Bourbon County Correction Deed Form

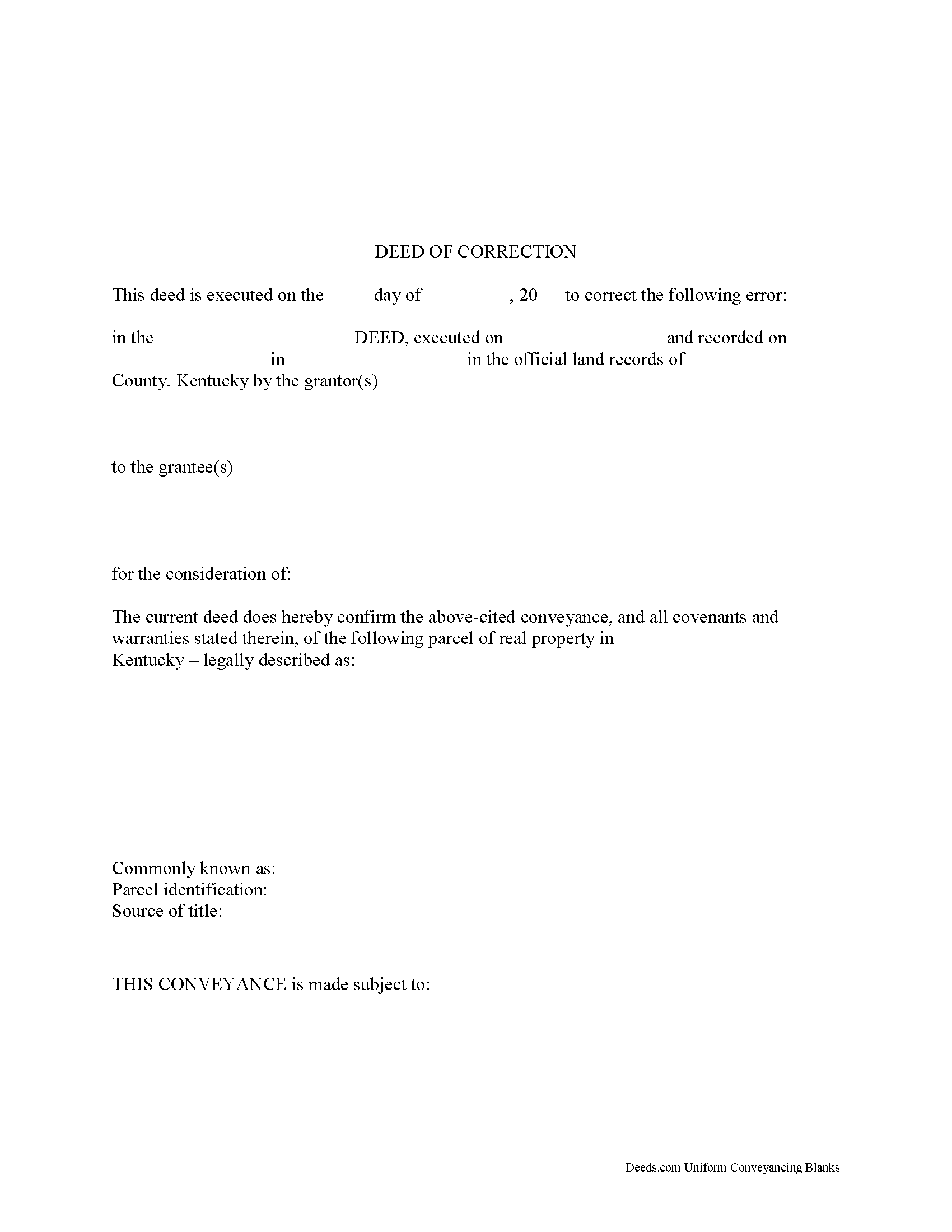

Bourbon County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

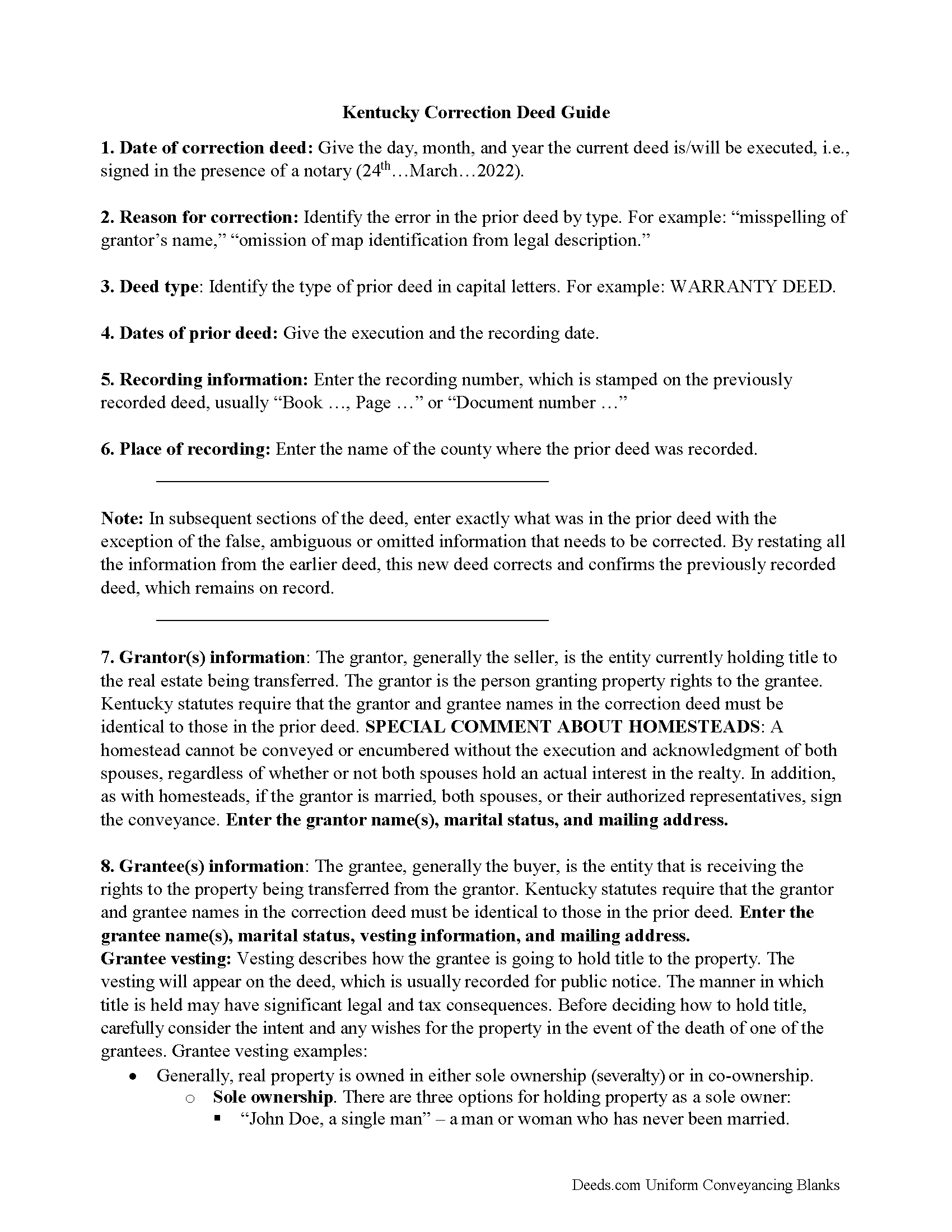

Bourbon County Correction Deed Guide

Line by line guide explaining every blank on the form.

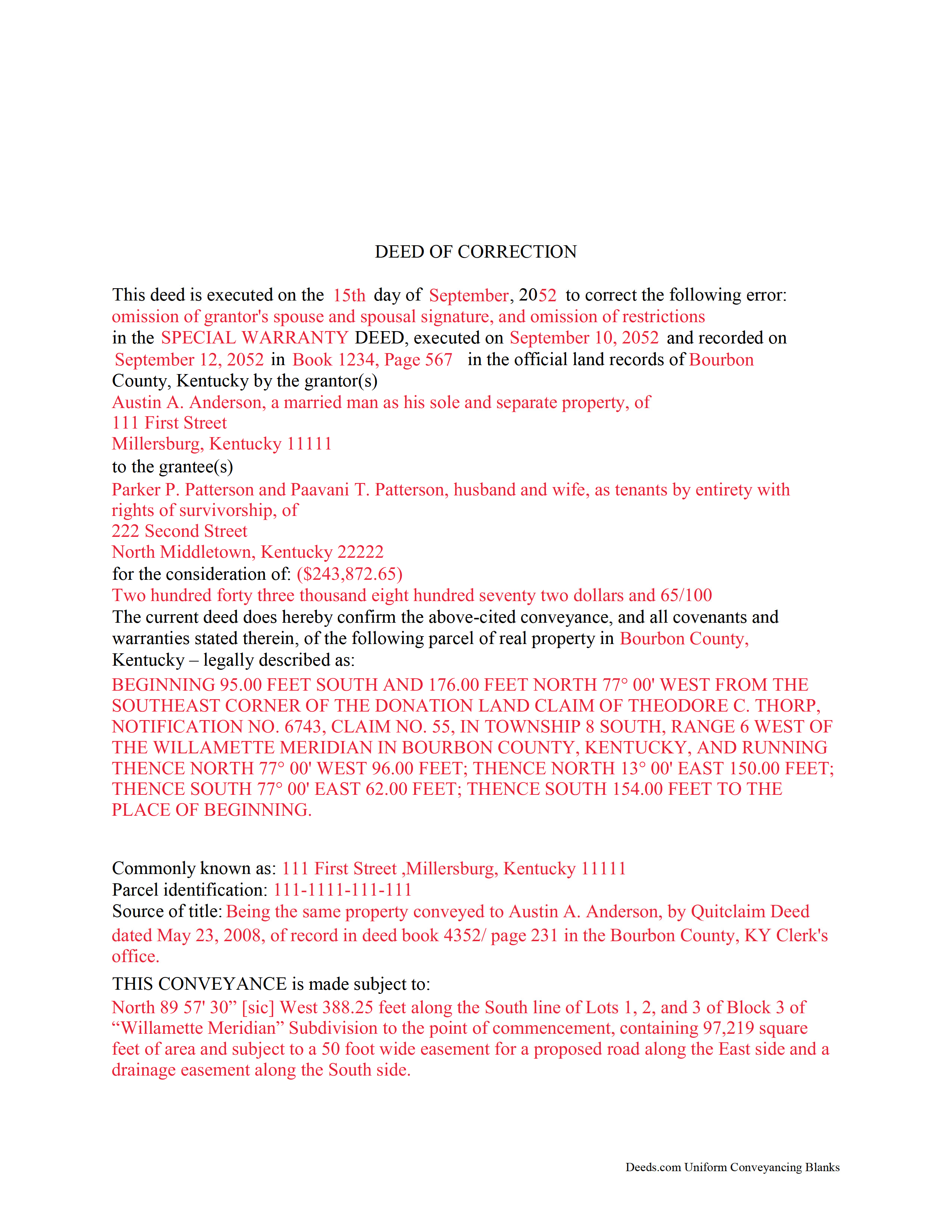

Bourbon County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Bourbon County documents included at no extra charge:

Where to Record Your Documents

Bourbon County Clerk

Paris, Kentucky 40361-0312

Hours: 8:30 to 4:30 Mon-Thu & 8:30 to 6:00 Fri

Phone: (859) 987-2142

Recording Tips for Bourbon County:

- Documents must be on 8.5 x 11 inch white paper

- Make copies of your documents before recording - keep originals safe

- Bring extra funds - fees can vary by document type and page count

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Bourbon County

Properties in any of these areas use Bourbon County forms:

- Millersburg

- North Middletown

- Paris

Hours, fees, requirements, and more for Bourbon County

How do I get my forms?

Forms are available for immediate download after payment. The Bourbon County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Bourbon County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Bourbon County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Bourbon County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Bourbon County?

Recording fees in Bourbon County vary. Contact the recorder's office at (859) 987-2142 for current fees.

Questions answered? Let's get started!

In Kentucky, use a correction deed to amend a previously recorded deed that contains a minor error.

A corrective deed is in effect an explanation and correction of an error in a prior instrument. As such, it passes no title, but only reiterates and confirms the prior conveyance. It must be executed from the original grantor(s) to the original grantee(s), and it needs to be recorded in order to be legally valid.

The correction deed must reference the original conveyance it is correcting by type of error, date of execution and recording, as well as by recording number and location. Beyond that, it restates the information given in the prior deed, thus serving as its de facto reiteration. The prior deed, however, which constitutes the actual conveyance of title, remains on record.

Deeds of correction are most appropriate for minor errors and omissions in the original deed, such as misspelled names, omission of marital status, or typos in the legal description. When making more substantial changes, for example to the vesting information or legal description of the property, it is best to seek legal advice regarding the long-term consequences.

Kentucky statutes give the following examples of corrections that can be made with a deed of correction: the number of acres or the source of the title for example (KRS 382.337). This implies that some material changes, such as the amount of property and errors to the chain of title, can be addressed through a correction deed. However, adding a name to the title or removing a name from it cannot be achieved via a correction deed in Kentucky and instead require a new deed of conveyance.

Another correction vehicle available in Kentucky is the affidavit of correction. It can be filed by one of the parties or the attorney who prepared the deed, but the statute limits its use to errors in the marital status and the acknowledgment or notary section of the deed (KRS 382.337), so they are only useful for a small number of corrections overall.

Correction deeds cost less to record in Kentucky than standard deeds, and they are exempt from transfer tax, and a consideration certificate is generally not required (KRS 382.135) unless the consideration amount is different from that in the prior deed (KRS 142.050). In that case, a new consideration certificate, notarized and signed by grantor and grantee, is required, and the clerk might collect additional transfer tax if the consideration amount is higher than in the prior deed.

(Kentucky Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Bourbon County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Bourbon County.

Our Promise

The documents you receive here will meet, or exceed, the Bourbon County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Bourbon County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Diane S.

May 13th, 2020

Money well spent. I used the example and filled out with no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph D.

July 1st, 2022

Exellent and easy! Thqanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Sandra W.

April 7th, 2019

I think this is going to be a very resourceful website, really have not had a chance to fully navigate yet. I look forward to accessing more.

Thank you!

Eduardo A.

January 22nd, 2022

Perfect, blank forms, just what I ordered. Easy to download, understand, and complete.

Thank you!

Jack B.

May 2nd, 2020

The service was fast, but I didn't learn about the results until I logged in. I would have liked to get email when the report was finished.

Thank you for your feedback. We really appreciate it. Have a great day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

William M.

May 30th, 2025

I found your service for deeds easy to use and I was able to quickly get the information (forms, example of forms filled out, and guide for filling out the form) down downloaded. I wish all government services and information was as easy to use as your's was. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

April 28th, 2020

Hi Please do not take time to respond to my previous inquiry - - - I figured it out. Deeds.com is a great tool for those of us who have occasional need for your type of services. Thanks ! Chuck

Thank you!

Jorge O.

June 11th, 2019

Everything work excellent. Don't think any update is needed at this time. Thank you

Thank you!

Nick V.

July 21st, 2020

Turn time was great. Highly recommend.

Thank you!

Carole M.

June 9th, 2020

So far it seems easy and hopefully be acceptable to Hillsborough Co

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robby T.

February 16th, 2022

Most people coming to this sight will not have the knowledge for deeds. Therefore, I wish there were more instructions on when the Grantor signs and when the Grantee signs and the process steps to making the transaction final. I would give it 4 out of 5 starts

Thank you for your feedback. We really appreciate it. Have a great day!

JOE M.

August 31st, 2024

The form I needed were easy to find. And very affordable. Great service.

Thank you for your feedback. We really appreciate it. Have a great day!

Mary-Ann K.

November 23rd, 2021

Very pleasantly pleased so far. Hope to hear from the town registrar Transfer On Death Deed accepted. Wish all legal proceedings were so simple . . .

Thank you for your feedback. We really appreciate it. Have a great day!

Nicole D.

January 12th, 2021

Very pleased with Deed.com. Quick response with instructions. Great service and will use again.

Thank you for your feedback. We really appreciate it. Have a great day!