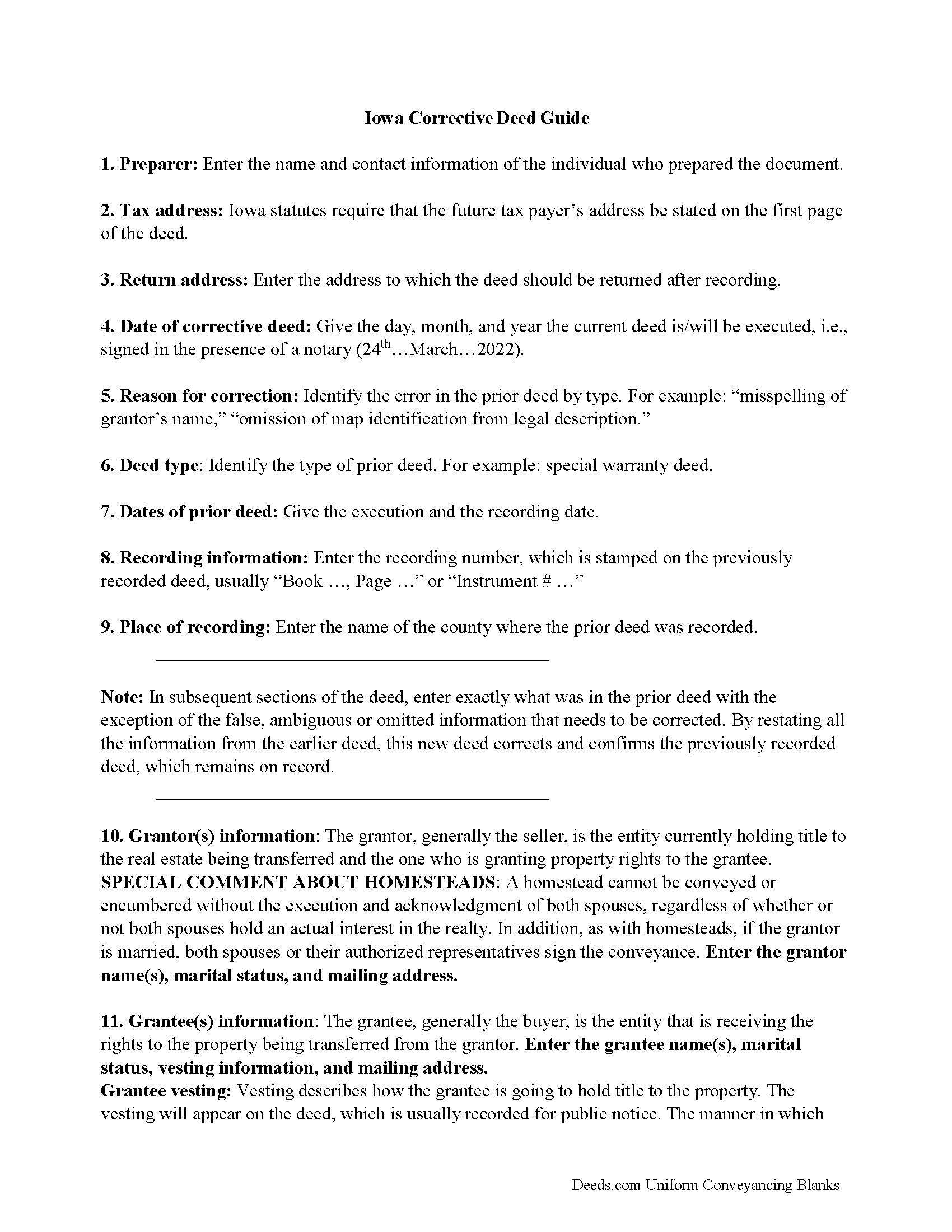

Osceola County Corrective Deed Guide

Line by line guide explaining every blank on the form.

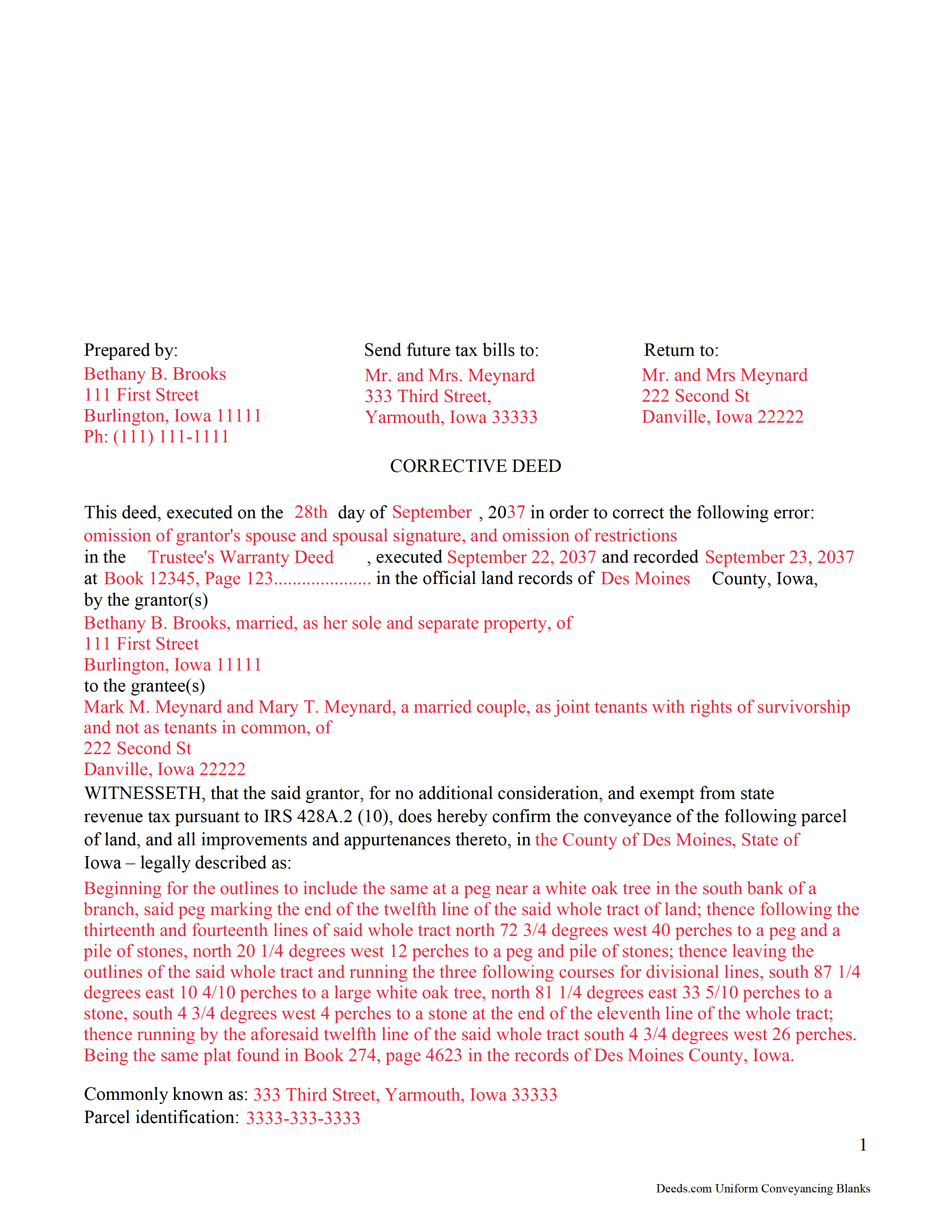

Osceola County Completed Example of the Corrective Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Osceola County documents included at no extra charge:

Where to Record Your Documents

Osceola County Recorder

Sibley, Iowa 51249

Hours: 8:00 to 4:30 M-F

Phone: (712) 754-3345

Recording Tips for Osceola County:

- Bring your driver's license or state-issued photo ID

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Osceola County

Properties in any of these areas use Osceola County forms:

- Ashton

- Harris

- Melvin

- Ocheyedan

- Sibley

Hours, fees, requirements, and more for Osceola County

How do I get my forms?

Forms are available for immediate download after payment. The Osceola County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Osceola County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Osceola County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Osceola County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Osceola County?

Recording fees in Osceola County vary. Contact the recorder's office at (712) 754-3345 for current fees.

Questions answered? Let's get started!

In Iowa, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is, in effect, an explanation and correction of an error in a prior instrument. As such, it passes no title and, except for the corrected item, reiterates and confirms the prior conveyance. It should be executed from the original grantor to the original grantee, and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, which remains on record and receives a cross-reference to the corrective instrument.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. More substantial changes, such as adding a name to the title, changing the vesting information or the legal description of the property, may require a new deed of conveyance instead of a correction deed.

Correction deeds are exempt from state revenue tax pursuant to IRS 428A.2 (10) that exempts "deeds which, without additional consideration, confirm, correct, modify, or supplement a deed previously recorded." The exemption needs to be identified on the deed itself, or the declaration of value form must be submitted with the deed.

(Iowa Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Osceola County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Osceola County.

Our Promise

The documents you receive here will meet, or exceed, the Osceola County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Osceola County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Daren K.

April 29th, 2019

Awesome, so far. Thanks

Thank you!

Luwana C.

April 2nd, 2019

I think the Website takes out a lot of leg work, Makes it easier to take care of paperwork 10 times faster.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jennifer A M.

March 6th, 2021

Great service; very easy and simple, especially as an individual that needed only one (1) document recorded with my municipality.

Thank you!

Pansie H.

August 23rd, 2019

Quick and Easy

Thank you!

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joanna L.

September 12th, 2019

This is a great tool. It is easy to use and saves me a lot of time.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda L.

December 29th, 2021

mostly good; however, you need to update the annual exclusion gift amount from $14,000 to $15,000 (where it has ben for several years), and you need to make your Gift Deed final paragraph be gender neutral like "they" or "he or she" rather than just"he". We women lawyers and our women clients appreciate that.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer T.

September 29th, 2023

I got instant access to the exact forms I needed! The guide to completing the form was very thorough and easy to understand. I am very thankful for this service!

Thank you for the kind words Jennifer. We appreciate you!

Robert B.

April 2nd, 2019

Excellent, easy to operate, saved $$$ by doing this TOD deed myself. WILL BUY AGAIN!!

Thank you Robert. Have a fantastic day!

James M.

January 3rd, 2023

It would be helpful to have a joint tenant example.

Thank you!

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

Biagio V.

July 16th, 2022

Process was quick , through and completed with no problems. Excellent service for the price involved.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly R.

January 8th, 2019

Very easy to use. Very informative. I think this is a very good service and is worth the $19 especially if you value time.

Thank you for your feedback. We really appreciate it. Have a great day!

laura w.

March 7th, 2021

I found Deeds to be okay except I was hoping it would give me a title or deed to my house if I would have known I would have just got a warranty deed I probably would not have pay the money but it's still worth it

Thank you for your feedback. We really appreciate it. Have a great day!

Paul W.

March 11th, 2022

Exceptionally easy site to navigate. Forms and related documents downloaded quickly and were helpful in completing the forms, which have already been filed with the County Registrar of Deeds. Many thanks for an extremely useful site!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!