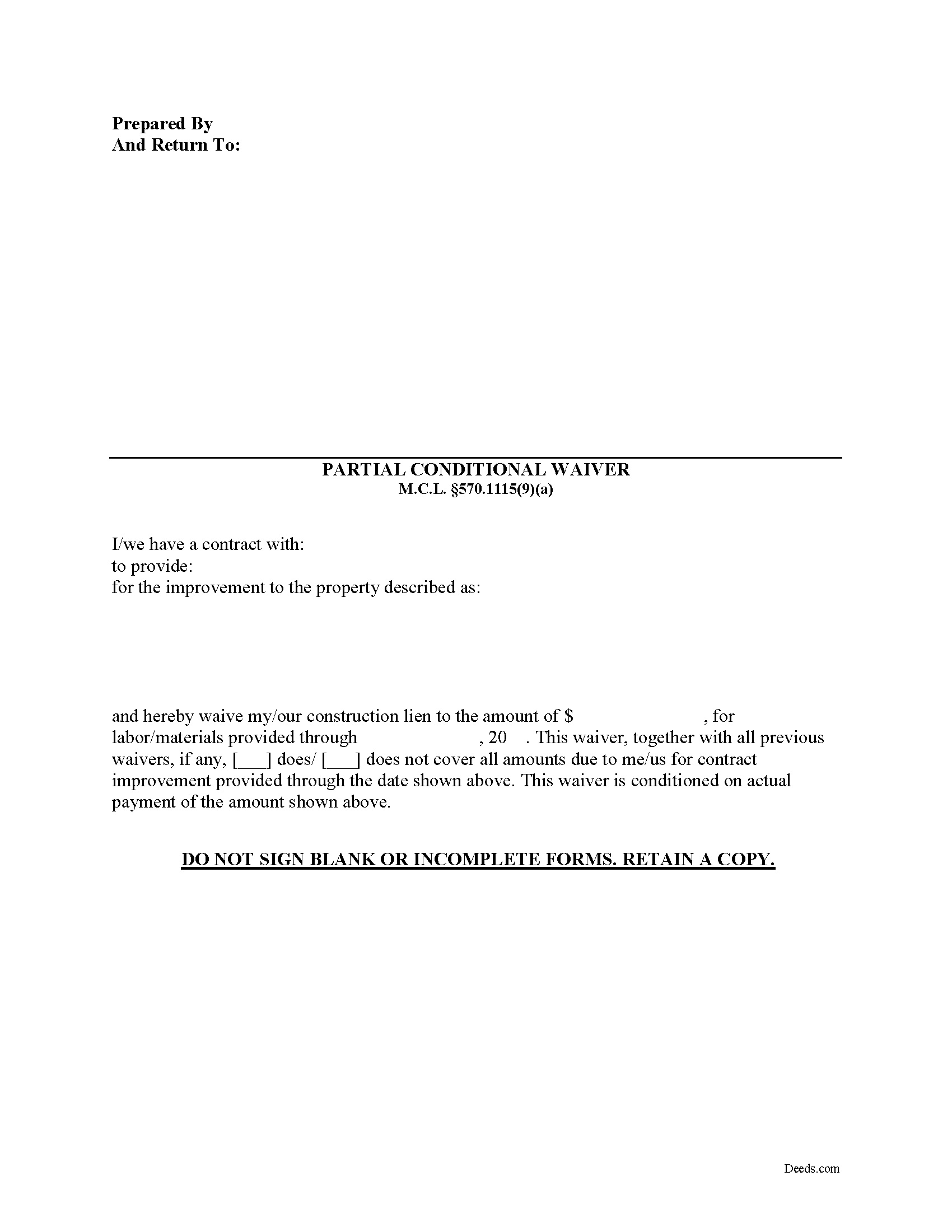

Macomb County Partial Conditional Waiver of Lien Form

Macomb County Partial Conditional Waiver of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

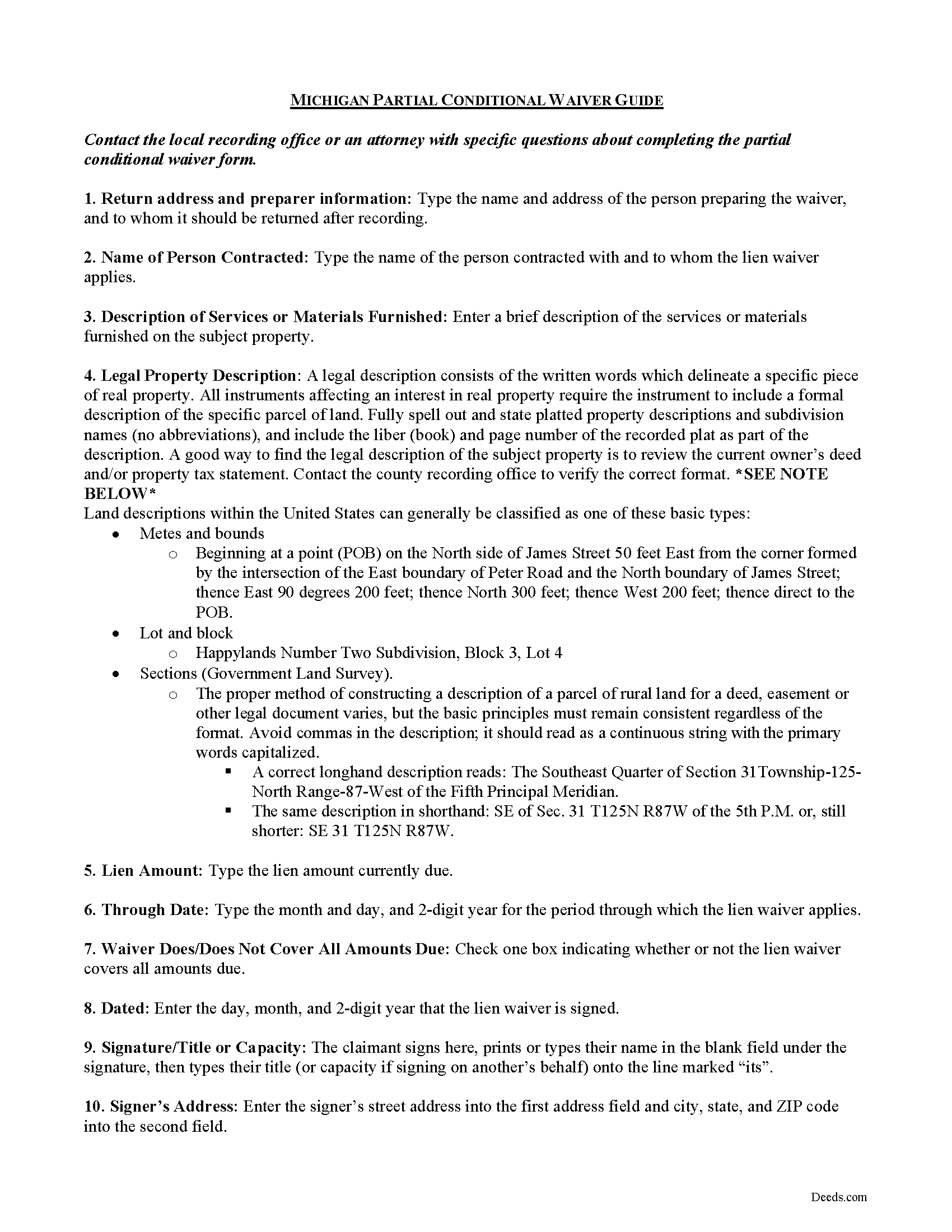

Macomb County Partial Conditional Waiver of Lien Guide

Line by line guide explaining every blank on the form.

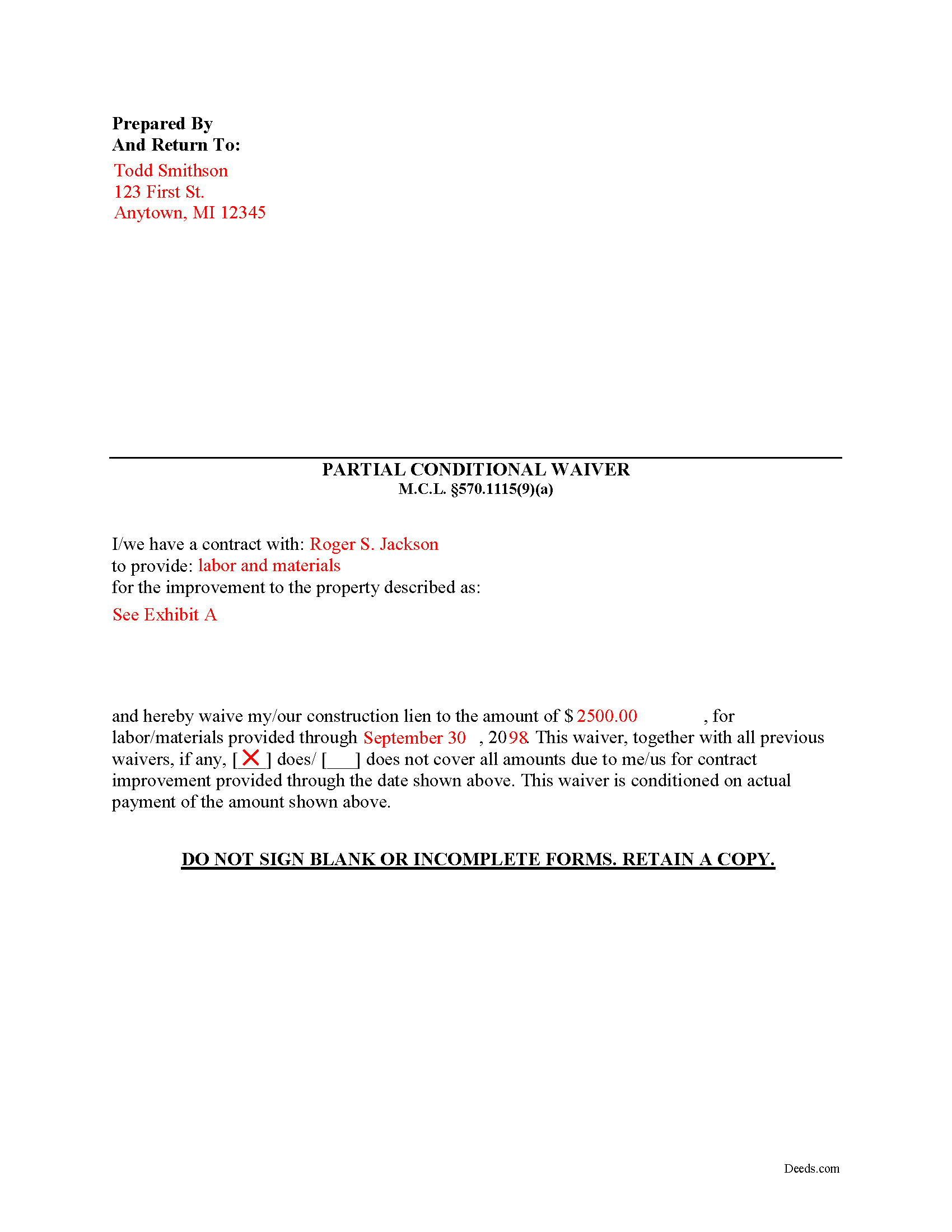

Macomb County Completed Example of the Partial Conditional Waiver of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Michigan and Macomb County documents included at no extra charge:

Where to Record Your Documents

Macomb County Register of Deeds

Mt. Clemens, Michigan 48043

Hours: 8:00am - 4:15pm M-F

Phone: (586) 469-7953

Recording Tips for Macomb County:

- Documents must be on 8.5 x 11 inch white paper

- Ask if they accept credit cards - many offices are cash/check only

- Ask about their eRecording option for future transactions

Cities and Jurisdictions in Macomb County

Properties in any of these areas use Macomb County forms:

- Armada

- Center Line

- Clinton Township

- Eastpointe

- Fraser

- Harrison Township

- Macomb

- Mount Clemens

- New Baltimore

- New Haven

- Ray

- Richmond

- Romeo

- Roseville

- Saint Clair Shores

- Sterling Heights

- Utica

- Warren

- Washington

Hours, fees, requirements, and more for Macomb County

How do I get my forms?

Forms are available for immediate download after payment. The Macomb County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Macomb County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Macomb County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Macomb County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Macomb County?

Recording fees in Macomb County vary. Contact the recorder's office at (586) 469-7953 for current fees.

Questions answered? Let's get started!

During the construction process, a property owner (or his or her lessee) may ask the contractor for a lien waiver in exchange for a full or partial payment.

Michigan defines four permissible types of lien waivers. These include: (1) Partial Unconditional Waiver, (2) Partial Conditional Waiver, (3), Full Unconditional Waiver, and (4) Full Conditional Waiver. M.C.L. 570.1115(9).

Use a partial conditional waiver of lien when the claimant receives an agreed-upon payment for his or her contract from the owner, lessee, or designee. M.C.L. 570.1115(4). This partial payment may be a scheduled disbursement, be tied to a progress point in the improvement process, or another circumstance as set out in the original contract.

A waiver under this section takes effect when a person makes payment relying on the waiver, unless at the time the payment was made, the person making the payment had written notice that the payment or consideration for the waiver has failed (i.e., the check bounced at the bank). M.C.L. 570.1115(6).

Lien waiver forms must be in writing and must comply with Michigan law to be valid. Include the names of the contractor and the property owner, and identify the property and dates covered by the recorded lien.

Lien waivers can be confusing and issuing the wrong type of waiver (or issuing one too early) can lead to dire consequences for construction liens. Contact an attorney with questions about waivers or any other issues related to liens in Michigan.

Important: Your property must be located in Macomb County to use these forms. Documents should be recorded at the office below.

This Partial Conditional Waiver of Lien meets all recording requirements specific to Macomb County.

Our Promise

The documents you receive here will meet, or exceed, the Macomb County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Macomb County Partial Conditional Waiver of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4601 Reviews )

Amy R.

January 8th, 2025

Forms I was looking for were easy to find, easy to download and accessible at any time in my account.

We are grateful for your feedback and looking forward to serving you again. Thank you!

Lawrence W.

January 17th, 2019

Great so Far!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

DENIS K.

July 17th, 2020

Excellent, invaluable and reasonable!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Richard T.

February 8th, 2020

Easy forms for DIYers

Thank you!

LIsa B.

January 27th, 2023

Deeds.com made this process of electronic document recording so easy! The communication was quick, friendly, helpful and efficient. I am out of state and have administrative items to handle for my father who has Alzheimer's. Deeds.com is a great service. I highly recommend them, and will use them again when the time comes.

Thank you!

Will O.

May 2nd, 2020

Saved me so much time and $!!

Thank you!

charles c.

October 14th, 2020

Great service, well worth the $15 fee. Especially helpful was the review of my documentation and the quick responses. Recommending it to associates who might need this service.

Thank you for your feedback. We really appreciate it. Have a great day!

Alvera A.

May 6th, 2023

Very easy to find my documents, download and print them!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Celeste F.

November 24th, 2020

Great experience. No hassle. It kept me out of a government office.

Thank you for your feedback. We really appreciate it. Have a great day!

Donald B.

November 21st, 2021

Pretty good forms, they would probably be better if I read the directions but...

Thank you!

Pamela H.

April 10th, 2019

With Deeds.com I was able to acquire the form I needed for a reasonable fee. Easy navigation, plus guidelines & example of how the finished form should be filled out. I was most pleased to download blank form so I could type into it and then save the blank form. Well organized informative tool. Highly recommend

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

James B.

March 10th, 2021

Was a lot easier than driving to the County Building and faster than expected. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael D.

June 14th, 2024

Quick and easy!

Thank you!

David L.

December 29th, 2020

It was a very easy to use application. I can only give it four stars because I have yet to receive confirmation from the county that my application was acceptable, ie., format, font, etc. I believe it will be fine.

Thank you for your feedback. We really appreciate it. Have a great day!

Delia C.

November 18th, 2019

Your service is a life saver! I'm a paralegal and new to lien releases especially in Platte Co., MO. The clerk was not helpful and I so appreciate your service in accomplishing this very important task!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!