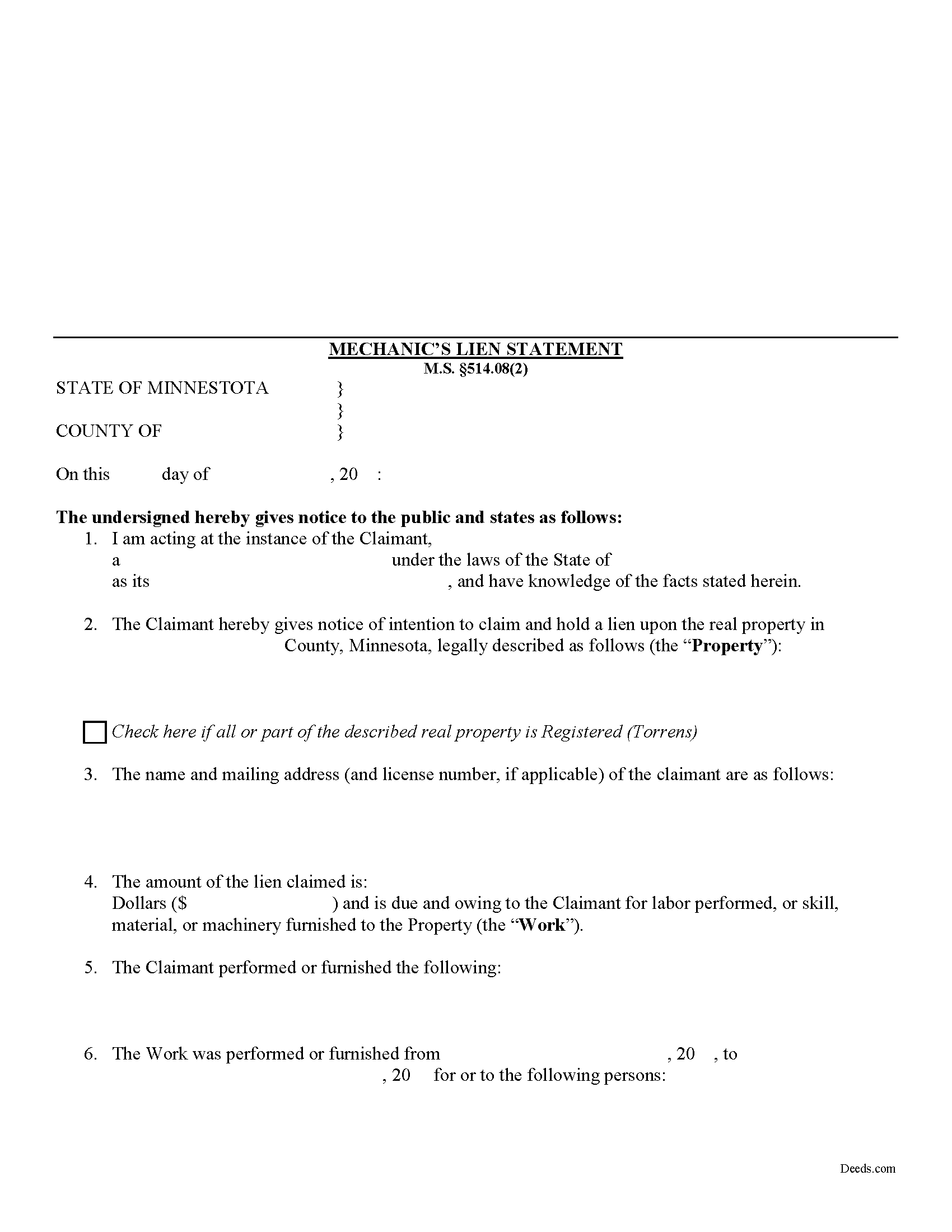

Clay County Mechanics Statement of Lien Form

Clay County Mechanics Statement of Lien Form

Fill in the blank Mechanics Statement of Lien form formatted to comply with all Minnesota recording and content requirements.

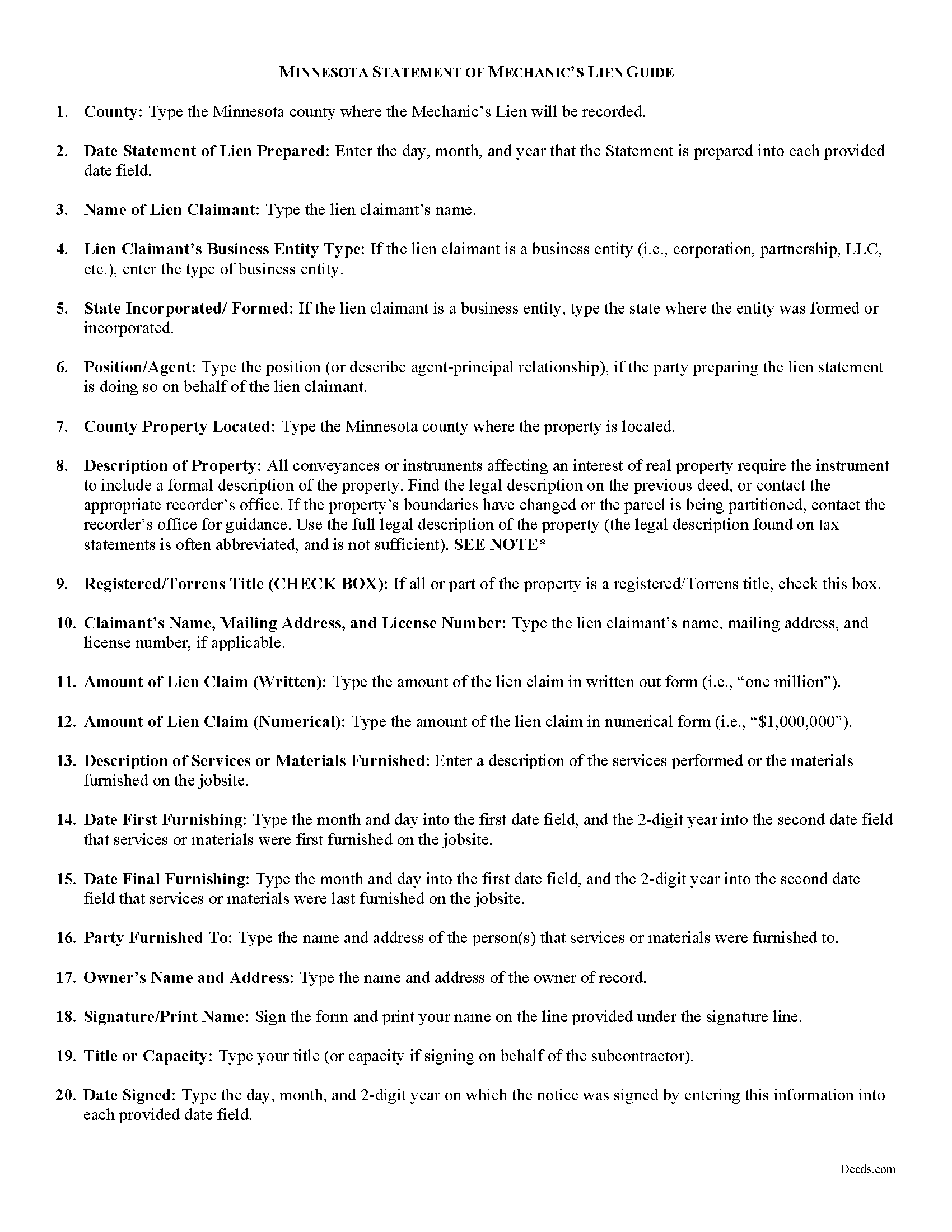

Clay County Mechanic Statement of Lien Guide

Line by line guide explaining every blank on the form.

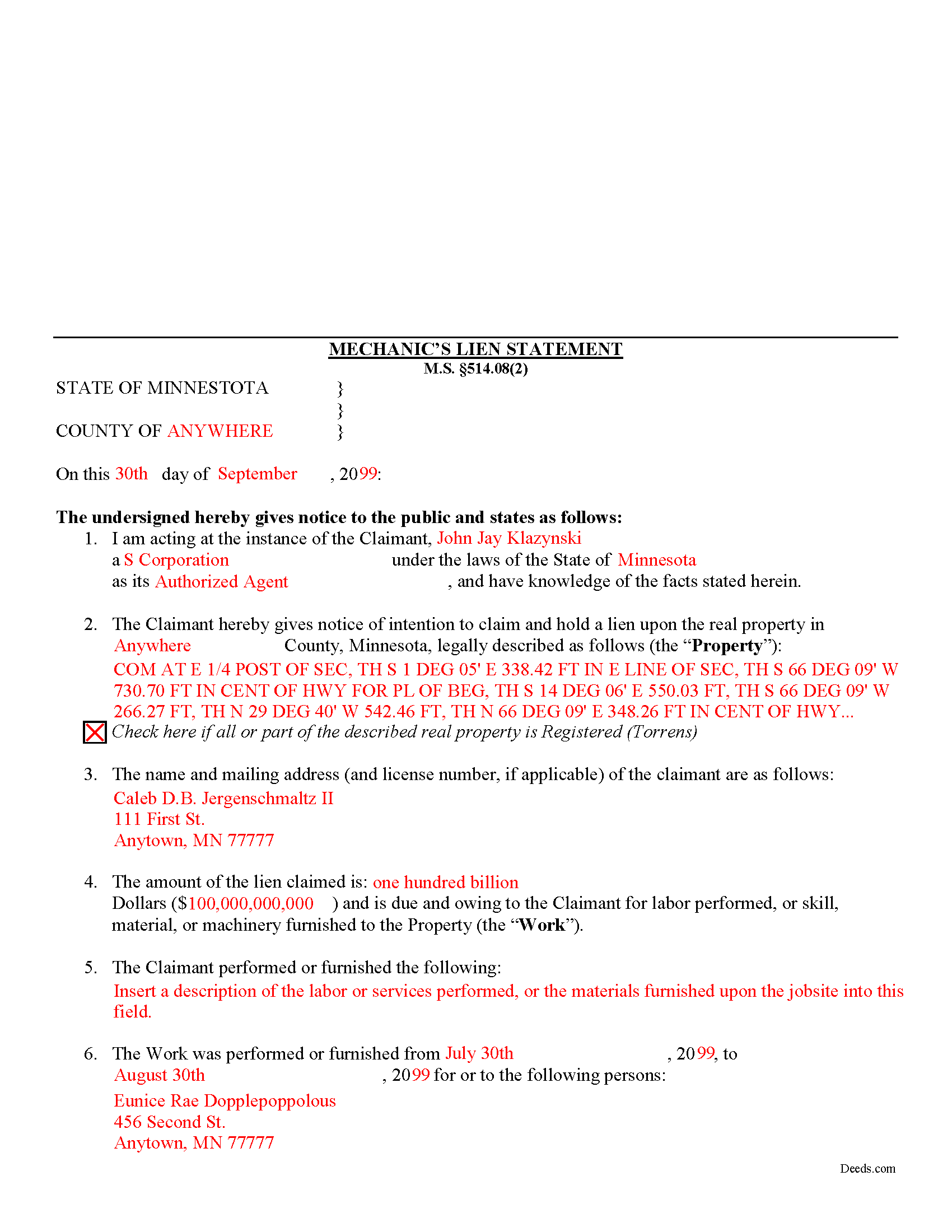

Clay County Completed Example of the Mechanic Statement of Lien Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Minnesota and Clay County documents included at no extra charge:

Where to Record Your Documents

Clay County Recorder/Registrar

Moorhead, Minnesota 56560

Hours: 8:00 to 4:30 M-F

Phone: (218) 299-5031

Recording Tips for Clay County:

- Verify all names are spelled correctly before recording

- Bring extra funds - fees can vary by document type and page count

- Ask for certified copies if you need them for other transactions

Cities and Jurisdictions in Clay County

Properties in any of these areas use Clay County forms:

- Barnesville

- Comstock

- Dilworth

- Felton

- Georgetown

- Glyndon

- Hawley

- Hitterdal

- Moorhead

- Sabin

- Ulen

Hours, fees, requirements, and more for Clay County

How do I get my forms?

Forms are available for immediate download after payment. The Clay County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clay County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clay County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clay County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clay County?

Recording fees in Clay County vary. Contact the recorder's office at (218) 299-5031 for current fees.

Questions answered? Let's get started!

Recording a Statement of Lien in Minnesota

Claims for mechanic's liens are used to recover unpaid balances for services rendered or materials delivered by placing an encumbrance (block) on the owner's title until the owner pays up and the claimant grants the owner a release. To obtain a mechanic's lien in Minnesota, claimants draft and record a form called a "Statement of Lien," but only after giving the required preliminary (pre-lien) notice to the property owner and other interested parties within 45 days of first starting the work or delivering any materials. M.S. 514.011.

The lien statement must be made by or at the instance of the lien claimant and be verified by the oath of some person shown by the verification to have knowledge of the facts stated. M.S. 514.08(2). The lien statement contains the following information: (1) a notice of intention to claim and hold a lien, and the amount thereof; (2) that such amount is due and owing to the claimant for labor performed, or for skill, material, or machinery furnished, and for what improvement the same was done or supplied; (3) the names of the claimant, and of the person for or to whom performed or furnished; (4) the dates when the first and last items of the claimant's contribution to the improvement were made; (5) a description of the premises to be charged, identifying the same with reasonable certainty; (6) the name of the owner at the time of making such statement, according to the best information available; (7) the post office address of the claimant (the failure to insert such post office address will not invalidate the lien statement); (8) that claimant acknowledges that a copy of the statement must be served personally or by certified mail within the 120-day period provided in this section on the owner, the owner's authorized agent or the person who entered the contract with the contractor as provided herein; and (9) that notice as required by M.S. 514.011(2), if any, was given. Id.

When the claimant files the notice, the Social Security number of an individual owner or the Internal Revenue Service taxpayer identification number for an owner other than an individual is not required. Id.

The statement of the claim must be filed with the county recorder or, if registered (Torrens title) land, with the registrar of titles of the county in which the improved premises are situated within 120 days of the last furnishing. M.S. 514.08(1). If the claim is made under M.S. 514.04 (for railway, telegraph or similar projects), the statement must be filed with the secretary of state. Id. After recording, a copy of the statement must be served personally or by certified mail on the owner or the owner's authorized agent (or the person who entered the contract with the contractor) within the same 120-day period. Id.

Once you the lien is in place, the claimant gains a valuable bargaining chip to help persuade the owner to arrange payment for the services of materials provided. Be aware that liens don't last forever. Because liens affect the owner's title, the legislature gives them an expiration period for enforcement actions. No lien shall be enforced in any case unless the holder files a complaint or answer with the court administrator, within one year after the date of the last item of the claim as set forth in the recorded lien statement. M.S. 514.12(3).

This article is provided for informational purposes only and is not intended to be relied upon a substitute for the advice of an attorney. Please contact a Minnesota-licensed attorney with any questions about recording a lien statement or other related issues.

Important: Your property must be located in Clay County to use these forms. Documents should be recorded at the office below.

This Mechanics Statement of Lien meets all recording requirements specific to Clay County.

Our Promise

The documents you receive here will meet, or exceed, the Clay County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clay County Mechanics Statement of Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

SHERRILL B.

October 10th, 2024

I received prompt attention to the package I submitted. It was submitted promptly the recorders office with a quick turn around for the recorded document. Overall a very pleasant experience.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

CAROL C.

July 30th, 2020

Deeds.com is very user friendly and quite simple to use. Customer service is also prompt in responding to any inquiry. I have been pleased with them since I began using them over 3-years ago.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

November 20th, 2020

Fantastic service. I purchased the form one day, had it filled out, notarized and e-filed the next day. The following day I received the recorded document back. It was really overnight service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Andrew H.

November 11th, 2020

Very efficient does what it says on the box.

Thank you!

JAMES M.

July 17th, 2023

The forms are just what I needed! Easy to navigate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lila L.

December 30th, 2020

Everyone was very responsive and helpful. Thank you. I give you a 5!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

William A.

May 12th, 2020

great service and very accommodating generally, and especially during these times.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jina N.

January 29th, 2019

Awesome site!! You guys really make it simple to understand and access any Deeds that I need. I know you keep very up to date forms, as my county is hard core when it comes to the smallest of details, even compared to every other county across the state. Yet you made it simple and quick, and I never had to redo anything. Even the clerk was impressed that I had it filled out correctly the first time, as that usually never happened. Even the size of type/font and the margins were perfect. That saved a lot of time, money and most of all, frustration. I've recommended you to relatives, friends and co-workers. Thanks to the staff at deeds dot com !! I truly appreciate you. j

Thank you!

Angela B.

July 22nd, 2020

The site made everything very easy to understand and access. I was able to get everything I needed and the cost was reasonable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffery H.

October 18th, 2023

Very easy to use. Thanks for your quick response on my document submissions and follow up and guidance on specific questions.

Thank you for your positive words! We’re thrilled to hear about your experience.

LeiLoni L.

June 18th, 2025

This site was easy to use.

Thank you for your positive words! We’re thrilled to hear about your experience.

Susan M.

May 12th, 2022

Simple and straightforward

Thank you for your feedback. We really appreciate it. Have a great day!

Cathaleen P.

April 26th, 2021

Excellent service and very easy to process. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Amy S.

March 7th, 2022

So convenient! I love this service. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Juanita B.

November 12th, 2020

Very easy and fast transaction. Thank you for complete set of forms needed for property transfer.

Thank you for your feedback. We really appreciate it. Have a great day!