Graves County Special Warranty Deed Form

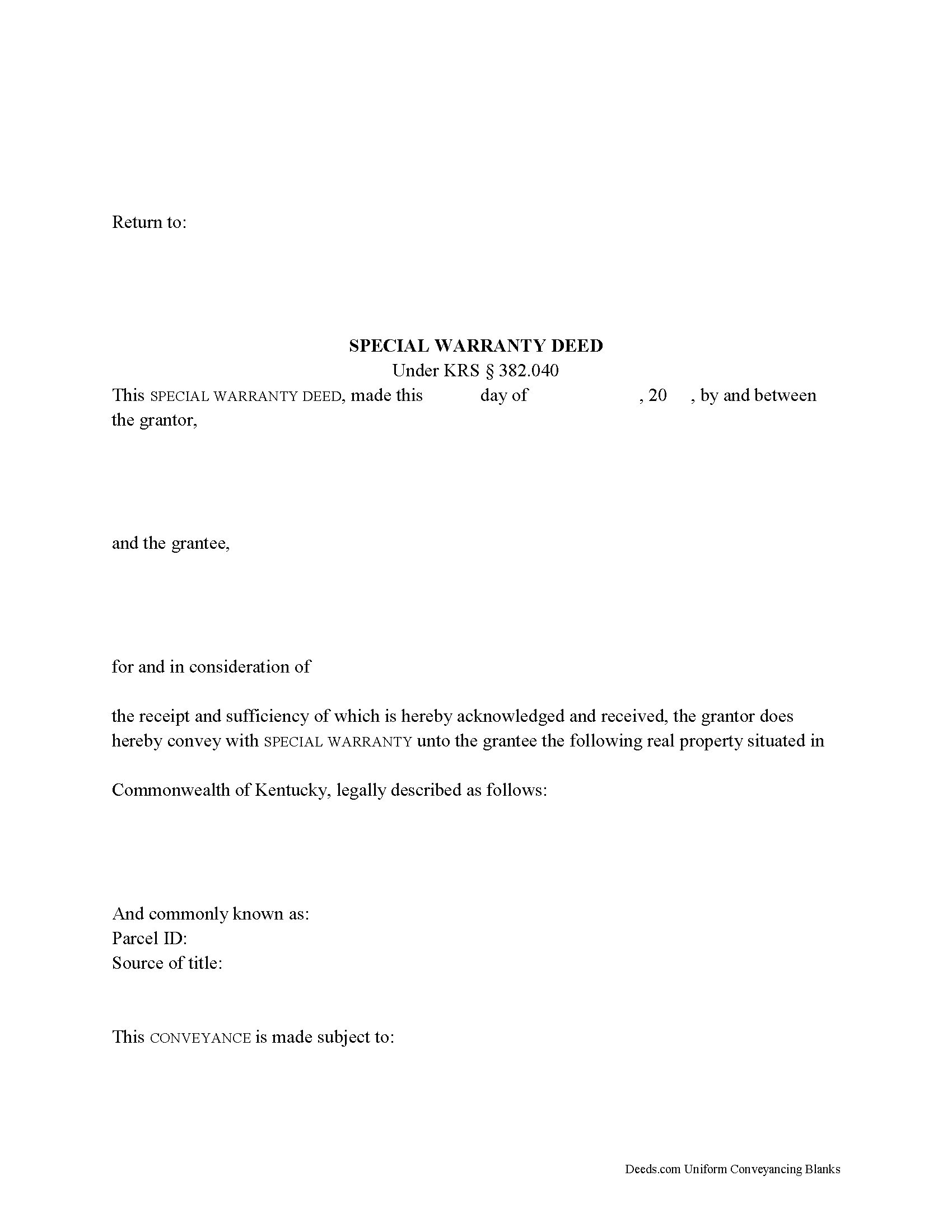

Graves County Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

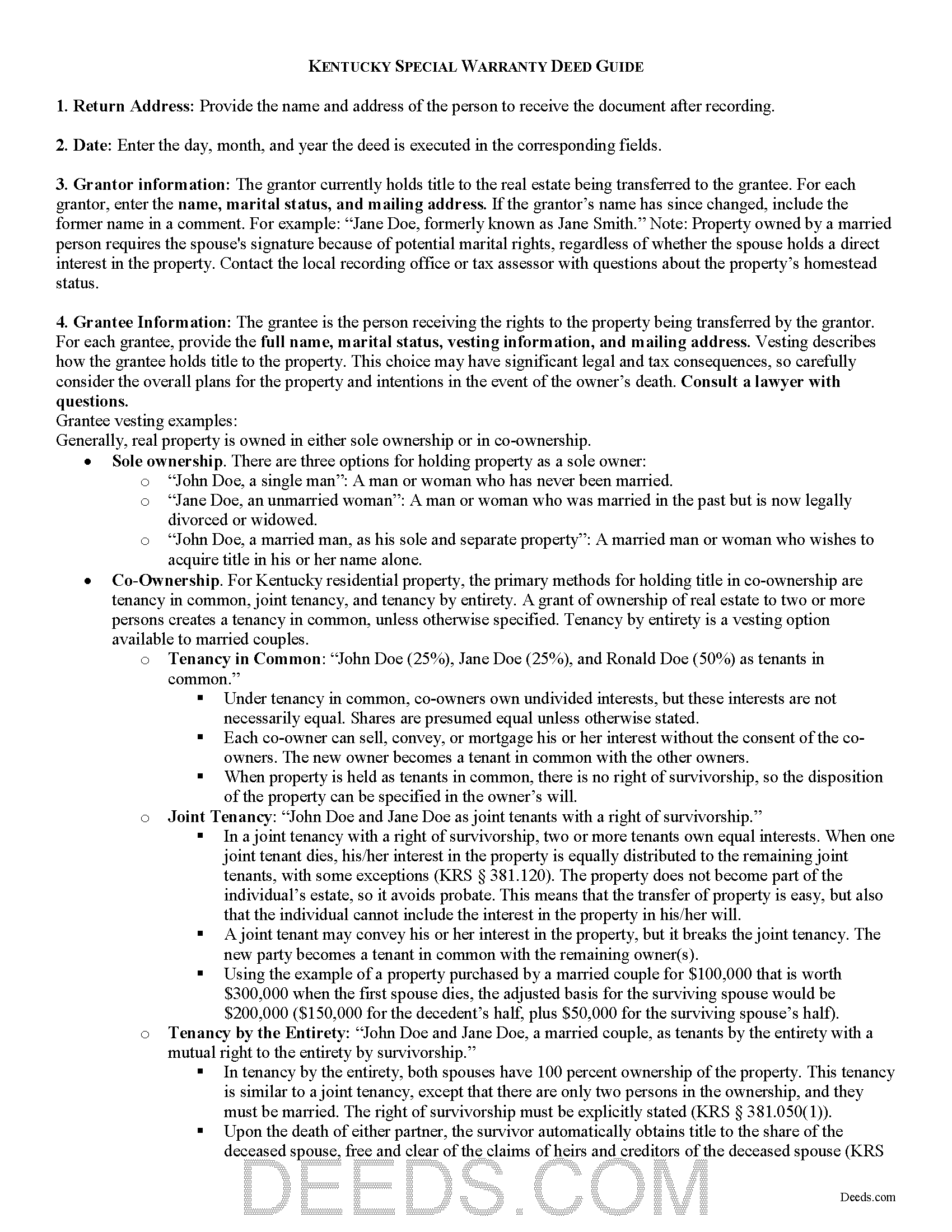

Graves County Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

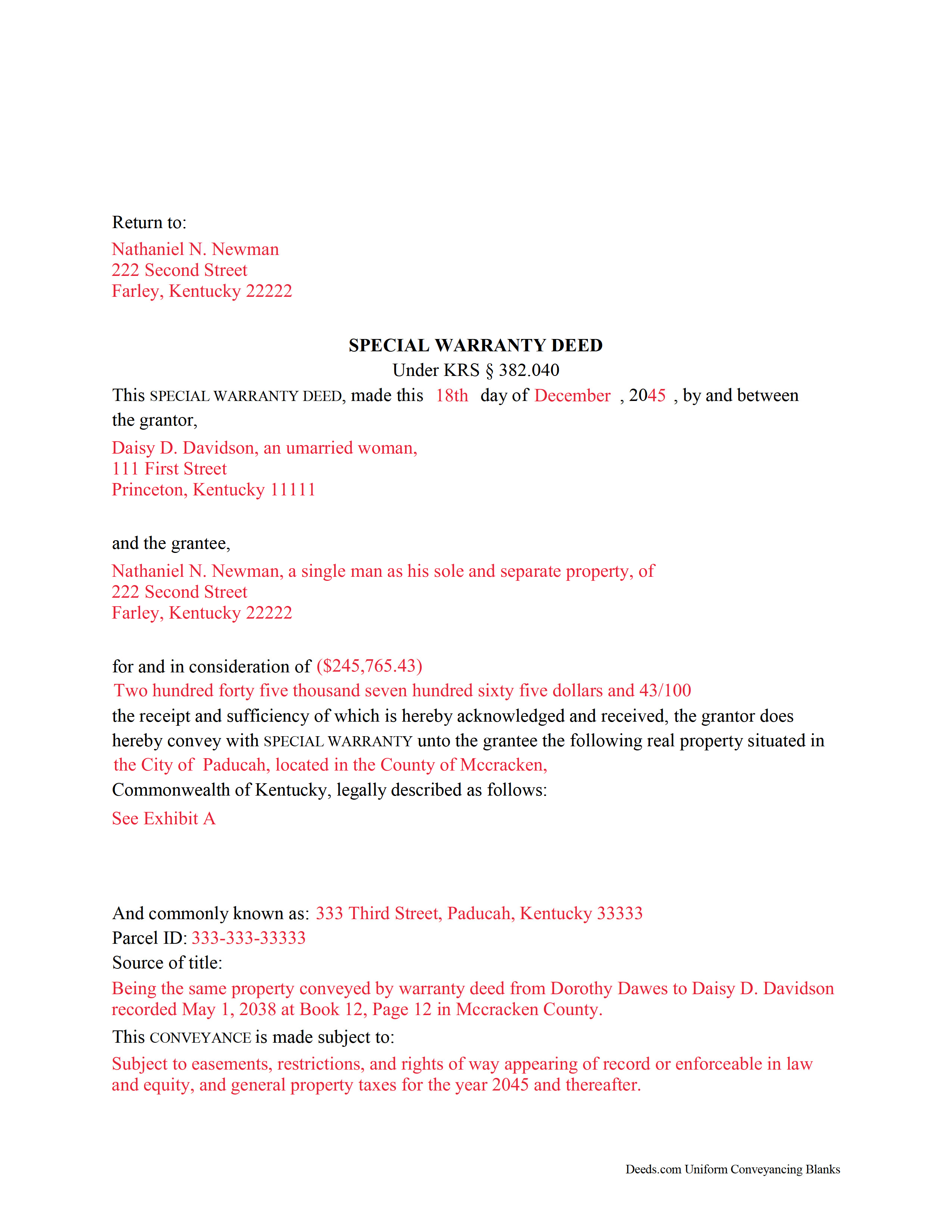

Graves County Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Kentucky and Graves County documents included at no extra charge:

Where to Record Your Documents

Graves County Clerk

Mayfield, Kentucky 42066

Hours: 8:00 to 4:00 Monday through Friday

Phone: (270) 247-1676

Recording Tips for Graves County:

- White-out or correction fluid may cause rejection

- Recorded documents become public record - avoid including SSNs

- Bring multiple forms of payment in case one isn't accepted

Cities and Jurisdictions in Graves County

Properties in any of these areas use Graves County forms:

- Boaz

- Fancy Farm

- Farmington

- Hickory

- Lowes

- Lynnville

- Mayfield

- Melber

- Sedalia

- Symsonia

- Water Valley

- Wingo

Hours, fees, requirements, and more for Graves County

How do I get my forms?

Forms are available for immediate download after payment. The Graves County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Graves County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Graves County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Graves County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Graves County?

Recording fees in Graves County vary. Contact the recorder's office at (270) 247-1676 for current fees.

Questions answered? Let's get started!

Real property conveyances are governed by Chapter 382 of the Kentucky Revised Statutes.

Special warranty deeds are statutory under KRS 382.040 and transfer ownership of real property from the grantor (the seller) to the grantee (the buyer) with limited warranties of title. They provide guarantees that the grantor is the true owner of the property, has the legal right to convey it, and will defend the title against any claims originating from the time they owned the property. However, the grantor does not guarantee that there are no other title defects before they owned it, so this type of deed offers more protection for the grantor, and less for the grantee.

A lawful special warranty deed includes the names and addresses of each grantor and grantee. Kentucky requires all recorded documents or documents affecting a change in property ownership to contain information on how the grantee will hold title. For residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Tenancy by entirety is a vesting option available to married couples only (KRS 381.050(1)).

Provide a complete legal description of the property and the source of the current grantor's title. The deed must also include the preparer's name, address, and signature (KRS 382.335), and the in-care-of tax address (KRS 382.110(2)). State law also stipulates either listing the full amount of consideration exchanged for the transfer, or, if nominal or no consideration has been exchanged, the fair cash value of the property (KRS 385.135). The county assesses a transfer tax on the consideration, due at the time of recording, unless the transaction is exempt under KRS 142.050.

Finally, the form must meet all state and local standards for recorded documents, which may vary from county to county. Confirm these requirements with the local recording office.

Both the grantor and grantee must sign the deed in front of a notary for the deed to be recorded (KRS 382.130). Submit the completed deed, along with any supplemental documentation necessary for the specific transaction, to the county clerk's office of the county in which the property is situated (KRS 382.110(1)). Recording preserves the ownership history of the property and provides public notice of the transfer, which protects both the grantor and the grantee from claims based on false information.

This article is provided for informational purposes only and is not a substitute for legal advice. Contact an attorney with questions about special warranty deeds or for any other issues related to the transfer of real property in Kentucky.

(Kentucky Special Warranty Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Graves County to use these forms. Documents should be recorded at the office below.

This Special Warranty Deed meets all recording requirements specific to Graves County.

Our Promise

The documents you receive here will meet, or exceed, the Graves County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Graves County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4587 Reviews )

Lisa H.

May 27th, 2020

I needed a copy of a deed for a client and wanted to be sure I had the most recent one. I used Deeds.com and had it along with detailed property information within minutes at a very reasonable price. I am very pleased.

Thank you!

Laura H.

August 25th, 2020

I was very impressed with how quickly I was provided the data.

Thank you!

Kelly M.

August 27th, 2021

Deeds.com made it so easy and convenient to get my homestead document recorded. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

dorothy f.

March 27th, 2019

Thank you, for help.

Anytime Dorothy, have a great day.

April C.

June 24th, 2020

Great service fast and patience great team their staff kvh was very great part of team .I need it filed the same day . I will recommend them to others

Thank you for your feedback. We really appreciate it. Have a great day!

Arturo P.

August 16th, 2021

Super easy to use! Totally satisfied. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexia B.

June 11th, 2020

Excellent service with rapid turn around time!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tracy E.

December 19th, 2020

This is so convenient. Thank you.

Thank you!

Thomas R.

June 21st, 2024

First time user. Was pleased with the easy of use and the step-by-step directions provided by the website.

We are motivated by your feedback to continue delivering excellence. Thank you!

Bobby V.

October 30th, 2019

Great

Thank you!

William C.

February 23rd, 2020

Excellent, easy to use. Technically accurate in all information offered.

Thank you!

Michael C.

January 4th, 2023

Overall positive experience; especially liked immediate access to downloaded documents and instructions. My only concern was lack of adequate space in portions of your beneficiary deed blank form which then required me to use 3 exhibits to complete all necessary documents for the county recorders office. Assuming they accept them I will call this a strong win. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lawrence D.

March 14th, 2019

My first time using it; very fast service. I am an estate planning attorney (44 years). None of my old title company contacts are around anymore to provide deed copies, so this is a great source. I will be using it again.

Thank you Lawrence, we appreciate your feedback. Have a fantastic day!

Steven W.

April 11th, 2021

Seems to be just what I needed and easy to use.

Thank you!

Russell N.

March 16th, 2021

Very simple process to purchase and download. Made it easy to understand the different forms and their uses and how to select the right form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!