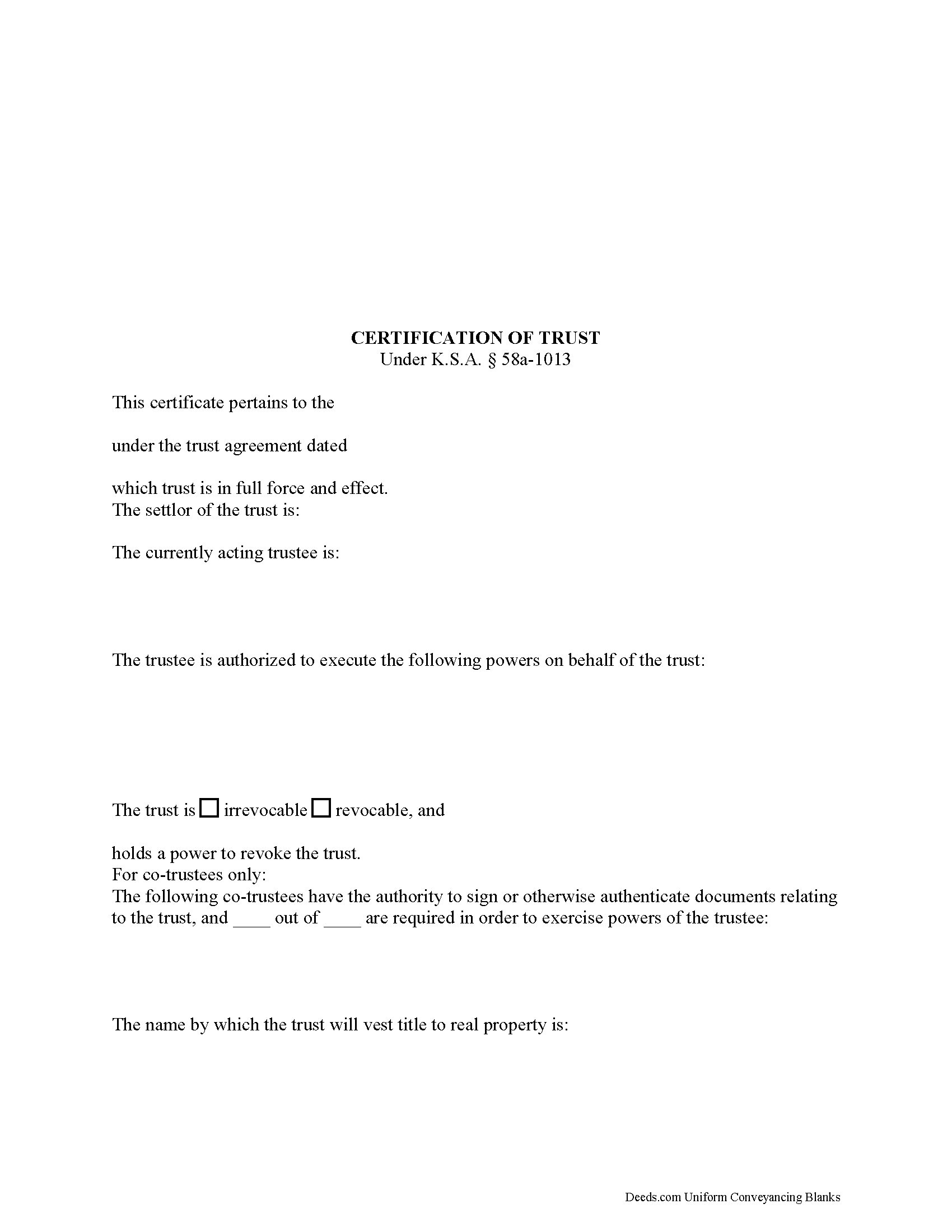

Wilson County Certificate of Trust Form

Wilson County Certificate of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

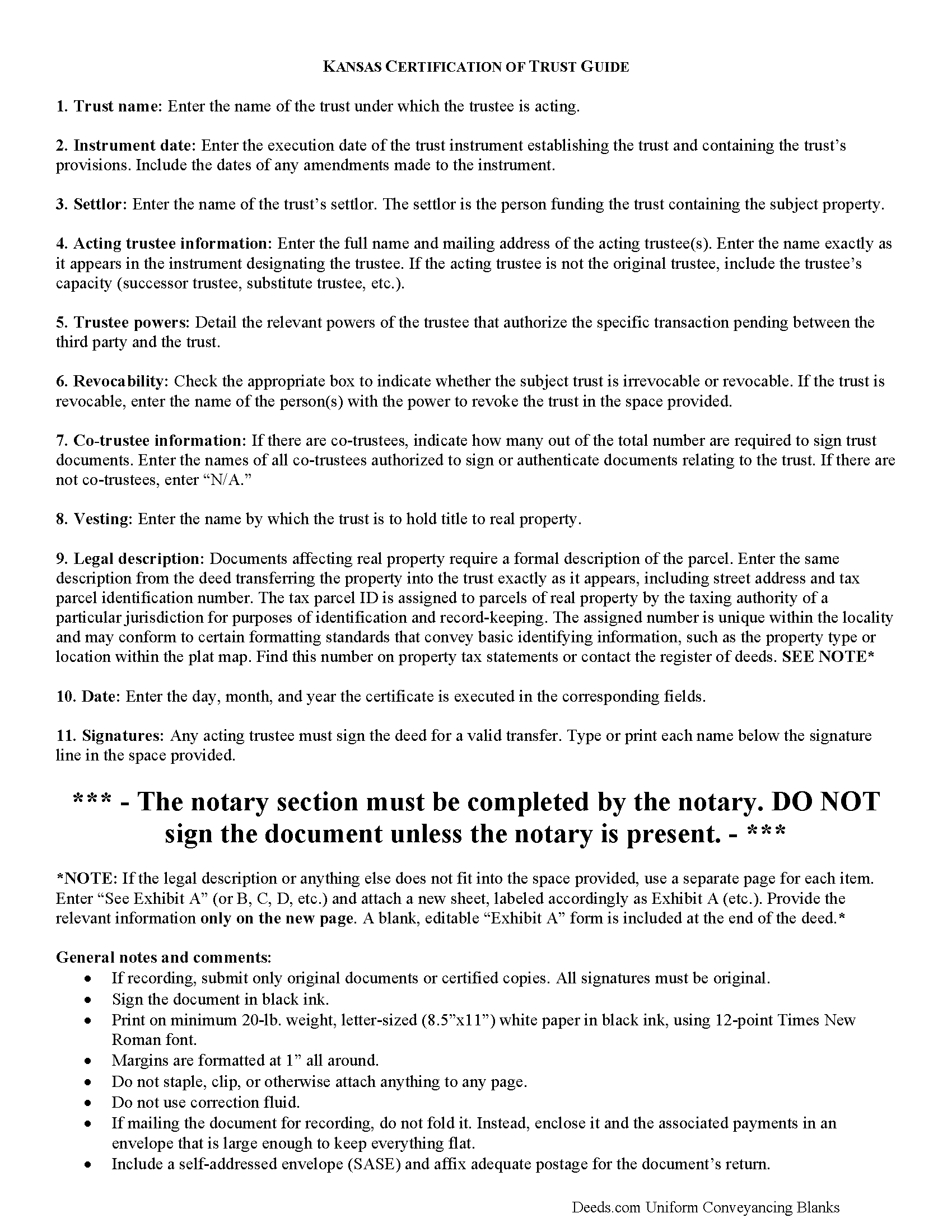

Wilson County Certificate of Trust Form

Line by line guide explaining every blank on the form.

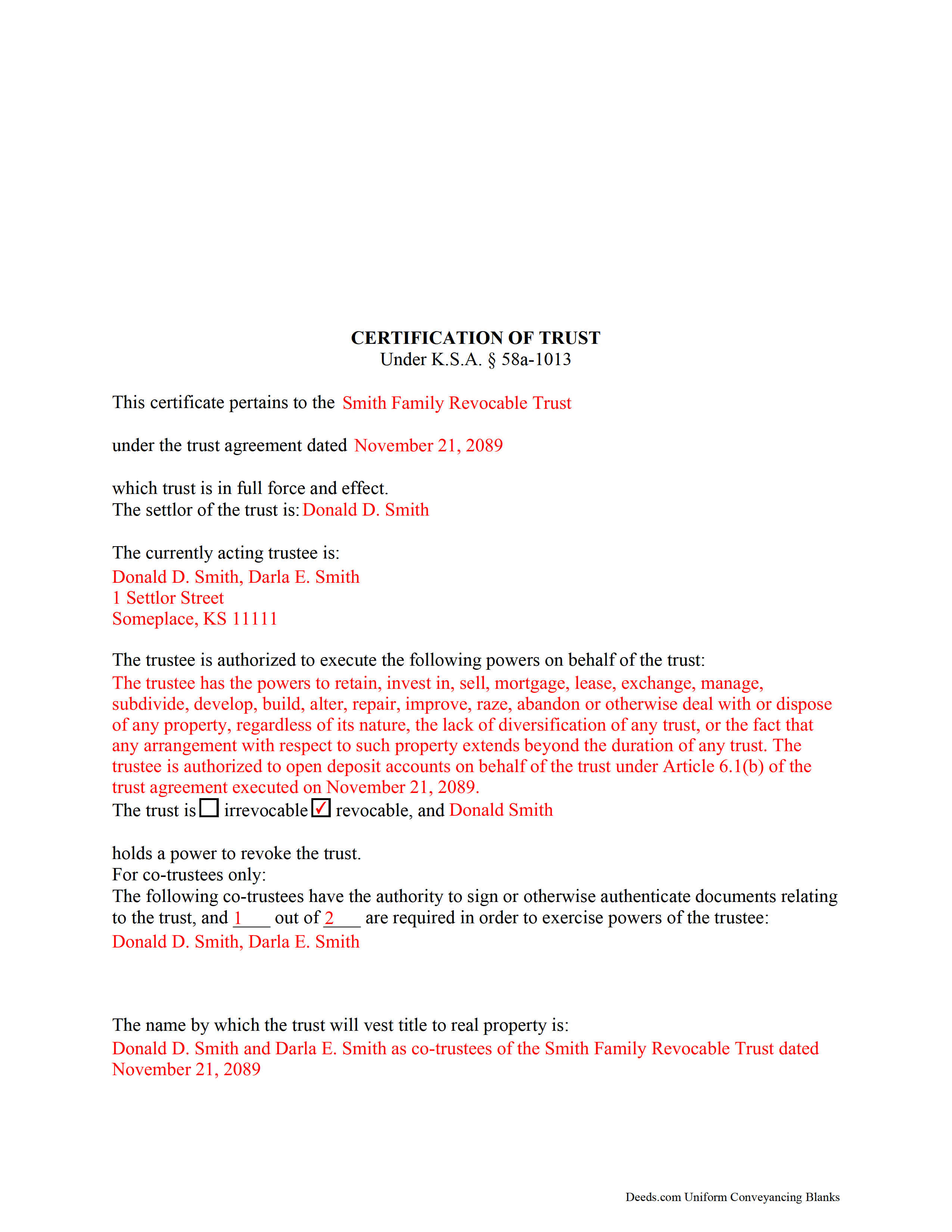

Wilson County Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Wilson County documents included at no extra charge:

Where to Record Your Documents

Wilson County Register of Deeds

Fredonia, Kansas 66736

Hours: 8:00 to 5:00 M-F

Phone: (620) 378-3662

Recording Tips for Wilson County:

- Ensure all signatures are in blue or black ink

- Double-check legal descriptions match your existing deed

- White-out or correction fluid may cause rejection

- Leave recording info boxes blank - the office fills these

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Wilson County

Properties in any of these areas use Wilson County forms:

- Altoona

- Benedict

- Buffalo

- Fredonia

- Neodesha

- New Albany

Hours, fees, requirements, and more for Wilson County

How do I get my forms?

Forms are available for immediate download after payment. The Wilson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Wilson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wilson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Wilson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Wilson County?

Recording fees in Wilson County vary. Contact the recorder's office at (620) 378-3662 for current fees.

Questions answered? Let's get started!

Part of the Kansas Uniform Trust Code, the certification of trust is codified at K.S.A. 58a-1013.

In lieu of the trust instrument, a trustee doing business with a third party who is not a trust beneficiary can provide an acknowledged certification of trust. The certification is an abstract of the trust instrument and contains only information essential to the transaction.

A trust instrument, executed by the trust's settlor, contains the trust provisions. It designates a trustee, or a fiduciary that represents the trust. The trust instrument also identifies the trust beneficiaries, or the person(s) having a present or future interest in the trust (K.S.A. 58a-103(2)(A)).

A certification of trust does not disclose the trust's beneficiaries, or other information a settlor may wish to keep private. In Kansas, only trust instruments pertaining to "the state, or any county, municipality, political or governmental subdivision, or governmental agency of the state as the beneficiary" are required to be recorded (K.S.A. 58-2431, 2).

The document certifies, first and foremost, the existence of the trust and the trustee's authority to represent the trust. The certification also states the name, date, and type (revocable or irrevocable) of trust and provides the identity of the trust's settlor, or the person who established the trust and is funding the trust with assets, as well as the name of any person able to revoke the trust, if applicable.

In addition, the certification details the powers that the trustee has been granted relevant to the transaction at hand. For trusts with more than one trustee, the document identifies all trustees who may authorize documents relating to the trust and whether all or less than all is required to authenticate trust documents. Finally, the certification should include the manner of taking title to trust property.

All Kansas documents affecting real property require a legal description. If using the document in conjunction with a trustee's deed, the certification should contain the legal description of the subject real property.

A recipient of a certification of trust can request copies of excerpts from the original trust instrument and later amendments which designate the trustee and confer the power to act in the pending transaction, but may assume without inquiry the existence of the facts contained in the certification (K.S.A. 58a-1013(e),(f). Requesting the entire trust instrument in addition to the certification or excerpts opens the recipient to certain liabilities in court.

Consult a lawyer for guidance and with any questions relating to trusts or certifications of trust, as each situation is unique.

(Kansas Certificate of Trust Package includes form, guidelines, and completed example)

Important: Your property must be located in Wilson County to use these forms. Documents should be recorded at the office below.

This Certificate of Trust meets all recording requirements specific to Wilson County.

Our Promise

The documents you receive here will meet, or exceed, the Wilson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wilson County Certificate of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Angela D.

August 19th, 2020

The only problem I had was that it doesn't let you create a file for all documents to go into as one. Mahalo Angie

Thank you for your feedback. We really appreciate it. Have a great day!

Beverly J. A.

November 27th, 2022

The forms where easy to follow with the directions showing how to fill out the forms that I needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Marlin M.

March 10th, 2025

all round GREAT!

Always great to hear kind words from such a long time customer Marlin, thank you.

Sofia H.

October 9th, 2020

Where has this site been my entire career? Very helpful. This site made what would normally take three days with a runner, a snap. Five Stars.

Thank you for your feedback. We really appreciate it. Have a great day!

Sara R.

July 24th, 2020

The deed is presently at the auditors office and will be recorded after approval from zoning board. As far as I know, everything is going along well. A self addressed envelope was left at recorder's office for return after recording is complete.

Thank you!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!

terrance G.

February 11th, 2025

Excellent Service, with quick turnaround times.

Thank you for your positive words! We’re thrilled to hear about your experience.

Cleatous S.

December 9th, 2020

The deed form is hard to fill in. There is no way to fill in the county in the "reviewed by" section. Also, there is no place for the Grantee's address on the form. I had to include it in the fill-in space for the legal description.

Thank you!

John D.

September 30th, 2020

I was quite impressed by the quality of your documents and the ease of the download.

Thank you for your feedback. We really appreciate it. Have a great day!

Wayne T.

February 2nd, 2021

I was skeptical when I first came upon this website. Not sure why I had such a negative feeling, but after I received the printed deed I felt relieved and completely satisfied. This is a great website for everyone who wouldn't want to retrieve their deed in person and worth the reasonable fee.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Curley L F.

May 1st, 2019

The deed form I downloaded was easy to use and just what i needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hayley C.

November 19th, 2020

Love this site, so easy to work with and customer service is amazing.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JOSEPH W.

September 17th, 2021

Easy peezy!

Thank you!

James D.

April 24th, 2019

It was very easy to set up the account but then everything is very costly. I didn't see any publications that were free to account holders, so as infrequently I have to do a title search, I may as well just hire an online service to do the legwork too.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carla H.

May 29th, 2020

This is a very useful site for downloading legal forms - just be sure you're getting the form you need before buying. Unfortunately I selected the wrong form initially and had to buy a 2nd form to correct my error. I saw no way of communicating my error at that point - i.e., loss of one star.

Thank you for your feedback. We really appreciate it. Have a great day!