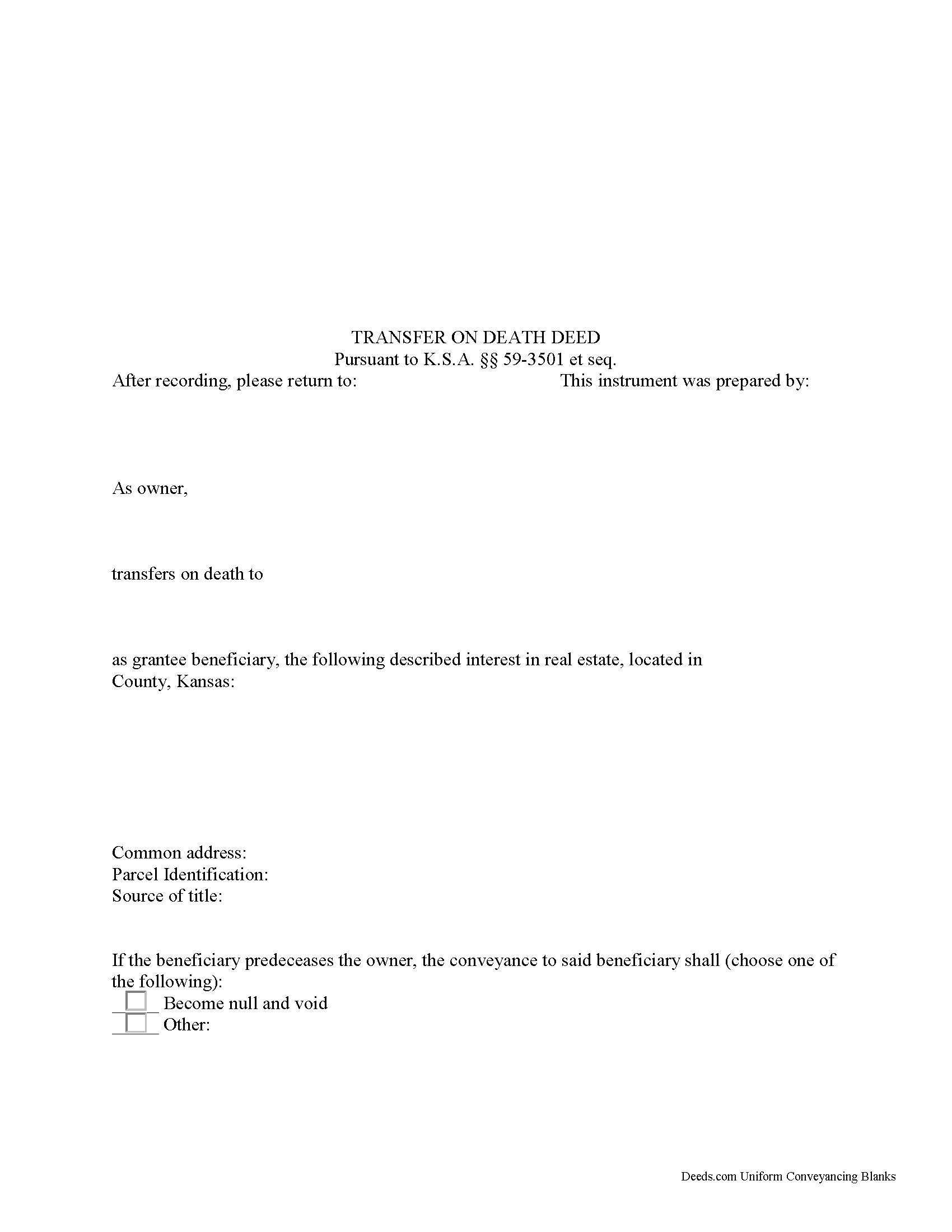

Gray County Transfer on Death Deed Form

Gray County Transfer on Death Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

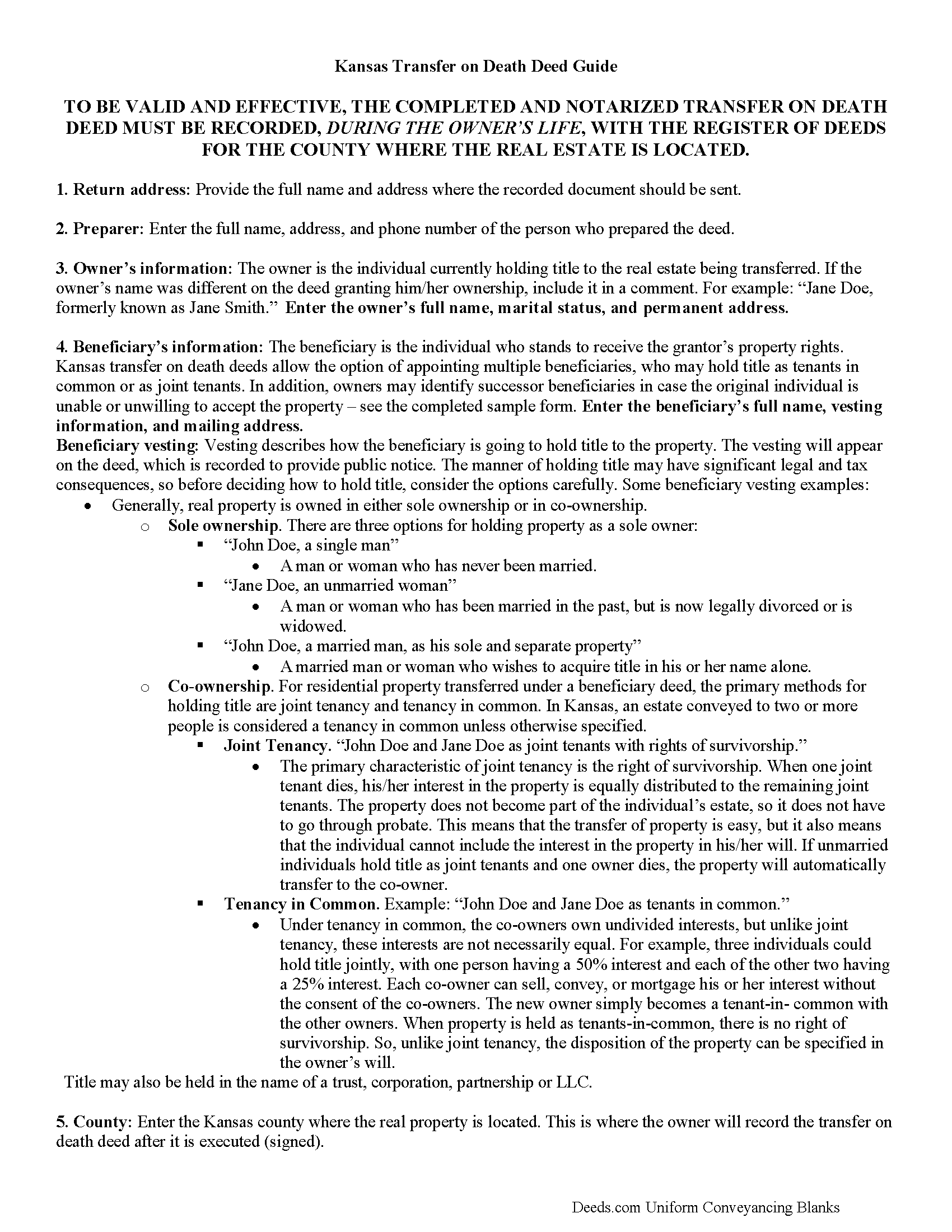

Gray County Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

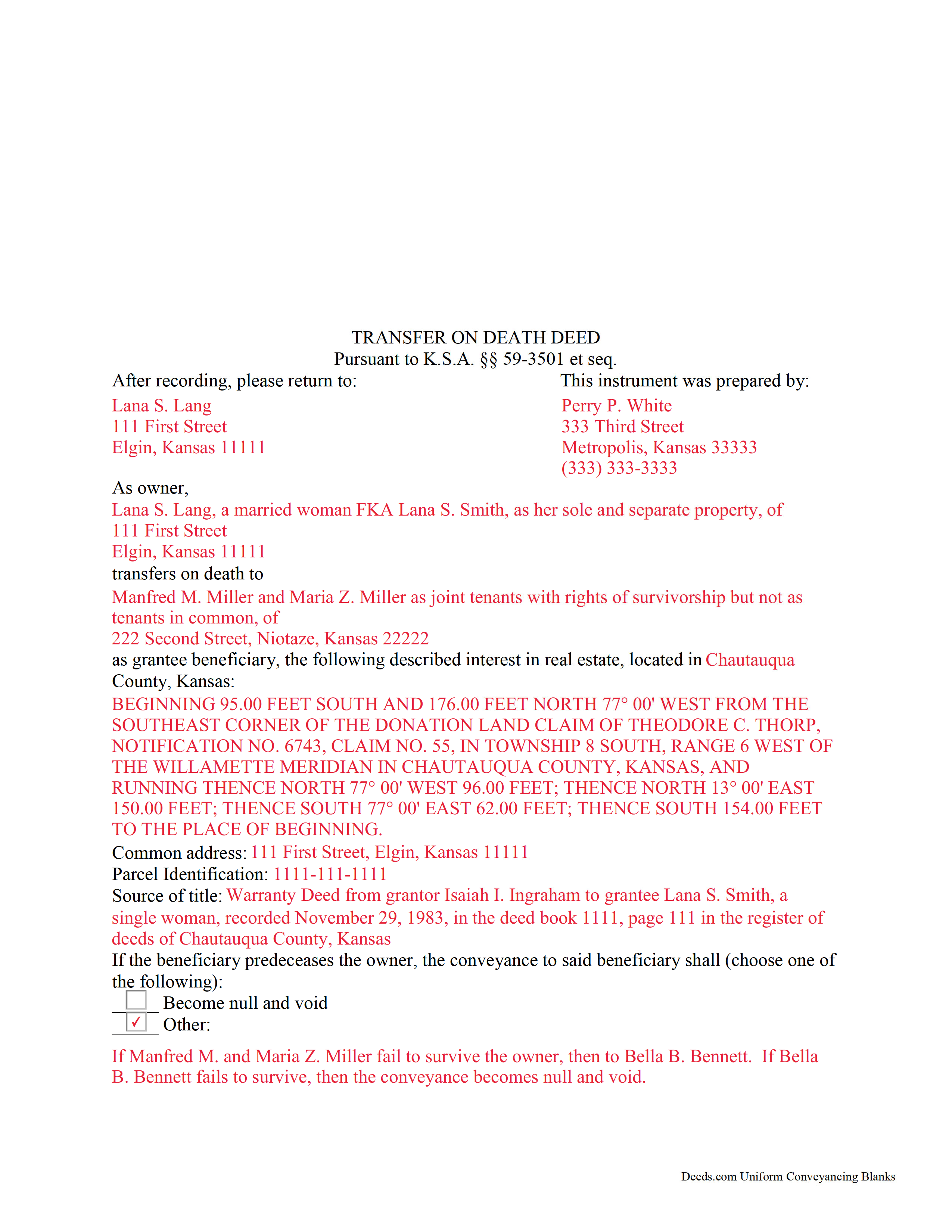

Gray County Completed Example of the Transfer on Death Deed Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kansas and Gray County documents included at no extra charge:

Where to Record Your Documents

Gray County Register of Deeds

Cimarron, Kansas 67835

Hours: 8:00am-5:00pm M-F

Phone: (620) 855-3835

Recording Tips for Gray County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Make copies of your documents before recording - keep originals safe

- Avoid the last business day of the month when possible

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Gray County

Properties in any of these areas use Gray County forms:

- Cimarron

- Copeland

- Ensign

- Ingalls

- Montezuma

Hours, fees, requirements, and more for Gray County

How do I get my forms?

Forms are available for immediate download after payment. The Gray County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gray County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gray County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gray County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gray County?

Recording fees in Gray County vary. Contact the recorder's office at (620) 855-3835 for current fees.

Questions answered? Let's get started!

Kansas enacted its statutory transfer on death deeds in 1997. These nontestamentary, nonprobate conveyances are governed by K.S.A. 59-3501 (2012) et seq. Nontestamentary means that the transfer is not included in or affected by the owner's last will and testament. Nonprobate means that the property's change in title occurs outside the probate process.

Transfer on death deeds, when lawfully executed and RECORDED DURING THE OWNER'S LIFE, convey a land owner's interest in a specific piece of real property to a designated beneficiary after the owner dies. Until death, the owner retains absolute rights to and control over the property, including entering into agreements to rent, mortgage, or sell the property outright.

The deeds do not require any consideration from the beneficiary, nor do they demand that the beneficiary receive notice about his/her/their potential future interest in real estate. The owner may also change, revoke, or otherwise modify the terms of the transfer. In addition, the statute explains that a "subsequent transfer-on-death beneficiary designation revokes all prior designations of grantee beneficiary or beneficiaries by such record owner for such interest in real estate" (K.S.A. 59-3503(b)).

As with a transfer on death deed, all revocations or other changes to a recorded transfer on death deed may be made "at any time prior to the death of the record owner, by executing, acknowledging and recording in the office of the register of deeds in the county where the real estate is located an instrument describing the interest revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary or beneficiaries is not required" (K.S.A. 59-3503(a)).

Beneficiaries should be aware, however, that they take "the record owner's interest in the real estate at death subject to all conveyances, assignments, contracts, mortgages, liens and security pledges made by the record owner or to which the record owner was subject during the record owner's lifetime, including . . . claims of the state of Kansas for medical assistance, as defined in K.S.A. 39-702" (K.S.A. 59-3504(b)).

Overall, transfer on death deeds offer a flexible and useful tool to owners of Kansas real estate. Even so, there are benefits and drawbacks to this method of estate planning. Because each situation is unique, contact an attorney with specific questions or for complex situations.

(Kansas Transfer on Death Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Gray County to use these forms. Documents should be recorded at the office below.

This Transfer on Death Deed meets all recording requirements specific to Gray County.

Our Promise

The documents you receive here will meet, or exceed, the Gray County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gray County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

CORA T.

January 17th, 2022

very convenient and quick access

Thank you!

Adriane L.

November 20th, 2024

great experience. Great communication and very fast turn around ty Adriane

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Hinz H.

May 28th, 2020

Prompt accurate service

Thank you!

Doreen A.

February 13th, 2024

Easy to navigate Efficient Service

Your kind words warm our hearts. Thank you for sharing your experience!

Norma O.

March 10th, 2020

good

Thank you!

Guy G.

March 22nd, 2023

Deeds.com was easy to use and their easement deed was exactly what I was looking for. I knew I didn't need to spend hundreds of dollars talking to an attorney.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

sonja E.

May 31st, 2019

It's very easy to find your way around on deeds.com, Excellent layout on this website and user friendly!

Thank you!

Robert S.

March 2nd, 2025

My Quick claim formsi downloaded had not come through so I contacted customer service and they provided me with the instructions on how to retrieve my forms, A plus service.

We are delighted to have been of service. Thank you for the positive review!

Walter C.

March 23rd, 2023

Awesome everything you would ever need

Thank you!

Carolyn S.

January 24th, 2021

This website was very helpful in explaining what a "gift" deed is and how to execute it. I didn't want to incur legal fees for a simple transaction and this website helped me avoid that.

Thank you for your feedback. We really appreciate it. Have a great day!

Margaret T.

May 6th, 2022

Had a difficult time finding my download after purchase. Thankfully I had printed the form and had. However it was read only and I'm not experienced enough to be able to change that. So I went into my word program and typed in the form. I should be able to use it for my purpose. Just glad I was finally able to find it after hours of searching online. I'm in my 70's and not real computer intelligent which may have been part of the problem

Sorry to hear of your struggle Margaret, we will try harder to make our forms easier for everyone.

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Hope A.

June 4th, 2021

Great Website and layout!! so easy!

Thank you!

Lorraine F.

October 9th, 2024

I followed the instructions to download the form for my Mac, typed in the legal description of the real property but the space provided for it would not expand so I just typed the form into Word as a document. While I appreciate having the form to work with it would have been a breeze if it worked properly.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Daniel D.

April 22nd, 2019

quick and easy

Thank you Daniel.