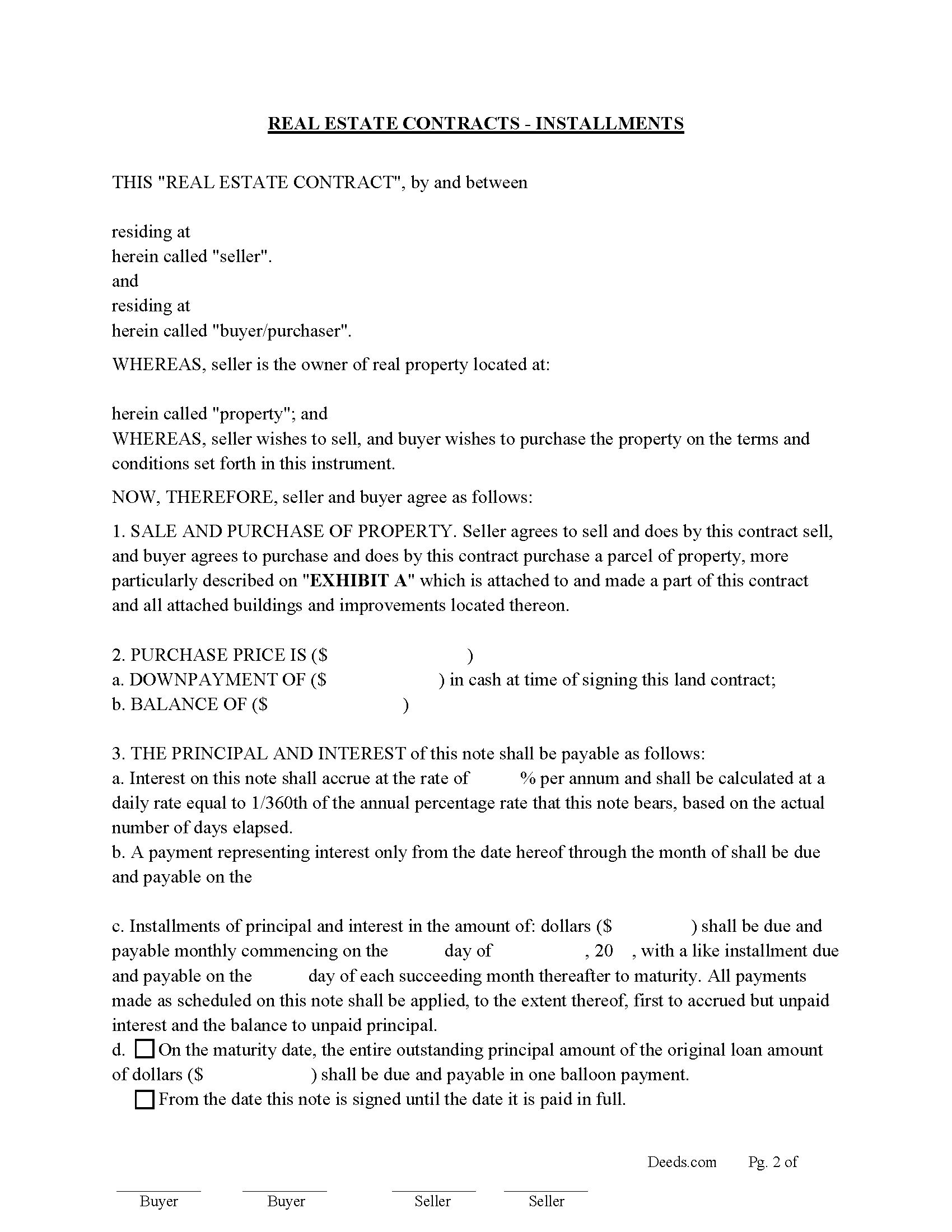

Story County Real Estate Contract-Installments Form

Story County Real Estate Contract-Installments Form

Fill in the blank Real Estate Contract-Installments form formatted to comply with all Iowa recording and content requirements.

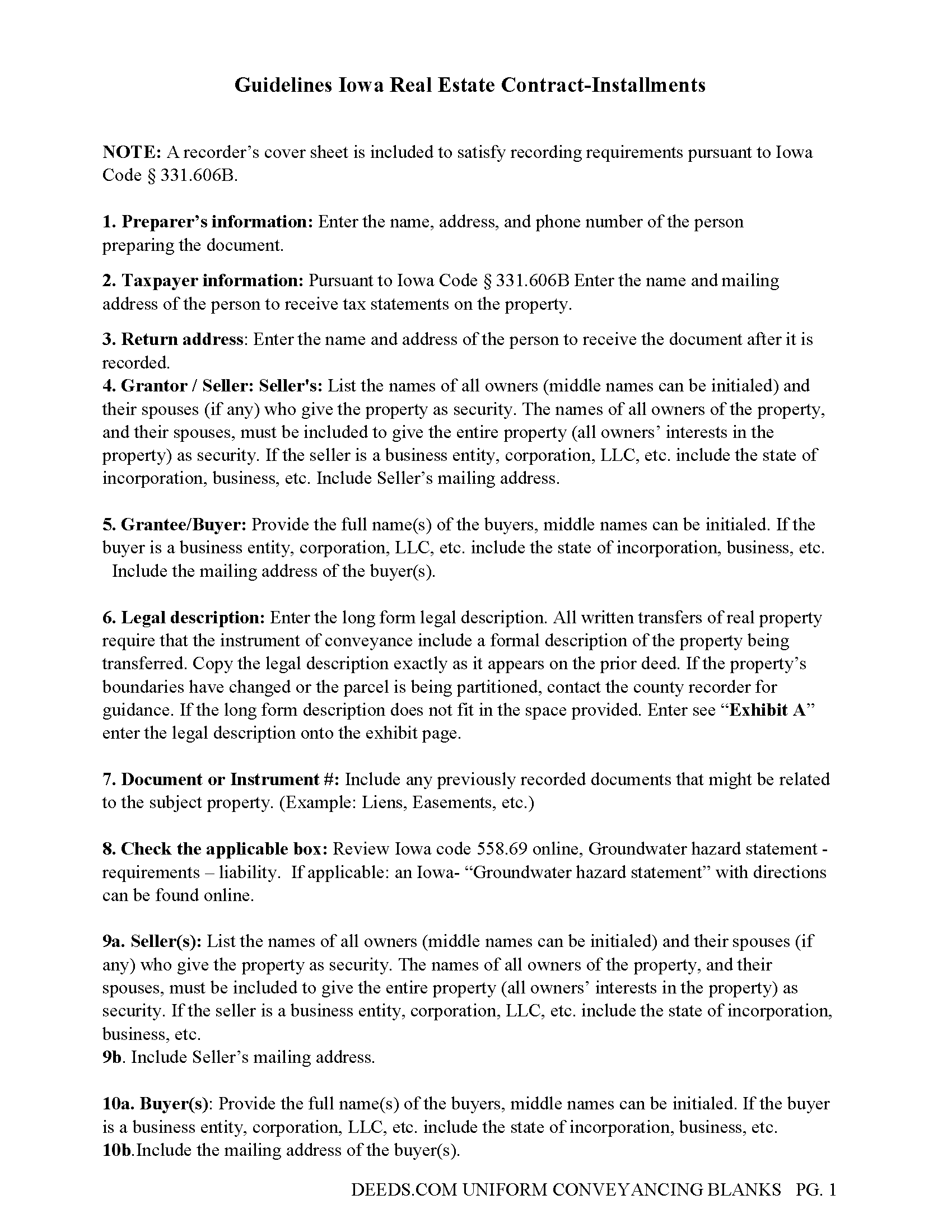

Story County Real Estate Contract-Installments Guide

Line by line guide explaining every blank on the Real Estate Contract-Installments form.

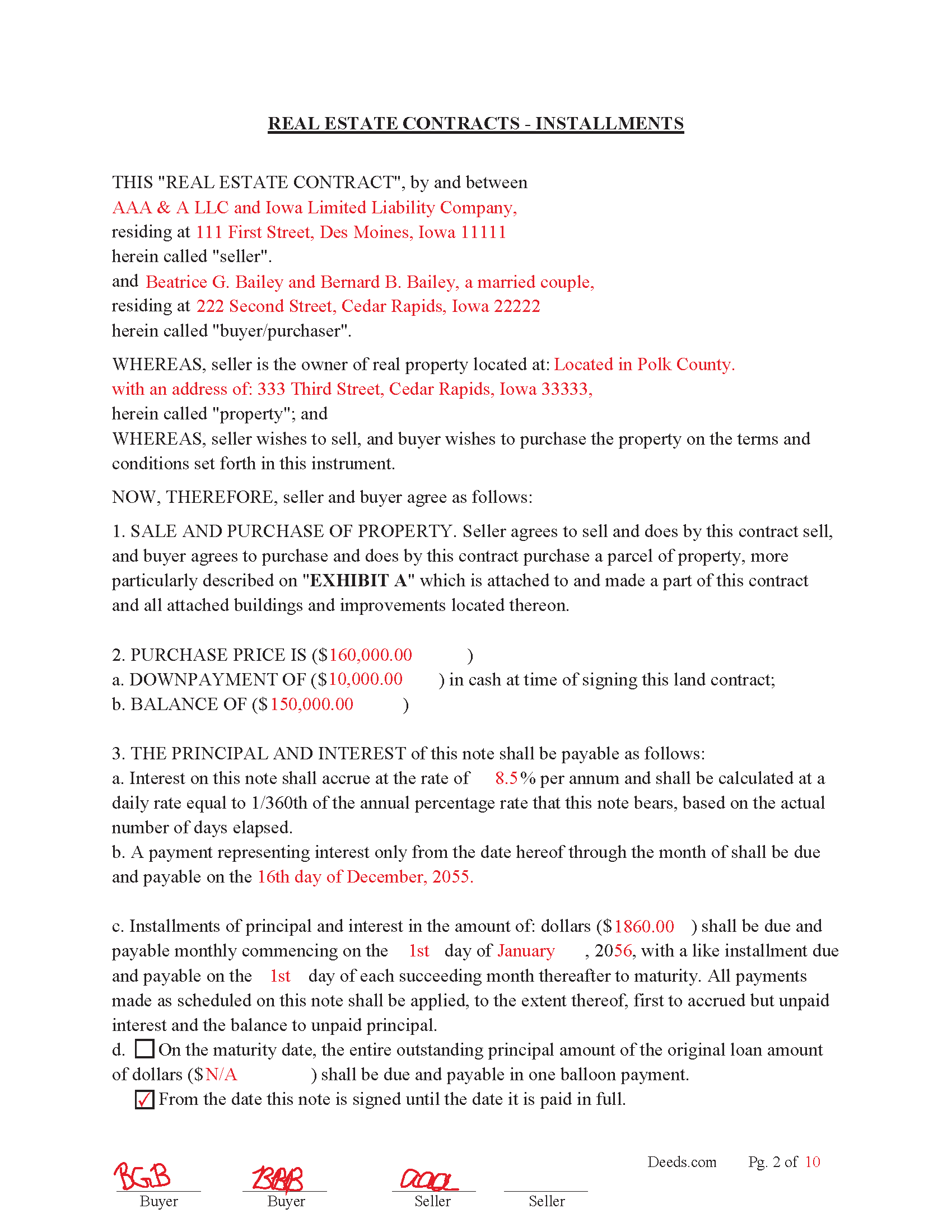

Story County Completed Example of the Real Estate Contract-Installments Document

Example of a properly completed Iowa Real Estate Contract-Installments document for reference.

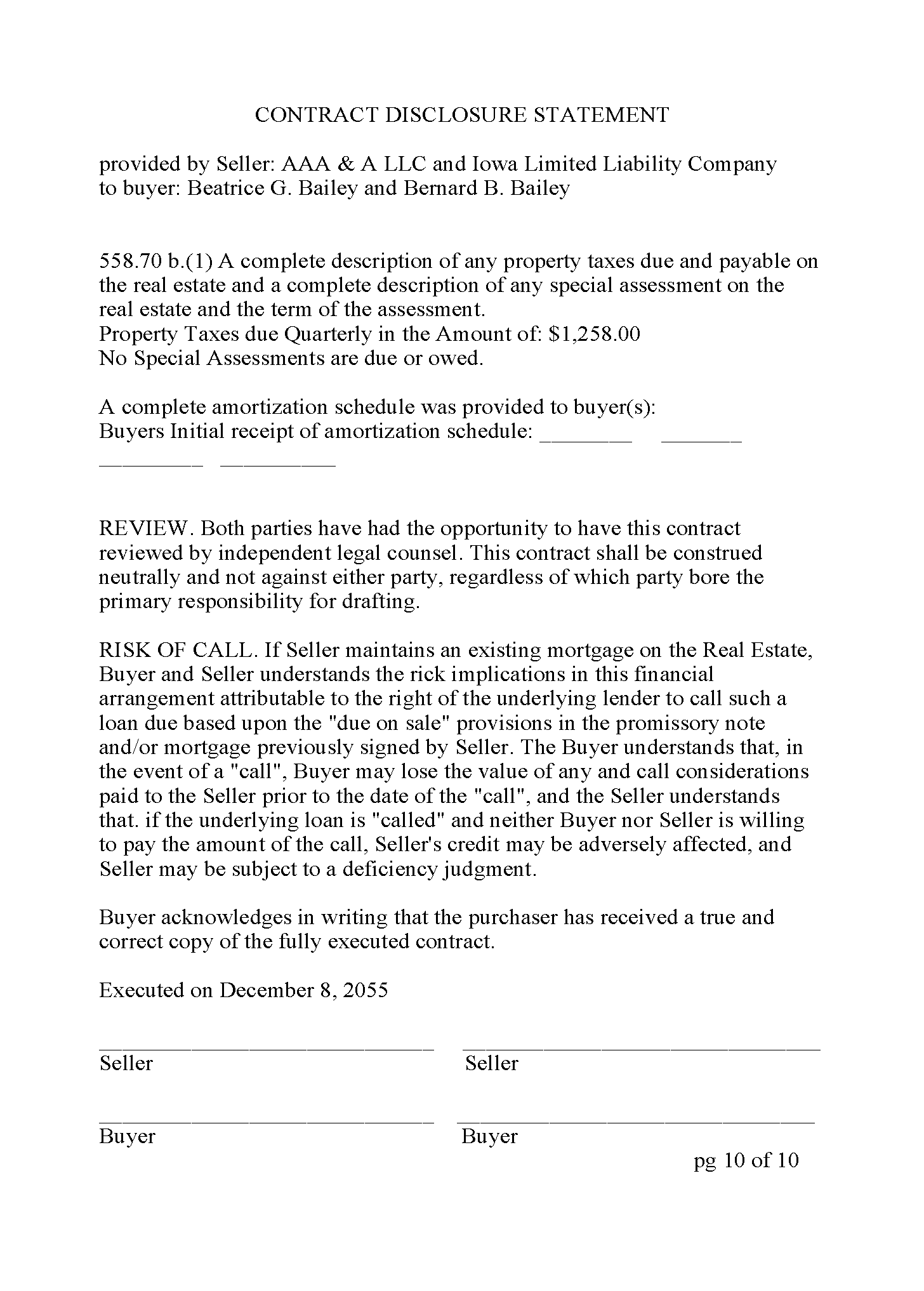

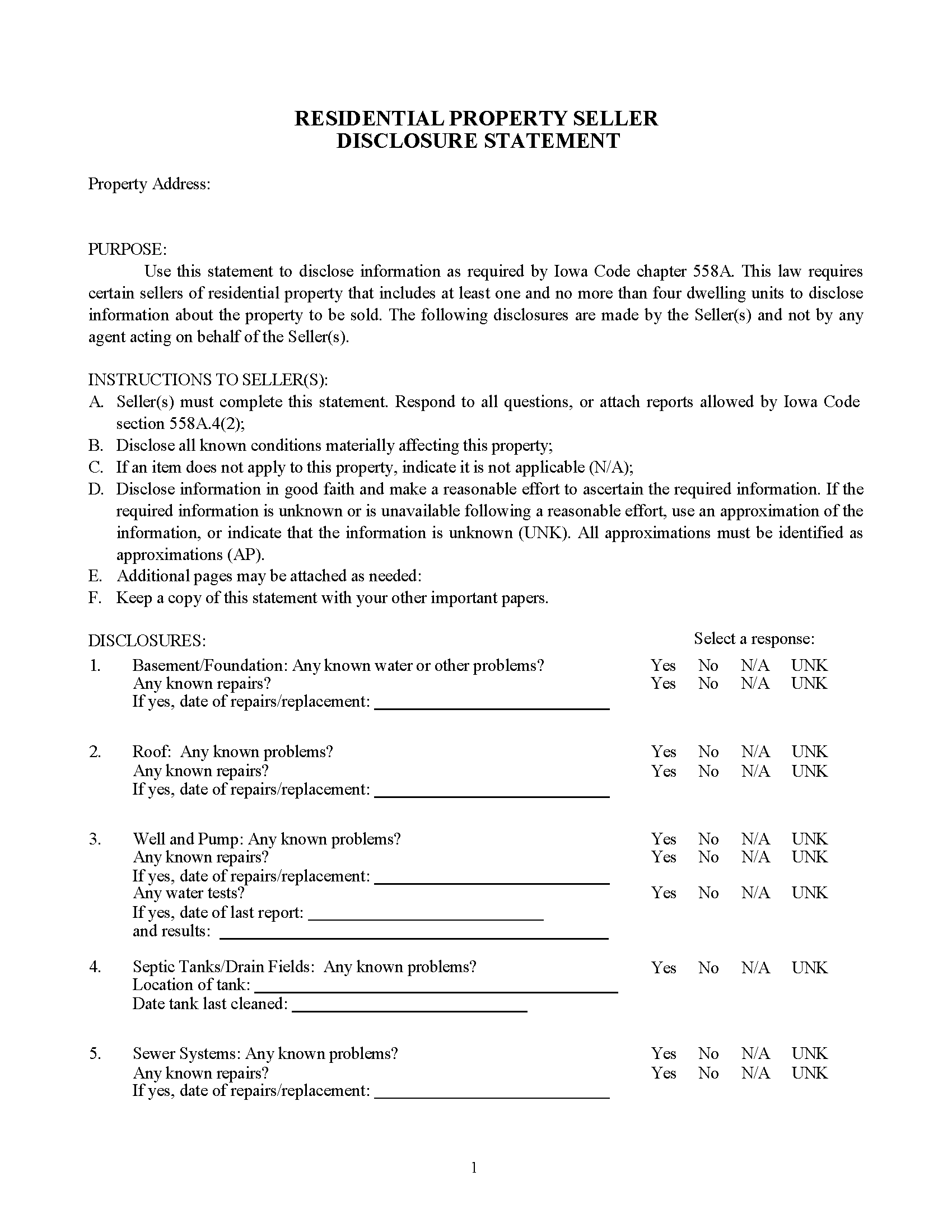

Story County Contract Disclosure Form

Required by seller for certain residential property.

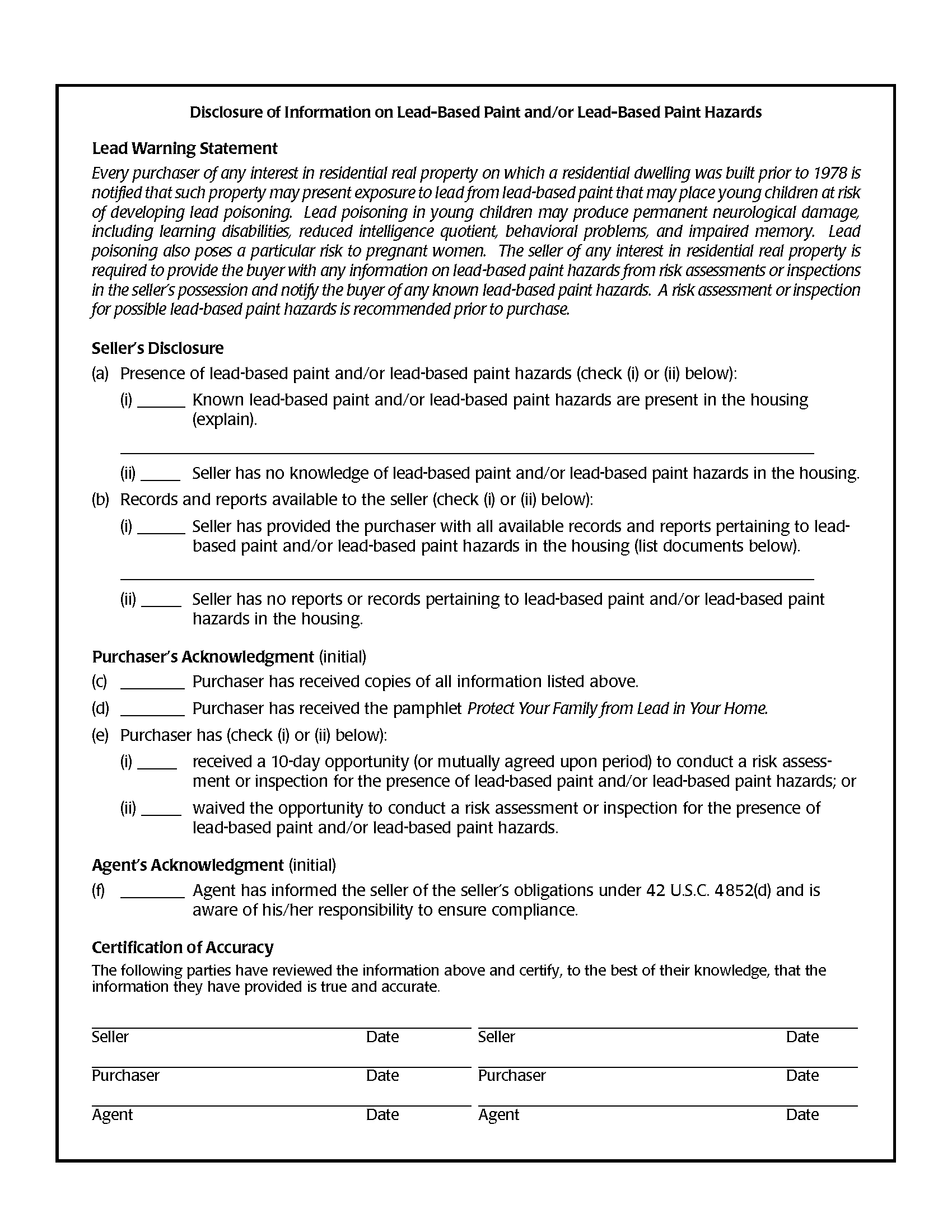

Story County Lead Based Paint Disclosure Form

Required for residential property built before 1978.

Story County Protect your family from lead based paint

Issue to buyers if lead based paint disclosure is required.

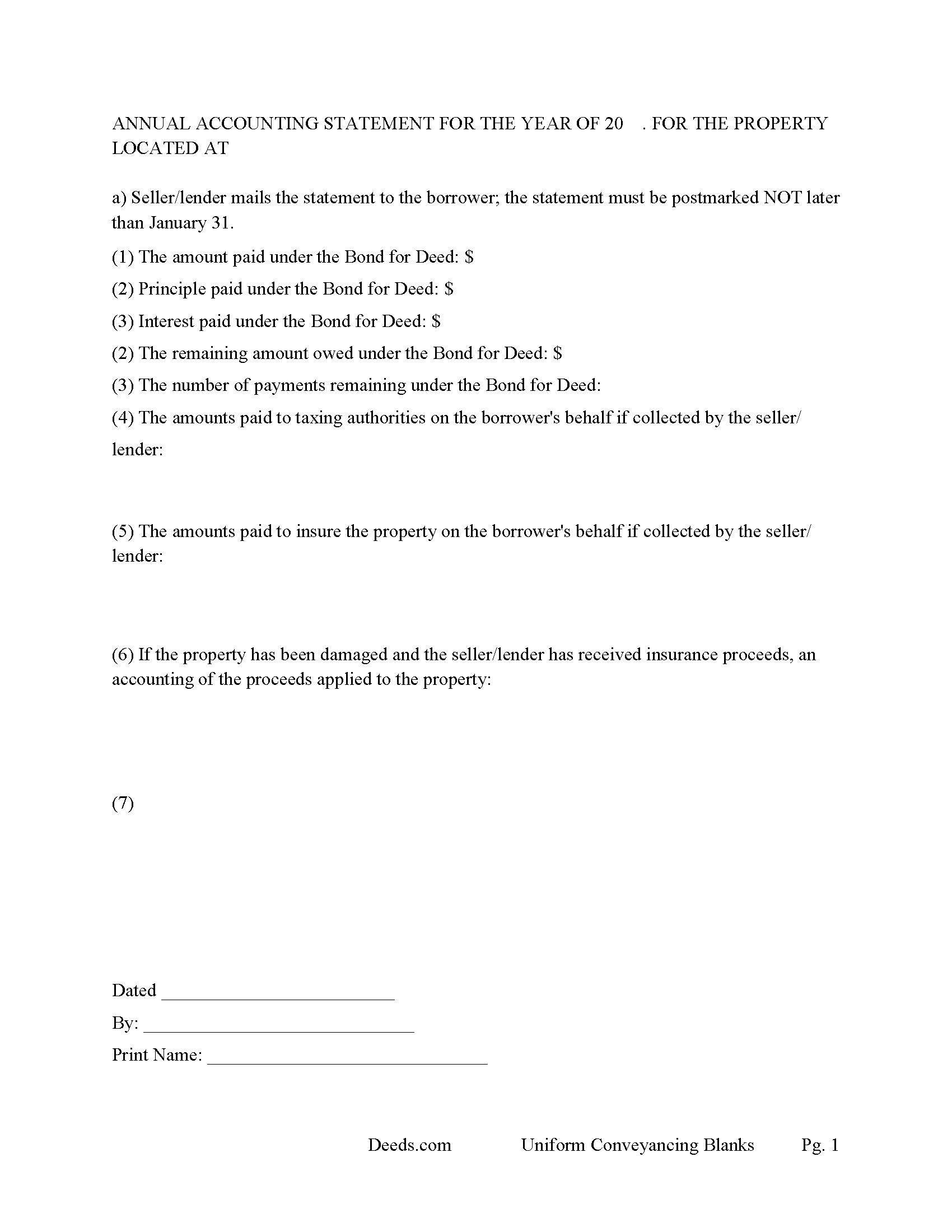

Story County Annual Accounting Statement Form

Issue to buyers at end of year for fiscal year reporting, interest paid, etc.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Iowa and Story County documents included at no extra charge:

Where to Record Your Documents

Story County Recorder

Nevada, Iowa 50201

Hours: 8:00am to 5:00pm Monday through Friday / Recording until 3:30pm

Phone: (515) 382-7230

Recording Tips for Story County:

- White-out or correction fluid may cause rejection

- Recording fees may differ from what's posted online - verify current rates

- Make copies of your documents before recording - keep originals safe

Cities and Jurisdictions in Story County

Properties in any of these areas use Story County forms:

- Ames

- Cambridge

- Collins

- Colo

- Gilbert

- Huxley

- Kelley

- Maxwell

- Mc Callsburg

- Nevada

- Roland

- Slater

- Story City

- Zearing

Hours, fees, requirements, and more for Story County

How do I get my forms?

Forms are available for immediate download after payment. The Story County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Story County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Story County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Story County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Story County?

Recording fees in Story County vary. Contact the recorder's office at (515) 382-7230 for current fees.

Questions answered? Let's get started!

In Iowa, a "Real Estate Contract–Installments" (commonly referred to as a contract for deed or installment land contract) is an agreement in which the seller finances the purchase of real estate for the buyer. The buyer makes payments over time, but the seller retains legal title to the property until the contract is fully paid.

When Applicable:

A real estate contract for installments is commonly used in the following situations:

1. Buyer Cannot Obtain Traditional Financing:

Buyers who are unable to secure a traditional mortgage due to poor credit, lack of credit history, or other financial barriers may use a real estate contract.

The seller essentially acts as the lender, providing an alternative to bank financing.

2. Seller-Owned Properties:

The property is owned outright by the seller, and the seller agrees to sell the property under a financing arrangement.

3. Vacant Land or Unique Properties:

Installment contracts are often used for rural or vacant land, or for properties that might not qualify for traditional financing.

4. Investor Arrangements:

Real estate investors sometimes use installment contracts to purchase properties while deferring full payment.

5. Tax Advantages for Sellers:

A seller may prefer an installment sale for tax purposes because the capital gains tax is spread out over the term of the payments.

________________________________________

Key Features of an Iowa Real Estate Contract–Installments:

1. Retention of Legal Title:

The seller retains legal title to the property until the buyer fulfills the terms of the contract (usually full payment of the purchase price).

2. Possession Rights:

The buyer typically takes possession of the property and assumes responsibility for taxes, insurance, and maintenance.

3. Payment Structure:

Payments are made in regular installments over a specified period, often including principal and interest.

4. Default and Termination:

If the buyer defaults, Iowa law provides specific protections and procedures for termination, including potential forfeiture of payments and the return of property to the seller.

________________________________________

Legal Requirements in Iowa:

Iowa Code § 558.46 outlines specific requirements for installment real estate contracts, including:

1. Written Agreement:

The contract must be in writing and signed by both parties.

2. Recording Requirements:

The seller must record the contract with the county recorder where the property is located within 180 days of execution. Failure to do so can lead to penalties and make the contract unenforceable.

3. Disclosure Statement:

Iowa Code § 558.70 requires sellers to provide a disclosure statement detailing the terms of the contract (e.g., purchase price, interest rate, payment schedule, and property description).

4. Forfeiture or Foreclosure:

If a buyer defaults, the seller may pursue forfeiture under Iowa Code Chapter 656 or foreclosure through court proceedings. Forfeiture is faster but generally results in the buyer losing all payments made.

________________________________________

Advantages and Disadvantages:

Advantages for Buyers:

Easier access to property ownership without traditional financing.

Flexible terms negotiated directly with the seller.

Immediate possession and use of the property.

Disadvantages for Buyers:

Higher risk of forfeiture if unable to meet payment terms.

No legal title until the contract is fulfilled.

Potentially higher costs than traditional financing.

Advantages for Sellers:

Ability to sell property without requiring the buyer to obtain financing.

Opportunity to earn interest on the sale price.

Retention of legal title as security for the agreement.

Disadvantages for Sellers:

Risk of buyer default.

Responsibility for legal action in case of default or disputes.

________________________________________

Situations Requiring Legal Advice:

1. Complex Terms: Buyers or sellers negotiating complex installment contracts should seek legal advice to ensure fair terms and compliance with Iowa law.

2. Default: Understanding rights and remedies in the event of a default is crucial for both parties.

3. Disclosures and Recording: Ensuring compliance with Iowa Code §§ 558.46 and 558.70 is essential to avoid penalties and legal issues.

For a valid and enforceable agreement, both parties should consult a real estate attorney to draft or review the contract.

In Iowa, real estate installment contracts—commonly known as contracts for deed—are governed by specific statutes designed to protect both buyers and sellers. Key provisions include:

Mandatory Recording of Contracts:

• Iowa Code § 558.46: Sellers must record residential real estate installment sales contracts with the county recorder where the property is located within 90 days of execution. Failure to record prohibits the seller from initiating forfeiture proceedings based on contract non-compliance.

• Iowa Code § 558.46 (4). If a real estate contract is required to be recorded under this section, the requirement is satisfied by recording either the entire real estate contract or a memorandum of the contract containing at least the names and addresses of all parties named in the contract, a description of all real property and interests in the real property subject to the contract, the length of the contract, and a statement as to whether the seller is entitled to the remedy of forfeiture and as to the dates upon which payments are due.

Contract Disclosure Requirements:

• Iowa Code § 558.70: Before executing a residential real estate installment sales contract, sellers must provide buyers with a written disclosure statement. This statement should include details such as the property's assessed value, any due property taxes or special assessments, existing mortgages or liens, a complete amortization schedule, interest rates, and any balloon payments. The disclosure ensures transparency and informs buyers of their rights and obligations.

Forfeiture Procedures:

• Iowa Code Chapter 656: This chapter outlines the procedures for forfeiture of real estate contracts in cases of buyer default. It specifies the notice requirements and timelines that sellers must follow to terminate the contract legally.

Real Estate Disclosures:

• Iowa Code Chapter 558A: This chapter mandates that sellers provide a disclosure statement to buyers, detailing the condition and characteristics of the property. The disclosure must be provided at least seven days before the execution of a real estate installment sales contract.

These statutes aim to ensure transparency, protect the interests of both parties, and maintain fair practices in real estate transactions involving installment contracts in Iowa.

Important: Your property must be located in Story County to use these forms. Documents should be recorded at the office below.

This Real Estate Contract-Installments meets all recording requirements specific to Story County.

Our Promise

The documents you receive here will meet, or exceed, the Story County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Story County Real Estate Contract-Installments form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Dave M.

March 10th, 2020

Service as needed. A bit expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Cecelia C.

December 16th, 2021

Service was fantastic. So helpful and they promptly get back with you. No reason to drive if you are out of state and need to get a deed filed. Safe way to file if you don't want to go to public office or can't physically get there.

Thank you for your feedback. We really appreciate it. Have a great day!

Chris O.

August 21st, 2019

Very user friendly website. Had a variety of forms. Reasonable price

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Yunyan B.

November 12th, 2019

Great website, fraction of the price if doing title research elsewhere

Thank you for your feedback. We really appreciate it. Have a great day!

Stanley P.

February 14th, 2019

Fast accurate service

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lillian D.

May 24th, 2020

I found the deeds.com site easy to use and very up to date. I am a senior citizen and not very tek inclined but I was able to reach the goal that I was seeking. I would use it again if the need arrived.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Samantha A.

June 9th, 2022

Its exactly what it said it was. I received multiple downloads, loaded fast and was pretty easy to navigate.

Thank you for your feedback. We really appreciate it. Have a great day!

Kathryn P.

February 9th, 2022

Somewhat easy to traverse.

Thank you!

janice m.

November 9th, 2022

was great!

Thank you!

Rip V.

October 5th, 2022

Found the forms I needed but had to type these out my self in Word since these forms do not allow any information to be saved. I understand you want this to be proprietary information but you failed to deliver a usable product. I printed this template and built my own in microsoft word. Good examples and instructions with poor execution. I lost hours of typing and nearly lost real estate deals due to these documents not being in a format ready to use. Will be using another service next time or buying these as guides alone.

Thank you for taking the time to leave your feedback. Sorry to hear of the struggle you had using our forms. We will look into the issues you reported to see what we can do to provide a better product. For your trouble we have provided a full refund of your order.

JOSEPH P.

March 12th, 2021

It would have been a lot better if I could have downloaded ALL at once, as a package.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert C.

May 31st, 2023

Not easy to navigate as a first time user. I printed the first page but lost the link to the second page.

Thank you for taking the time to provide us with your valuable feedback. I'm sorry to hear that you've encountered difficulties with our website's navigation, particularly as a first-time user.

Furthermore, your comments about the website's navigation have been taken into account. We continually strive to improve our website and make it as intuitive and user-friendly as possible. Your feedback is crucial for us in achieving this goal.

Thank you again for your feedback. If you have any other suggestions or need further assistance, please don't hesitate to contact us.

James S.

August 26th, 2020

unbelievable Deeds Rocks Start to finish 2=Day Recommended by Coconino County Recorders office in Arizona there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

henry p v.

March 18th, 2020

The deed easily downloaded. Form fill was smooth. I thought the service was a good value.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!